Wales now has the powers to manage and collect its own specifically Welsh taxes. Land transaction tax (LTT) will replace stamp duty land tax (SDLT); and landfill disposals tax (LDT) will replace landfill tax from 1 April 2018. The Welsh Revenue Authority (WRA) has been established by the Welsh government to collect and manage these taxes. Registration for the tax system will begin in February and all agents will need to register with the WRA in order to file and submit LTT returns online for land transactions in Wales. Similarly, landfill site operators will also need to register with WRA for LDT. The WRA is calling on customers and the Welsh public to contribute to its charter consultation before 13 February.

2018 will be a significant year for tax practitioners. As chief executive officer of the Welsh Revenue Authority (WRA), I want to take this opportunity to provide readers with a progress update and a summary of what you can expect from the WRA, as well as the steps you will need to take over the coming months to prepare for taxes in Wales.

I’m often asked what I consider to be the key challenges and opportunities in setting up the WRA and I’ve summarised these into the three following areas.

The Tax Collection and Management (Wales) Act 2016 granted powers to the Welsh government to establish the WRA to collect and manage devolved taxes.

Kathryn Bishop was appointed as chair of the organisation by the cabinet secretary for finance in early 2017 and the WRA was established formally in October 2017.

For land transaction tax and landfill disposals tax, the WRA will be the Welsh equivalent of HMRC but smaller, with a specialised team of staff who will all need to be experts in a diverse range of fields. HMRC will continue to play a role in Wales for all other taxes.

We are currently asking for views on our proposed charter. We have designed this differently to traditional charters so that we can reflect the type of organisation we want to be. This is an important part of establishing the WRA and sets out the values and the way in which we can work together to deliver a fair tax system for Wales. It is worth reiterating that we want our charter to reflect the organisation we want to be and the relationship we want to have with our customers.

Our proposed charter has been published on the consultations pages of the Welsh government website (bit.ly/2DgiuVl), along with a response form for you to have your say. Alternatively, you can contact us directly (haveyoursay@wra.gov.wales) before the closing date of the consultation on 13 February.

We believe that working with our customers and with the Welsh public is vital, so please do take this opportunity to tell us what you think.

We recognise that the vast majority of taxpayers want to pay the right tax at the right time and our aim is to help them to do so. However, we have the tools (including, for example, the general anti-avoidance rule) and expertise to address those who do not want to comply with the new taxes to ensure we maintain a level playing field.

We are keen to engage directly with customers to support them to get things right from the start. To do this, we want to ensure we understand our customers and the context in which they operate, and provide them with the advice, tools and support they need.

This is an opportunity to do things differently in Wales. We will develop our understanding of our customers and the compliance landscape for devolved taxes through smart use of data and open engagement with taxpayers and advisers. Crucially, the Welsh language will be at the forefront of our service and customers will be able to engage with us in either English or Welsh, as they choose.

One of the key topics of discussion during our engagement with the profession has been the publication of guidance. We have worked closely with members of the Law Society in Wales and the Chartered Institute of Taxation (CIOT), as well as other professional bodies, to ensure that the development of guidance is carried out in consultation with our future customers. Thank you to those who have volunteered to take part in this review exercise. Early feedback has been very positive and I am delighted with the commitment and efforts within the profession to support us in this process.

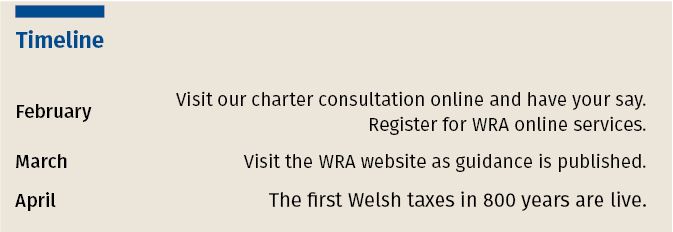

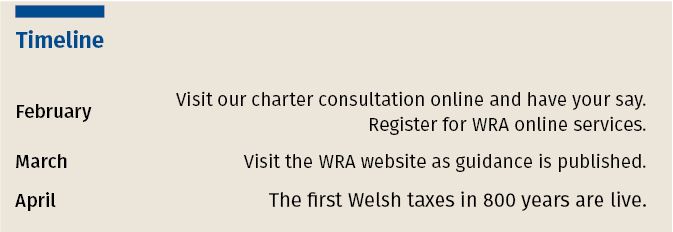

Following this development process, publication of guidance to the WRA website will begin in early 2018. We expect this to be carried out in stages, beginning with guidance on registering with the tax system and continuing until all relevant LTT guidance is available ahead of the taxes going live.

Our guidance will be regularly updated and monitored to ensure we are reacting to developments. We will be listening to feedback on an ongoing basis and discussing where improvements can be made.

To provide early information for taxpayers, the rates and bands for land transaction tax and landfill disposal tax for 2018/19 were proposed as part of the Welsh Tax Policy Report, alongside the Welsh government’s draft Budget on 3 October. Following changes in the UK government Budget, the cabinet secretary for finance announced revised land transaction tax residential rates in December.

The draft regulations for the LTT rates and bands have now been published (bit.ly/2DvxFy6) and were debated by the National Assembly for Wales at the end of January 2018.

Whilst there is a long border between Wales and England, there are expected to be only a small number of transactions where part of the property is in Wales and part in England; or where part of the transaction relates to land in Wales and part to land elsewhere. Detailed guidance, with numerous examples, is being provided to assist in dealing with such cases and in particular to perform the just and reasonable apportionment that will be necessary.

A key feature of the future landscape is the increased use of digital technology. The ongoing work to develop our digital tax system, with volunteers from the tax profession, is fundamental to ensuring that the system meets your needs as taxpayers or professional advisers. We will continue to work with stakeholders in an open and collaborative way as tax collection begins, resolving any queries and issues accurately and quickly.

Initially, the account will enable an organisation to complete, save and submit an LTT return and obtain a copy of the LTT certificate to send to HM Land Registry. We are working hard to get the basics right, and we are already hearing ideas about how we could enhance the functionality of the system from April onwards. We want this to continue and to work with you to understand your needs as you start to use the system.

We will provide channels for you to send your feedback and we will use this to explore how we can continually improve your experience. For example, following engagement with you on early iterations of the system, we have made improvements to the registration screens and process. We encourage you to continue giving us your feedback as you work with us.

We will be asking agents to register for a WRA online tax account. Organisations will be able to have multiple users active on their account. Our digital service will allow you to submit returns online quickly and easily, generate an LTT certificate and see your previously submitted returns. There will be an invitation to register online in February and our website gov.wales/wra will provide all the information needed to do this.

In order for the required security checks to be made, it will be necessary to allow a period of approximately ten working days to complete the registration process. We encourage practitioners to register early on to ensure a smooth transition period.

When registration begins in February, you will be able to contact us via our website, by phone or in writing. The phone helpdesk will be open between 9.30am and 4.30pm and we will monitor how this service is used to see if these hours meet the needs of our customers.

We will also be taking customer queries regarding the application of the tax, as well as offering our ‘tax opinion service’. Further information on this service will be available on our website shortly.

When I look back at what has been achieved in setting up the Welsh Revenue Authority during 2017, I’m astounded at the sheer volume of activity that has taken place. I have no doubt that 2018 will continue in the same way. I want to build an organisation that is confident in delivery and inspires confidence in the people who use it. We look forward to working in partnership with taxpayers and professionals as we shape this new organisation to meet the needs of the people of Wales.

Wales now has the powers to manage and collect its own specifically Welsh taxes. Land transaction tax (LTT) will replace stamp duty land tax (SDLT); and landfill disposals tax (LDT) will replace landfill tax from 1 April 2018. The Welsh Revenue Authority (WRA) has been established by the Welsh government to collect and manage these taxes. Registration for the tax system will begin in February and all agents will need to register with the WRA in order to file and submit LTT returns online for land transactions in Wales. Similarly, landfill site operators will also need to register with WRA for LDT. The WRA is calling on customers and the Welsh public to contribute to its charter consultation before 13 February.

2018 will be a significant year for tax practitioners. As chief executive officer of the Welsh Revenue Authority (WRA), I want to take this opportunity to provide readers with a progress update and a summary of what you can expect from the WRA, as well as the steps you will need to take over the coming months to prepare for taxes in Wales.

I’m often asked what I consider to be the key challenges and opportunities in setting up the WRA and I’ve summarised these into the three following areas.

The Tax Collection and Management (Wales) Act 2016 granted powers to the Welsh government to establish the WRA to collect and manage devolved taxes.

Kathryn Bishop was appointed as chair of the organisation by the cabinet secretary for finance in early 2017 and the WRA was established formally in October 2017.

For land transaction tax and landfill disposals tax, the WRA will be the Welsh equivalent of HMRC but smaller, with a specialised team of staff who will all need to be experts in a diverse range of fields. HMRC will continue to play a role in Wales for all other taxes.

We are currently asking for views on our proposed charter. We have designed this differently to traditional charters so that we can reflect the type of organisation we want to be. This is an important part of establishing the WRA and sets out the values and the way in which we can work together to deliver a fair tax system for Wales. It is worth reiterating that we want our charter to reflect the organisation we want to be and the relationship we want to have with our customers.

Our proposed charter has been published on the consultations pages of the Welsh government website (bit.ly/2DgiuVl), along with a response form for you to have your say. Alternatively, you can contact us directly (haveyoursay@wra.gov.wales) before the closing date of the consultation on 13 February.

We believe that working with our customers and with the Welsh public is vital, so please do take this opportunity to tell us what you think.

We recognise that the vast majority of taxpayers want to pay the right tax at the right time and our aim is to help them to do so. However, we have the tools (including, for example, the general anti-avoidance rule) and expertise to address those who do not want to comply with the new taxes to ensure we maintain a level playing field.

We are keen to engage directly with customers to support them to get things right from the start. To do this, we want to ensure we understand our customers and the context in which they operate, and provide them with the advice, tools and support they need.

This is an opportunity to do things differently in Wales. We will develop our understanding of our customers and the compliance landscape for devolved taxes through smart use of data and open engagement with taxpayers and advisers. Crucially, the Welsh language will be at the forefront of our service and customers will be able to engage with us in either English or Welsh, as they choose.

One of the key topics of discussion during our engagement with the profession has been the publication of guidance. We have worked closely with members of the Law Society in Wales and the Chartered Institute of Taxation (CIOT), as well as other professional bodies, to ensure that the development of guidance is carried out in consultation with our future customers. Thank you to those who have volunteered to take part in this review exercise. Early feedback has been very positive and I am delighted with the commitment and efforts within the profession to support us in this process.

Following this development process, publication of guidance to the WRA website will begin in early 2018. We expect this to be carried out in stages, beginning with guidance on registering with the tax system and continuing until all relevant LTT guidance is available ahead of the taxes going live.

Our guidance will be regularly updated and monitored to ensure we are reacting to developments. We will be listening to feedback on an ongoing basis and discussing where improvements can be made.

To provide early information for taxpayers, the rates and bands for land transaction tax and landfill disposal tax for 2018/19 were proposed as part of the Welsh Tax Policy Report, alongside the Welsh government’s draft Budget on 3 October. Following changes in the UK government Budget, the cabinet secretary for finance announced revised land transaction tax residential rates in December.

The draft regulations for the LTT rates and bands have now been published (bit.ly/2DvxFy6) and were debated by the National Assembly for Wales at the end of January 2018.

Whilst there is a long border between Wales and England, there are expected to be only a small number of transactions where part of the property is in Wales and part in England; or where part of the transaction relates to land in Wales and part to land elsewhere. Detailed guidance, with numerous examples, is being provided to assist in dealing with such cases and in particular to perform the just and reasonable apportionment that will be necessary.

A key feature of the future landscape is the increased use of digital technology. The ongoing work to develop our digital tax system, with volunteers from the tax profession, is fundamental to ensuring that the system meets your needs as taxpayers or professional advisers. We will continue to work with stakeholders in an open and collaborative way as tax collection begins, resolving any queries and issues accurately and quickly.

Initially, the account will enable an organisation to complete, save and submit an LTT return and obtain a copy of the LTT certificate to send to HM Land Registry. We are working hard to get the basics right, and we are already hearing ideas about how we could enhance the functionality of the system from April onwards. We want this to continue and to work with you to understand your needs as you start to use the system.

We will provide channels for you to send your feedback and we will use this to explore how we can continually improve your experience. For example, following engagement with you on early iterations of the system, we have made improvements to the registration screens and process. We encourage you to continue giving us your feedback as you work with us.

We will be asking agents to register for a WRA online tax account. Organisations will be able to have multiple users active on their account. Our digital service will allow you to submit returns online quickly and easily, generate an LTT certificate and see your previously submitted returns. There will be an invitation to register online in February and our website gov.wales/wra will provide all the information needed to do this.

In order for the required security checks to be made, it will be necessary to allow a period of approximately ten working days to complete the registration process. We encourage practitioners to register early on to ensure a smooth transition period.

When registration begins in February, you will be able to contact us via our website, by phone or in writing. The phone helpdesk will be open between 9.30am and 4.30pm and we will monitor how this service is used to see if these hours meet the needs of our customers.

We will also be taking customer queries regarding the application of the tax, as well as offering our ‘tax opinion service’. Further information on this service will be available on our website shortly.

When I look back at what has been achieved in setting up the Welsh Revenue Authority during 2017, I’m astounded at the sheer volume of activity that has taken place. I have no doubt that 2018 will continue in the same way. I want to build an organisation that is confident in delivery and inspires confidence in the people who use it. We look forward to working in partnership with taxpayers and professionals as we shape this new organisation to meet the needs of the people of Wales.