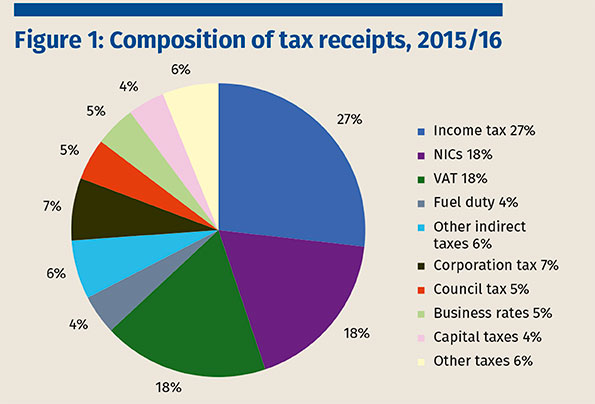

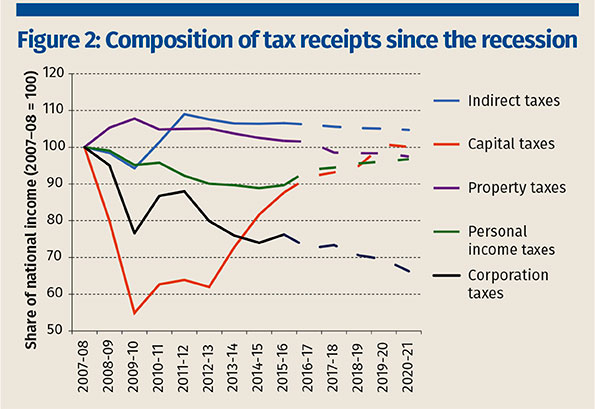

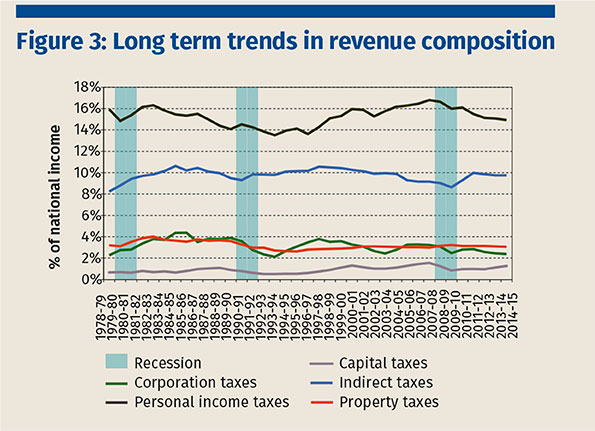

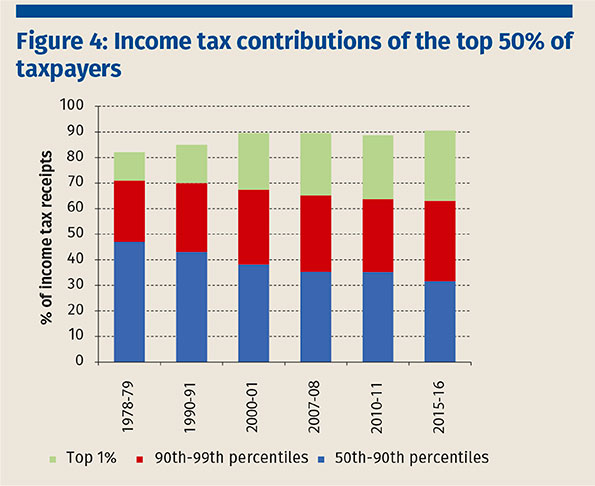

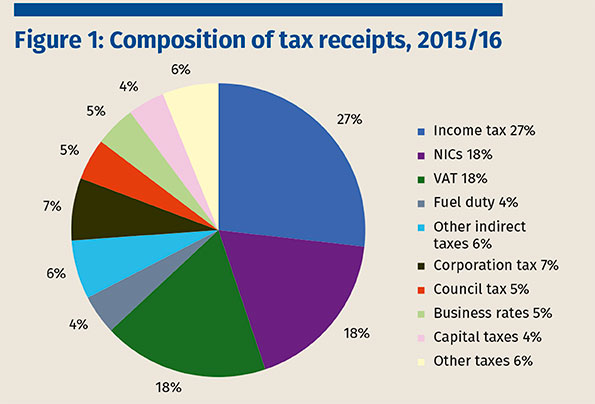

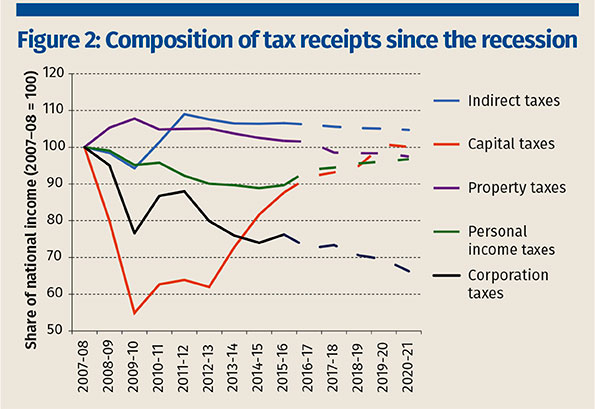

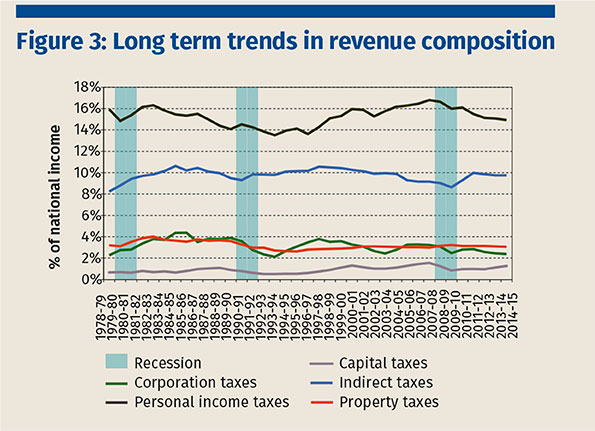

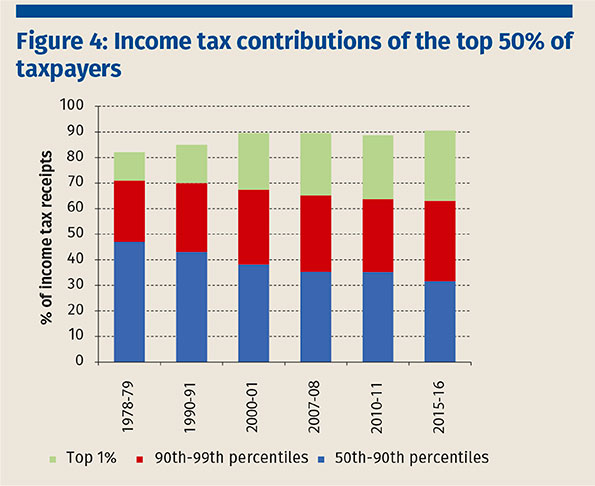

By the end of the parliament, tax receipts are due to return to their pre-recession share of national income. However, compared with 2007/08, policy choices mean the taxman looks set to raise more from VAT and less from other indirect taxes; about the same amount from personal income taxes, though with more of that coming from the highest earners; less from the main property taxes; and substantially less from corporation tax. HM Treasury will be more reliant on small taxes, including five entirely new ones. Whether these changes have been part of a clear and coherent overarching strategy is, to put it kindly, unclear.

Helen Miller and Thomas Pope (Institute for Fiscal Studies) examine the latest tax receipts for 2015/16 and ask whether the government’s policies – which have changed their composition – have been part of a clear and coherent strategy.

By the end of the parliament, tax receipts are due to return to their pre-recession share of national income. However, compared with 2007/08, policy choices mean the taxman looks set to raise more from VAT and less from other indirect taxes; about the same amount from personal income taxes, though with more of that coming from the highest earners; less from the main property taxes; and substantially less from corporation tax. HM Treasury will be more reliant on small taxes, including five entirely new ones. Whether these changes have been part of a clear and coherent overarching strategy is, to put it kindly, unclear.

Helen Miller and Thomas Pope (Institute for Fiscal Studies) examine the latest tax receipts for 2015/16 and ask whether the government’s policies – which have changed their composition – have been part of a clear and coherent strategy.