The Budget was less about setting grand visions and more about addressing the particular challenges of today.

The pre-Budget press comment suggested that there wasn’t much Philip Hammond could do in his second Budget without coming a cropper one way or another. In the event, he was able to deliver a Budget packed with both tax and spending measures, without handing any obvious hostages to fortune.

So what was the theme of the Budget?

‘Theme’ might be stretching a point when considering the tax elements alone, but there were certainly several motifs which recurred during the speech of just over an hour. In the interests of political knock-about, there were the usual contrasts with the legacy inherited from the Labour government. Then there was the slogan, throughout the speech, about making Britain ‘Fit for the Future’ and the repeated assertion of wanting to help the hard pressed right away.

And to top it all, there was the strangely lacklustre reheating of Harold Wilson’s white heat of technology motif, as the ‘genuinely’ in ‘Britain is genuinely at the forefront of a technological revolution’ seemed to cast doubt on all earlier claims.

None of this added up to a great theme, let alone an emerging Hammondism. In truth, though, the Budget was less about setting grand visions (as one might otherwise expect of first Budgets in a Parliament) and more about addressing the particular challenges of today.

So who were the winners at this Budget?

There is no debate about it this time: on the face of it, the very clear winners were would-be first time buyers benefiting from a targeted abolition of stamp duty land tax (SDLT). Those house hunting in the neighbourhoods of up to £300,000 will see SDLT evaporate completely, while those shopping closer to the higher end (up to £500,000) will see it disappear on the first £300,000. This largesse, amounting to almost £3.2bn over the six year period up to 2022/23, was the single largest element in a ‘housing and homeownership’ package with a price tag of £9.3bn. Whether this actually helps first time buyers, or instead helps those selling to first time buyers, is yet to be seen. Perhaps the other housing measures and a wider commitment – covering funding, loans and guarantees – to pump an additional £44bn into housing, may be more effective?

The other winners – though the win was much smaller than they would have wished, and had lobbied for – were the business rate payers, who will see the advantageous switch from RPI to CPI inflation indexing brought forward by two years. This is not cheap at £2.3bn. Of course, this doesn’t address the legacy of the RPI increases since 2010, which have outstripped property values by 16%, resulting in a higher business rates burden for all.

Arguably, the hard-pressed car drivers of the UK were also winners, with the chancellor spending a handsome £4.2bn to continue to freeze fuel duty. Purists might, though, wonder whether an approach which has an official policy of inflationary increases, but an equally long term practice of freezes, is a sustainable position.

There was also news that sin is no more deplorable than it was last year (unless your tipple is white cider and you drive an old diesel car), with no increases in the excise on taxes on cars, boozing and gambling, and no more than expected on cigarettes.

It may worth adding that, slightly under the presentational radar, the long term winners from the continued commitments to reducing the corporation tax headline rate and increasing income tax’s personal allowances and higher rate threshold just keep on winning.

Where did the chancellor raise money?

The Budget saw two packages of measures focused on: the continued clampdown on ‘avoidance, evasion, fraud and error’; and the modernisation measures under ‘“a fair and sustainable tax system’.

Amid a general boosting of the resources devoted to HMRC’s effort on avoidance and evasion (a significant £2bn extra), the largest revenue raisers are:

Among the modernisation measures, the greatest impact will come from the freezing of the indexation allowance from January 2018. The chancellor seems to have decided that inflation is no longer an issue at current rates, placing reliance on the work of the Bank of England.

Beyond these packages, the imposition of joint and several VAT liability on online marketplaces will, at the very least, impose additional burdens on the intermediaries.

Any innovations?

In the realm of the digital economy, where governments globally are struggling to form a coherent response, Hammond has gone for some partial gun–jumping. While remaining true to the credo of seeking an international fix though the OECD, the UK will, in the interim, explore options to raise revenue from digital businesses that generate value from UK users, such as a tax on revenues that these businesses derive from the UK market. A positon paper was published as part of the Budget bundle.

One very welcome innovation was the positive conclusion of the patient capital review. This exercise, which had ‘lost in the long grass’ written all over it at the outset, has resulted in drawing together a £20bn package of measures – including the establishment of an investment fund incubated in the British Business Bank, and enhancements to the enterprise investment scheme and venture capital trust scheme – to support longer term investment in UK start-ups.

What should we be watching out for in future?

As is customary, the Budget flagged a range of forthcoming consultations, including:

So what do the numbers tell us?

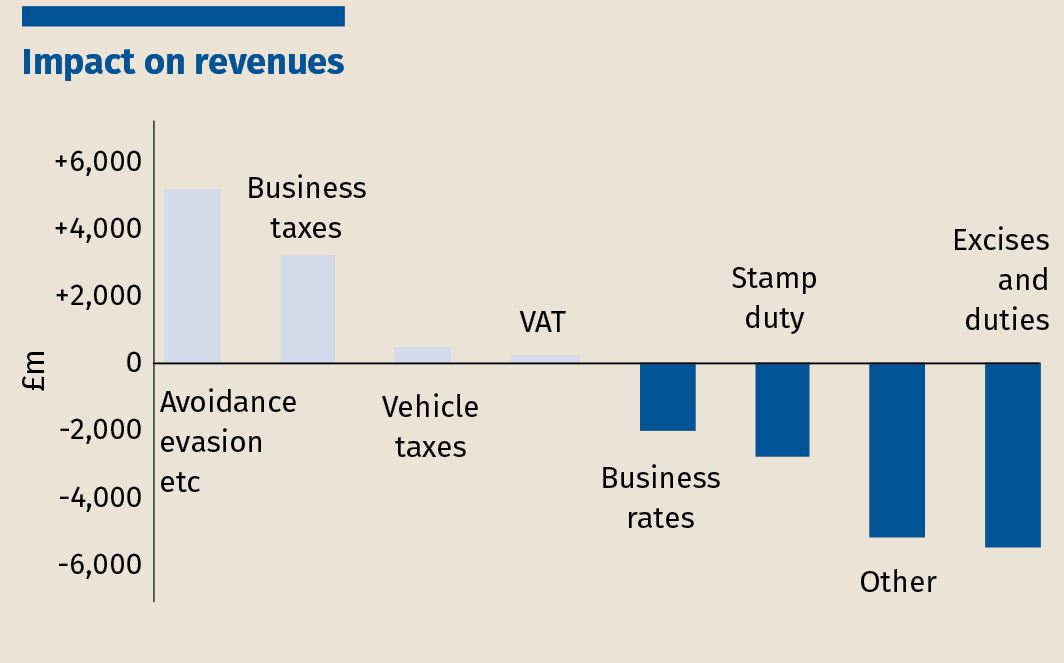

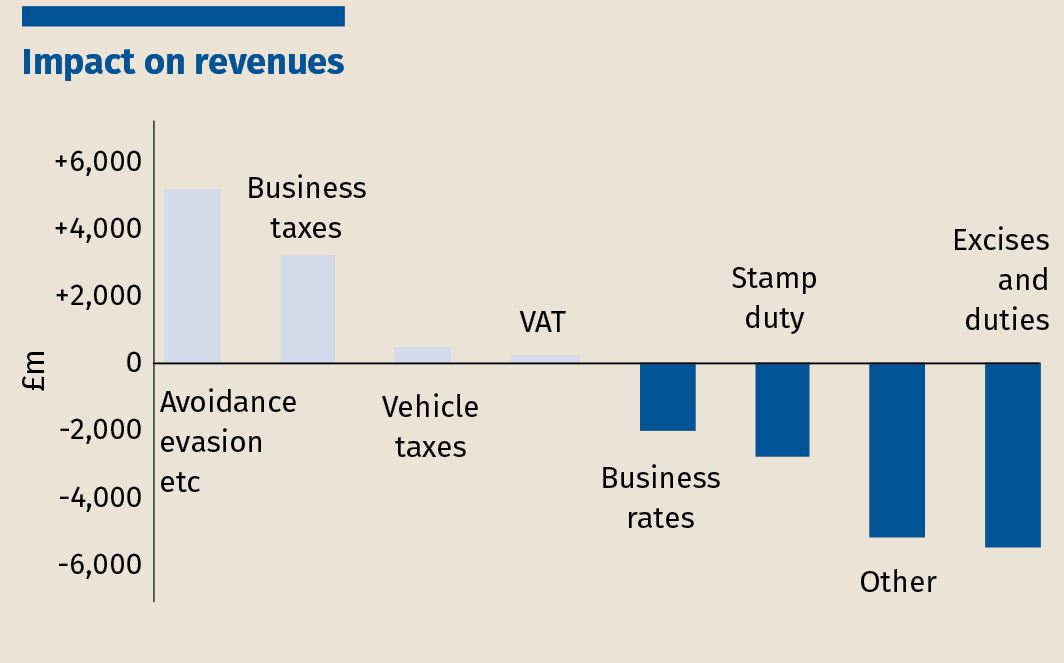

Standing back from the individual measures, what we see from the Budget arithmetic is the extent to which the government revenue expectations are reliant on the successful pursuit of the anti-evasion and avoidance strategy, with changes to business taxes doing the rest of the heavy lifting. Meanwhile, the big tax raising levers (income tax, NICs and VAT) remain unpulled.

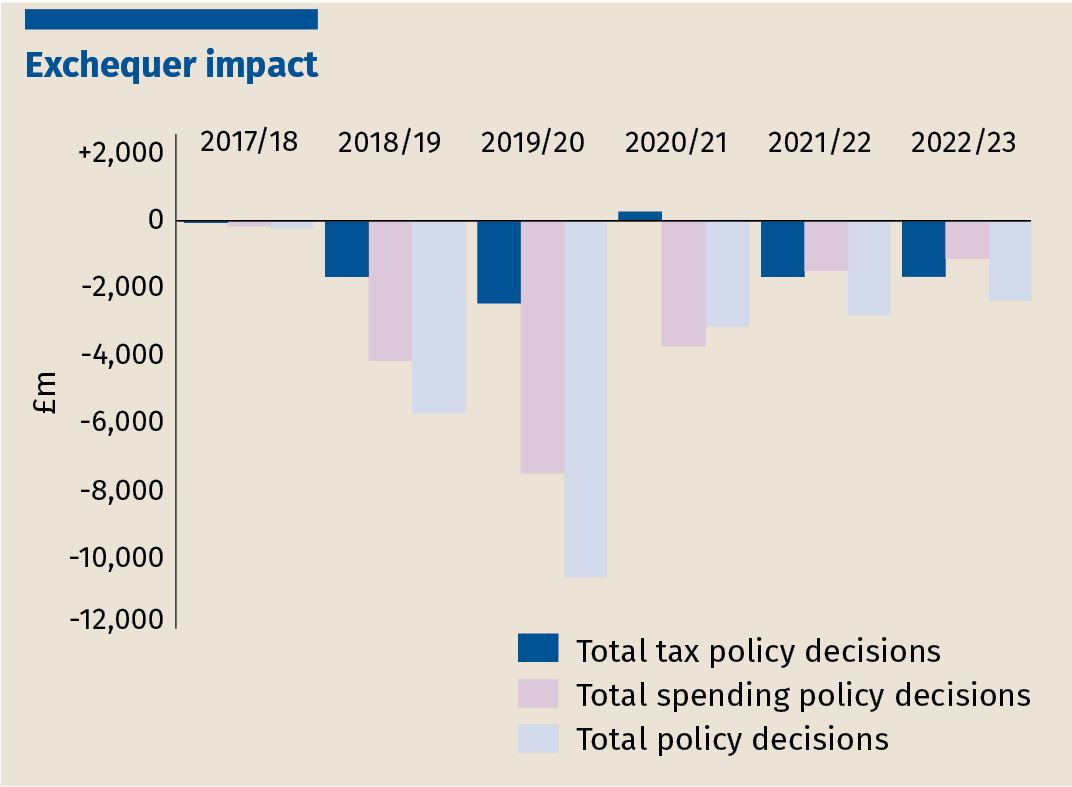

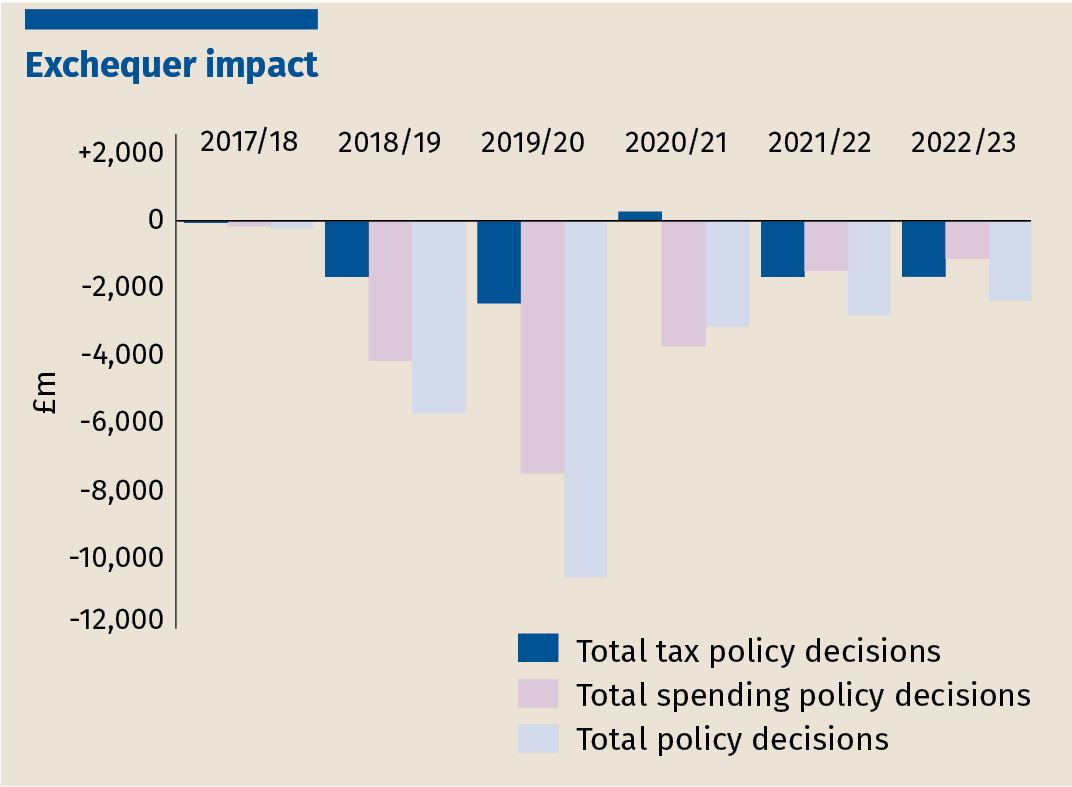

Across the Budget as a whole, despite the lack of eye-catching giveaways and indeed the proverbial rabbit from the hat, the chancellor’s work today has resulted in spending an extra £18bn and reducing taxes by £7bn in total. This is quite different from the first Budgets of the Parliaments of his recent predecessors!

Any final thoughts?

Having had two Budgets this year, the chancellor’s plans for a ‘single fiscal event’ means that there should not be another one for a full 12 months. However, with the Spring Statement coming in between, it remains to be seen whether the chancellor can, or indeed politics will allow him to, avoid returning to tax measures before then. Having successfully navigated this Budget, perhaps the chancellor has a greater chance of resisting such temptations than many would have predicted?

The Budget was less about setting grand visions and more about addressing the particular challenges of today.

The pre-Budget press comment suggested that there wasn’t much Philip Hammond could do in his second Budget without coming a cropper one way or another. In the event, he was able to deliver a Budget packed with both tax and spending measures, without handing any obvious hostages to fortune.

So what was the theme of the Budget?

‘Theme’ might be stretching a point when considering the tax elements alone, but there were certainly several motifs which recurred during the speech of just over an hour. In the interests of political knock-about, there were the usual contrasts with the legacy inherited from the Labour government. Then there was the slogan, throughout the speech, about making Britain ‘Fit for the Future’ and the repeated assertion of wanting to help the hard pressed right away.

And to top it all, there was the strangely lacklustre reheating of Harold Wilson’s white heat of technology motif, as the ‘genuinely’ in ‘Britain is genuinely at the forefront of a technological revolution’ seemed to cast doubt on all earlier claims.

None of this added up to a great theme, let alone an emerging Hammondism. In truth, though, the Budget was less about setting grand visions (as one might otherwise expect of first Budgets in a Parliament) and more about addressing the particular challenges of today.

So who were the winners at this Budget?

There is no debate about it this time: on the face of it, the very clear winners were would-be first time buyers benefiting from a targeted abolition of stamp duty land tax (SDLT). Those house hunting in the neighbourhoods of up to £300,000 will see SDLT evaporate completely, while those shopping closer to the higher end (up to £500,000) will see it disappear on the first £300,000. This largesse, amounting to almost £3.2bn over the six year period up to 2022/23, was the single largest element in a ‘housing and homeownership’ package with a price tag of £9.3bn. Whether this actually helps first time buyers, or instead helps those selling to first time buyers, is yet to be seen. Perhaps the other housing measures and a wider commitment – covering funding, loans and guarantees – to pump an additional £44bn into housing, may be more effective?

The other winners – though the win was much smaller than they would have wished, and had lobbied for – were the business rate payers, who will see the advantageous switch from RPI to CPI inflation indexing brought forward by two years. This is not cheap at £2.3bn. Of course, this doesn’t address the legacy of the RPI increases since 2010, which have outstripped property values by 16%, resulting in a higher business rates burden for all.

Arguably, the hard-pressed car drivers of the UK were also winners, with the chancellor spending a handsome £4.2bn to continue to freeze fuel duty. Purists might, though, wonder whether an approach which has an official policy of inflationary increases, but an equally long term practice of freezes, is a sustainable position.

There was also news that sin is no more deplorable than it was last year (unless your tipple is white cider and you drive an old diesel car), with no increases in the excise on taxes on cars, boozing and gambling, and no more than expected on cigarettes.

It may worth adding that, slightly under the presentational radar, the long term winners from the continued commitments to reducing the corporation tax headline rate and increasing income tax’s personal allowances and higher rate threshold just keep on winning.

Where did the chancellor raise money?

The Budget saw two packages of measures focused on: the continued clampdown on ‘avoidance, evasion, fraud and error’; and the modernisation measures under ‘“a fair and sustainable tax system’.

Amid a general boosting of the resources devoted to HMRC’s effort on avoidance and evasion (a significant £2bn extra), the largest revenue raisers are:

Among the modernisation measures, the greatest impact will come from the freezing of the indexation allowance from January 2018. The chancellor seems to have decided that inflation is no longer an issue at current rates, placing reliance on the work of the Bank of England.

Beyond these packages, the imposition of joint and several VAT liability on online marketplaces will, at the very least, impose additional burdens on the intermediaries.

Any innovations?

In the realm of the digital economy, where governments globally are struggling to form a coherent response, Hammond has gone for some partial gun–jumping. While remaining true to the credo of seeking an international fix though the OECD, the UK will, in the interim, explore options to raise revenue from digital businesses that generate value from UK users, such as a tax on revenues that these businesses derive from the UK market. A positon paper was published as part of the Budget bundle.

One very welcome innovation was the positive conclusion of the patient capital review. This exercise, which had ‘lost in the long grass’ written all over it at the outset, has resulted in drawing together a £20bn package of measures – including the establishment of an investment fund incubated in the British Business Bank, and enhancements to the enterprise investment scheme and venture capital trust scheme – to support longer term investment in UK start-ups.

What should we be watching out for in future?

As is customary, the Budget flagged a range of forthcoming consultations, including:

So what do the numbers tell us?

Standing back from the individual measures, what we see from the Budget arithmetic is the extent to which the government revenue expectations are reliant on the successful pursuit of the anti-evasion and avoidance strategy, with changes to business taxes doing the rest of the heavy lifting. Meanwhile, the big tax raising levers (income tax, NICs and VAT) remain unpulled.

Across the Budget as a whole, despite the lack of eye-catching giveaways and indeed the proverbial rabbit from the hat, the chancellor’s work today has resulted in spending an extra £18bn and reducing taxes by £7bn in total. This is quite different from the first Budgets of the Parliaments of his recent predecessors!

Any final thoughts?

Having had two Budgets this year, the chancellor’s plans for a ‘single fiscal event’ means that there should not be another one for a full 12 months. However, with the Spring Statement coming in between, it remains to be seen whether the chancellor can, or indeed politics will allow him to, avoid returning to tax measures before then. Having successfully navigated this Budget, perhaps the chancellor has a greater chance of resisting such temptations than many would have predicted?