The draft Scottish budget, on 14 December 2017, set out the Scottish government’s proposals for 2018/19. From a tax perspective, the key point of interest is the introduction of five income tax bands, raising several questions. Who will pay more or less? Who administers the new bands? How will the partially devolved income tax interact with other elements of the income tax system? Scotland has a minority government, so the proposals are not set in stone and could potentially change. A rate resolution is expected to be passed by mid-February. There will also be consultation regarding a first-time buyer relief for the land and buildings transaction tax.

2017 was a roller coaster of a year when it came to budgets, particularly for those working with Scottish taxes. There was a UK Spring Budget and the UK Autumn Budget, although the latter was surprisingly limited in its impact on Scotland. The Autumn Budget illustrated how much has been devolved to the Scottish Parliament. The shift was confirmed in the Scottish Budget, delivered by Derek Mackay, cabinet secretary for finance and the constitution on 14 December 2017. This was anticipated with considerable interest in Scotland for a number of reasons:

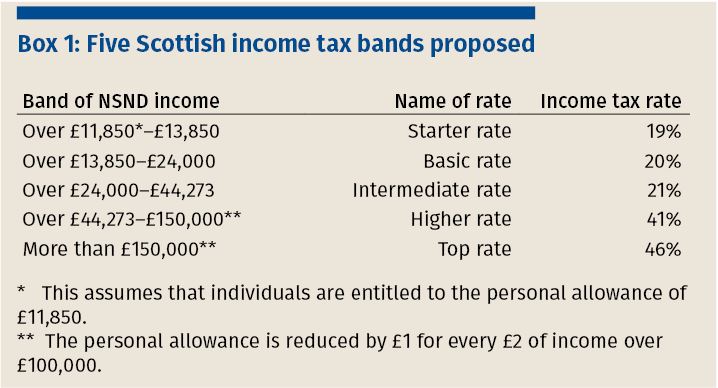

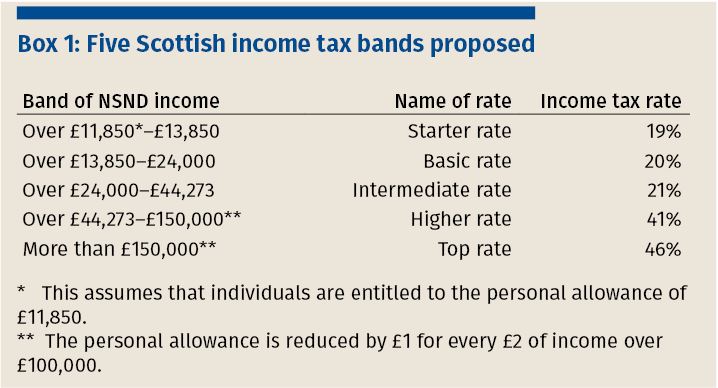

The Scottish Budget proposed the five income tax bands set out in box 1 (below). These apply to the earnings, pensions and property income of Scottish taxpayers; in other words, the NSND income of individuals who have their main home in Scotland. (There is guidance in the HMRC manuals on determining who is a Scottish taxpayer.) The Scotland Act 1998 requires the rates and bands to be set for the tax year, in advance of the start of the tax year.

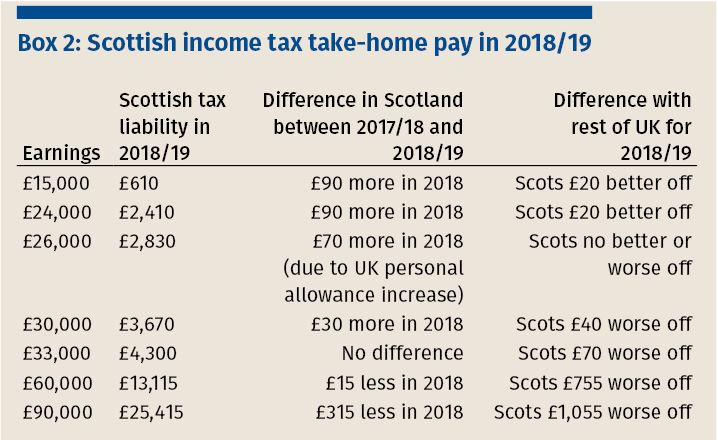

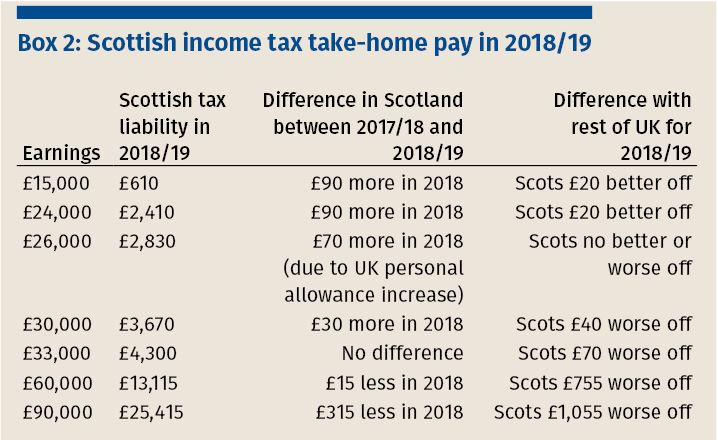

Box 2 (below) shows whether a Scottish taxpayer will pay more or less. There are two comparisons that can be made. First, will a Scottish taxpayer comparing 2018/19 and the previous year (2017/18), on the same salary, pay more? The cut-off point when comparing a Scottish taxpayer’s take home pay is £33,000. However, this is in absolute terms and does not account for inflation. Second, will a Scottish taxpayer in 2018/19 pay more than someone on the same salary in England? The cut-off point for this comparison is £26,000.

It is notable that the personal allowance (which continues to be set by the UK government) has a major impact on who pays tax in the first place. According to the Scottish government, 44% in Scotland do not pay income tax as their income is below the personal allowance. The personal allowance also accounts for much of any increase in 2018/19 in take home pay. A person in Scotland earning £15,000 will be £90 better off in 2018/19 than 2017/18. This comprises two elements: the increase in the UK personal allowance, which provides a £70 increase in take-home pay; and a £2,000 starter band at 19% which saves 1%, i.e. £20. A person on the average Scottish wage of £24,000 will pay £90 less in tax in 2018/19 than 2017/18 for the same reasons.

In 2018/19, at the UK higher rate threshold of £46,350 (the higher rate threshold in Scotland is proposed to be £44,273), a Scottish taxpayer will pay £639 more than their English counterpart.

For those with income over £24,000, the tax rate is 1% higher than the rest of the UK. There is some debate about the behavioural impact of this proposal. Will it encourage incorporations? Will 1% on the higher rates be a driver of tax planning? Concerns have been expressed by some that it may not look attractive to inward investors.

Scottish taxpayers’ savings and dividends income are charged at UK rates, taking account of any UK measures such as the personal savings allowance (which will be £500 or £1,000 depending on the amount of total income a taxpayer has using the UK measure) or the dividend zero rate band. This means further complication.

Bringing in five bands also makes the interaction with other parts of income tax burdensome. In particular, the basic rate is key for withholding tax at source, or for giving relief at source. In Scotland, the basic rate is now proposed to apply to the band of income between £13,850 and £24,000 – with new rates of 19% and 21% introduced above and below this band. This creates an administrative nuisance in giving relief at the correct rate. It may lead to more people needing to go into the self-assessment (SA) regime, which seems counterproductive in view of other HMRC objectives to remove taxpayers from SA. HMRC prepared three technical notes on the interaction of Scottish income tax and the wider income tax regime, notably in relation to gift aid, pensions and trusts in May 2012, December 2014 and November 2016.

In relation to charitable donations, the challenges are somewhat in abeyance for the time being, as the UK government’s position is that charities should reclaim gift aid at the UK basic rate. While tax bands now vary and there is a new starter rate, the UK and Scottish basic rates remain the same. There is a theoretical risk at the margins, as someone paying tax at the starter rate may not have paid enough tax to cover a gift aid claim made on their donation at the UK basic rate.

The practical challenges for pension arrangements operating on a relief at source basis are more of a concern and therefore pose a more immediate policy challenge for the UK government. Pension administrators claim tax relief on pension contributions on behalf of individuals at the UK basic rate, with higher and top rate taxpayers able to make a further claim through self-assessment.

Clarification is needed as to how the starter rate is treated. If administrators are required to make claims in respect of Scottish taxpayers using the starter rate as the basis of tax relief claims, it would put most taxpayers in relief at source pension arrangements into self-assessment. The introduction of the intermediate band of 21% will in itself mean that more Scottish tax-payers will need to make self-assessment returns to take advantage of the full tax relief available to them, unless a less burdensome solution can be found.

Some allowances are tied to the basic rate as a form of means testing; for example, the marriage allowance. Compared with the position south of the border, this allowance is already restricted to a limited extent this year (2017/18) for Scottish taxpaying couples (to the higher rate threshold of £43,000 rather than £45,000) but next year it may be further restricted.

The marriage allowance was introduced by FA 2014 and incorporated into ITA 2007 ss 55A–55E. The legislation permits up to 10% of a spouse’s or civil partner’s unused personal allowance to be transferred but s 55B imposes the condition that the individual is not, for the tax year, liable to tax at a rate other than the basic rate. This has been amended to include the default basic rate, the savings basic rate, the dividend nil rate, the Scottish basic rate, the dividend ordinary rate, the savings nil rate or the starting rate for savings. However, the Scottish basic rate band will become much narrower in 2018/19 – applying to income from £13,850 to £24,000. We understand that it is intended by both the Scottish and UK governments that the allowance is to be extended to Scottish taxpayers on the starter, basic and intermediate rates, although the precise mechanics of this are not yet known.

Income tax for Scottish taxpayers will be more progressive, but more complex. For those with a range of income sources it may be difficult to understand the combination of bands and how they apply to NSND income, and to savings and dividends income. Accountability is important, so this complexity is not helpful.

Employed Scottish taxpayers should be in receipt of a coding notice from HMRC with a designatory ‘S’ prefix, which indicates that they have been deemed to be a Scottish taxpayer by HMRC. HMRC is responsible for identifying ‘S’ taxpayers and payroll departments must change tax codes when they receive notifications from HMRC. There has been some debate about the completeness of this operation. The National Audit Office estimates that around 80,000 people in the UK move into or out of Scotland each year, which generates work for HMRC and payroll departments.

The Scottish budget estimates are that the proposed changes will raise an additional £164m for the Scottish government; but some of this will be paid to HMRC to administer the tax. There will also be software costs for payroll administrators, pension providers and employers. Both HMRC and third-party software providers will need to get to grips with the complexities arising from the proposals and ensure that their products work, enabling taxpayers to file correct returns. Experience of the large number of online filing exceptions HMRC was forced to introduce for 2017 returns suggests that HMRC may struggle.

The NICs upper threshold in 2018/19 is to be increased across the UK in line with the rest of the UK (rUK) higher rate threshold for income tax. For Scottish taxpayers who have an income between the two higher rate thresholds of £44,273 (Scottish taxpayers) and £46,350 (rUK taxpayers), there will be a marginal rate of 53% (41% income tax and 12% NICs). Of course, it’s a moot point whether NICs is a tax or a social contribution, but the exercise of devolved income tax powers brings this question to the fore.

An interesting feature of LBTT is that at the outset it was different from SDLT, with progressive rates. However, since April 2015 the two taxes, LBTT and SDLT, have become increasingly aligned. This Scottish budget is no exception to the trend with a consultation proposed on a possible relief for first time buyers, but at a lower threshold than outside Scotland. It is unclear whether such a relief is needed in Scotland, given that the normal starting point for LBTT (£145,000) is already higher than that for SDLT (£125,000), while average property prices in many parts of Scotland are lower than in the rest of the UK.

UK air passenger duty (APD) was expected to be replaced with air departure tax from 1 April 2018, but this change is to be deferred until issues raised by the Scottish government in relation to the Highlands and Islands exemption have been resolved. The UK government will maintain the application of APD in Scotland in the interim, and the current APD rates will apply in Scotland for 2018/19.

An annual budget is needed in the UK because income tax is an annual tax and must be enacted every year. In Scotland, there is no such requirement but there does need to be a rate resolution on the income tax rates and bands. This is expected to be passed in February and it will be interesting to see the final political agreement on the Scottish income tax rates and bands. In relation to the devolved taxes, there is no regular, formal procedure for amending existing acts.

Note: After going to press, the Scottish government issued an updated fact sheet (http://bit.ly/2GBFQ9Z) and changed where the higher rate threshold is to come in from £44,273 down to £43,430.

The draft Scottish budget, on 14 December 2017, set out the Scottish government’s proposals for 2018/19. From a tax perspective, the key point of interest is the introduction of five income tax bands, raising several questions. Who will pay more or less? Who administers the new bands? How will the partially devolved income tax interact with other elements of the income tax system? Scotland has a minority government, so the proposals are not set in stone and could potentially change. A rate resolution is expected to be passed by mid-February. There will also be consultation regarding a first-time buyer relief for the land and buildings transaction tax.

2017 was a roller coaster of a year when it came to budgets, particularly for those working with Scottish taxes. There was a UK Spring Budget and the UK Autumn Budget, although the latter was surprisingly limited in its impact on Scotland. The Autumn Budget illustrated how much has been devolved to the Scottish Parliament. The shift was confirmed in the Scottish Budget, delivered by Derek Mackay, cabinet secretary for finance and the constitution on 14 December 2017. This was anticipated with considerable interest in Scotland for a number of reasons:

The Scottish Budget proposed the five income tax bands set out in box 1 (below). These apply to the earnings, pensions and property income of Scottish taxpayers; in other words, the NSND income of individuals who have their main home in Scotland. (There is guidance in the HMRC manuals on determining who is a Scottish taxpayer.) The Scotland Act 1998 requires the rates and bands to be set for the tax year, in advance of the start of the tax year.

Box 2 (below) shows whether a Scottish taxpayer will pay more or less. There are two comparisons that can be made. First, will a Scottish taxpayer comparing 2018/19 and the previous year (2017/18), on the same salary, pay more? The cut-off point when comparing a Scottish taxpayer’s take home pay is £33,000. However, this is in absolute terms and does not account for inflation. Second, will a Scottish taxpayer in 2018/19 pay more than someone on the same salary in England? The cut-off point for this comparison is £26,000.

It is notable that the personal allowance (which continues to be set by the UK government) has a major impact on who pays tax in the first place. According to the Scottish government, 44% in Scotland do not pay income tax as their income is below the personal allowance. The personal allowance also accounts for much of any increase in 2018/19 in take home pay. A person in Scotland earning £15,000 will be £90 better off in 2018/19 than 2017/18. This comprises two elements: the increase in the UK personal allowance, which provides a £70 increase in take-home pay; and a £2,000 starter band at 19% which saves 1%, i.e. £20. A person on the average Scottish wage of £24,000 will pay £90 less in tax in 2018/19 than 2017/18 for the same reasons.

In 2018/19, at the UK higher rate threshold of £46,350 (the higher rate threshold in Scotland is proposed to be £44,273), a Scottish taxpayer will pay £639 more than their English counterpart.

For those with income over £24,000, the tax rate is 1% higher than the rest of the UK. There is some debate about the behavioural impact of this proposal. Will it encourage incorporations? Will 1% on the higher rates be a driver of tax planning? Concerns have been expressed by some that it may not look attractive to inward investors.

Scottish taxpayers’ savings and dividends income are charged at UK rates, taking account of any UK measures such as the personal savings allowance (which will be £500 or £1,000 depending on the amount of total income a taxpayer has using the UK measure) or the dividend zero rate band. This means further complication.

Bringing in five bands also makes the interaction with other parts of income tax burdensome. In particular, the basic rate is key for withholding tax at source, or for giving relief at source. In Scotland, the basic rate is now proposed to apply to the band of income between £13,850 and £24,000 – with new rates of 19% and 21% introduced above and below this band. This creates an administrative nuisance in giving relief at the correct rate. It may lead to more people needing to go into the self-assessment (SA) regime, which seems counterproductive in view of other HMRC objectives to remove taxpayers from SA. HMRC prepared three technical notes on the interaction of Scottish income tax and the wider income tax regime, notably in relation to gift aid, pensions and trusts in May 2012, December 2014 and November 2016.

In relation to charitable donations, the challenges are somewhat in abeyance for the time being, as the UK government’s position is that charities should reclaim gift aid at the UK basic rate. While tax bands now vary and there is a new starter rate, the UK and Scottish basic rates remain the same. There is a theoretical risk at the margins, as someone paying tax at the starter rate may not have paid enough tax to cover a gift aid claim made on their donation at the UK basic rate.

The practical challenges for pension arrangements operating on a relief at source basis are more of a concern and therefore pose a more immediate policy challenge for the UK government. Pension administrators claim tax relief on pension contributions on behalf of individuals at the UK basic rate, with higher and top rate taxpayers able to make a further claim through self-assessment.

Clarification is needed as to how the starter rate is treated. If administrators are required to make claims in respect of Scottish taxpayers using the starter rate as the basis of tax relief claims, it would put most taxpayers in relief at source pension arrangements into self-assessment. The introduction of the intermediate band of 21% will in itself mean that more Scottish tax-payers will need to make self-assessment returns to take advantage of the full tax relief available to them, unless a less burdensome solution can be found.

Some allowances are tied to the basic rate as a form of means testing; for example, the marriage allowance. Compared with the position south of the border, this allowance is already restricted to a limited extent this year (2017/18) for Scottish taxpaying couples (to the higher rate threshold of £43,000 rather than £45,000) but next year it may be further restricted.

The marriage allowance was introduced by FA 2014 and incorporated into ITA 2007 ss 55A–55E. The legislation permits up to 10% of a spouse’s or civil partner’s unused personal allowance to be transferred but s 55B imposes the condition that the individual is not, for the tax year, liable to tax at a rate other than the basic rate. This has been amended to include the default basic rate, the savings basic rate, the dividend nil rate, the Scottish basic rate, the dividend ordinary rate, the savings nil rate or the starting rate for savings. However, the Scottish basic rate band will become much narrower in 2018/19 – applying to income from £13,850 to £24,000. We understand that it is intended by both the Scottish and UK governments that the allowance is to be extended to Scottish taxpayers on the starter, basic and intermediate rates, although the precise mechanics of this are not yet known.

Income tax for Scottish taxpayers will be more progressive, but more complex. For those with a range of income sources it may be difficult to understand the combination of bands and how they apply to NSND income, and to savings and dividends income. Accountability is important, so this complexity is not helpful.

Employed Scottish taxpayers should be in receipt of a coding notice from HMRC with a designatory ‘S’ prefix, which indicates that they have been deemed to be a Scottish taxpayer by HMRC. HMRC is responsible for identifying ‘S’ taxpayers and payroll departments must change tax codes when they receive notifications from HMRC. There has been some debate about the completeness of this operation. The National Audit Office estimates that around 80,000 people in the UK move into or out of Scotland each year, which generates work for HMRC and payroll departments.

The Scottish budget estimates are that the proposed changes will raise an additional £164m for the Scottish government; but some of this will be paid to HMRC to administer the tax. There will also be software costs for payroll administrators, pension providers and employers. Both HMRC and third-party software providers will need to get to grips with the complexities arising from the proposals and ensure that their products work, enabling taxpayers to file correct returns. Experience of the large number of online filing exceptions HMRC was forced to introduce for 2017 returns suggests that HMRC may struggle.

The NICs upper threshold in 2018/19 is to be increased across the UK in line with the rest of the UK (rUK) higher rate threshold for income tax. For Scottish taxpayers who have an income between the two higher rate thresholds of £44,273 (Scottish taxpayers) and £46,350 (rUK taxpayers), there will be a marginal rate of 53% (41% income tax and 12% NICs). Of course, it’s a moot point whether NICs is a tax or a social contribution, but the exercise of devolved income tax powers brings this question to the fore.

An interesting feature of LBTT is that at the outset it was different from SDLT, with progressive rates. However, since April 2015 the two taxes, LBTT and SDLT, have become increasingly aligned. This Scottish budget is no exception to the trend with a consultation proposed on a possible relief for first time buyers, but at a lower threshold than outside Scotland. It is unclear whether such a relief is needed in Scotland, given that the normal starting point for LBTT (£145,000) is already higher than that for SDLT (£125,000), while average property prices in many parts of Scotland are lower than in the rest of the UK.

UK air passenger duty (APD) was expected to be replaced with air departure tax from 1 April 2018, but this change is to be deferred until issues raised by the Scottish government in relation to the Highlands and Islands exemption have been resolved. The UK government will maintain the application of APD in Scotland in the interim, and the current APD rates will apply in Scotland for 2018/19.

An annual budget is needed in the UK because income tax is an annual tax and must be enacted every year. In Scotland, there is no such requirement but there does need to be a rate resolution on the income tax rates and bands. This is expected to be passed in February and it will be interesting to see the final political agreement on the Scottish income tax rates and bands. In relation to the devolved taxes, there is no regular, formal procedure for amending existing acts.

Note: After going to press, the Scottish government issued an updated fact sheet (http://bit.ly/2GBFQ9Z) and changed where the higher rate threshold is to come in from £44,273 down to £43,430.