HMRC has published new guidance on the VAT penalties and interest charges that will apply to those submitting VAT returns for accounting periods starting on or after 1 January 2023.

The default surcharge regime will be withdrawn for VAT return periods starting after 31 December 2022. Instead, a new penalty regime will apply if VAT returns are submitted late or if VAT is paid late. Repayment supplement will also be withdrawn and will be replaced by repayment interest.

Any nil or repayment VAT returns received late will also be subject to late-submission penalty points and financial penalties.

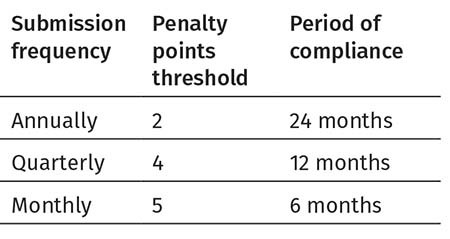

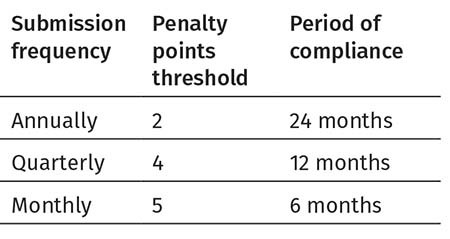

Late-submission penalties will work on a points-based system. Each VAT return submitted late will receive one late-submission penalty point. Once a penalty threshold is reached, businesses will receive a £200 penalty and a further £200 penalty for each subsequent late submission. The late-submission penalty points threshold will vary according to submission frequency.

From 1 January 2023, HMRC will charge late-payment interest from the day a VAT payment is overdue to the day the VAT is paid, calculated at the Bank of England base rate plus 2.5%.

Repayment supplement will be withdrawn for accounting periods starting after 31 December 2022. Instead, HMRC will pay repayment interest on VAT it owes, calculated from the day after the due date of submission of the VAT return, or the date of submission if later, until the day HMRC pays the amount of VAT that it owes. Repayment interest will normally be calculated at the Bank of England base rate minus 1%, but will never be lower than 0.5%, even if the repayment interest calculation results in a lower percentage.

HMRC has published new guidance on the VAT penalties and interest charges that will apply to those submitting VAT returns for accounting periods starting on or after 1 January 2023.

The default surcharge regime will be withdrawn for VAT return periods starting after 31 December 2022. Instead, a new penalty regime will apply if VAT returns are submitted late or if VAT is paid late. Repayment supplement will also be withdrawn and will be replaced by repayment interest.

Any nil or repayment VAT returns received late will also be subject to late-submission penalty points and financial penalties.

Late-submission penalties will work on a points-based system. Each VAT return submitted late will receive one late-submission penalty point. Once a penalty threshold is reached, businesses will receive a £200 penalty and a further £200 penalty for each subsequent late submission. The late-submission penalty points threshold will vary according to submission frequency.

From 1 January 2023, HMRC will charge late-payment interest from the day a VAT payment is overdue to the day the VAT is paid, calculated at the Bank of England base rate plus 2.5%.

Repayment supplement will be withdrawn for accounting periods starting after 31 December 2022. Instead, HMRC will pay repayment interest on VAT it owes, calculated from the day after the due date of submission of the VAT return, or the date of submission if later, until the day HMRC pays the amount of VAT that it owes. Repayment interest will normally be calculated at the Bank of England base rate minus 1%, but will never be lower than 0.5%, even if the repayment interest calculation results in a lower percentage.