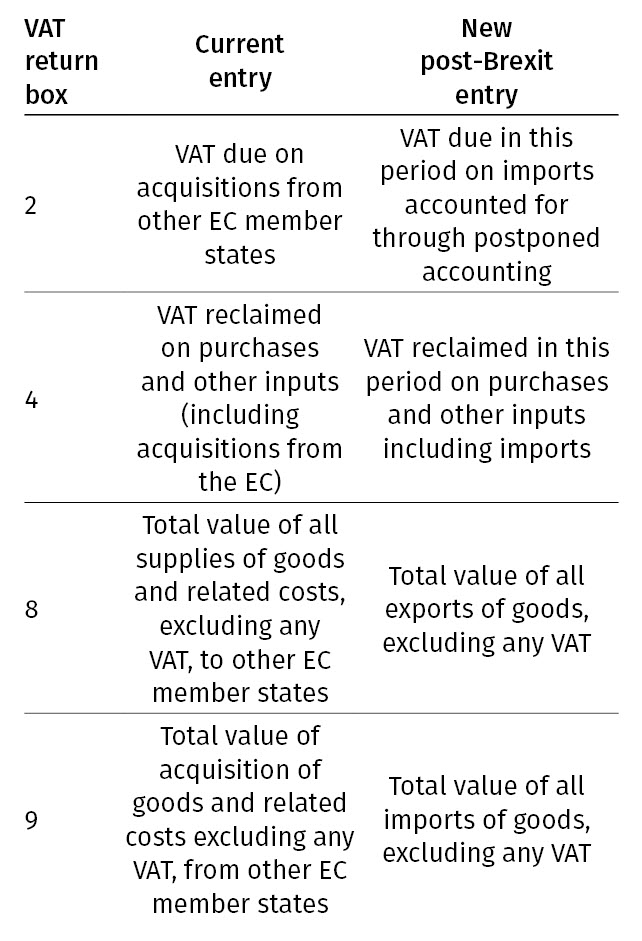

If the UK leaves the European Union on 31 October 2019, there will be a number of changes to VAT filings covering cross-border transactions. These arise as the UK leaves the EU VAT regime and becomes a ‘third country’ under EU rules.

Major changes to the VAT submissions will include:

and ending intra-community reporting on transactions between businesses in the UK and remaining 27 EU member states (‘EU27’).

In the case of a deal being signed in time for the 31 October deadline, it will likely include a transition period until at least 31 December 2020. In this case, the changes will only come into effect after that time when the UK leaves the EU VAT regime.

Reporting postponed accounting and avoiding cash payments: Leaving the EU VAT regime means the ending of the zero VAT rating simplification on sales of goods, ‘intra-community supplies’, between businesses in the UK and EU27. Instead, these transactions will become imports and exports, subject to UK or EU27 import VAT for the first time. There will be two options for settling the 20% UK VAT on goods coming into the UK from the EU27, or from anywhere in the world:

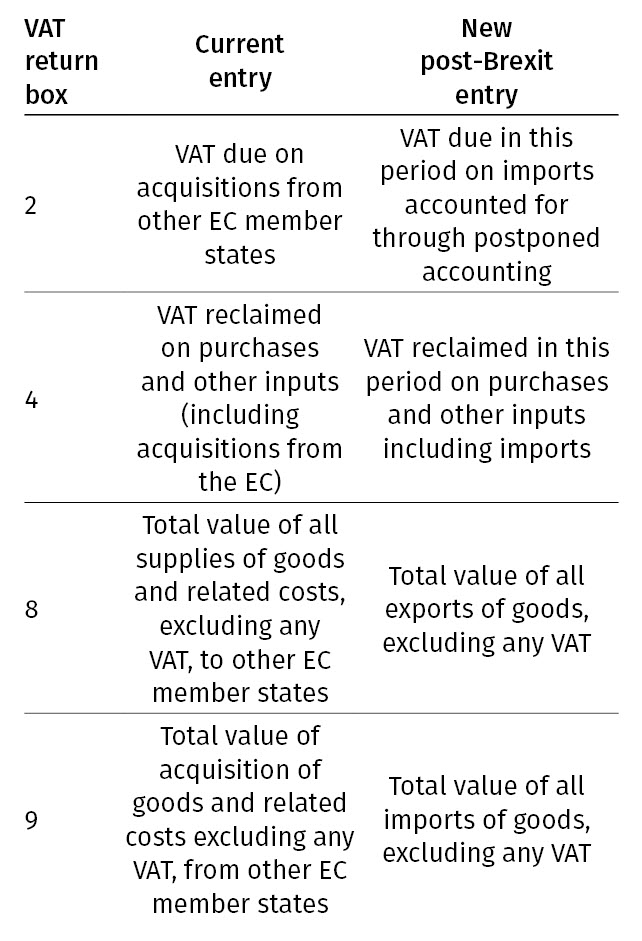

If the UK leaves the European Union on 31 October 2019, there will be a number of changes to VAT filings covering cross-border transactions. These arise as the UK leaves the EU VAT regime and becomes a ‘third country’ under EU rules.

Major changes to the VAT submissions will include:

and ending intra-community reporting on transactions between businesses in the UK and remaining 27 EU member states (‘EU27’).

In the case of a deal being signed in time for the 31 October deadline, it will likely include a transition period until at least 31 December 2020. In this case, the changes will only come into effect after that time when the UK leaves the EU VAT regime.

Reporting postponed accounting and avoiding cash payments: Leaving the EU VAT regime means the ending of the zero VAT rating simplification on sales of goods, ‘intra-community supplies’, between businesses in the UK and EU27. Instead, these transactions will become imports and exports, subject to UK or EU27 import VAT for the first time. There will be two options for settling the 20% UK VAT on goods coming into the UK from the EU27, or from anywhere in the world: