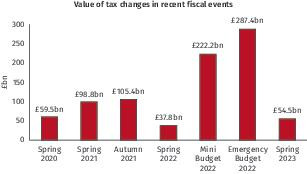

The Spring Budget included £54bn of changes across 40 tax policy areas over the next five years, according to Thomson Reuters, contrasting with over £220bn worth of changes to just 15 taxes in former Chancellor Kwarteng’s ‘Growth Plan’ mini-Budget in September 2022.

The research suggests the government has returned to something of a business as usual approach in terms of the impact of tax changes, with the value of the Spring Budget changes falling roughly in line with those in the Spring 2020 Budget.

Chancellor Hunt’s emergency Autumn Statement in November 2022 involved an eye-watering £287bn of tax changes, according to the data, although much of that was directed to reversing Chancellor Kwarteng’s proposals which themselves would have been worth £222bn had they come into force.

The Spring Budget included £54bn of changes across 40 tax policy areas over the next five years, according to Thomson Reuters, contrasting with over £220bn worth of changes to just 15 taxes in former Chancellor Kwarteng’s ‘Growth Plan’ mini-Budget in September 2022.

The research suggests the government has returned to something of a business as usual approach in terms of the impact of tax changes, with the value of the Spring Budget changes falling roughly in line with those in the Spring 2020 Budget.

Chancellor Hunt’s emergency Autumn Statement in November 2022 involved an eye-watering £287bn of tax changes, according to the data, although much of that was directed to reversing Chancellor Kwarteng’s proposals which themselves would have been worth £222bn had they come into force.