The further 2p cut to the main rates of employee and self-employed NICs will:

But in aggregate the NICs cuts just serve to give back a portion of the money that is being taken away through other income tax and NICs changes – in particular, multi-year freezes to tax thresholds at a time of high inflation. Overall, for every £1 given back to workers (including the self-employed) by the NICs cuts, £1.30 will have been taken away due to threshold changes between 2021 and 2024, with this rising to £1.90 in 2027.

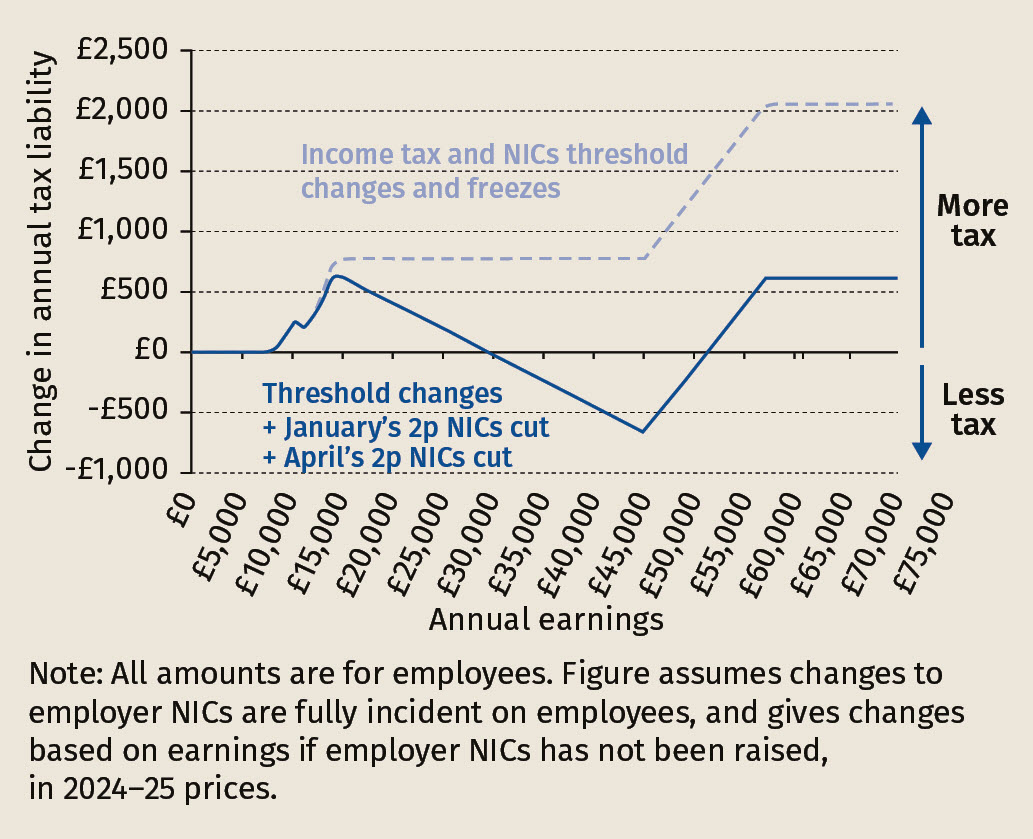

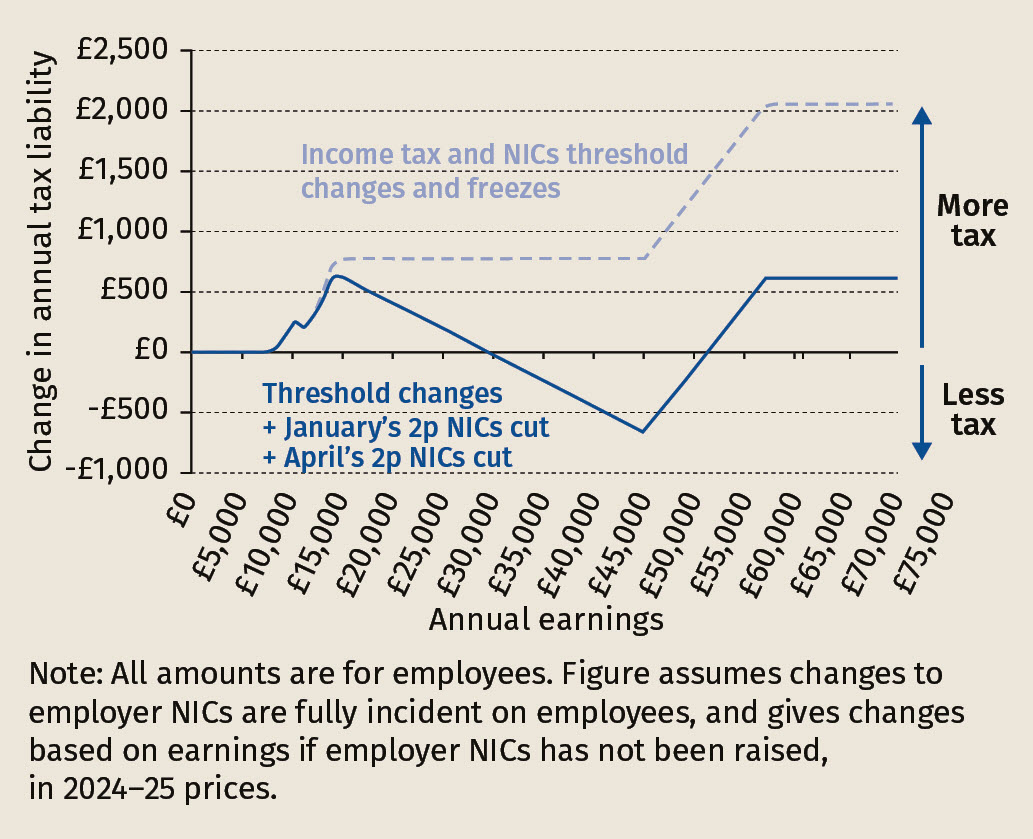

The pattern of gains and losses varies by earnings level.

In 2024/25, the net effect of all NICs and income tax changes since 2021 for an average earner will be a tax cut of about £340. Overall about half of employees – the 11 million earning between about £26,000 and £60,000 per year (the 40th and 90th percentiles of the earnings distribution) – will be better off. Any other employees earning enough to pay NICs or income tax will be worse off, because the cuts to NICs rates are more than offset by other tax rises.

By 2027/28, after another three years of real-terms cuts to tax thresholds, the net effect of income tax and NICs changes since 2021 for the average full-time earner will be a tax cut of £140 per year. Overall about a third of employees will still be better off as a result of all these changes: the 7 million earning between about £32,000 and £55,000 per year. Taxpaying employees earning less or more than that will lose.

The further 2p cut to the main rates of employee and self-employed NICs will:

But in aggregate the NICs cuts just serve to give back a portion of the money that is being taken away through other income tax and NICs changes – in particular, multi-year freezes to tax thresholds at a time of high inflation. Overall, for every £1 given back to workers (including the self-employed) by the NICs cuts, £1.30 will have been taken away due to threshold changes between 2021 and 2024, with this rising to £1.90 in 2027.

The pattern of gains and losses varies by earnings level.

In 2024/25, the net effect of all NICs and income tax changes since 2021 for an average earner will be a tax cut of about £340. Overall about half of employees – the 11 million earning between about £26,000 and £60,000 per year (the 40th and 90th percentiles of the earnings distribution) – will be better off. Any other employees earning enough to pay NICs or income tax will be worse off, because the cuts to NICs rates are more than offset by other tax rises.

By 2027/28, after another three years of real-terms cuts to tax thresholds, the net effect of income tax and NICs changes since 2021 for the average full-time earner will be a tax cut of £140 per year. Overall about a third of employees will still be better off as a result of all these changes: the 7 million earning between about £32,000 and £55,000 per year. Taxpaying employees earning less or more than that will lose.