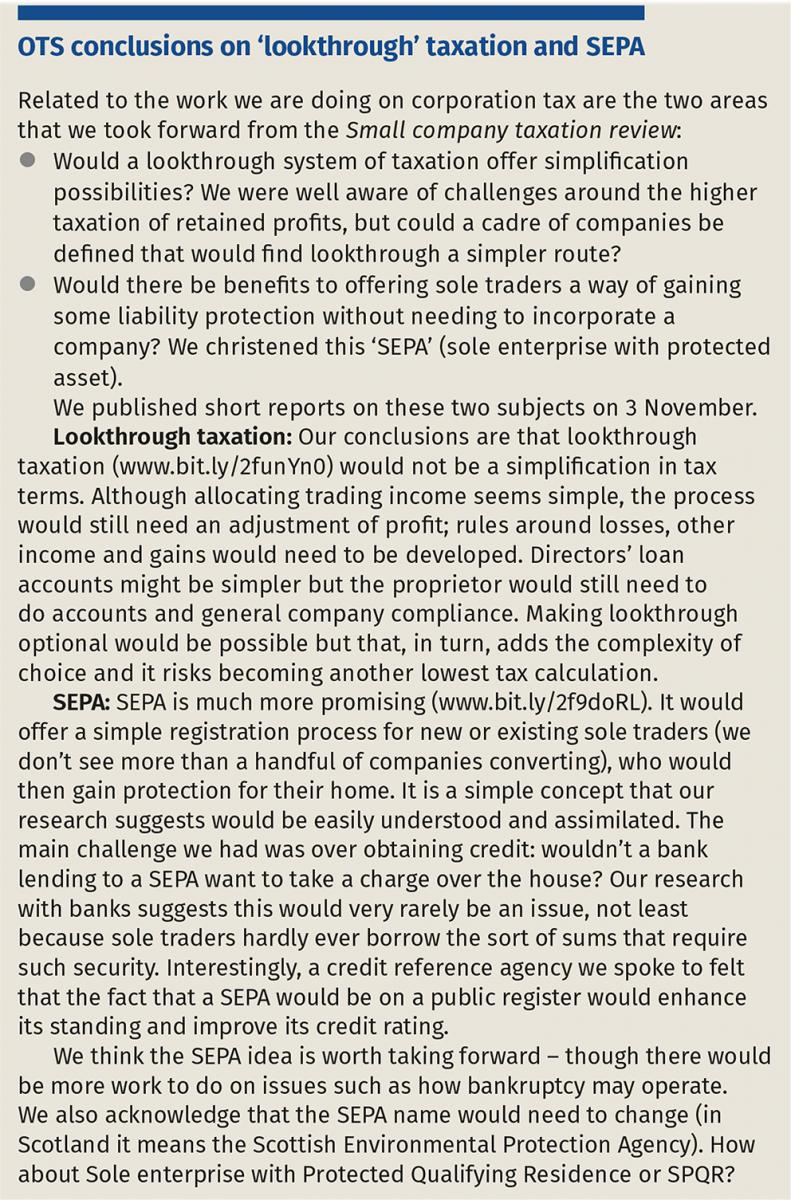

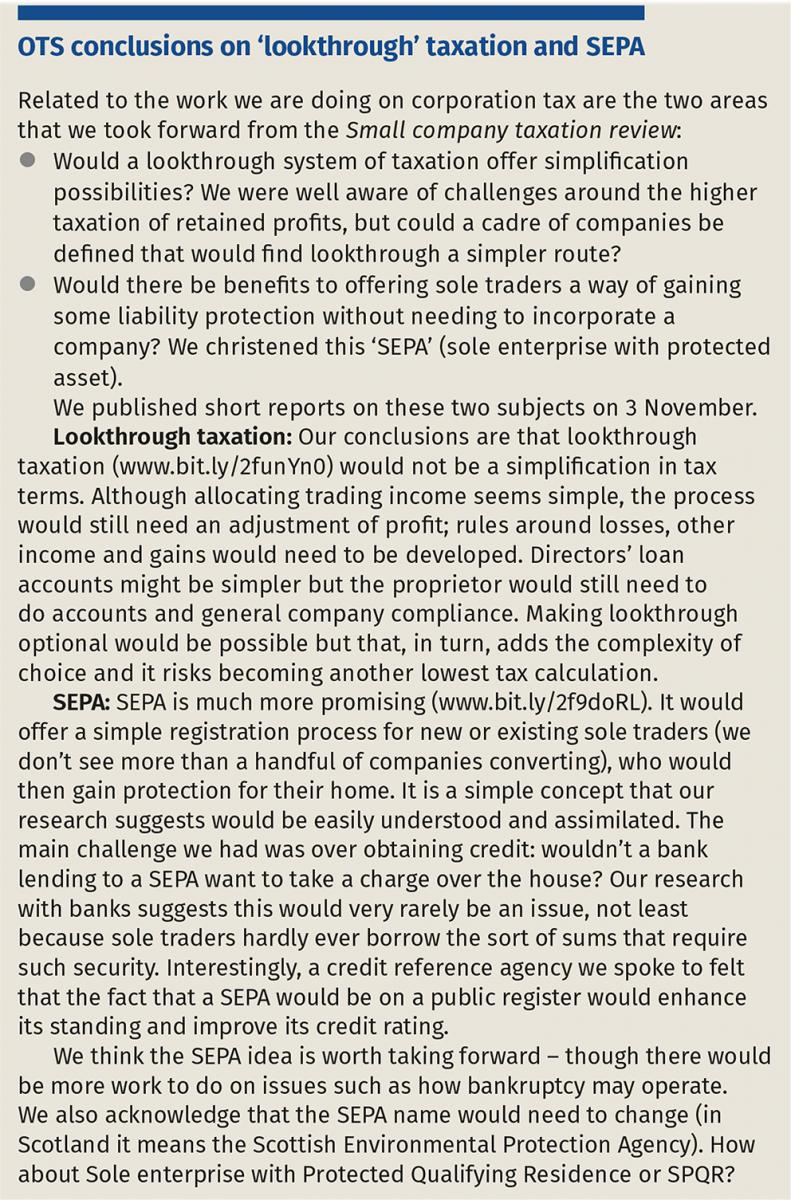

The Office of Tax Simplification (OTS) has published a progress report and call for evidence on its corporation tax simplification project. We need to gather evidence of where change is needed, support those changes and show that change is worthwhile. Comments are invited on seven main areas; alternatively, there are online surveys for businesses and their agents to complete. Input is needed between now and January so that the OTS can report by the end of February. The OTS has also published its conclusions on ‘lookthrough’ taxation – thumbs down; and SEPA (sole enterprise with protected asset) – thumbs up.

The OTS wants to know what companies and their advisers find difficult or time consuming about corporation tax, says its tax director John Whiting.

Corporation tax (CT) is not a new subject for the Office of Tax Simplification (OTS). It was a central feature of our Review of the competitiveness of the UK tax administration (www.bit.ly/2f98wMo); and earlier this year we reported on simplifying small company taxation (www.bit.ly/1R586EU). Both concluded that there was real scope for simplifying – streamlining, if you like – the calculation and compliance surrounding CT. We were therefore pleased when, earlier this year, ministers agreed to us undertaking a formal project that would take our ideas forward.

The terms of reference are published at www.bit.ly/27x4eC7. We are working on the basis that simplification of the CT computation is seen as desirable. Accordingly, we now need to dig down into what a simpler system might look like and what the implications would be.

Although many elements of CT have been re-engineered in recent decades and new provisions added, significant aspects of its underlying mechanics remain from its 19th century origins. A key question for this review has been the relevance of the way the computation works for a modern company.

The majority of CT rules apply both to large multinationals and to small one-person companies. There are, of course, hugely important issues about the taxation of multinational entities operating across multiple jurisdictions. But these specialist issues affect only a small proportion of companies: in 2013/14, out of two million companies making CT returns, only around 30,000 companies had a turnover over £10m.

This review is about the ‘bread and butter’ of CT as it affects every company, large and small. There may be areas where tax needs to remain specialist, but a taxpayer should be able to understand what they have paid and why. Is the way the computation works still ‘fit for purpose’ for the generality of companies, bearing in mind changing work and business patterns?

As well as drawing on our previous work, we have already been helped by the members of the consultative committee we set up to help guide this project. We have also spoken to a range of businesses and advisers. This has enabled us to frame properly the main issues that seem to be difficult or time consuming about CT. In doing so, we have confirmed support for what, in many ways, is one of our central tenets: with the CT rate being reduced to 17% by 2020, the value for money of many traditional adjustments needs to be questioned. After all, many date from a time when the rate was somewhat higher. Does anyone besides me remember CT of 52%?

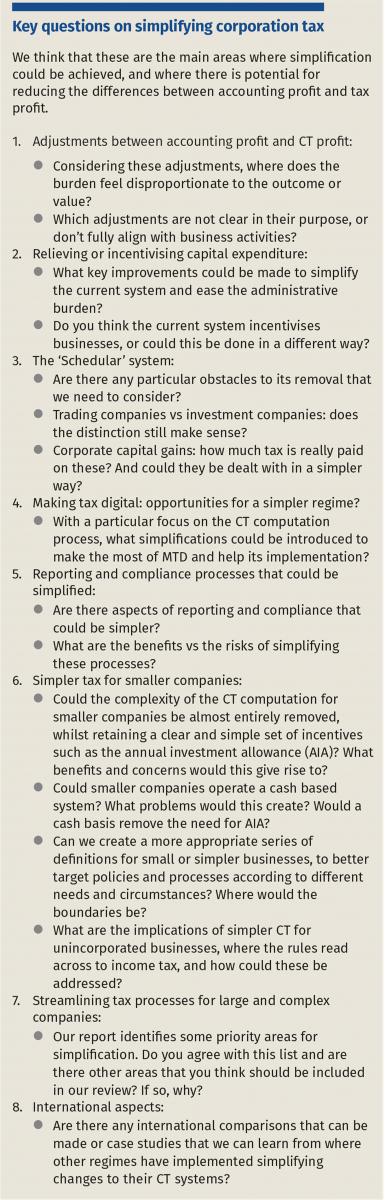

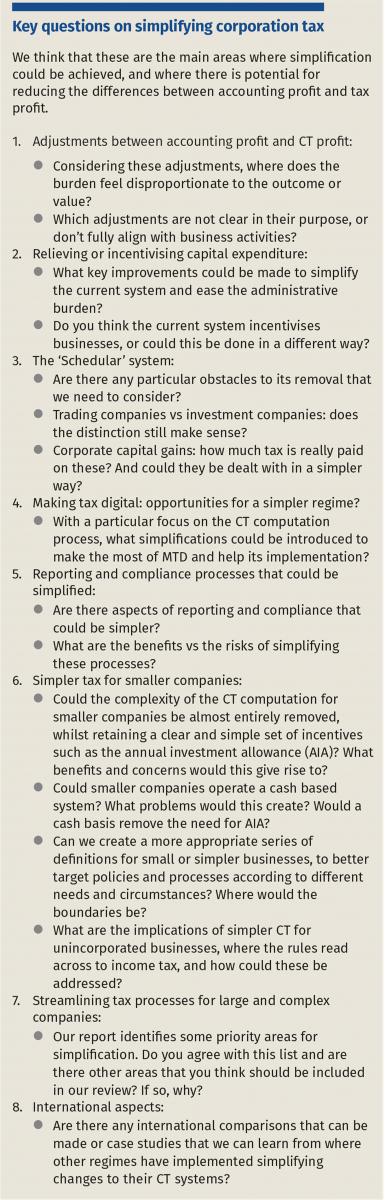

To take things forward, on 1 November we published a short progress report and call for evidence (http://bit.ly/2ez3gP3)). We set out seven areas where we think there is scope for simplification and potential for reducing the differences between accounting profit and tax profit:

What we need to know is what are the benefits and challenges in changing things in these areas? What is the prize? Is it worth the cost?

As always, the OTS wants to gather evidence to support our eventual recommendations. That means we want to engage companies and their advisers in a discussion on the themes we have set out and drill down into how best to answer the questions we have posed. We want to know what would make the most difference. We want views on the difficulties that making changes will cause. (After all, it has long been one of our mantras that change is the biggest cause of complexity – so if we are to propose change, those changes must be ‘worth it’.)

Are we focusing on the right areas? Are there other areas that need to be included? Let us know about approaches used in other countries that you think it would be useful for us to consider. What are the benefits, concerns and challenges that we will need to think about? Is there a simplification prize?

Views, however long or short, can be sent to us at ots@ots.gsi.gov.uk. We are always happy to meet with interested parties to hear views and share ideas. But, building on our previous successes with online surveys, we have also created two new surveys – one for small companies (www.bit.ly/2futhTu) and another for their advisers (www.bit.ly/2eETkpN) – to help us build a richer picture of this diverse business group. We think these can be completed in ten minutes – though it may take more or less time depending on views of course!

For larger business, as they are a smaller population, we will continue to discuss their issues with key stakeholders. These include accounting and other firms who do tax compliance work, industry representative bodies, individual large companies and groups with in-house tax teams, as well as with professional bodies. We will also be talking to front line HMRC staff and gathering data from HMRC’s Knowledge, Analysis and Intelligence (KAI) team and HM Treasury.

Comments are welcome at any time but will be most helpful by the end of 2016. We will still be talking to groups and businesses into January 2017 and we will be publishing our final report and recommendations before Budget 2017.

The Office of Tax Simplification (OTS) has published a progress report and call for evidence on its corporation tax simplification project. We need to gather evidence of where change is needed, support those changes and show that change is worthwhile. Comments are invited on seven main areas; alternatively, there are online surveys for businesses and their agents to complete. Input is needed between now and January so that the OTS can report by the end of February. The OTS has also published its conclusions on ‘lookthrough’ taxation – thumbs down; and SEPA (sole enterprise with protected asset) – thumbs up.

The OTS wants to know what companies and their advisers find difficult or time consuming about corporation tax, says its tax director John Whiting.

Corporation tax (CT) is not a new subject for the Office of Tax Simplification (OTS). It was a central feature of our Review of the competitiveness of the UK tax administration (www.bit.ly/2f98wMo); and earlier this year we reported on simplifying small company taxation (www.bit.ly/1R586EU). Both concluded that there was real scope for simplifying – streamlining, if you like – the calculation and compliance surrounding CT. We were therefore pleased when, earlier this year, ministers agreed to us undertaking a formal project that would take our ideas forward.

The terms of reference are published at www.bit.ly/27x4eC7. We are working on the basis that simplification of the CT computation is seen as desirable. Accordingly, we now need to dig down into what a simpler system might look like and what the implications would be.

Although many elements of CT have been re-engineered in recent decades and new provisions added, significant aspects of its underlying mechanics remain from its 19th century origins. A key question for this review has been the relevance of the way the computation works for a modern company.

The majority of CT rules apply both to large multinationals and to small one-person companies. There are, of course, hugely important issues about the taxation of multinational entities operating across multiple jurisdictions. But these specialist issues affect only a small proportion of companies: in 2013/14, out of two million companies making CT returns, only around 30,000 companies had a turnover over £10m.

This review is about the ‘bread and butter’ of CT as it affects every company, large and small. There may be areas where tax needs to remain specialist, but a taxpayer should be able to understand what they have paid and why. Is the way the computation works still ‘fit for purpose’ for the generality of companies, bearing in mind changing work and business patterns?

As well as drawing on our previous work, we have already been helped by the members of the consultative committee we set up to help guide this project. We have also spoken to a range of businesses and advisers. This has enabled us to frame properly the main issues that seem to be difficult or time consuming about CT. In doing so, we have confirmed support for what, in many ways, is one of our central tenets: with the CT rate being reduced to 17% by 2020, the value for money of many traditional adjustments needs to be questioned. After all, many date from a time when the rate was somewhat higher. Does anyone besides me remember CT of 52%?

To take things forward, on 1 November we published a short progress report and call for evidence (http://bit.ly/2ez3gP3)). We set out seven areas where we think there is scope for simplification and potential for reducing the differences between accounting profit and tax profit:

What we need to know is what are the benefits and challenges in changing things in these areas? What is the prize? Is it worth the cost?

As always, the OTS wants to gather evidence to support our eventual recommendations. That means we want to engage companies and their advisers in a discussion on the themes we have set out and drill down into how best to answer the questions we have posed. We want to know what would make the most difference. We want views on the difficulties that making changes will cause. (After all, it has long been one of our mantras that change is the biggest cause of complexity – so if we are to propose change, those changes must be ‘worth it’.)

Are we focusing on the right areas? Are there other areas that need to be included? Let us know about approaches used in other countries that you think it would be useful for us to consider. What are the benefits, concerns and challenges that we will need to think about? Is there a simplification prize?

Views, however long or short, can be sent to us at ots@ots.gsi.gov.uk. We are always happy to meet with interested parties to hear views and share ideas. But, building on our previous successes with online surveys, we have also created two new surveys – one for small companies (www.bit.ly/2futhTu) and another for their advisers (www.bit.ly/2eETkpN) – to help us build a richer picture of this diverse business group. We think these can be completed in ten minutes – though it may take more or less time depending on views of course!

For larger business, as they are a smaller population, we will continue to discuss their issues with key stakeholders. These include accounting and other firms who do tax compliance work, industry representative bodies, individual large companies and groups with in-house tax teams, as well as with professional bodies. We will also be talking to front line HMRC staff and gathering data from HMRC’s Knowledge, Analysis and Intelligence (KAI) team and HM Treasury.

Comments are welcome at any time but will be most helpful by the end of 2016. We will still be talking to groups and businesses into January 2017 and we will be publishing our final report and recommendations before Budget 2017.