The CCCTB is a single set of rules that companies operating in the EU would use to calculate their taxable profits, rather than national tax rules. The profits would then be allocated between member states on a formulary apportionment basis by reference to employees, assets and sales in each member state. Each member state then applies its own tax rate to the profits allocated to it. Member states would therefore retain sovereignty over corporate tax rates, but most other aspects of corporate profits taxation would become an EU competency.

The idea for a harmonised EU corporate profits tax dates back almost a quarter of a century, to the Ruding Report, produced for the Commission in 1992 by the Institute for Fiscal Studies. The policy has since been the subject of various Commission communications, including Towards an internal market without tax obstacles (2001). A Commission Working Group was set up in 2004, and a Commission CCCTB legislative proposal was finally published in March 2011.

This was, however, highly controversial. Some member states (and, in particular, the UK) were opposed in principle, on the basis that member states would cease to be able to determine most questions of corporate tax policy. Other member states were concerned that unitary taxation would have the overall effect of shifting tax revenues and employment from smaller countries to larger countries (see Study on the economic and budgetary impact of the introduction of a common consolidated corporate tax base in the European Union, commissioned by the Irish Department of Finance from EY in 2011).

Hence, the 2011 proposal did not proceed. The Commission has now published a revised CCCTB proposal in an attempt to revitalise the process.

The key changes, reflected in both CCTB and CCCTB, are:

The general principle is that all revenues are taxable unless expressly exempted. The CCTB/CCCTB rules calculate the tax base by taking ‘revenues less exempt revenues, deductible expenses and other deductible items’:

As with the 2011 proposal, taxpayers would be able to carry forward losses indefinitely, but losses cannot be carried back. The CCTB Directive includes transitional cross-border loss relief provisions, pending the implementation of the CCCTB Directive.

A resident taxpayer that meets the mandatory enrolment criteria (i.e. consolidated revenues of over €750m) would be required to form a group with:

‘Qualifying subsidiaries’ would be determined in accordance with the following two part test:

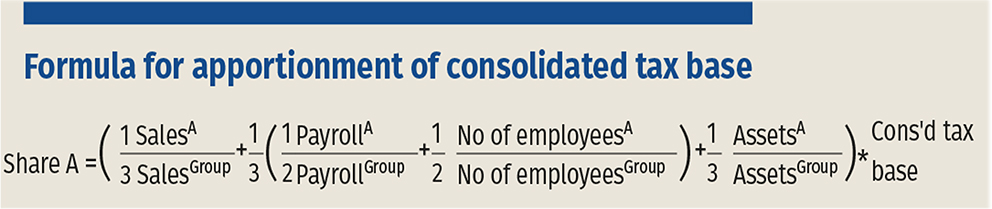

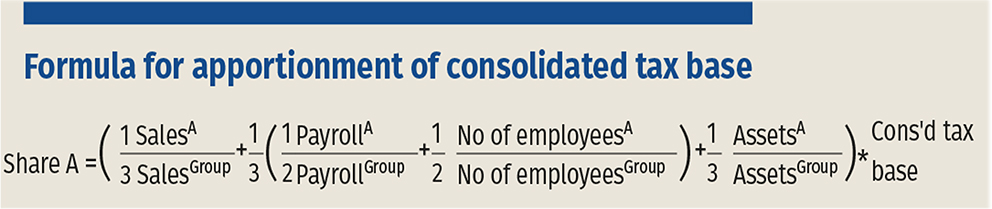

Under the CCCTB Directive, the tax bases of all group members would be added together to form a consolidated tax base. Where this amount is negative, this loss would be carried forward. Where the amount is positive, the consolidated tax base would be apportioned between the different members of the group (and therefore the relevant member states) using an apportionment formula. Member states would then apply their own tax rate to the relevant apportioned amounts.

The formula (shown below) comprises three equally weighted factors:

Intangible and financial assets are said to be excluded from the formula due to their mobility, to avoid the risk of circumventing the system. This, of course, creates obvious anomalies for the financial sector and businesses, dependent on intellectual property. (This is discussed further below.)

Under the CCCTB proposal, each group would be represented by a single group member (the principal taxpayer). The principal taxpayer would then only deal with one tax administration (the ‘principal tax authority’), which would be the tax authority in which it is tax resident.

Audits would be initiated by the principal tax authority. However, other member states in which group members are resident may also request the initiation of an audit.

Any disputes between taxpayers and tax authorities would be heard by an administrative body which is competent to hear appeals at first instance under the laws of the member state of the principal tax authority.

The Commission sees two key benefits for the CCCTB.

The first is countering tax avoidance by eliminating ‘mismatches and loopholes between national systems, which companies currently can exploit to avoid taxation’. The Commission suggests that the CCCTB would eliminate 70% of profit shifting for tax purposes.

The second is reducing the administrative burden of compliance costs that companies face when dealing with 28 national tax systems, in particular transfer pricing rules. The Commission has estimated that time spent on annual compliance could be cut by 8%, whilst the time taken to set up a subsidiary would decrease by up to 67%.

The Commission believes the same benefits apply to the CCTB (to a lesser degree).

The CCCTB is a single set of rules that companies operating in the EU would use to calculate their taxable profits, rather than national tax rules. The profits would then be allocated between member states on a formulary apportionment basis by reference to employees, assets and sales in each member state. Each member state then applies its own tax rate to the profits allocated to it. Member states would therefore retain sovereignty over corporate tax rates, but most other aspects of corporate profits taxation would become an EU competency.

The idea for a harmonised EU corporate profits tax dates back almost a quarter of a century, to the Ruding Report, produced for the Commission in 1992 by the Institute for Fiscal Studies. The policy has since been the subject of various Commission communications, including Towards an internal market without tax obstacles (2001). A Commission Working Group was set up in 2004, and a Commission CCCTB legislative proposal was finally published in March 2011.

This was, however, highly controversial. Some member states (and, in particular, the UK) were opposed in principle, on the basis that member states would cease to be able to determine most questions of corporate tax policy. Other member states were concerned that unitary taxation would have the overall effect of shifting tax revenues and employment from smaller countries to larger countries (see Study on the economic and budgetary impact of the introduction of a common consolidated corporate tax base in the European Union, commissioned by the Irish Department of Finance from EY in 2011).

Hence, the 2011 proposal did not proceed. The Commission has now published a revised CCCTB proposal in an attempt to revitalise the process.

The key changes, reflected in both CCTB and CCCTB, are:

The general principle is that all revenues are taxable unless expressly exempted. The CCTB/CCCTB rules calculate the tax base by taking ‘revenues less exempt revenues, deductible expenses and other deductible items’:

As with the 2011 proposal, taxpayers would be able to carry forward losses indefinitely, but losses cannot be carried back. The CCTB Directive includes transitional cross-border loss relief provisions, pending the implementation of the CCCTB Directive.

A resident taxpayer that meets the mandatory enrolment criteria (i.e. consolidated revenues of over €750m) would be required to form a group with:

‘Qualifying subsidiaries’ would be determined in accordance with the following two part test:

Under the CCCTB Directive, the tax bases of all group members would be added together to form a consolidated tax base. Where this amount is negative, this loss would be carried forward. Where the amount is positive, the consolidated tax base would be apportioned between the different members of the group (and therefore the relevant member states) using an apportionment formula. Member states would then apply their own tax rate to the relevant apportioned amounts.

The formula (shown below) comprises three equally weighted factors:

Intangible and financial assets are said to be excluded from the formula due to their mobility, to avoid the risk of circumventing the system. This, of course, creates obvious anomalies for the financial sector and businesses, dependent on intellectual property. (This is discussed further below.)

Under the CCCTB proposal, each group would be represented by a single group member (the principal taxpayer). The principal taxpayer would then only deal with one tax administration (the ‘principal tax authority’), which would be the tax authority in which it is tax resident.

Audits would be initiated by the principal tax authority. However, other member states in which group members are resident may also request the initiation of an audit.

Any disputes between taxpayers and tax authorities would be heard by an administrative body which is competent to hear appeals at first instance under the laws of the member state of the principal tax authority.

The Commission sees two key benefits for the CCCTB.

The first is countering tax avoidance by eliminating ‘mismatches and loopholes between national systems, which companies currently can exploit to avoid taxation’. The Commission suggests that the CCCTB would eliminate 70% of profit shifting for tax purposes.

The second is reducing the administrative burden of compliance costs that companies face when dealing with 28 national tax systems, in particular transfer pricing rules. The Commission has estimated that time spent on annual compliance could be cut by 8%, whilst the time taken to set up a subsidiary would decrease by up to 67%.

The Commission believes the same benefits apply to the CCTB (to a lesser degree).