The proposals for more flexible relief of losses arising after 1 April 2017 are welcome. It is recognised that there has been public debate about the impact of losses on corporate profits, and that the 50%/25% profit restrictions for offsetting carried-forward losses no doubt reflect pressure on corporate tax revenues. However, the current proposed changes represent a missed opportunity to review both the substance of the corporate tax loss relief rules and the claim and timing mechanics. Subject to post-consultation changes, the new rules will create some winners (particularly smaller groups with limited losses) but they are complex, contain areas of uncertainty, and will have significant cash and DTA implications for some larger groups. If implemented as set out in the consultation document, the new regime will result in the loss capping being more drastic for some groups than the 50%/25% headline suggests. Tax teams will want to assess carefully the impact of the proposals in the light of actual figures and forecast profits/losses.

Loss relief is a contentious subject at the moment. In the US, questions about loss relief and Donald Trump’s personal tax position have hit global headlines, and comments from campaigning groups have encouraged wider debate about whether profitable groups and companies should be able to eliminate their tax liabilities through relief for carried-forward losses. Country-by-country reporting is likely to increase this scrutiny, some of it less than well informed. This has been particularly sensitive for banks: many banks had huge 2008 losses and in some countries, including the UK until April 2015, they were able to use these to offset fully qualifying profits in later years. There has also been a certain amount of economy with the truth in the public policy debate; for example, when announcing the original change to carry forward loss rules for banks in December 2014, the chancellor implied that the size of bank losses came as a surprise, leading to prompt change in the rules. The size of bank losses was well known and would have been publicly apparent from the 2010 OCED report Addressing tax risks involving bank losses (see page 17), if not before. And there has been a divergence of national approaches. Controversially, Spain, Italy, Greece and Portugal, rather than capping relief for bank losses, have created a repayable credit regime to enable these to count as part of capital for Basel III and CRD IV, giving rise to some state aid controversy.

The UK’s current proposals for restriction of losses appear to have been developed quickly and modelled on the hastily introduced bank loss restriction regime. It is unfortunate that there has been no wider consultation on the policy objectives of corporate loss relief, how best to balance revenue raising requirements with workability, and the cost/benefit of different design options. If there has been evaluation of the benefit of loss relief for some groups versus a lower corporation tax rate overall, HMT has certainly not shared the outcome. The cashflow implications of delaying relief for real economic losses over multiple years are potentially serious in volatile or capital intensive industries, particularly for major infrastructure projects. Delayed start up loss relief is also a problem for industries dependent on high risk research or IT development – which the UK is eager to attract and retain, particularly post-Brexit.

The March 2016 Budget announcements were, in broad terms that, from April 2017:

While (4) above will undoubtedly be very welcome, and goes some way to address concerns about problems with the current loss relief rules, the current proposals do not live up to their presentation as a change to modernise an ‘arbitrary’ set of rules which are ‘not consistent with international best practice, overly restrictive and not reflective of the way in which businesses operate’ (HMRC’s consultation document Reforms to corporation tax loss relief: consultation on delivery (May 2016), paras 1.14–15). These proposals will give rise to winners and losers, impose a significant compliance burden, particularly for banks, and will affect some groups’ deferred tax assets (DTA) positions.

The consultation document assumes, while inviting comments, that the definition of ‘group’ will remain the same as for current group relief purposes. As indicated above, consortia are to be allowed to benefit from the more flexible offset rules for post-1 April 2017 losses, subject to a range of safeguards and allocation provisions.

As with most recent tax changes, a number of proposed design features are driven by fears about manipulation of the rules, and targeted anti-avoidance rules (TAARs) may also be incorporated. It is, unfortunately, a safe bet that any ‘targeted’ anti-avoidance rules will be widely worded, complicate the relevant statutory provisions and lead to grey areas; and it may well be difficult to get any confirmation from HMRC about its interpretation of these rules in particular circumstances within a realistic commercial timeframe.

It also looks as if HMRC’s well intentioned determination to make certain that no bank losses will ever be relieved at more than 25% will result in lengthy and complex provisions relating to mixed groups. Mixed groups will, in reality, include not just groups that are primarily non-banking groups (retail, motor or production groups that have a bank in the group), but also most groups which the ordinary person thinks of as banking groups, because most such groups combine one or two banks with many non-banking companies which are holding entities, carry on ancillary activities (services, for example) or non-banking financial services activities (such as insurance or consumer credit).

The first overall problem with the proposals is their complexity. Despite HMRC neatly ‘bucketing’ various stages of the calculation under headings to imply there is a process involving only a few steps, the reality is that each of these ‘steps’ involves several processes; and, since these calculations apply for each individual company, for large and complex groups the additional compliance burden will be considerable. That is why the process for a very simplified example of a group calculation takes three pages of A4 to lay out, and a simplified banking example takes even more. For a real life large group, the calculations will be much more complex. Also, all HMRC’s examples use post-2017 periods to avoid the need to apportion 2017 profits and losses, which will create further complications (and potentially grey areas) for all groups other than the small number with a 31 March year end.

HMRC has noted that the £5m exemption from the 50% loss restriction rules means that a high proportion of taxpaying companies/groups will not see any immediate adverse cash tax impact. However, the Budget estimates that £1.36bn in revenue will be raised from the measures over the next four years, demonstrating how much HMRC expects these to extract from large groups, where the £5m exemption will have little effect.

Given the stated policy objectives, the mechanics did not need to be complicated. All that was needed was:

In reality, when reviewing the detail of the proposals, it does not just become clear that the system extremely complex; but also, that it has been complicated in a way which will in practice restrict loss relief for larger groups beyond the level suggested by the headlines.

Before looking at example calculations, it is easiest to begin with the principles that are not expected to be affected by the new regime:

There are other areas where the consultation document envisaged possible change while seeking input. These included the following:

The question of whether reliefs which can be set against chargeable gains can be offset to 100% is not expressly discussed. The document merely refers to capital losses (at paras 2.17–2.21), where the argument for additional flexibility for capital loss offset has been rejected. Chargeable gains bear no resemblance to accounting profits in any case, and it is not clear in the examples whether ‘non-trading profits’ include gains. In policy terms, it seems inappropriate to distinguish allowable capital losses, but to treat chargeable gains as simply part of non-trading income.

HMRC’s proposed approach to in year loss offset will present many groups with serious problems, and it will be important to try and model this. Representations based on practical examples are always of more interest to HMRC than theoretical issues; therefore, where the outcome would be sensitive to business decisions about siting, for example research activity in the UK, the issue should be raised with HMT/HMRC.

It is probably easiest to illustrate the difficulties by using one of HMRC’s own examples: example 5 (see pages 32–53). However, we will multiply all the numbers by a factor of 10, because otherwise the £5m allowance masks the nature and extent of the problems.

HMRC has chosen an example which simplifies the calculation by skipping past the 2017 straddle period. To illustrate the key concern here and keep the numbers simple, we will do the same – but note that apportionment will complicate real life calculations in 2017.

See figure 1 below.

Under present rules, a decision would have to be taken as to how to balance the benefit of immediate use of losses against the risk of certain losses becoming trapped. This has become more problematic than it used to be, because of heightened sensitivity about the application of anti-avoidance rules (and the Banking Code) where steps are taken to match income and available losses after the event.

Under the current proposals, the reliefs which give any flexibility are:

The group will also want to use the £5m exemption for losses available for 100% carry forward, but with a group of this size this has limited impact. We will not look further at company K here due to lack of space, as its position is more straightforward.

HMRC assumes a group relief election is made to offset the whole of company J’s loss against company I’s profits. As noted above, utilising current year losses will stop them being subject to the 50% cap in subsequent years, which increases significantly the incentive to use these on a current year basis, even if there were substantial profits in company J in the following year. On the other hand, for losses treated as post-2017, failure to use these in year means that they are much less likely to become ‘trapped’ losses, which are hard to use because they cannot be set off against the right type of income or transferred.

However, the HMRC proposals assume, by contrast with the current rules, where group relief shelters (broadly) the last slice of relief, that group relief once elected for is taken as the first slice of relief. This has a major impact on company I’s tax position. With apologies to those who prefer principles to numbers, the position looks like this (see figure 2):

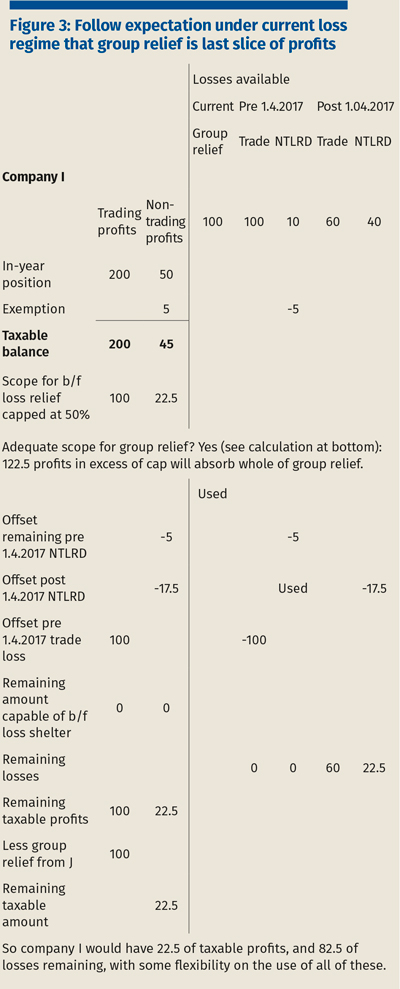

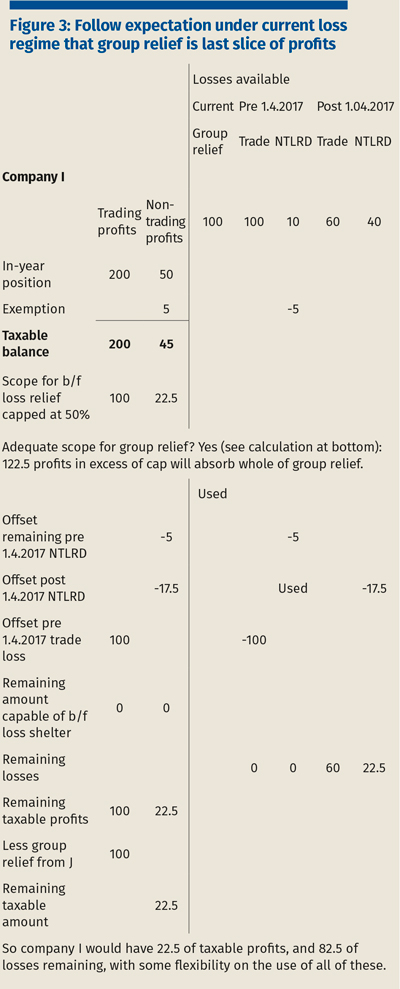

If instead, as would be expected from the headline messages, there was no major change in methodology, and group relief remained the last line of relief, the position would be as follows (see figure 3):

If the current proposals are adopted, groups will find themselves in an unwelcome cleft stick, because it will not normally be particularly attractive to try to preserve scope for offset of brought forward losses by choosing not to group relieve losses. This illustrates the position for company I if no group relief claim is made (see figure 4).

The outcome delivered by HMRC’s approach also differs from the outcome if, instead of company J’s trade being carried on by a separate company, it was carried on by company I itself. This would lead to the same cash tax being due as in the group relief scenario, but with a switch in the split between trading and non-trading profits which affects the losses utilised (see figure 5).

Depending on the amounts, and the group’s subsequent tax profile, the difference could be significant. If the trade losses had instead been, say 150, the difference between the position if HMRC’s current approach were adopted and the position if activities (trading or non-trading) are conducted in a single company could be substantial.

The proposed scheme sticks rigidly to the current stipulations for offsetting pre-2017 losses against trade profit or non-trade profits; however, by assuming that group relief is the first slice of relief and is applied on a pro rata basis, it restricts the scope for offset further than the 50% headline suggests. This is presumably considered to be justifiable because (in concept) group relief is against total profits. In reality, though, this approach both reduces brought forward loss offset and affects the amount of trading and non-trading losses. As can be seen from the last calculation above, if the losses are trading losses in entity, they do not affect the trading/non-trading profit split. If they are in another entity, even if exclusively trading or non-trading losses, they are apportioned between non-trading and trading profits in the recipient entity. In the example above, company I had brought forward losses of all types; however, for an entity with a single type of losses but also some scope for group relief, the outcome could be harsh.

This example focuses on the position for pre-2017 brought forward losses, where the potential impact is most serious. For post-2017 losses, there will be some compensation because of the flexibility in surrendering the losses.

Groups will want to work out the implications of this on an individual basis, but it is a little surprising that the implications of HMRC’s methodology are not expressly and clearly flagged. It is tempting to recall Lord Denning’s typically blunt comment about an exclusion clause in Thornton v Shoe Lane Parking [1971] 2 WLR 585, that it was so significant it should be ‘printed in red ink with a red hand pointing to it – or something equally startling’. It is important that group tax teams, currently deluged with consultation material and proposed changes, should be aware of the issues and have key elements prominently identified.

If implemented in their current form, the proposals will create winners and losers. Broadly, the winners will be:

The losers will be:

The impact will need to be taken into account when calculating DTAs and therefore it may have a financial statement impact, as well as a cash tax effect. Because the more flexible loss relief rules will not apply to any pre-2017 losses, for most groups any change to DTAs in 2017 is likely to be negative, even if in later years groups benefit from being able to recognise losses which would formerly have been treated as trapped and disregarded.

For M&A transactions, modelling the effect of the changes on acquired or merged groups will be important; however, this will not be helped by the current uncertainty about the scope of restrictions on surrender of losses between pre and post-acquisition sub-groups.

Groups impacted by the group relief methodology problem will want to make appropriate representations. For large and complex groups, even if the rules come in with some modification, ‘what if?’ scenario models are likely to be useful in judging what group loss relief claims to make. Perhaps this is HMRC’s contribution to making sure we all keep our skills sharp; but it also feels like the creation of a set of rules which are ripe for change under the current OTS review of the corporation tax computation, even before they are actually implemented.

The proposals for more flexible relief of losses arising after 1 April 2017 are welcome. It is recognised that there has been public debate about the impact of losses on corporate profits, and that the 50%/25% profit restrictions for offsetting carried-forward losses no doubt reflect pressure on corporate tax revenues. However, the current proposed changes represent a missed opportunity to review both the substance of the corporate tax loss relief rules and the claim and timing mechanics. Subject to post-consultation changes, the new rules will create some winners (particularly smaller groups with limited losses) but they are complex, contain areas of uncertainty, and will have significant cash and DTA implications for some larger groups. If implemented as set out in the consultation document, the new regime will result in the loss capping being more drastic for some groups than the 50%/25% headline suggests. Tax teams will want to assess carefully the impact of the proposals in the light of actual figures and forecast profits/losses.

Loss relief is a contentious subject at the moment. In the US, questions about loss relief and Donald Trump’s personal tax position have hit global headlines, and comments from campaigning groups have encouraged wider debate about whether profitable groups and companies should be able to eliminate their tax liabilities through relief for carried-forward losses. Country-by-country reporting is likely to increase this scrutiny, some of it less than well informed. This has been particularly sensitive for banks: many banks had huge 2008 losses and in some countries, including the UK until April 2015, they were able to use these to offset fully qualifying profits in later years. There has also been a certain amount of economy with the truth in the public policy debate; for example, when announcing the original change to carry forward loss rules for banks in December 2014, the chancellor implied that the size of bank losses came as a surprise, leading to prompt change in the rules. The size of bank losses was well known and would have been publicly apparent from the 2010 OCED report Addressing tax risks involving bank losses (see page 17), if not before. And there has been a divergence of national approaches. Controversially, Spain, Italy, Greece and Portugal, rather than capping relief for bank losses, have created a repayable credit regime to enable these to count as part of capital for Basel III and CRD IV, giving rise to some state aid controversy.

The UK’s current proposals for restriction of losses appear to have been developed quickly and modelled on the hastily introduced bank loss restriction regime. It is unfortunate that there has been no wider consultation on the policy objectives of corporate loss relief, how best to balance revenue raising requirements with workability, and the cost/benefit of different design options. If there has been evaluation of the benefit of loss relief for some groups versus a lower corporation tax rate overall, HMT has certainly not shared the outcome. The cashflow implications of delaying relief for real economic losses over multiple years are potentially serious in volatile or capital intensive industries, particularly for major infrastructure projects. Delayed start up loss relief is also a problem for industries dependent on high risk research or IT development – which the UK is eager to attract and retain, particularly post-Brexit.

The March 2016 Budget announcements were, in broad terms that, from April 2017:

While (4) above will undoubtedly be very welcome, and goes some way to address concerns about problems with the current loss relief rules, the current proposals do not live up to their presentation as a change to modernise an ‘arbitrary’ set of rules which are ‘not consistent with international best practice, overly restrictive and not reflective of the way in which businesses operate’ (HMRC’s consultation document Reforms to corporation tax loss relief: consultation on delivery (May 2016), paras 1.14–15). These proposals will give rise to winners and losers, impose a significant compliance burden, particularly for banks, and will affect some groups’ deferred tax assets (DTA) positions.

The consultation document assumes, while inviting comments, that the definition of ‘group’ will remain the same as for current group relief purposes. As indicated above, consortia are to be allowed to benefit from the more flexible offset rules for post-1 April 2017 losses, subject to a range of safeguards and allocation provisions.

As with most recent tax changes, a number of proposed design features are driven by fears about manipulation of the rules, and targeted anti-avoidance rules (TAARs) may also be incorporated. It is, unfortunately, a safe bet that any ‘targeted’ anti-avoidance rules will be widely worded, complicate the relevant statutory provisions and lead to grey areas; and it may well be difficult to get any confirmation from HMRC about its interpretation of these rules in particular circumstances within a realistic commercial timeframe.

It also looks as if HMRC’s well intentioned determination to make certain that no bank losses will ever be relieved at more than 25% will result in lengthy and complex provisions relating to mixed groups. Mixed groups will, in reality, include not just groups that are primarily non-banking groups (retail, motor or production groups that have a bank in the group), but also most groups which the ordinary person thinks of as banking groups, because most such groups combine one or two banks with many non-banking companies which are holding entities, carry on ancillary activities (services, for example) or non-banking financial services activities (such as insurance or consumer credit).

The first overall problem with the proposals is their complexity. Despite HMRC neatly ‘bucketing’ various stages of the calculation under headings to imply there is a process involving only a few steps, the reality is that each of these ‘steps’ involves several processes; and, since these calculations apply for each individual company, for large and complex groups the additional compliance burden will be considerable. That is why the process for a very simplified example of a group calculation takes three pages of A4 to lay out, and a simplified banking example takes even more. For a real life large group, the calculations will be much more complex. Also, all HMRC’s examples use post-2017 periods to avoid the need to apportion 2017 profits and losses, which will create further complications (and potentially grey areas) for all groups other than the small number with a 31 March year end.

HMRC has noted that the £5m exemption from the 50% loss restriction rules means that a high proportion of taxpaying companies/groups will not see any immediate adverse cash tax impact. However, the Budget estimates that £1.36bn in revenue will be raised from the measures over the next four years, demonstrating how much HMRC expects these to extract from large groups, where the £5m exemption will have little effect.

Given the stated policy objectives, the mechanics did not need to be complicated. All that was needed was:

In reality, when reviewing the detail of the proposals, it does not just become clear that the system extremely complex; but also, that it has been complicated in a way which will in practice restrict loss relief for larger groups beyond the level suggested by the headlines.

Before looking at example calculations, it is easiest to begin with the principles that are not expected to be affected by the new regime:

There are other areas where the consultation document envisaged possible change while seeking input. These included the following:

The question of whether reliefs which can be set against chargeable gains can be offset to 100% is not expressly discussed. The document merely refers to capital losses (at paras 2.17–2.21), where the argument for additional flexibility for capital loss offset has been rejected. Chargeable gains bear no resemblance to accounting profits in any case, and it is not clear in the examples whether ‘non-trading profits’ include gains. In policy terms, it seems inappropriate to distinguish allowable capital losses, but to treat chargeable gains as simply part of non-trading income.

HMRC’s proposed approach to in year loss offset will present many groups with serious problems, and it will be important to try and model this. Representations based on practical examples are always of more interest to HMRC than theoretical issues; therefore, where the outcome would be sensitive to business decisions about siting, for example research activity in the UK, the issue should be raised with HMT/HMRC.

It is probably easiest to illustrate the difficulties by using one of HMRC’s own examples: example 5 (see pages 32–53). However, we will multiply all the numbers by a factor of 10, because otherwise the £5m allowance masks the nature and extent of the problems.

HMRC has chosen an example which simplifies the calculation by skipping past the 2017 straddle period. To illustrate the key concern here and keep the numbers simple, we will do the same – but note that apportionment will complicate real life calculations in 2017.

See figure 1 below.

Under present rules, a decision would have to be taken as to how to balance the benefit of immediate use of losses against the risk of certain losses becoming trapped. This has become more problematic than it used to be, because of heightened sensitivity about the application of anti-avoidance rules (and the Banking Code) where steps are taken to match income and available losses after the event.

Under the current proposals, the reliefs which give any flexibility are:

The group will also want to use the £5m exemption for losses available for 100% carry forward, but with a group of this size this has limited impact. We will not look further at company K here due to lack of space, as its position is more straightforward.

HMRC assumes a group relief election is made to offset the whole of company J’s loss against company I’s profits. As noted above, utilising current year losses will stop them being subject to the 50% cap in subsequent years, which increases significantly the incentive to use these on a current year basis, even if there were substantial profits in company J in the following year. On the other hand, for losses treated as post-2017, failure to use these in year means that they are much less likely to become ‘trapped’ losses, which are hard to use because they cannot be set off against the right type of income or transferred.

However, the HMRC proposals assume, by contrast with the current rules, where group relief shelters (broadly) the last slice of relief, that group relief once elected for is taken as the first slice of relief. This has a major impact on company I’s tax position. With apologies to those who prefer principles to numbers, the position looks like this (see figure 2):

If instead, as would be expected from the headline messages, there was no major change in methodology, and group relief remained the last line of relief, the position would be as follows (see figure 3):

If the current proposals are adopted, groups will find themselves in an unwelcome cleft stick, because it will not normally be particularly attractive to try to preserve scope for offset of brought forward losses by choosing not to group relieve losses. This illustrates the position for company I if no group relief claim is made (see figure 4).

The outcome delivered by HMRC’s approach also differs from the outcome if, instead of company J’s trade being carried on by a separate company, it was carried on by company I itself. This would lead to the same cash tax being due as in the group relief scenario, but with a switch in the split between trading and non-trading profits which affects the losses utilised (see figure 5).

Depending on the amounts, and the group’s subsequent tax profile, the difference could be significant. If the trade losses had instead been, say 150, the difference between the position if HMRC’s current approach were adopted and the position if activities (trading or non-trading) are conducted in a single company could be substantial.

The proposed scheme sticks rigidly to the current stipulations for offsetting pre-2017 losses against trade profit or non-trade profits; however, by assuming that group relief is the first slice of relief and is applied on a pro rata basis, it restricts the scope for offset further than the 50% headline suggests. This is presumably considered to be justifiable because (in concept) group relief is against total profits. In reality, though, this approach both reduces brought forward loss offset and affects the amount of trading and non-trading losses. As can be seen from the last calculation above, if the losses are trading losses in entity, they do not affect the trading/non-trading profit split. If they are in another entity, even if exclusively trading or non-trading losses, they are apportioned between non-trading and trading profits in the recipient entity. In the example above, company I had brought forward losses of all types; however, for an entity with a single type of losses but also some scope for group relief, the outcome could be harsh.

This example focuses on the position for pre-2017 brought forward losses, where the potential impact is most serious. For post-2017 losses, there will be some compensation because of the flexibility in surrendering the losses.

Groups will want to work out the implications of this on an individual basis, but it is a little surprising that the implications of HMRC’s methodology are not expressly and clearly flagged. It is tempting to recall Lord Denning’s typically blunt comment about an exclusion clause in Thornton v Shoe Lane Parking [1971] 2 WLR 585, that it was so significant it should be ‘printed in red ink with a red hand pointing to it – or something equally startling’. It is important that group tax teams, currently deluged with consultation material and proposed changes, should be aware of the issues and have key elements prominently identified.

If implemented in their current form, the proposals will create winners and losers. Broadly, the winners will be:

The losers will be:

The impact will need to be taken into account when calculating DTAs and therefore it may have a financial statement impact, as well as a cash tax effect. Because the more flexible loss relief rules will not apply to any pre-2017 losses, for most groups any change to DTAs in 2017 is likely to be negative, even if in later years groups benefit from being able to recognise losses which would formerly have been treated as trapped and disregarded.

For M&A transactions, modelling the effect of the changes on acquired or merged groups will be important; however, this will not be helped by the current uncertainty about the scope of restrictions on surrender of losses between pre and post-acquisition sub-groups.

Groups impacted by the group relief methodology problem will want to make appropriate representations. For large and complex groups, even if the rules come in with some modification, ‘what if?’ scenario models are likely to be useful in judging what group loss relief claims to make. Perhaps this is HMRC’s contribution to making sure we all keep our skills sharp; but it also feels like the creation of a set of rules which are ripe for change under the current OTS review of the corporation tax computation, even before they are actually implemented.