At present, I am principally fielding technical queries about the disguised remuneration rules, employee share schemes and sales of companies to Employee Ownership Trusts (EOTs), although my practice extends to all direct taxes and related trust and company laws.

It would be to allow trustees of a bona fide employees’ trust holding ordinary shares of the principal class in the employer company or group to receive distributions free of UK tax provided that, within, say, 30 days, they are fully distributed amongst beneficiaries on an ‘all-employee and similar terms’ basis. Subject to safeguards against abuse, such amounts should then be taxed as dividend, not employment, income in the hands of existing and ex-employees. This would encourage the collective ownership of shares in (especially PE-backed) companies, and meaningful financial participation, for the benefit of all of a company’s employees.

How enjoyable and intellectually satisfying life as a tax barrister can be. I transferred from practising as a solicitor in 2017 but should have done so 20 years ago! The support of my clerks and of other members of chambers has been fantastic and helped me to produce two new tax books in 2021 and 2022 (Claritax guides to Disguised Remuneration and EOTs), and to accept instructions on, and deal with, some very challenging and high-value matters. Being entitled to lunch in Hall in the Inns of Court is also a tremendous benefit.

David Gottlieb, then head of tax at Clifford-Turner (and who died prematurely at the age of just 39), in the early 1980s, instilled in me both the need to examine all the detail and the maxim ‘always assume you are wrong and question your own opinion’ (He would then add: ‘always assume your adversary is more right than you are, but still assume they too are wrong.’) He gave me the time to study, understand and absorb the tax, trusts and company legislation without the pressure to meet financial targets. It was a fantastic training.

The 2023 decision of the Supreme Court in HMRC v Vermilion Holdings Ltd [2023] UKSC 37 has given rise to widespread uncertainty as to what is and is not an employment-related security or option, falling within the charging provisions of ITEPA 2003 Part 7. The ratio is that the deeming provision in s 471(3) is a ‘bright line rule’, but the conflation of identifying who provides shares or share options with that of identifying who provided the right or opportunity for an employee to acquire them, has muddied the waters.

Getting one’s head around the proposed new residence-based tax regime for non-doms will be a challenge this year, but an important issue ignored in the Budget, is the ongoing plight of those lower-paid employees caught in the Loan Charge scandal as a consequence of HMRC’s failure to act effectively, or at all, when tax avoidance schemes for contractors and others were being peddled in full sight. The resulting penury for so many caught up in HMRC’s zealous efforts to recover tax from the victims, rather than the promotors of such arrangements, is a scandal not dissimilar to that of the Post Office saga.

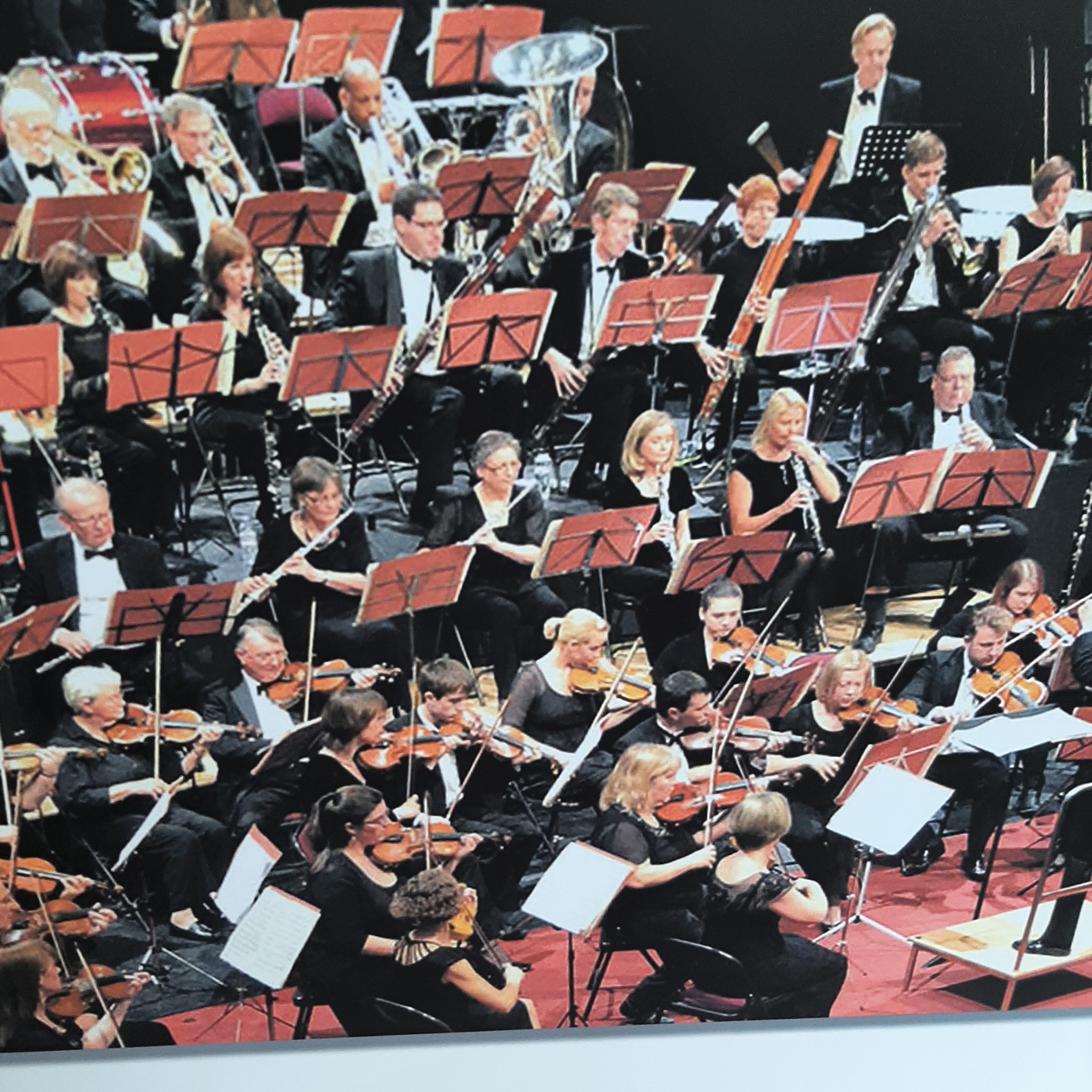

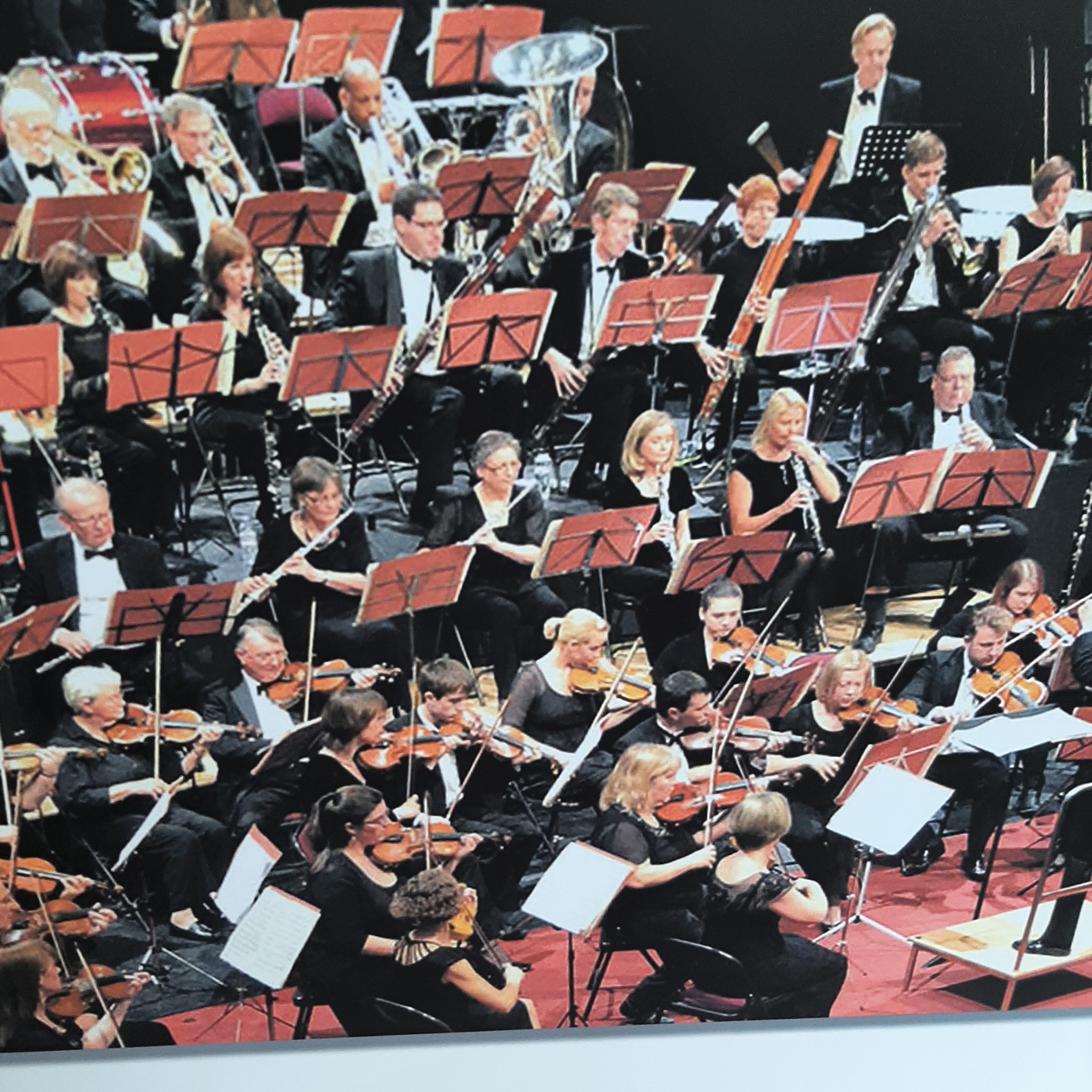

Since a teenager, I have pursued a parallel career as an orchestral timpanist. This has afforded opportunities to play much of the symphonic repertoire and in some of the finest concert venues in Europe. There is nothing like participating in a performance of a Tchaikovsky or a Mahler symphony for shedding frustrations and angst. I still enjoy time spent at the back of a large ensemble of musicians – much of it counting bars – and conquering the fear of coming in at just the wrong moment! It has some similarities with appearing before a court or tribunal.

David Pett, top right

At present, I am principally fielding technical queries about the disguised remuneration rules, employee share schemes and sales of companies to Employee Ownership Trusts (EOTs), although my practice extends to all direct taxes and related trust and company laws.

It would be to allow trustees of a bona fide employees’ trust holding ordinary shares of the principal class in the employer company or group to receive distributions free of UK tax provided that, within, say, 30 days, they are fully distributed amongst beneficiaries on an ‘all-employee and similar terms’ basis. Subject to safeguards against abuse, such amounts should then be taxed as dividend, not employment, income in the hands of existing and ex-employees. This would encourage the collective ownership of shares in (especially PE-backed) companies, and meaningful financial participation, for the benefit of all of a company’s employees.

How enjoyable and intellectually satisfying life as a tax barrister can be. I transferred from practising as a solicitor in 2017 but should have done so 20 years ago! The support of my clerks and of other members of chambers has been fantastic and helped me to produce two new tax books in 2021 and 2022 (Claritax guides to Disguised Remuneration and EOTs), and to accept instructions on, and deal with, some very challenging and high-value matters. Being entitled to lunch in Hall in the Inns of Court is also a tremendous benefit.

David Gottlieb, then head of tax at Clifford-Turner (and who died prematurely at the age of just 39), in the early 1980s, instilled in me both the need to examine all the detail and the maxim ‘always assume you are wrong and question your own opinion’ (He would then add: ‘always assume your adversary is more right than you are, but still assume they too are wrong.’) He gave me the time to study, understand and absorb the tax, trusts and company legislation without the pressure to meet financial targets. It was a fantastic training.

The 2023 decision of the Supreme Court in HMRC v Vermilion Holdings Ltd [2023] UKSC 37 has given rise to widespread uncertainty as to what is and is not an employment-related security or option, falling within the charging provisions of ITEPA 2003 Part 7. The ratio is that the deeming provision in s 471(3) is a ‘bright line rule’, but the conflation of identifying who provides shares or share options with that of identifying who provided the right or opportunity for an employee to acquire them, has muddied the waters.

Getting one’s head around the proposed new residence-based tax regime for non-doms will be a challenge this year, but an important issue ignored in the Budget, is the ongoing plight of those lower-paid employees caught in the Loan Charge scandal as a consequence of HMRC’s failure to act effectively, or at all, when tax avoidance schemes for contractors and others were being peddled in full sight. The resulting penury for so many caught up in HMRC’s zealous efforts to recover tax from the victims, rather than the promotors of such arrangements, is a scandal not dissimilar to that of the Post Office saga.

Since a teenager, I have pursued a parallel career as an orchestral timpanist. This has afforded opportunities to play much of the symphonic repertoire and in some of the finest concert venues in Europe. There is nothing like participating in a performance of a Tchaikovsky or a Mahler symphony for shedding frustrations and angst. I still enjoy time spent at the back of a large ensemble of musicians – much of it counting bars – and conquering the fear of coming in at just the wrong moment! It has some similarities with appearing before a court or tribunal.

David Pett, top right