Since assuming a lead role in the development of tax treaties from the League of Nations, the Organisation for Economic Cooperation and Development (OECD) has been the pre-eminent voice behind international tax matters. It has been responsible for the model that underpins most bilateral tax treaties, provided the global standard for transfer pricing, and spearheaded the most far reaching modern change to international taxation yet, the base erosion and profit shifting (BEPS) project.

The pre-eminence of the OECD in international tax matters has, however, been threatened recently by an arms race with the European Commission (EC) (which is itself an OECD participant) to determine who can be the first to achieve consensus on redesigning the international tax system so that it applies effectively to ‘digitalised’ businesses. The OECD was first out of the gate, issuing its interim report, Tax challenges arising from digitalisation: interim report 2018, on 16 March 2018 (‘interim report’). This emphasised the need for a long-term solution, just days before the EC released both a long-term and an interim proposal on 21 March 2018. This difference in approach initiated a geopolitical struggle between short-term measures driven by political expediency and the OECD’s vision of a more long-term and principled answer that complements the existing international tax framework through taxing profits rather than gross revenues.

In theory, the OECD appears to be leading in this race for now, as the 4 December 2018 meeting of the European Council of Finance Ministers (ECOFIN) ended without winning the necessary support for the EU’s mooted digital services tax (DST). However, this position may be fragile, with the ECOFIN meeting resulting in the European Council agreeing to work on a new joint proposal from France and Germany for the adoption of a binding Directive on the DST by March 2019, to come into force on 1 January 2021. While the prospect of member states agreeing to such a change may be remote, the EC’s proposal to shift from unanimity in tax matters to ‘qualified majority voting’ could further narrow the race by accelerating agreement over a course of action for the DST at an EU level.

The UK appears to embody the tension between long-term and short-term approaches. It plans to introduce its own digital services tax (UK DST) by April 2020 but to review this in 2025 in light of progress made by the OECD, suggesting that it still recognises the value of waiting for the OECD’s solution, but does not expect this to be reached by 2020.

This article examines the OECD’s race to deliver a long-term and principled answer against unilateral actions that not only jeopardise its chances of success but also has the potential to damage the ability of the OECD to function as the standards setting body responsible for a fair, certain and consistent international framework. We begin by exploring the remit of the OECD Task Force on the Digital Economy (‘the task force’) and the practical implications of the fact that its work is being undertaken under the auspices of the inclusive frameworks on BEPS (‘the inclusive framework’). We consider the work to date and speculate on the consensus view that may emerge from the OECD. We conclude by considering the extent to which the OECD’s position as the body governing the trajectory of global taxation can be maintained while the EC ‘waits in the wings’ and the threat of unilateral measures looms large.

The task force was originally formed in 2013 to consider Action 1 (‘addressing the tax challenges of the digital economy) under the BEPS project. In October 2015, the task force concluded that because the digital economy is increasingly becoming the economy itself, it would not be feasible to ringfence the digital economy from the rest of the economy for tax purposes. However, the task force was reformed in 2017 on a ‘beyond BEPS’ basis and was served a mandate to deliver a final report on the tax challenges of the digital economy by 2020 and an interim report by 2018.

The task force is operating under the oversight of the inclusive framework, which emerged in response to the OECD and G20’s call, at the time of endorsing that the BEPS actions, for ‘rapid, widespread and consistent implementation of the BEPS measures’ and a monitoring framework ‘in which all countries will participate on an equal footing’ (see bit.ly/1OrTGfQ). In exchange for agreeing to commit to the four minimum standards of the BEPS package (and to have the implementation of these standards peer reviewed), participating states (referred to as ‘BEPS associates’) have been given the opportunity for ‘an inclusive dialogue on an equal footing to directly shape standard setting and monitoring process’, allowing them to have ‘an equal voice in the development of standard setting and BEPS implementation monitoring’.

A BEPS associate may ‘participate in the full range of the body’s work’ and ‘also participate in the body’s decision-making process’ (see bit.ly/2AUHRNk). It has the same rights and obligations as OECD members vis-à-vis the particular project or development and can participate in discussions over new legal instruments and future standards. Unfortunately, the specific agreements reached between BEPS associates and the OECD are not public documents, and it is therefore difficult to ascertain precisely the meaning of participating on an ‘equal footing’. For instance, if BEPS associates have the power of veto, one dissenting view could jeopardise an entire proposal.

It also remains unclear whether full OECD members retain the ultimate power to decide on the reform package in relation to which the members of the inclusive framework have to abide. We assume that an ‘equal footing’ simply means that senior officials representing members of the inclusive framework have the power to:

Whilst the OECD is no stranger to working with others – as demonstrated by its willingness to meet the G20 finance ministers’ call in March 2017 for an interim report addressing the digital economy taxation issues raised by the BEPS action plan (see bit.ly/2ByO8yY) – collaboration of this scale is unprecedented. To date, over 120 countries are included in the consultative process, which will inevitably complicate the path to consensus. Added to the sheer number of potential perspectives is the fact that the inclusive framework includes many countries that have traditionally held views which are not aligned with those of the 36 full OECD members, who themselves have increasingly more varied views on source versus residence taxation.

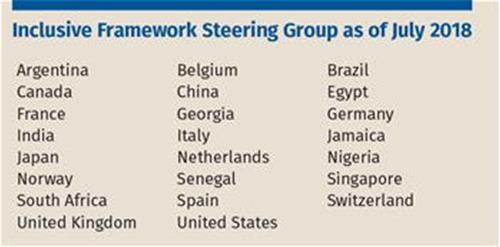

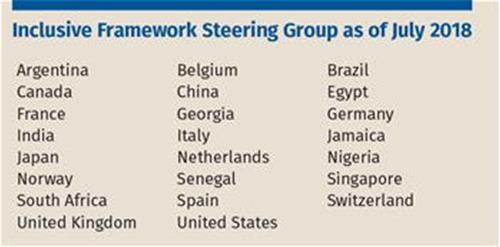

This is perhaps best illustrated by looking at the membership of the Inclusive Framework Steering Group, whose role it is to steer the work carried out by the inclusive framework. As at July 2018, the steering group consisted of the 23 countries detailed in the table below, each of which has an equal vote. Never before have the views of the OECD been steered by a combination which includes India, China and the US, the former two of which, as non-OECD members, have not previously had a strong voice in OECD-related matters.

Despite the challenges in consolidating the views of its expanded constituency, the OECD’s interim report delivered some important conclusions in relation to the taxation of the digital economy. These included confirmation that the digital economy could not be ‘ringfenced’ from the broader economy, noting the widespread adoption of extraterritorial VAT measures on cross-border B2C supplies and the enhanced tax collections that these have realised, as well as criticism of interim measures. In addition, the interim report noted that any interim measure would need to be consistent with international tax and trade obligations.

The interim report was also successful in narrowing the fundamental questions to be addressed on the taxation of the digital economy. These included:

Views particularly diverged on whether there was a problem with existing nexus rules and profit attribution rules; and whether user participation/contribution is such a significant driver of value creation that the international tax framework should be adjusted to recognise it.

In the absence of consensus, the interim report also set out three groupings of views between different countries.

The first group takes the general view that ‘user engagement’ in the digital economy should be taxed, but does not acknowledge any other increased taxation rights for country of source or any other sector beyond the digital economy. This group is therefore the only group that attempts to ringfence the digital economy. As can only be expected, unilateral measures have been suggested by members of this group. This includes the UK, which recently proposed the introduction of an extraterritorial 2% UK DST from 2020 to apply to revenues arising from UK users participating on certain internet platforms. (The UK has stated that if an appropriate international agreement is in place, it will assess whether a UK DST is still needed.)

The second group, which includes the United States, takes the broader view that digitalisation and globalisation do present challenges to the international tax framework, but these are not specific or exclusive to highly digitalised business models; rather they relate to other companies too – particularly those with valuable intangibles. Such a view is understandable given the bedrock view that it is not possible to ringfence the digital economy, where ‘bricks and mortar businesses operate through the same ‘digital’ business models that these reforms seek to address. India also appears to fall in this second group, with its significant economic presence measure broadly drafted to encompass both digital and analogue businesses, although it is a late entrant, calling for even more aggressive allocation towards the market state, not necessarily based on use of marketing intangibles.

Finally, the third group takes the view that the BEPS package largely addressed double non-taxation, although it is still too early to address the full impact. In short, this is a ‘let’s wait and see’ group. This group generally consists of smaller export-oriented countries that are on the whole satisfied with the existing tax system and see no need for significant changes.

The interim report therefore concluded by saying that ensuring that tax systems are equipped to respond to the changes brought about by digitalisation is a critical challenge. Further, it noted that ‘political support would be required to undertake the detailed, often complex, work needed to deliver on these objectives’.

Since publication of the interim report, there has been growing debate over whether the political support for this process will be forthcoming. OECD officials have stressed that separate country or regional unilateral measures are harmful, and should not be pursued in favour of letting the OECD/G20 finish its task. Much of this commentary has been focused on the EC proposal, with the sentiment best summarised in the words of OECD secretary-general Ángel Gurría, who said: ‘[W]e just ask that the EU not create short-term measures … Please don’t do anything short-term that will stop long-term solutions.’

The question marks over the extent of political support for the OECD/G20 measures have not, however, been limited to challenges from the EC. Since publication of the interim report, in September the lower house of the Mexican Congress took steps towards a 3% gross-basis tax, publishing its proposal in the Congressional Gazette.

In October, the UK and Spain announced that they each will unilaterally introduce a DST (which would apply to different transactions, demonstrating vividly the morass which will be created through multiple unilateral actions).

The Australian Treasury also released a discussion paper in October raising the issues from the interim report and similarly considering whether taxing rights should change to reflect user-created value, while posing broader questions as to whether the value of marketing intangibles is appropriately recognised by the international tax system and commenting that profits could be allocated across countries using formulary apportionment.

Another recent example comes from France, where the French minister of economy and finance, Bruno Le Maire, announced on 17 December 2018, in a press conference, that it will impose a tax on highly digitalised enterprises, to enter into force on 1 January 2019. This law is expected to closely follow the EC’s gross-basis tax proposal, though no draft law has been released to date.

Adding to this is the Italian Parliament’s approval of the 2019 Budget Law on 30 December 2018, which introduced a tax on digital services that mirrors the EC’s digital services tax proposal. The moves by Australia, Mexico, Spain, France and the UK are particularly noteworthy, as all four countries are full members of the OECD.

Despite such commotion, it is worth noting that of such proposals, only India’s new ‘substantial economic presence’ PE rule (discussed below) has actually been implemented. Nevertheless, the existence of such proposals in themselves presents a challenge to the OECD developing a consensus based solution. Beyond the implications for the OECD, these measures would also be bad for business, with gross taxes creating inevitable substantial double taxation (unless taxpayers are able to establish that these taxes should be subject to tax treaties) and unquestionably resulting in significant compliance costs.

Despite these challenges, there are some highly influential and vocal OECD members that appear to be fully invested in the process of developing and reaching consensus on these subjects. Of particular note are the public comments by US Treasury secretary Steven Mnuchin, in which he has reiterated the United States’ strong opposition to a ‘unilateral and unfair gross sales tax’ and urged countries to ‘finish the OECD process’ rather than take unilateral action.

Furthermore, at the International Fiscal Association (IFA) 2018 Seoul Congress, India (which is both an inclusive framework member and represented on the steering group for the inclusive framework) expressed confidence towards finding a solution to taxing the digital economy. Akhilesh Ranjan, India’s chief commissioner of income tax, noted the development of India’s significant economic presence principle as something that could form the basis of new nexus rules and a concept that India hoped other countries would build upon to achieve consensus. This is a concept that, while seeming unlikely to find favour, is now being explored on a ‘without prejudice’ basis by the inclusive framework (see discussion below). Ranjan also cited the US’s adoption of a broader concept of intangibles to include going concern value, workforce in place and goodwill (concepts he noted had been part of Indian law for some time) as something that will shape transfer pricing and profit allocation. Few would have predicted that India might have a say in obtaining consensus on digital economy issues, further demonstrating the role the inclusive framework may have on the future direction of the OECD Committee for Fiscal Affairs.

At its 7 December 2018 meeting, the task force grouped the proposals being considered by the inclusive framework and the task force on a ‘without prejudice’ basis into two ‘pillars’. Further detail on these was set out again by Pascal Saint-Amans in the OECD’s tax talk on 29 January 2019.

The first of these pillars relates to nexus-based approaches involving the allocation of taxing rights, including revising existing profit allocation rules by reference to ‘active user contribution’, ‘marketing intangibles’ or where a ‘significant economic presence’ exists.

The second pillar relates to a potential minimum tax, proposing two sets of ‘interlocking’ rules involving an income inclusion rule on profits of related party investors subject to a low-ETR and a source country deduction denial rule on under-taxed payments.

The first pillar is subdivided into three possible nexus-based proposals based on the concepts of:

Within these proposals, it is possible that the concept most likely to gain momentum is the first involving some form of nexus-based reallocation of taxing rights based on the value of marketing intangibles. The fact that such an approach may not be sector-specific tax makes it something the US can support. Furthermore, the concept of ‘market’ as a driver of value has been consistently supported by countries such as China who argues that the unique features of its market means it deserves a greater return and India, whose authorities have increasingly sought to ascribe greater value to workforce functions generating marketing intangibles. The substantial economic presence approach was proposed by India and has support from developing countries. With both India and China’s unprecedented position on the steering committee of the inclusive framework, it is quite possible that this marketing intangibles concept will be pushed. It is also not a major leap for countries such as Spain or the UK that have already bought into the idea that users in their market create value. One of the many open questions, however, would be which (or which combination) of nexus-based approaches would be adopted, and how far such the concepts within that approach might extend. For example, would ‘marketing intangibles’ encompass market-specific features, workforce and goodwill, or would it be determined purely by the number of users or customers in a market state?

However, the other ‘pillar’, involving a minimum tax proposal, can also not be ruled out. The recent global anti-base-erosion (GLOBE) proposal, which was spearheaded by Germany and France, couples a tax on base-eroding outbound payments (similar to the US BEAT provisions) with an income inclusion rule for cases involving controlled foreign companies (which is similar to the US GILTI provisions) and a proposal to safeguard the two measures against treaty overrides. Germany and France, along with others, have advocated strongly for global minimum taxation, which also closely aligns with BEPS principles, earning the proposal the nickname ‘BEPS 2.0’. Such an alignment, along with the similarities to the US provisions – which the OECD has described as a ‘precedent’ for the minimum tax approach – may also see a minimum tax being an attractive means to consensus.

The task force will undertake a public consultation in March 2019 and is expected to release an update on progress in June 2019. It is anticipated that, at this point, the task force might be in a position to give a sense of direction or some form of recommendation for further work to refine the proposals. Japan, which historically has staunchly supported a consensus-based approach, took over the G20 presidency on 1 December 2018, and it is possible that some kind of agreement can be reached by the time the G20 finance ministers meet in June 2019.

The OECD has expressed hope that at this G20 summit it will be able to ‘celebrate an agreement on the what and how of a long-term solution to be delivered in 2020’. It is critical such a consensus materialises, as the failure to do so may see a greater spread of unilateral digital economy measures, leading to double taxation and a significant compliance burden for companies as they grapple with different bases of taxation across the world. The OECD has shown through the BEPS project that it will call on political support from the highest levels to ensure its measures are successful. Whether it can muster that political capital and win the race for consensus to push through a reform package remains to be seen.

The authors thank Jill Hallpike, Ayesha Chanda and Ler Woon Phua for their assistance in preparing this article.

Since assuming a lead role in the development of tax treaties from the League of Nations, the Organisation for Economic Cooperation and Development (OECD) has been the pre-eminent voice behind international tax matters. It has been responsible for the model that underpins most bilateral tax treaties, provided the global standard for transfer pricing, and spearheaded the most far reaching modern change to international taxation yet, the base erosion and profit shifting (BEPS) project.

The pre-eminence of the OECD in international tax matters has, however, been threatened recently by an arms race with the European Commission (EC) (which is itself an OECD participant) to determine who can be the first to achieve consensus on redesigning the international tax system so that it applies effectively to ‘digitalised’ businesses. The OECD was first out of the gate, issuing its interim report, Tax challenges arising from digitalisation: interim report 2018, on 16 March 2018 (‘interim report’). This emphasised the need for a long-term solution, just days before the EC released both a long-term and an interim proposal on 21 March 2018. This difference in approach initiated a geopolitical struggle between short-term measures driven by political expediency and the OECD’s vision of a more long-term and principled answer that complements the existing international tax framework through taxing profits rather than gross revenues.

In theory, the OECD appears to be leading in this race for now, as the 4 December 2018 meeting of the European Council of Finance Ministers (ECOFIN) ended without winning the necessary support for the EU’s mooted digital services tax (DST). However, this position may be fragile, with the ECOFIN meeting resulting in the European Council agreeing to work on a new joint proposal from France and Germany for the adoption of a binding Directive on the DST by March 2019, to come into force on 1 January 2021. While the prospect of member states agreeing to such a change may be remote, the EC’s proposal to shift from unanimity in tax matters to ‘qualified majority voting’ could further narrow the race by accelerating agreement over a course of action for the DST at an EU level.

The UK appears to embody the tension between long-term and short-term approaches. It plans to introduce its own digital services tax (UK DST) by April 2020 but to review this in 2025 in light of progress made by the OECD, suggesting that it still recognises the value of waiting for the OECD’s solution, but does not expect this to be reached by 2020.

This article examines the OECD’s race to deliver a long-term and principled answer against unilateral actions that not only jeopardise its chances of success but also has the potential to damage the ability of the OECD to function as the standards setting body responsible for a fair, certain and consistent international framework. We begin by exploring the remit of the OECD Task Force on the Digital Economy (‘the task force’) and the practical implications of the fact that its work is being undertaken under the auspices of the inclusive frameworks on BEPS (‘the inclusive framework’). We consider the work to date and speculate on the consensus view that may emerge from the OECD. We conclude by considering the extent to which the OECD’s position as the body governing the trajectory of global taxation can be maintained while the EC ‘waits in the wings’ and the threat of unilateral measures looms large.

The task force was originally formed in 2013 to consider Action 1 (‘addressing the tax challenges of the digital economy) under the BEPS project. In October 2015, the task force concluded that because the digital economy is increasingly becoming the economy itself, it would not be feasible to ringfence the digital economy from the rest of the economy for tax purposes. However, the task force was reformed in 2017 on a ‘beyond BEPS’ basis and was served a mandate to deliver a final report on the tax challenges of the digital economy by 2020 and an interim report by 2018.

The task force is operating under the oversight of the inclusive framework, which emerged in response to the OECD and G20’s call, at the time of endorsing that the BEPS actions, for ‘rapid, widespread and consistent implementation of the BEPS measures’ and a monitoring framework ‘in which all countries will participate on an equal footing’ (see bit.ly/1OrTGfQ). In exchange for agreeing to commit to the four minimum standards of the BEPS package (and to have the implementation of these standards peer reviewed), participating states (referred to as ‘BEPS associates’) have been given the opportunity for ‘an inclusive dialogue on an equal footing to directly shape standard setting and monitoring process’, allowing them to have ‘an equal voice in the development of standard setting and BEPS implementation monitoring’.

A BEPS associate may ‘participate in the full range of the body’s work’ and ‘also participate in the body’s decision-making process’ (see bit.ly/2AUHRNk). It has the same rights and obligations as OECD members vis-à-vis the particular project or development and can participate in discussions over new legal instruments and future standards. Unfortunately, the specific agreements reached between BEPS associates and the OECD are not public documents, and it is therefore difficult to ascertain precisely the meaning of participating on an ‘equal footing’. For instance, if BEPS associates have the power of veto, one dissenting view could jeopardise an entire proposal.

It also remains unclear whether full OECD members retain the ultimate power to decide on the reform package in relation to which the members of the inclusive framework have to abide. We assume that an ‘equal footing’ simply means that senior officials representing members of the inclusive framework have the power to:

Whilst the OECD is no stranger to working with others – as demonstrated by its willingness to meet the G20 finance ministers’ call in March 2017 for an interim report addressing the digital economy taxation issues raised by the BEPS action plan (see bit.ly/2ByO8yY) – collaboration of this scale is unprecedented. To date, over 120 countries are included in the consultative process, which will inevitably complicate the path to consensus. Added to the sheer number of potential perspectives is the fact that the inclusive framework includes many countries that have traditionally held views which are not aligned with those of the 36 full OECD members, who themselves have increasingly more varied views on source versus residence taxation.

This is perhaps best illustrated by looking at the membership of the Inclusive Framework Steering Group, whose role it is to steer the work carried out by the inclusive framework. As at July 2018, the steering group consisted of the 23 countries detailed in the table below, each of which has an equal vote. Never before have the views of the OECD been steered by a combination which includes India, China and the US, the former two of which, as non-OECD members, have not previously had a strong voice in OECD-related matters.

Despite the challenges in consolidating the views of its expanded constituency, the OECD’s interim report delivered some important conclusions in relation to the taxation of the digital economy. These included confirmation that the digital economy could not be ‘ringfenced’ from the broader economy, noting the widespread adoption of extraterritorial VAT measures on cross-border B2C supplies and the enhanced tax collections that these have realised, as well as criticism of interim measures. In addition, the interim report noted that any interim measure would need to be consistent with international tax and trade obligations.

The interim report was also successful in narrowing the fundamental questions to be addressed on the taxation of the digital economy. These included:

Views particularly diverged on whether there was a problem with existing nexus rules and profit attribution rules; and whether user participation/contribution is such a significant driver of value creation that the international tax framework should be adjusted to recognise it.

In the absence of consensus, the interim report also set out three groupings of views between different countries.

The first group takes the general view that ‘user engagement’ in the digital economy should be taxed, but does not acknowledge any other increased taxation rights for country of source or any other sector beyond the digital economy. This group is therefore the only group that attempts to ringfence the digital economy. As can only be expected, unilateral measures have been suggested by members of this group. This includes the UK, which recently proposed the introduction of an extraterritorial 2% UK DST from 2020 to apply to revenues arising from UK users participating on certain internet platforms. (The UK has stated that if an appropriate international agreement is in place, it will assess whether a UK DST is still needed.)

The second group, which includes the United States, takes the broader view that digitalisation and globalisation do present challenges to the international tax framework, but these are not specific or exclusive to highly digitalised business models; rather they relate to other companies too – particularly those with valuable intangibles. Such a view is understandable given the bedrock view that it is not possible to ringfence the digital economy, where ‘bricks and mortar businesses operate through the same ‘digital’ business models that these reforms seek to address. India also appears to fall in this second group, with its significant economic presence measure broadly drafted to encompass both digital and analogue businesses, although it is a late entrant, calling for even more aggressive allocation towards the market state, not necessarily based on use of marketing intangibles.

Finally, the third group takes the view that the BEPS package largely addressed double non-taxation, although it is still too early to address the full impact. In short, this is a ‘let’s wait and see’ group. This group generally consists of smaller export-oriented countries that are on the whole satisfied with the existing tax system and see no need for significant changes.

The interim report therefore concluded by saying that ensuring that tax systems are equipped to respond to the changes brought about by digitalisation is a critical challenge. Further, it noted that ‘political support would be required to undertake the detailed, often complex, work needed to deliver on these objectives’.

Since publication of the interim report, there has been growing debate over whether the political support for this process will be forthcoming. OECD officials have stressed that separate country or regional unilateral measures are harmful, and should not be pursued in favour of letting the OECD/G20 finish its task. Much of this commentary has been focused on the EC proposal, with the sentiment best summarised in the words of OECD secretary-general Ángel Gurría, who said: ‘[W]e just ask that the EU not create short-term measures … Please don’t do anything short-term that will stop long-term solutions.’

The question marks over the extent of political support for the OECD/G20 measures have not, however, been limited to challenges from the EC. Since publication of the interim report, in September the lower house of the Mexican Congress took steps towards a 3% gross-basis tax, publishing its proposal in the Congressional Gazette.

In October, the UK and Spain announced that they each will unilaterally introduce a DST (which would apply to different transactions, demonstrating vividly the morass which will be created through multiple unilateral actions).

The Australian Treasury also released a discussion paper in October raising the issues from the interim report and similarly considering whether taxing rights should change to reflect user-created value, while posing broader questions as to whether the value of marketing intangibles is appropriately recognised by the international tax system and commenting that profits could be allocated across countries using formulary apportionment.

Another recent example comes from France, where the French minister of economy and finance, Bruno Le Maire, announced on 17 December 2018, in a press conference, that it will impose a tax on highly digitalised enterprises, to enter into force on 1 January 2019. This law is expected to closely follow the EC’s gross-basis tax proposal, though no draft law has been released to date.

Adding to this is the Italian Parliament’s approval of the 2019 Budget Law on 30 December 2018, which introduced a tax on digital services that mirrors the EC’s digital services tax proposal. The moves by Australia, Mexico, Spain, France and the UK are particularly noteworthy, as all four countries are full members of the OECD.

Despite such commotion, it is worth noting that of such proposals, only India’s new ‘substantial economic presence’ PE rule (discussed below) has actually been implemented. Nevertheless, the existence of such proposals in themselves presents a challenge to the OECD developing a consensus based solution. Beyond the implications for the OECD, these measures would also be bad for business, with gross taxes creating inevitable substantial double taxation (unless taxpayers are able to establish that these taxes should be subject to tax treaties) and unquestionably resulting in significant compliance costs.

Despite these challenges, there are some highly influential and vocal OECD members that appear to be fully invested in the process of developing and reaching consensus on these subjects. Of particular note are the public comments by US Treasury secretary Steven Mnuchin, in which he has reiterated the United States’ strong opposition to a ‘unilateral and unfair gross sales tax’ and urged countries to ‘finish the OECD process’ rather than take unilateral action.

Furthermore, at the International Fiscal Association (IFA) 2018 Seoul Congress, India (which is both an inclusive framework member and represented on the steering group for the inclusive framework) expressed confidence towards finding a solution to taxing the digital economy. Akhilesh Ranjan, India’s chief commissioner of income tax, noted the development of India’s significant economic presence principle as something that could form the basis of new nexus rules and a concept that India hoped other countries would build upon to achieve consensus. This is a concept that, while seeming unlikely to find favour, is now being explored on a ‘without prejudice’ basis by the inclusive framework (see discussion below). Ranjan also cited the US’s adoption of a broader concept of intangibles to include going concern value, workforce in place and goodwill (concepts he noted had been part of Indian law for some time) as something that will shape transfer pricing and profit allocation. Few would have predicted that India might have a say in obtaining consensus on digital economy issues, further demonstrating the role the inclusive framework may have on the future direction of the OECD Committee for Fiscal Affairs.

At its 7 December 2018 meeting, the task force grouped the proposals being considered by the inclusive framework and the task force on a ‘without prejudice’ basis into two ‘pillars’. Further detail on these was set out again by Pascal Saint-Amans in the OECD’s tax talk on 29 January 2019.

The first of these pillars relates to nexus-based approaches involving the allocation of taxing rights, including revising existing profit allocation rules by reference to ‘active user contribution’, ‘marketing intangibles’ or where a ‘significant economic presence’ exists.

The second pillar relates to a potential minimum tax, proposing two sets of ‘interlocking’ rules involving an income inclusion rule on profits of related party investors subject to a low-ETR and a source country deduction denial rule on under-taxed payments.

The first pillar is subdivided into three possible nexus-based proposals based on the concepts of:

Within these proposals, it is possible that the concept most likely to gain momentum is the first involving some form of nexus-based reallocation of taxing rights based on the value of marketing intangibles. The fact that such an approach may not be sector-specific tax makes it something the US can support. Furthermore, the concept of ‘market’ as a driver of value has been consistently supported by countries such as China who argues that the unique features of its market means it deserves a greater return and India, whose authorities have increasingly sought to ascribe greater value to workforce functions generating marketing intangibles. The substantial economic presence approach was proposed by India and has support from developing countries. With both India and China’s unprecedented position on the steering committee of the inclusive framework, it is quite possible that this marketing intangibles concept will be pushed. It is also not a major leap for countries such as Spain or the UK that have already bought into the idea that users in their market create value. One of the many open questions, however, would be which (or which combination) of nexus-based approaches would be adopted, and how far such the concepts within that approach might extend. For example, would ‘marketing intangibles’ encompass market-specific features, workforce and goodwill, or would it be determined purely by the number of users or customers in a market state?

However, the other ‘pillar’, involving a minimum tax proposal, can also not be ruled out. The recent global anti-base-erosion (GLOBE) proposal, which was spearheaded by Germany and France, couples a tax on base-eroding outbound payments (similar to the US BEAT provisions) with an income inclusion rule for cases involving controlled foreign companies (which is similar to the US GILTI provisions) and a proposal to safeguard the two measures against treaty overrides. Germany and France, along with others, have advocated strongly for global minimum taxation, which also closely aligns with BEPS principles, earning the proposal the nickname ‘BEPS 2.0’. Such an alignment, along with the similarities to the US provisions – which the OECD has described as a ‘precedent’ for the minimum tax approach – may also see a minimum tax being an attractive means to consensus.

The task force will undertake a public consultation in March 2019 and is expected to release an update on progress in June 2019. It is anticipated that, at this point, the task force might be in a position to give a sense of direction or some form of recommendation for further work to refine the proposals. Japan, which historically has staunchly supported a consensus-based approach, took over the G20 presidency on 1 December 2018, and it is possible that some kind of agreement can be reached by the time the G20 finance ministers meet in June 2019.

The OECD has expressed hope that at this G20 summit it will be able to ‘celebrate an agreement on the what and how of a long-term solution to be delivered in 2020’. It is critical such a consensus materialises, as the failure to do so may see a greater spread of unilateral digital economy measures, leading to double taxation and a significant compliance burden for companies as they grapple with different bases of taxation across the world. The OECD has shown through the BEPS project that it will call on political support from the highest levels to ensure its measures are successful. Whether it can muster that political capital and win the race for consensus to push through a reform package remains to be seen.

The authors thank Jill Hallpike, Ayesha Chanda and Ler Woon Phua for their assistance in preparing this article.