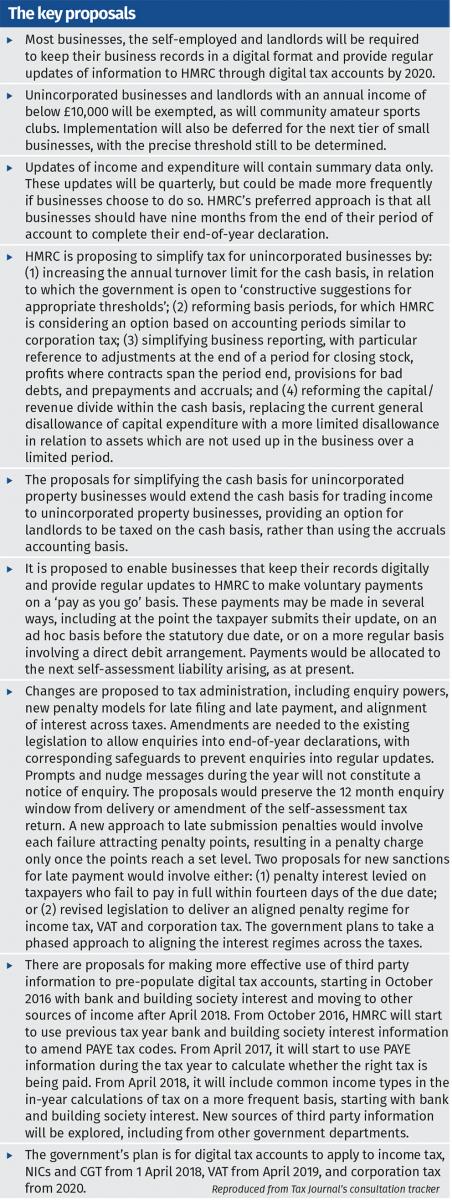

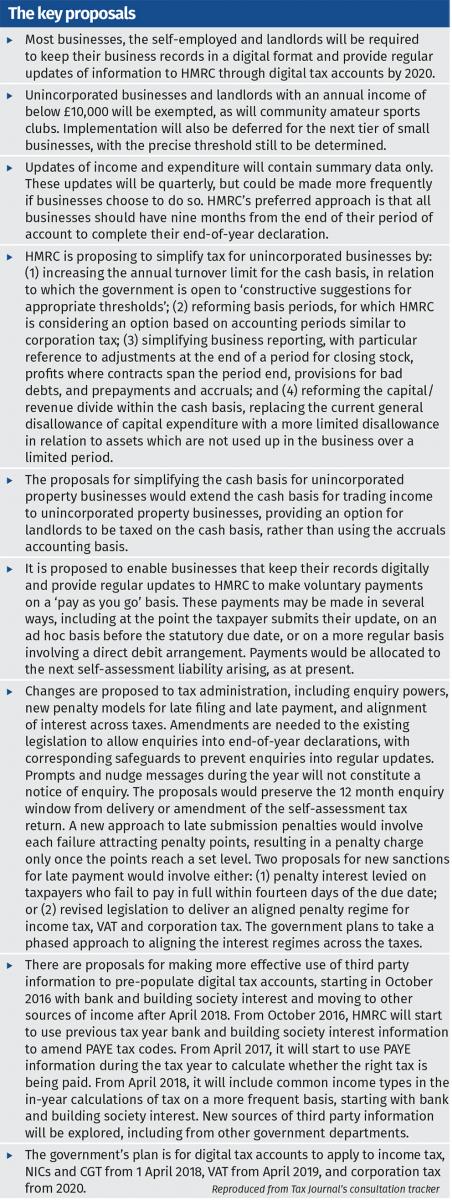

Elements of HMRC’s proposals for ‘making tax digital’ are outlined in a series of six consultation documents (condocs), finally published on 15 August 2016. The condocs focus mainly on small business, as HMRC does not yet seem to have considered how this can work for larger or more complex taxpayers, let alone tax agents. The condocs set out HMRC’s timetable for implementation; and proposals including digital record keeping, quarterly submissions, potential tax technical changes, including extending the cash basis, and updated powers around data collection and deterrents, including penalties. Comments on these proposals are due by 7 November 2016.

Tina Riches (Smith & Williamson) sets out the key issues from the current consultations and the implications for tax agents and their clients.

What will happen to agent authorisation?

Elements of HMRC’s proposals for ‘making tax digital’ are outlined in a series of six consultation documents (condocs), finally published on 15 August 2016. The condocs focus mainly on small business, as HMRC does not yet seem to have considered how this can work for larger or more complex taxpayers, let alone tax agents. The condocs set out HMRC’s timetable for implementation; and proposals including digital record keeping, quarterly submissions, potential tax technical changes, including extending the cash basis, and updated powers around data collection and deterrents, including penalties. Comments on these proposals are due by 7 November 2016.

Tina Riches (Smith & Williamson) sets out the key issues from the current consultations and the implications for tax agents and their clients.

What will happen to agent authorisation?