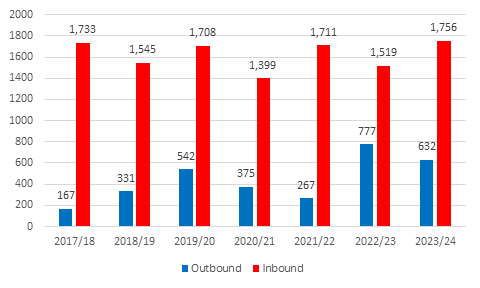

Information requests between HMRC and foreign tax authorities for information on UK taxpayers are at their highest level in at least seven years in 2023/24, according to data obtained by Price Bailey.

The data released under the Freedom of Information Act reveals that 2,388 requests for information were made or received by HMRC regarding taxpayers with assets in the UK and overseas in 2023/24. HMRC made 632 outbound requests in 2023/24, which is not as many as those made in 2022/23 (777) but almost double the number immediately prior to the pandemic (331 in 2018/19).

Outbound and inbound information requests between HMRC and foreign tax authorities

According to Price Bailey, the volume of information exchanged is likely to rise this year following the announcement in the Spring Budget that non-UK assets will be subject to inheritance tax, capital gains tax and income tax based on residence rather than domicile from 6 April 2025.

HMRC also issued 23,500 nudge letters in relation to offshore matters in 2023/24, a slight decline on 2022/23 when 23,936 were issued. However, the monetary value of disclosures resulting from these letters almost trebled between 2022/23 and 2023/24 from £19.6m to £57.2m.

Andrew Park, Partner at Price Bailey, said: ‘We have been seeing increased HMRC scrutiny of wealthy people with overseas assets. This is likely to intensify following the abolition of the non-dom tax regime, which will bring more offshore assets within the UK tax net. HMRC will be relying heavily on requests to foreign tax authorities to build a picture of the increased tax liabilities of wealthy UK residents. It is likely that some UK residents who currently take advantage of non-dom status will fail to disclose their full liabilities to HMRC.’

‘HMRC began issuing nudge letters in 2023/24 to wealthy people named in the Pandora Papers. It cannot be a coincidence that the amount generated from offshore nudge letters trebled to nearly £60m as these taxpayers came under HMRC’s spotlight’, he added.

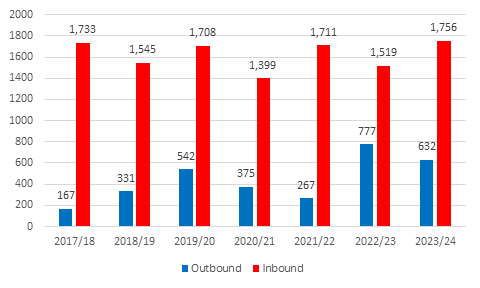

Information requests between HMRC and foreign tax authorities for information on UK taxpayers are at their highest level in at least seven years in 2023/24, according to data obtained by Price Bailey.

The data released under the Freedom of Information Act reveals that 2,388 requests for information were made or received by HMRC regarding taxpayers with assets in the UK and overseas in 2023/24. HMRC made 632 outbound requests in 2023/24, which is not as many as those made in 2022/23 (777) but almost double the number immediately prior to the pandemic (331 in 2018/19).

Outbound and inbound information requests between HMRC and foreign tax authorities

According to Price Bailey, the volume of information exchanged is likely to rise this year following the announcement in the Spring Budget that non-UK assets will be subject to inheritance tax, capital gains tax and income tax based on residence rather than domicile from 6 April 2025.

HMRC also issued 23,500 nudge letters in relation to offshore matters in 2023/24, a slight decline on 2022/23 when 23,936 were issued. However, the monetary value of disclosures resulting from these letters almost trebled between 2022/23 and 2023/24 from £19.6m to £57.2m.

Andrew Park, Partner at Price Bailey, said: ‘We have been seeing increased HMRC scrutiny of wealthy people with overseas assets. This is likely to intensify following the abolition of the non-dom tax regime, which will bring more offshore assets within the UK tax net. HMRC will be relying heavily on requests to foreign tax authorities to build a picture of the increased tax liabilities of wealthy UK residents. It is likely that some UK residents who currently take advantage of non-dom status will fail to disclose their full liabilities to HMRC.’

‘HMRC began issuing nudge letters in 2023/24 to wealthy people named in the Pandora Papers. It cannot be a coincidence that the amount generated from offshore nudge letters trebled to nearly £60m as these taxpayers came under HMRC’s spotlight’, he added.