Restructuring transactions are not limited to the type of economic downturn in which the Covid-19 crisis seems likely to result. They can occur at every stage of the business cycle and may appear in various forms. For example, a group may restructure its balance sheet under a debt for equity swap. Or a group may reorganise its operations through an intra-group transfer of assets and liabilities, including in conjunction with a demerger or spin off. A substantial amount of UK tax law impinges upon this area, as the following paragraphs will illustrate.

Debt restructurings

Debt releases

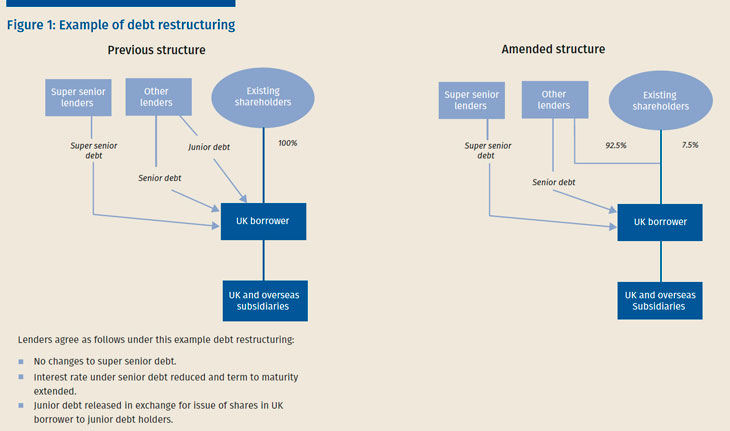

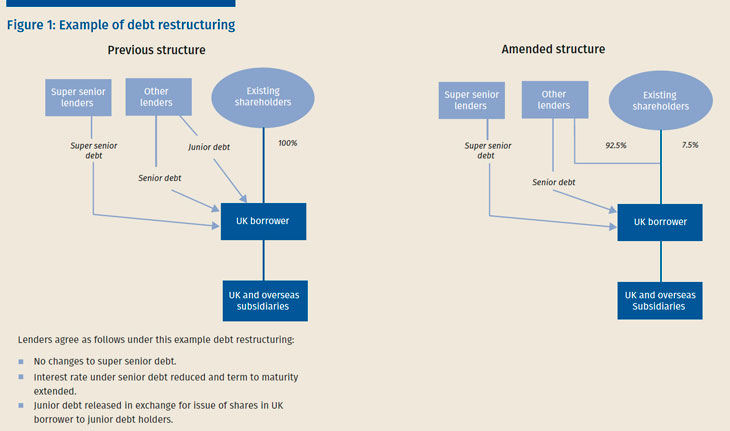

As part of a debt restructuring (see figure 1), the lenders to a UK borrower may agree to a release of some of the borrower’s debt. Since 2015, distressed UK corporate borrowers have had access to the UK’s corporate rescue exemption as a means of sheltering releases of debt from UK corporation tax. The exemption applies if it can be reasonably assumed that, but for the release and surrounding arrangements, there would be a material risk of the borrower being unable to pay its debts within the next 12 months (CTA 2009 s 322(5B)). Unable to pay its debts for these purposes can include both an insufficiency of cash to pay those debts and a state of balance sheet insolvency (CTA 2009 s 323(A1) and HMRC’s Corporate Finance Manual at CFM33194). Consequently, the exemption does not require the borrower to be in an insolvency procedure such as an administration or even, necessarily, on the verge of that procedure.

However, as HMRC makes clear in its guidance, the exemption will not be available for mere liability management exercises. The borrower in question must be in ‘significant financial distress’ with a ‘real prospect’ (absent the restructuring) of going into insolvency within the next 12 months (CFM33192 and CFM33194).

Consequently, advisers have sometimes been reluctant to conclude that the corporate rescue exemption will definitely apply to particular debt restructurings. In turn, standard advice is for relevant directors to carefully consider and document why they consider the exemption’s requirements are satisfied. Depending upon the context, reliance might also be placed on other exemptions, such as the debt for equity swap exemption in CTA 2009 s 322(4) or the exemption for debt releases that occur as part of a scheme of arrangement in CTA 2009 s 322(3).

Debt modifications

A mere modification of the terms of debt (for example, a reduction in its interest rate or extension of its term) can have tax implications for both borrower and lenders. In particular, if the modification is sufficiently material, and depending upon the laws of their jurisdictions, lenders might be treated as making a taxable disposal of their debt. In addition, a UK borrower might be treated as realising an accounting and, therefore, a taxable profit under the UK’s loan relationship rules as a result of the modification.

The latter area, in particular, can be complicated and will usually require accounting input. Nevertheless, some basic points can be noted.

Under both FRS 102 and IFRS 9, it is understood that ‘substantial’ modifications of debt can result in an accounting profit or loss for a UK borrower (FRS 102.11.36–38 and IFRS 9.3.3), which, ordinarily, the UK borrower would be required to bring into account under the UK’s loan relationship rules.

FRS 102 provides no real guidance as to the meaning of substantial in this context. In contrast, it is understood that, under IFRS 9, a modification will be substantial for these purposes if, broadly speaking, the discounted present value of the cash flows under the amended debt is different by at least 10% when compared with the discounted present value of the remaining cash flows under the original debt (discounted in both cases by applying the original effective interest rate) (IFRS 9.B3.3.6).

The authors also understand that, in certain circumstances under FRS 102 and IFRS 9, non-substantial modifications of debt can result in the above accounting and, therefore, tax consequences for a UK borrower (see, for example, IFRS 9.B5.4.6).

However, a UK borrower will not be required to bring an accounting profit into account as a result of the substantial modification of its debt if the corporate rescue exemption in CTA 2009 s 323A applies. This exemption entails the same requirements as the previously mentioned corporate rescue exemption that applies to releases of debt, albeit with the focus on whether the modification (and surrounding arrangements) satisfies those requirements.

Interest deductibility

A borrower may enter into new debt under a debt restructuring and will generally want to obtain as much tax relief for interest it pays under the new debt as possible. It will also want to preserve as much of the tax relief to which it was previously entitled under its existing debt. However, interest deductibility for UK corporate borrowers is now one of the more complicated areas of UK tax law with numerous obstacles to its availability.

For example, a UK borrower group that has ‘aggregate net tax-interest expense’ of more than £2m per annum may be restricted in the tax relief it can claim for that expense under the UK’s corporate interest restriction rules in TIOPA 2010 Part 10. Generally speaking, the rules restrict tax relief in this way to a proportion of the group’s ‘aggregate tax-EBITDA’, which, subject to certain caps and exemptions, will be 30% of that EBITDA under the fixed ratio rule or such higher percentage as is permitted under the elective group ratio rule.

The impact of the corporate interest restriction rules for a restructured group may be complicated, depending, for example, upon potentially hard-to-predict fluctuations in the group’s aggregate tax-EBITDA from one year to the next. However, two points about the rules can usefully be made in this context.

First, a debt for equity swap might cause a previously unconnected lender to become a ‘related party’ of a UK borrower under TIOPA 2010 ss 462–472. If this is the case, interest on any debt of the lender that remains after the swap will be excluded from the borrower group’s ‘QNGIE’ under the group ratio rule, which may result in less interest deductibility for the group in the UK (TIOPA 2010 ss 398–400). Admittedly, under an important exception in TIOPA 2010 s 469, this treatment will not eventuate if the release of debt that causes the related party status (i.e. as a result of being in consideration for shares) is eligible for the corporate rescue exemption previously described. Nevertheless, that exception will not always apply.

Second, restructured groups can and should be pro-active in maximising interest deductibility under interest restriction rules such as the above UK rules and comparable overseas regimes. For example, under a debt restructuring, a UK borrower may have over borrowed in the UK as a proportion of the group’s ‘aggregate tax-EBITDA’ and be unable, as a result, to obtain tax relief for all its interest expense in the UK.

In contrast, an overseas subgroup may have sufficient headroom under the interest restriction rules applicable to it to obtain tax deductions for interest which are denied in the UK. In turn, a solution might be to novate debt from the UK into that sub-group so that it can make use of those tax deductions.

Change of control

As suggested above, a debt for equity swap might cause a lender to become a ‘related party’ of the borrower under the corporate interest restriction rules. It or other arrangements under which lenders acquire shares in the borrower group may also cause the group to undergo a change of control.

This type of change in the ownership structure of a UK borrower group can have numerous UK tax implications, including, potential degrouping charges and restrictions in interest deductibility under transfer pricing and anti-hybrid rules.

Crucially, however, equitisations of debt may result in a ‘change in the ownership’ of relevant companies under CTA 2010 Part 14 Chapter 7, in which case, those companies may forfeit valuable tax losses in certain circumstances, including where:

In this regard, the purpose of a restructuring will usually be to nurse the affected group back to financial health. In turn, it may be assumed that the group will be able to make use of carried-forward losses to shelter future expected profits from tax. Of course, since the enactment of F(No.2)A 2017, there are important structural limitations to a group’s ability to carry forward and utilise losses in this way (see also Sch 3 of the recently published Finance Bill). In particular, above an annual £5m allowance that they will usually share amongst themselves, UK group members will only generally be able to set off carried forward losses in this way up to a ‘relevant maximum’, which, broadly speaking, will equate to 50% of their taxable profit above that allowance (CTA 2010 Part 7ZA).

Nevertheless, the financial model for a debt restructuring may assume a particular level of utilisation of these losses, in which case it will be important to avoid triggering applicable restrictions on the carry forward of losses, including those set out in the above bullet points. Indeed, as regards protecting the type of non-trading losses to which the second bullet is relevant, UK groups have previously undertaken reductions of capital soon after the change in ownership, i.e. to give themselves a greater buffer against any subsequent increase in that capital.

Deemed release

An additional point to note is that a change in ownership or control of a UK borrower in favour of lenders may cause a deemed taxable release of the borrower’s debt under CTA 2009 s 362 and a potentially substantial taxable profit for it under the computational provisions in s 362(3). It is sometimes thought that s 362 can only apply in this way if a lender or connected lenders obtain ‘control’ of the borrower so as to become ‘connected’ with it under CTA 2009 s 466. In contrast, HMRC considers that this deemed release can also arise where unconnected lenders that do not individually control the borrower nevertheless obtain collective control over it and agree to act together in particular ways (CFM35120). In all such cases, however, the borrower should not be subject to UK corporation tax as a result of the deemed release provided, broadly speaking, that the conditions of the previously discussed corporate rescue exemption are satisfied and the debt in question is actually released within 60 days of its deemed release (CTA 2009 s 362A).

Intra-group restructurings

Separately, or as part of a debt restructuring, a UK group may undertake an internal reorganisation of its assets and liabilities, perhaps to facilitate a sale of particular operations to an external purchaser.

If intra-group debt is released as part of that reorganisation, the release will generally have no UK tax consequences for either lender or borrower (CTA 2009 s 358). UK tax rules will also generally allow the intra-group transfer of assets and liabilities within the UK to be undertaken on a tax neutral basis.

However, the transferor and transferee must form part of the same group under the applicable tax regime for this tax neutral treatment to apply – which may not be the case as regards chargeable gains groups, for example, if a relevant group company has entered into non ‘normal commercial loans’ with its creditors (TCGA 1992 s 170(8)). In addition, despite the initial tax neutrality, there may be degrouping charges or a clawback of reliefs previously claimed if the group relationship relied upon is subsequently broken within a certain period of time.

As an illustration of this, assets can generally be transferred between members of a chargeable gains group on a ‘no gain no loss’ basis (TCGA 1992 s 171), but a degrouping charge (calculated on the assumption that the relevant assets were disposed of and immediately reacquired for market value immediately after acquisition of the asset) may be triggered where the transferee ceases to be a member of the relevant group within six years of the date of transfer (TCGA 1992 s 179). Likewise, the intra-group transfer of intangible fixed assets within the intangibles regime is treated as tax neutral (CTA 2009 s 775) but a degrouping charge may be triggered if the transferee ceases to be a member of the relevant group within six years of the date of transfer (CTA 2009 s 780).

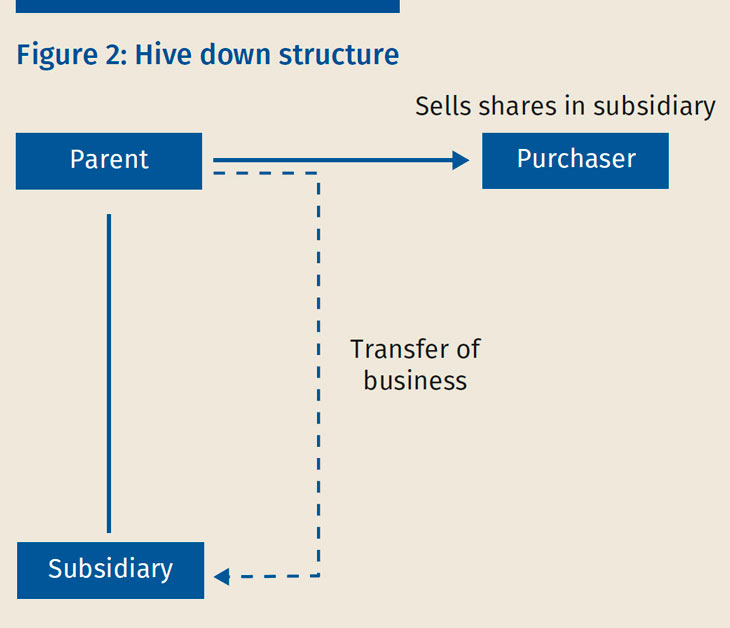

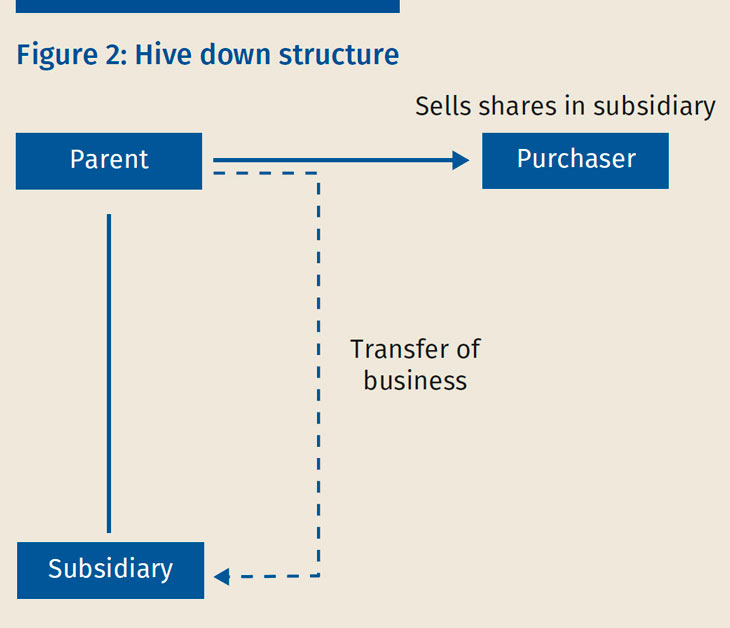

Hive downs

These degrouping charges generally arise in the transferee entity, but it is possible to elect for the charge to be treated as realised in another group company (TCGA 1992 s 171A and CTA 2009 s 792), which can be advantageous if another group company has losses available to shelter the degrouping gain. Moreover, if the degrouping of a relevant company results from the sale of its shares, then, in certain cases, any degrouping gain under the chargeable gains regime will be treated as forming part of the consideration for the sale of the target company that accrues to the vendor company - including, ordinarily, where the vendor company is a UK tax resident company (TCGA 1992 s 179(3D)). This exception can be helpful in the type of hive down structure that is illustrated in figure 2. In particular, it will often be possible for a UK group to hive down trading assets into a new subsidiary and sell it free of UK corporation tax under the substantial shareholding exemption from chargeable gains in TCGA 1992 Sch 7AC (see also Sch 7AC para 15A and CTA 2009 s 782A in this particular regard).

It may also be possible for corporation tax losses to be hived down into a new subsidiary along with the relevant trade (CTA 2010 Part 22). However, anti-avoidance rules will often restrict this where the transferor has liabilities in excess of its assets after the transfer (CTA 2010 s 945). In addition, the subsequent sale of the subsidiary’s shares to an external purchaser will constitute a ‘change in [its] ownership’ under CTA 2010 Part 14 Chapter 7. Consequently, the subsidiary may be prevented from retaining those losses under the type of restriction that is described above under the ‘Change of control’ heading.

Other taxes

Of further relevance to an intra-group reorganisation, group companies will generally be permitted to transfer shares and property to each other free of UK stamp duty and SDLT (FA 1930 s 42 for stamp duty; FA 2003 Sch 7 para 1 for SDLT). However, the SDLT regime has a clawback mechanism if the transferee leaves the group within three years of the date of transfer (FA 2003 Sch 7 para 3). In contrast, the stamp duty regime does not impose this clawback, but does have a forward looking test assessed at the time of the relevant transfer (stamp duty group relief will not apply if arrangements are in existence by virtue of which a person could obtain control of the transferee but not the transferor (FA 1930 s 42(2))).

It is also worth noting that intra-group transfers of assets and liabilities will be outside the scope of VAT where either:

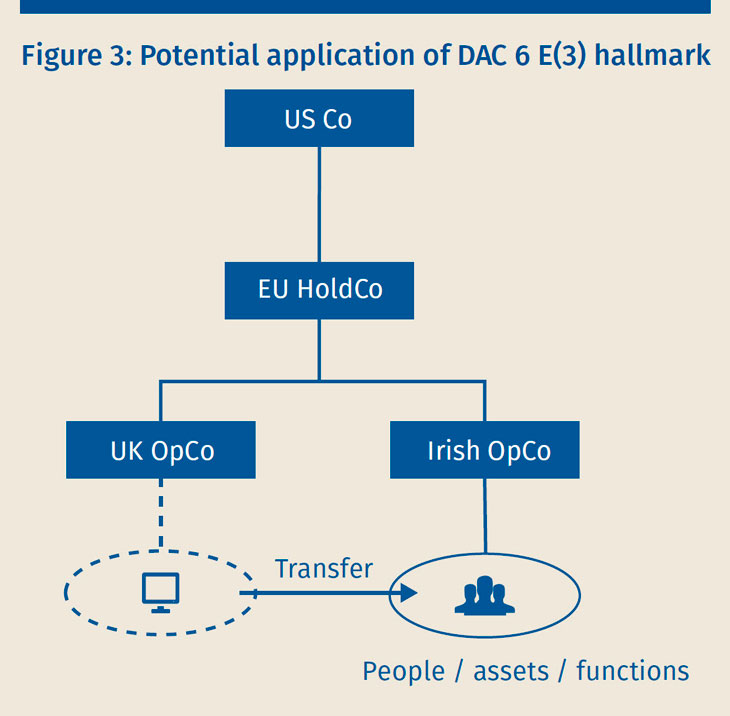

DAC 6

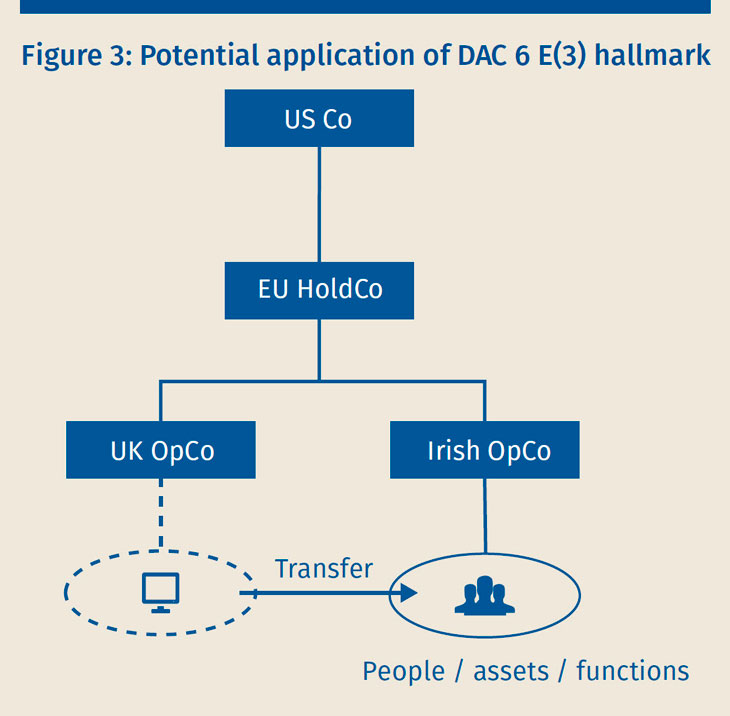

A final topical point is that an intra-group reorganisation of assets and liabilities may trigger reporting obligations under the new DAC 6 tax reporting regime regardless of its commercial rationale; for example, if it otherwise concerns the UK or an EU member state and a third country and entails under the ‘E(3)’ hallmark (see also figure 3): ‘the intragroup cross-border transfer of functions and/or risks and/or assets, if the projected annual earnings before interest and taxes (EBIT), during the three-year period after the transfer, of the transferor or transferors, are less than 50% of the projected annual EBIT of such transferor or transferors if the transfer had not been made.’

Insolvency

The previous paragraphs have considered so-called consensual, out-of-court restructurings. It is nevertheless possible that the restructuring will fail and the affected company or group be placed in administration or liquidation. Pending that, the company might also undertake other forms of business rescue, including a scheme of arrangement or, potentially, under recent government proposals relating to the Covid-19 virus, a ‘restructuring plan’ and related debt moratorium. The precise tax implications of this type of procedure for a UK borrower group and its lenders will depend upon the group’s tax profile and related considerations. One important point to note, however, is that HMRC will generally rank as an unsecured creditor in respect of the affected company’s UK tax debts that arise prior to an administration or liquidation. In contrast, UK taxes that the company incurs after entering that procedure will usually constitute expenses of the procedure, in which case they will rank above both floating charge holders and unsecured creditors in the relevant distribution waterfalls.

This distinction is important and can even invite the suggestion of triggering tax liabilities of an affected company (e.g. on the sale of valuable asset) before the relevant procedure begins. However, there are some crucial points to note in this area, as follows.

First, in certain circumstances, other group companies, which may themselves be solvent and outside an insolvency procedure, can be assessed for taxes that are primarily incurred by a company that is subject to such a procedure. As an illustration of this, if a UK company disposed of real estate, realising a large taxable gain, the ‘principal company’ of its group could be assessed for the resultant tax charge if the company failed to pay it (TCGA 1992 s 190).

Second, a tax liability owed by a UK company may be set off against an amount that HMRC owes to it with the effect that the UK company effectively funds some or all of the liability. For example, provided the amounts in question represent ‘pre-insolvency’ credits and debits, HMRC will generally have the power under FA 2008 s 130 to set off, say, a UK corporation tax liability of an insolvent company against a repayment of VAT to which the company is otherwise entitled.

Finally, whilst the general position as regards pre-insolvency tax debts is as set out above, the government has proposed legislation in this year’s Finance Bill under which for relevant insolvency procedures that begin on or after 1 December 2020 HMRC would become a secondary preferential creditor in respect of a company’s pre-insolvency PAYE income tax, VAT, employee NIC and construction industry scheme deductions. The government has also proposed other legislation in that Finance Bill under which directors and others could be made jointly and severally liable for the pre-insolvency tax debts of their company in certain cases of insolvency-related tax abuse (e.g. phoenixism).

Summary

As this article has hopefully demonstrated, restructuring transactions can generate numerous tax issues both in the UK and, where relevant, in overseas jurisdictions. The key, as always, is to obtain tax advice at an early stage of the proceedings and to implement that advice carefully thereafter.

Restructuring transactions are not limited to the type of economic downturn in which the Covid-19 crisis seems likely to result. They can occur at every stage of the business cycle and may appear in various forms. For example, a group may restructure its balance sheet under a debt for equity swap. Or a group may reorganise its operations through an intra-group transfer of assets and liabilities, including in conjunction with a demerger or spin off. A substantial amount of UK tax law impinges upon this area, as the following paragraphs will illustrate.

Debt restructurings

Debt releases

As part of a debt restructuring (see figure 1), the lenders to a UK borrower may agree to a release of some of the borrower’s debt. Since 2015, distressed UK corporate borrowers have had access to the UK’s corporate rescue exemption as a means of sheltering releases of debt from UK corporation tax. The exemption applies if it can be reasonably assumed that, but for the release and surrounding arrangements, there would be a material risk of the borrower being unable to pay its debts within the next 12 months (CTA 2009 s 322(5B)). Unable to pay its debts for these purposes can include both an insufficiency of cash to pay those debts and a state of balance sheet insolvency (CTA 2009 s 323(A1) and HMRC’s Corporate Finance Manual at CFM33194). Consequently, the exemption does not require the borrower to be in an insolvency procedure such as an administration or even, necessarily, on the verge of that procedure.

However, as HMRC makes clear in its guidance, the exemption will not be available for mere liability management exercises. The borrower in question must be in ‘significant financial distress’ with a ‘real prospect’ (absent the restructuring) of going into insolvency within the next 12 months (CFM33192 and CFM33194).

Consequently, advisers have sometimes been reluctant to conclude that the corporate rescue exemption will definitely apply to particular debt restructurings. In turn, standard advice is for relevant directors to carefully consider and document why they consider the exemption’s requirements are satisfied. Depending upon the context, reliance might also be placed on other exemptions, such as the debt for equity swap exemption in CTA 2009 s 322(4) or the exemption for debt releases that occur as part of a scheme of arrangement in CTA 2009 s 322(3).

Debt modifications

A mere modification of the terms of debt (for example, a reduction in its interest rate or extension of its term) can have tax implications for both borrower and lenders. In particular, if the modification is sufficiently material, and depending upon the laws of their jurisdictions, lenders might be treated as making a taxable disposal of their debt. In addition, a UK borrower might be treated as realising an accounting and, therefore, a taxable profit under the UK’s loan relationship rules as a result of the modification.

The latter area, in particular, can be complicated and will usually require accounting input. Nevertheless, some basic points can be noted.

Under both FRS 102 and IFRS 9, it is understood that ‘substantial’ modifications of debt can result in an accounting profit or loss for a UK borrower (FRS 102.11.36–38 and IFRS 9.3.3), which, ordinarily, the UK borrower would be required to bring into account under the UK’s loan relationship rules.

FRS 102 provides no real guidance as to the meaning of substantial in this context. In contrast, it is understood that, under IFRS 9, a modification will be substantial for these purposes if, broadly speaking, the discounted present value of the cash flows under the amended debt is different by at least 10% when compared with the discounted present value of the remaining cash flows under the original debt (discounted in both cases by applying the original effective interest rate) (IFRS 9.B3.3.6).

The authors also understand that, in certain circumstances under FRS 102 and IFRS 9, non-substantial modifications of debt can result in the above accounting and, therefore, tax consequences for a UK borrower (see, for example, IFRS 9.B5.4.6).

However, a UK borrower will not be required to bring an accounting profit into account as a result of the substantial modification of its debt if the corporate rescue exemption in CTA 2009 s 323A applies. This exemption entails the same requirements as the previously mentioned corporate rescue exemption that applies to releases of debt, albeit with the focus on whether the modification (and surrounding arrangements) satisfies those requirements.

Interest deductibility

A borrower may enter into new debt under a debt restructuring and will generally want to obtain as much tax relief for interest it pays under the new debt as possible. It will also want to preserve as much of the tax relief to which it was previously entitled under its existing debt. However, interest deductibility for UK corporate borrowers is now one of the more complicated areas of UK tax law with numerous obstacles to its availability.

For example, a UK borrower group that has ‘aggregate net tax-interest expense’ of more than £2m per annum may be restricted in the tax relief it can claim for that expense under the UK’s corporate interest restriction rules in TIOPA 2010 Part 10. Generally speaking, the rules restrict tax relief in this way to a proportion of the group’s ‘aggregate tax-EBITDA’, which, subject to certain caps and exemptions, will be 30% of that EBITDA under the fixed ratio rule or such higher percentage as is permitted under the elective group ratio rule.

The impact of the corporate interest restriction rules for a restructured group may be complicated, depending, for example, upon potentially hard-to-predict fluctuations in the group’s aggregate tax-EBITDA from one year to the next. However, two points about the rules can usefully be made in this context.

First, a debt for equity swap might cause a previously unconnected lender to become a ‘related party’ of a UK borrower under TIOPA 2010 ss 462–472. If this is the case, interest on any debt of the lender that remains after the swap will be excluded from the borrower group’s ‘QNGIE’ under the group ratio rule, which may result in less interest deductibility for the group in the UK (TIOPA 2010 ss 398–400). Admittedly, under an important exception in TIOPA 2010 s 469, this treatment will not eventuate if the release of debt that causes the related party status (i.e. as a result of being in consideration for shares) is eligible for the corporate rescue exemption previously described. Nevertheless, that exception will not always apply.

Second, restructured groups can and should be pro-active in maximising interest deductibility under interest restriction rules such as the above UK rules and comparable overseas regimes. For example, under a debt restructuring, a UK borrower may have over borrowed in the UK as a proportion of the group’s ‘aggregate tax-EBITDA’ and be unable, as a result, to obtain tax relief for all its interest expense in the UK.

In contrast, an overseas subgroup may have sufficient headroom under the interest restriction rules applicable to it to obtain tax deductions for interest which are denied in the UK. In turn, a solution might be to novate debt from the UK into that sub-group so that it can make use of those tax deductions.

Change of control

As suggested above, a debt for equity swap might cause a lender to become a ‘related party’ of the borrower under the corporate interest restriction rules. It or other arrangements under which lenders acquire shares in the borrower group may also cause the group to undergo a change of control.

This type of change in the ownership structure of a UK borrower group can have numerous UK tax implications, including, potential degrouping charges and restrictions in interest deductibility under transfer pricing and anti-hybrid rules.

Crucially, however, equitisations of debt may result in a ‘change in the ownership’ of relevant companies under CTA 2010 Part 14 Chapter 7, in which case, those companies may forfeit valuable tax losses in certain circumstances, including where:

In this regard, the purpose of a restructuring will usually be to nurse the affected group back to financial health. In turn, it may be assumed that the group will be able to make use of carried-forward losses to shelter future expected profits from tax. Of course, since the enactment of F(No.2)A 2017, there are important structural limitations to a group’s ability to carry forward and utilise losses in this way (see also Sch 3 of the recently published Finance Bill). In particular, above an annual £5m allowance that they will usually share amongst themselves, UK group members will only generally be able to set off carried forward losses in this way up to a ‘relevant maximum’, which, broadly speaking, will equate to 50% of their taxable profit above that allowance (CTA 2010 Part 7ZA).

Nevertheless, the financial model for a debt restructuring may assume a particular level of utilisation of these losses, in which case it will be important to avoid triggering applicable restrictions on the carry forward of losses, including those set out in the above bullet points. Indeed, as regards protecting the type of non-trading losses to which the second bullet is relevant, UK groups have previously undertaken reductions of capital soon after the change in ownership, i.e. to give themselves a greater buffer against any subsequent increase in that capital.

Deemed release

An additional point to note is that a change in ownership or control of a UK borrower in favour of lenders may cause a deemed taxable release of the borrower’s debt under CTA 2009 s 362 and a potentially substantial taxable profit for it under the computational provisions in s 362(3). It is sometimes thought that s 362 can only apply in this way if a lender or connected lenders obtain ‘control’ of the borrower so as to become ‘connected’ with it under CTA 2009 s 466. In contrast, HMRC considers that this deemed release can also arise where unconnected lenders that do not individually control the borrower nevertheless obtain collective control over it and agree to act together in particular ways (CFM35120). In all such cases, however, the borrower should not be subject to UK corporation tax as a result of the deemed release provided, broadly speaking, that the conditions of the previously discussed corporate rescue exemption are satisfied and the debt in question is actually released within 60 days of its deemed release (CTA 2009 s 362A).

Intra-group restructurings

Separately, or as part of a debt restructuring, a UK group may undertake an internal reorganisation of its assets and liabilities, perhaps to facilitate a sale of particular operations to an external purchaser.

If intra-group debt is released as part of that reorganisation, the release will generally have no UK tax consequences for either lender or borrower (CTA 2009 s 358). UK tax rules will also generally allow the intra-group transfer of assets and liabilities within the UK to be undertaken on a tax neutral basis.

However, the transferor and transferee must form part of the same group under the applicable tax regime for this tax neutral treatment to apply – which may not be the case as regards chargeable gains groups, for example, if a relevant group company has entered into non ‘normal commercial loans’ with its creditors (TCGA 1992 s 170(8)). In addition, despite the initial tax neutrality, there may be degrouping charges or a clawback of reliefs previously claimed if the group relationship relied upon is subsequently broken within a certain period of time.

As an illustration of this, assets can generally be transferred between members of a chargeable gains group on a ‘no gain no loss’ basis (TCGA 1992 s 171), but a degrouping charge (calculated on the assumption that the relevant assets were disposed of and immediately reacquired for market value immediately after acquisition of the asset) may be triggered where the transferee ceases to be a member of the relevant group within six years of the date of transfer (TCGA 1992 s 179). Likewise, the intra-group transfer of intangible fixed assets within the intangibles regime is treated as tax neutral (CTA 2009 s 775) but a degrouping charge may be triggered if the transferee ceases to be a member of the relevant group within six years of the date of transfer (CTA 2009 s 780).

Hive downs

These degrouping charges generally arise in the transferee entity, but it is possible to elect for the charge to be treated as realised in another group company (TCGA 1992 s 171A and CTA 2009 s 792), which can be advantageous if another group company has losses available to shelter the degrouping gain. Moreover, if the degrouping of a relevant company results from the sale of its shares, then, in certain cases, any degrouping gain under the chargeable gains regime will be treated as forming part of the consideration for the sale of the target company that accrues to the vendor company - including, ordinarily, where the vendor company is a UK tax resident company (TCGA 1992 s 179(3D)). This exception can be helpful in the type of hive down structure that is illustrated in figure 2. In particular, it will often be possible for a UK group to hive down trading assets into a new subsidiary and sell it free of UK corporation tax under the substantial shareholding exemption from chargeable gains in TCGA 1992 Sch 7AC (see also Sch 7AC para 15A and CTA 2009 s 782A in this particular regard).

It may also be possible for corporation tax losses to be hived down into a new subsidiary along with the relevant trade (CTA 2010 Part 22). However, anti-avoidance rules will often restrict this where the transferor has liabilities in excess of its assets after the transfer (CTA 2010 s 945). In addition, the subsequent sale of the subsidiary’s shares to an external purchaser will constitute a ‘change in [its] ownership’ under CTA 2010 Part 14 Chapter 7. Consequently, the subsidiary may be prevented from retaining those losses under the type of restriction that is described above under the ‘Change of control’ heading.

Other taxes

Of further relevance to an intra-group reorganisation, group companies will generally be permitted to transfer shares and property to each other free of UK stamp duty and SDLT (FA 1930 s 42 for stamp duty; FA 2003 Sch 7 para 1 for SDLT). However, the SDLT regime has a clawback mechanism if the transferee leaves the group within three years of the date of transfer (FA 2003 Sch 7 para 3). In contrast, the stamp duty regime does not impose this clawback, but does have a forward looking test assessed at the time of the relevant transfer (stamp duty group relief will not apply if arrangements are in existence by virtue of which a person could obtain control of the transferee but not the transferor (FA 1930 s 42(2))).

It is also worth noting that intra-group transfers of assets and liabilities will be outside the scope of VAT where either:

DAC 6

A final topical point is that an intra-group reorganisation of assets and liabilities may trigger reporting obligations under the new DAC 6 tax reporting regime regardless of its commercial rationale; for example, if it otherwise concerns the UK or an EU member state and a third country and entails under the ‘E(3)’ hallmark (see also figure 3): ‘the intragroup cross-border transfer of functions and/or risks and/or assets, if the projected annual earnings before interest and taxes (EBIT), during the three-year period after the transfer, of the transferor or transferors, are less than 50% of the projected annual EBIT of such transferor or transferors if the transfer had not been made.’

Insolvency

The previous paragraphs have considered so-called consensual, out-of-court restructurings. It is nevertheless possible that the restructuring will fail and the affected company or group be placed in administration or liquidation. Pending that, the company might also undertake other forms of business rescue, including a scheme of arrangement or, potentially, under recent government proposals relating to the Covid-19 virus, a ‘restructuring plan’ and related debt moratorium. The precise tax implications of this type of procedure for a UK borrower group and its lenders will depend upon the group’s tax profile and related considerations. One important point to note, however, is that HMRC will generally rank as an unsecured creditor in respect of the affected company’s UK tax debts that arise prior to an administration or liquidation. In contrast, UK taxes that the company incurs after entering that procedure will usually constitute expenses of the procedure, in which case they will rank above both floating charge holders and unsecured creditors in the relevant distribution waterfalls.

This distinction is important and can even invite the suggestion of triggering tax liabilities of an affected company (e.g. on the sale of valuable asset) before the relevant procedure begins. However, there are some crucial points to note in this area, as follows.

First, in certain circumstances, other group companies, which may themselves be solvent and outside an insolvency procedure, can be assessed for taxes that are primarily incurred by a company that is subject to such a procedure. As an illustration of this, if a UK company disposed of real estate, realising a large taxable gain, the ‘principal company’ of its group could be assessed for the resultant tax charge if the company failed to pay it (TCGA 1992 s 190).

Second, a tax liability owed by a UK company may be set off against an amount that HMRC owes to it with the effect that the UK company effectively funds some or all of the liability. For example, provided the amounts in question represent ‘pre-insolvency’ credits and debits, HMRC will generally have the power under FA 2008 s 130 to set off, say, a UK corporation tax liability of an insolvent company against a repayment of VAT to which the company is otherwise entitled.

Finally, whilst the general position as regards pre-insolvency tax debts is as set out above, the government has proposed legislation in this year’s Finance Bill under which for relevant insolvency procedures that begin on or after 1 December 2020 HMRC would become a secondary preferential creditor in respect of a company’s pre-insolvency PAYE income tax, VAT, employee NIC and construction industry scheme deductions. The government has also proposed other legislation in that Finance Bill under which directors and others could be made jointly and severally liable for the pre-insolvency tax debts of their company in certain cases of insolvency-related tax abuse (e.g. phoenixism).

Summary

As this article has hopefully demonstrated, restructuring transactions can generate numerous tax issues both in the UK and, where relevant, in overseas jurisdictions. The key, as always, is to obtain tax advice at an early stage of the proceedings and to implement that advice carefully thereafter.