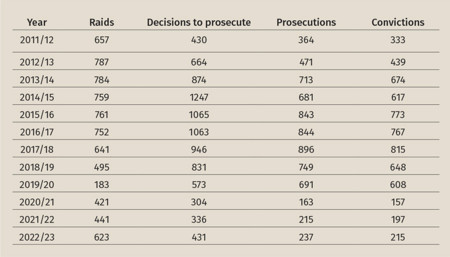

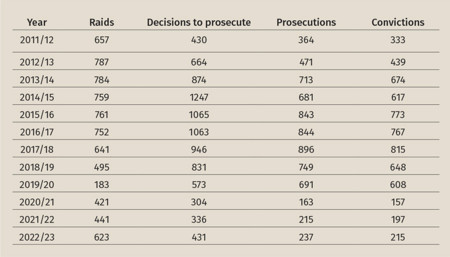

Fieldfisher tracks figures that reveal the extent of HMRC’s criminal investigations activity and the extent of its success: search warrants executed by HMRC (‘raids’); decisions by the CPS to charge for tax offences (‘decisions to prosecute’); individuals prosecuted (‘prosecutions’); and convictions for tax offences in the courts (‘convictions’). See the table above (which excludes tax credits offences).

Raids were up more than 40% in 2022/23 as a result of HMRC resuming ‘business as usual’ compliance activity after the pandemic. It’s a substantial investment in pursuing those HMRC believes may have committed serious tax evasion, because raids take weeks or months to plan, consume large amounts of human resource, and are followed by weeks and months of analysing the data.

The number of decisions to prosecute rose sharply, likely reflecting the government’s desire to take a tough line with businesses that illicitly exploited the government’s job assistance programmes through the Covid pandemic. The government’s attention to ‘get tough’ is further evidenced by the publication of the policy paper by HMRC on 18 July 2023 proposing doubling the maximum sentences from seven to 14 years for a swathe of ‘fraudulent evasion offences’.

The number of prosecutions also rose and 90% of prosecutions resulted in a conviction. HMRC and the CPS are to be commended for focusing their resources on bringing to trial high quality cases with a realistic prospect of conviction.

What does all this mean? Because the chances of a decision to prosecute, prosecution, and conviction resulting from the raid are all extremely high, if a taxpayer is the subject of a raid by HMRC, they are likely in serious trouble.

As professionals, we need to think about the mental health impact on clients of being the subject of a raid. Commonly, it is their first contact with the sharp end of law enforcement. They feel that their home has been violated, their family will ask them what they have done, they have to tell their employers that they have been arrested and their home searched, and regulated professionals commonly need to inform their regulator. Often, as a result, the regulator suspends that individual’s licence. The net result is that even someone ultimately adjudged not guilty of tax fraud in a court of law can lose their family, home, and career. Even the risk of these losses occurring can lead to dark thoughts. I know that suicidal ideation is common among those arrested on suspicion of tax evasion. Anecdotally, some try to commit suicide, and some succeed. So we recommend that clients who have been subjected to a raid obtain professional mental health support to help them cope.

Being the subject of a raid is not the only way for a taxpayer to find themselves being prosecuted. Making a false statement during a compliance check is enough, as with the recent successful prosecution of Bernie Ecclestone for lying during a COP 9 investigation – fraud by false representation – with his receiving a suspended prison sentence and paying enormous penalties due to an incomplete disclosure of offshore income and assets.

Fieldfisher tracks figures that reveal the extent of HMRC’s criminal investigations activity and the extent of its success: search warrants executed by HMRC (‘raids’); decisions by the CPS to charge for tax offences (‘decisions to prosecute’); individuals prosecuted (‘prosecutions’); and convictions for tax offences in the courts (‘convictions’). See the table above (which excludes tax credits offences).

Raids were up more than 40% in 2022/23 as a result of HMRC resuming ‘business as usual’ compliance activity after the pandemic. It’s a substantial investment in pursuing those HMRC believes may have committed serious tax evasion, because raids take weeks or months to plan, consume large amounts of human resource, and are followed by weeks and months of analysing the data.

The number of decisions to prosecute rose sharply, likely reflecting the government’s desire to take a tough line with businesses that illicitly exploited the government’s job assistance programmes through the Covid pandemic. The government’s attention to ‘get tough’ is further evidenced by the publication of the policy paper by HMRC on 18 July 2023 proposing doubling the maximum sentences from seven to 14 years for a swathe of ‘fraudulent evasion offences’.

The number of prosecutions also rose and 90% of prosecutions resulted in a conviction. HMRC and the CPS are to be commended for focusing their resources on bringing to trial high quality cases with a realistic prospect of conviction.

What does all this mean? Because the chances of a decision to prosecute, prosecution, and conviction resulting from the raid are all extremely high, if a taxpayer is the subject of a raid by HMRC, they are likely in serious trouble.

As professionals, we need to think about the mental health impact on clients of being the subject of a raid. Commonly, it is their first contact with the sharp end of law enforcement. They feel that their home has been violated, their family will ask them what they have done, they have to tell their employers that they have been arrested and their home searched, and regulated professionals commonly need to inform their regulator. Often, as a result, the regulator suspends that individual’s licence. The net result is that even someone ultimately adjudged not guilty of tax fraud in a court of law can lose their family, home, and career. Even the risk of these losses occurring can lead to dark thoughts. I know that suicidal ideation is common among those arrested on suspicion of tax evasion. Anecdotally, some try to commit suicide, and some succeed. So we recommend that clients who have been subjected to a raid obtain professional mental health support to help them cope.

Being the subject of a raid is not the only way for a taxpayer to find themselves being prosecuted. Making a false statement during a compliance check is enough, as with the recent successful prosecution of Bernie Ecclestone for lying during a COP 9 investigation – fraud by false representation – with his receiving a suspended prison sentence and paying enormous penalties due to an incomplete disclosure of offshore income and assets.