The Group Mismatch Schemes rules (in FA 2011 ss 29–30, Sch 5) target tax advantages arising from transactions in loans and derivatives involving UK group companies, and are widely drawn in an attempt to move away from reactive specific anti-avoidance. However, the rules can apply absent a tax motive and therefore all loan and derivative transactions involving two or more UK group companies need to be analysed. In practice, it should be possible to dismiss the rules quickly for most transactions, but where they do apply there are some uncertainties in their scope and application, including the calculation of the advantage which the rules seek to counter.

The Group Mismatch Schemes (GMS) rules (CTA 2010 Part 21B), which apply from 19 July 2011, are aimed at countering tax advantages from transactions in loans and derivatives involving UK members of a group, arising from asymmetries in the way those group members tax such transactions.

The Group Mismatch Schemes (GMS) rules (CTA 2010 Part 21B), which apply from 19 July 2011, are aimed at countering tax advantages from transactions in loans and derivatives involving UK members of a group, arising from asymmetries in the way those group members tax such transactions.

The rules are deliberately wide-ranging, as one of HMRC’s aims is to prevent future tax advantaged transactions in this area, rather than reacting to disclosures with specific anti-avoidance provisions.

However, the fact that the rules are widely drawn means that a number of important practical implications could arise.

The rules apply to any company which is party to a GMS and is a member of the scheme group. A scheme is a GMS if one of two conditions is met, assessed when the scheme is entered into:

(A) There is no practical likelihood that the scheme will fail to secure a relevant tax advantage of £2m or more; or

(B) The purpose, or one of the main purposes, of any member of the scheme group in entering into the scheme is to obtain the chance of securing a relevant tax advantage (of any amount); and there is no chance that the scheme will secure a relevant tax disadvantage, or if there is such a chance, the expected value of the scheme is positive.

Therefore, a tax motive is not required for the rules to apply – if there is a relevant tax advantage of more than £2 million, there is a GMS.

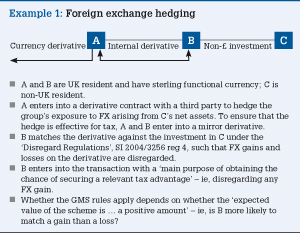

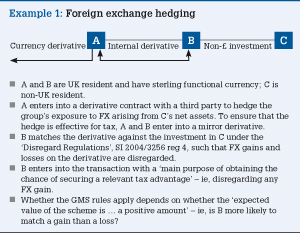

Also, the motive in Condition B is obtaining the chance of securing a relevant tax advantage – this could bring commercial hedging arrangements, which can result in either a tax advantage or disadvantage, within the scope of the rules (see Example 1).

As a result, HMRC introduced the ‘expected value’ requirement, that the scheme is more likely to produce a tax advantage than a disadvantage.

This requires a probability analysis of how likely a scheme is to produce a gain or a loss, but based on HMRC’s comments on introducing this requirement, in practice commercial hedging transactions are unlikely to fall within the scope of the rules.

The rules do not apply to schemes which are expected to produce a tax disadvantage, and are therefore one-sided in their application. While such a situation is unlikely, a disadvantage produced by, say, an adverse accounting asymmetry would therefore be unaffected.

Where the rules apply, scheme profits or losses are not brought into account. A profit or loss is a ‘scheme profit or loss’ if it:

A ‘relevant tax advantage’ is an ‘economic profit’ made by the scheme group which arises as a result of asymmetries in the way different members of the group bring, or do not bring, amounts into account as debits or credits for the purposes of CTA 2009 Part 5 or 7 (ie, it is not enough for there to simply be an asymmetry; the asymmetry must be in the way amounts are brought into account for tax purposes).

This includes absolute and timing advantages – ie, the NPV effect of a tax deferral can be within the scope of the rules.

‘Scheme’ is defined sufficiently widely to include transactions involving non-group members, although HMRC have stated (in their Technical Note entitled Financial Products Avoidance: Group Mismatches published on 6 December 2010, available via www.lexisurl.com/pELuX) that asymmetries arising from such transactions should not be subject to the GMS rules, because they do not produce a ‘relevant tax advantage’ as defined.

‘Group’ is also widely defined, with two companies being part of a group if one of five conditions is met, including being connected for loan relationships purposes, and being included in the same set of consolidated accounts.

An ‘economic profit or loss’ takes tax costs and benefits into account, and also the time value of money. There remains some uncertainty, though, in how to calculate an economic profit or loss (eg, should it be based on accounting profits or losses; what discount rate should be used in calculating present values?). It is hoped that HMRC will provide clarification in guidance.

The GMS rules have the potential to introduce additional computational complexity, particularly as no tax motive may be required. In practice, it should be relatively easy to dismiss the rules in most cases (as the necessary asymmetry will not be present); nevertheless, the rules will need to be considered for any transaction in loans and derivatives involving different UK group members.

The rules specifically exclude transactions with non-UK resident counterparties, but there is a question as to whether a transaction which is within the scope of the loan relationships or derivative codes in one UK company, but not in another (such that one company brings amounts into account under those codes, but the other does not) constitutes an asymmetry to which the rules can apply.

The specific inclusion of transactions with CFCs and certain transactions which only involve a deemed loan relationship for one party supports the view that such transactions are generally intended to be outside the scope, and this also appears to be HMRC’s view based on their 6 December 2010 Technical Note.

The GMS rules have express priority over the unallowable purpose, transfer pricing, tax arbitrage and worldwide debt cap rules – this is in part in response to disclosed schemes reliant on disallowances under the worldwide debt cap preventing the application of certain other anti-avoidance provisions.

Asymmetries caused by the utilisation of brought forward losses should not be caught per se, as there is an assumption that scheme parties obtain the full tax benefit of any loss, and incur the full tax cost of any profit.

The rules came into force on 19 July 2011 but have effect in relation to schemes entered into at any time. However, scheme losses or profits relating to a time before 19 July are not affected, and nor are scheme profits that relate to a time on or after 19 July arising from a scheme entered into before then.

This latter provision is designed to deal with schemes which may have produced a deduction before 19 July, which is reversed afterwards, as otherwise the GMS rules would disregard the reversal, resulting in a permanent advantage.

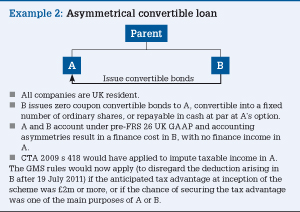

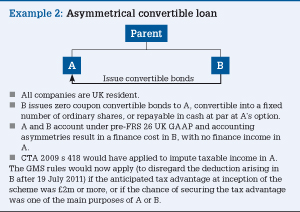

The GMS rules are intended to promote simplification by reducing the amount of specific anti-avoidance needed, but there are surprisingly only two repeals – CTA 2009 ss 418 and 419 (see Example 2), and s 453.

Therefore, the GMS rules initially will add to the complexity of the loan relationships and derivatives rules, but should hopefully reduce the need for future specific anti-avoidance.

The GMS rules are potentially wide-ranging and overall should achieve their stated effect of reducing the scope for transactions which result in tax advantages using loans and derivatives.

However, the breadth of the rules results in the need to assess them in relation to all transactions involving loans and derivatives and two or more UK group parties.

In practice, a group will usually know when it has entered into a transaction which could be subject to the rules but nevertheless, at least in the short term, the GMS rules have the potential to increase the compliance burden rather than reduce it.

Ben Moseley, Corporate Tax Partner, Deloitte

Stephen Weston, Corporate Tax Partner, Deloitte

The Group Mismatch Schemes rules (in FA 2011 ss 29–30, Sch 5) target tax advantages arising from transactions in loans and derivatives involving UK group companies, and are widely drawn in an attempt to move away from reactive specific anti-avoidance. However, the rules can apply absent a tax motive and therefore all loan and derivative transactions involving two or more UK group companies need to be analysed. In practice, it should be possible to dismiss the rules quickly for most transactions, but where they do apply there are some uncertainties in their scope and application, including the calculation of the advantage which the rules seek to counter.

The Group Mismatch Schemes (GMS) rules (CTA 2010 Part 21B), which apply from 19 July 2011, are aimed at countering tax advantages from transactions in loans and derivatives involving UK members of a group, arising from asymmetries in the way those group members tax such transactions.

The Group Mismatch Schemes (GMS) rules (CTA 2010 Part 21B), which apply from 19 July 2011, are aimed at countering tax advantages from transactions in loans and derivatives involving UK members of a group, arising from asymmetries in the way those group members tax such transactions.

The rules are deliberately wide-ranging, as one of HMRC’s aims is to prevent future tax advantaged transactions in this area, rather than reacting to disclosures with specific anti-avoidance provisions.

However, the fact that the rules are widely drawn means that a number of important practical implications could arise.

The rules apply to any company which is party to a GMS and is a member of the scheme group. A scheme is a GMS if one of two conditions is met, assessed when the scheme is entered into:

(A) There is no practical likelihood that the scheme will fail to secure a relevant tax advantage of £2m or more; or

(B) The purpose, or one of the main purposes, of any member of the scheme group in entering into the scheme is to obtain the chance of securing a relevant tax advantage (of any amount); and there is no chance that the scheme will secure a relevant tax disadvantage, or if there is such a chance, the expected value of the scheme is positive.

Therefore, a tax motive is not required for the rules to apply – if there is a relevant tax advantage of more than £2 million, there is a GMS.

Also, the motive in Condition B is obtaining the chance of securing a relevant tax advantage – this could bring commercial hedging arrangements, which can result in either a tax advantage or disadvantage, within the scope of the rules (see Example 1).

As a result, HMRC introduced the ‘expected value’ requirement, that the scheme is more likely to produce a tax advantage than a disadvantage.

This requires a probability analysis of how likely a scheme is to produce a gain or a loss, but based on HMRC’s comments on introducing this requirement, in practice commercial hedging transactions are unlikely to fall within the scope of the rules.

The rules do not apply to schemes which are expected to produce a tax disadvantage, and are therefore one-sided in their application. While such a situation is unlikely, a disadvantage produced by, say, an adverse accounting asymmetry would therefore be unaffected.

Where the rules apply, scheme profits or losses are not brought into account. A profit or loss is a ‘scheme profit or loss’ if it:

A ‘relevant tax advantage’ is an ‘economic profit’ made by the scheme group which arises as a result of asymmetries in the way different members of the group bring, or do not bring, amounts into account as debits or credits for the purposes of CTA 2009 Part 5 or 7 (ie, it is not enough for there to simply be an asymmetry; the asymmetry must be in the way amounts are brought into account for tax purposes).

This includes absolute and timing advantages – ie, the NPV effect of a tax deferral can be within the scope of the rules.

‘Scheme’ is defined sufficiently widely to include transactions involving non-group members, although HMRC have stated (in their Technical Note entitled Financial Products Avoidance: Group Mismatches published on 6 December 2010, available via www.lexisurl.com/pELuX) that asymmetries arising from such transactions should not be subject to the GMS rules, because they do not produce a ‘relevant tax advantage’ as defined.

‘Group’ is also widely defined, with two companies being part of a group if one of five conditions is met, including being connected for loan relationships purposes, and being included in the same set of consolidated accounts.

An ‘economic profit or loss’ takes tax costs and benefits into account, and also the time value of money. There remains some uncertainty, though, in how to calculate an economic profit or loss (eg, should it be based on accounting profits or losses; what discount rate should be used in calculating present values?). It is hoped that HMRC will provide clarification in guidance.

The GMS rules have the potential to introduce additional computational complexity, particularly as no tax motive may be required. In practice, it should be relatively easy to dismiss the rules in most cases (as the necessary asymmetry will not be present); nevertheless, the rules will need to be considered for any transaction in loans and derivatives involving different UK group members.

The rules specifically exclude transactions with non-UK resident counterparties, but there is a question as to whether a transaction which is within the scope of the loan relationships or derivative codes in one UK company, but not in another (such that one company brings amounts into account under those codes, but the other does not) constitutes an asymmetry to which the rules can apply.

The specific inclusion of transactions with CFCs and certain transactions which only involve a deemed loan relationship for one party supports the view that such transactions are generally intended to be outside the scope, and this also appears to be HMRC’s view based on their 6 December 2010 Technical Note.

The GMS rules have express priority over the unallowable purpose, transfer pricing, tax arbitrage and worldwide debt cap rules – this is in part in response to disclosed schemes reliant on disallowances under the worldwide debt cap preventing the application of certain other anti-avoidance provisions.

Asymmetries caused by the utilisation of brought forward losses should not be caught per se, as there is an assumption that scheme parties obtain the full tax benefit of any loss, and incur the full tax cost of any profit.

The rules came into force on 19 July 2011 but have effect in relation to schemes entered into at any time. However, scheme losses or profits relating to a time before 19 July are not affected, and nor are scheme profits that relate to a time on or after 19 July arising from a scheme entered into before then.

This latter provision is designed to deal with schemes which may have produced a deduction before 19 July, which is reversed afterwards, as otherwise the GMS rules would disregard the reversal, resulting in a permanent advantage.

The GMS rules are intended to promote simplification by reducing the amount of specific anti-avoidance needed, but there are surprisingly only two repeals – CTA 2009 ss 418 and 419 (see Example 2), and s 453.

Therefore, the GMS rules initially will add to the complexity of the loan relationships and derivatives rules, but should hopefully reduce the need for future specific anti-avoidance.

The GMS rules are potentially wide-ranging and overall should achieve their stated effect of reducing the scope for transactions which result in tax advantages using loans and derivatives.

However, the breadth of the rules results in the need to assess them in relation to all transactions involving loans and derivatives and two or more UK group parties.

In practice, a group will usually know when it has entered into a transaction which could be subject to the rules but nevertheless, at least in the short term, the GMS rules have the potential to increase the compliance burden rather than reduce it.

Ben Moseley, Corporate Tax Partner, Deloitte

Stephen Weston, Corporate Tax Partner, Deloitte