75 in-house tax directors and heads of tax took part in a recent Tax Journal/Pinsent Masons survey to give their views on the coalition government’s tax policies and identify priorities for the new government. Key findings are:

What is the view from business on the coalition government’s tax policies, and what should be the tax priorities for the new government? We report views from 75 in-house tax directors and heads of tax, in response to a recent Tax Journal / Pinsent Masons survey

Last week, Tax Journal featured the end of term reports on the coalition government’s performance, as well as the suggested tax manifestos from several leading advisers; now it’s the turn of industry to give its view. Seventy five in-house tax directors and heads of tax from large companies, including those in the FTSE 100, took part in a survey by Tax Journal and Pinsent Masons to give their view on the coalition’s tax policies and identify priorities for the next government.

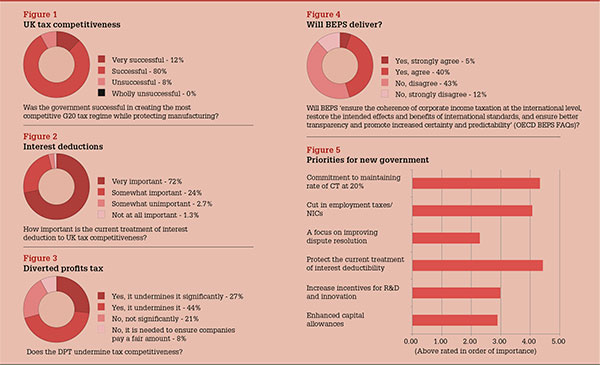

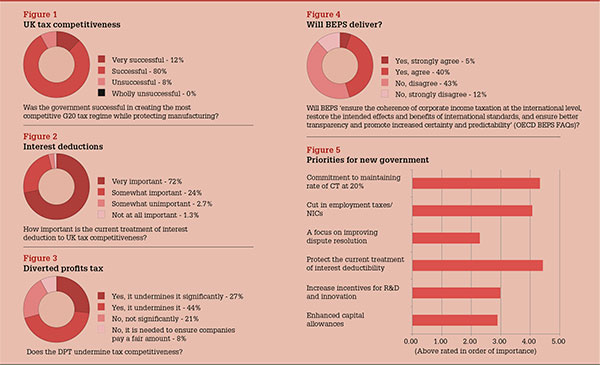

When the coalition government took office in May 2010, it said in its agreement that: ‘Our aim is to create the most competitive corporate tax regime in the G20, while protecting manufacturing industries.’ Around 92% of those polled (69 out of 75) rated the coalition government as having been ‘successful’ (80%) or ‘very successful’ (12%) overall (see figure 1 below). One commented that ‘policy has become more unpredictable and, in recent years, more political’. Another added that: ‘They have been trying to do the right big-picture things, in the main. But they still haven’t got to grips with the need for simplicity and certainty, and have given in to the media-led demand for “something to be done” about perceived tax avoidance.’

About 63% said that the lower headline rate of corporation tax, as set out in the Corporation Tax Roadmap 2010, boosted investment or growth in their own company in the UK; however, the vast majority of those respondents admitted this was to a marginal degree rather than a greater one. Also 59% rated the patent box as having been successful or very successful. More significantly, 96% of those surveyed said they felt the current treatment of interest deduction was either very important or somewhat important to UK tax competitiveness (see figure 2 below). ‘Putting the five-year roadmap in place which confirmed interest deductibility would be protected, as well as the direction of travel on corporate tax rates, etc was an excellent idea, as it gave a high level of certainty on the UK corporate tax regime for this parliament,’ one respondent wrote.

‘The Corporation Tax Roadmap was a good idea and it has generally been adhered to,’ another said. ‘A consistent approach has avoided nasty surprises and encouraged investment. The consultation on proposed budget changes in 2010 and the rethink on slashing capital allowances was particularly welcome and demonstrated that the coalition was prepared to listen. I think the presence of David Gauke at HM Treasury throughout the term of the government has been an important factor in ensuring consistency of approach.’

However, 61% of participants said the tax system does not adequately support infrastructure investment, with a number of respondents commenting about complexity, uncertainty and the lack of the long-term vision which is so crucial for projects which typically have a long lifespan.

There were mixed views on whether the coalition’s new approach to tax policy making met its stated aims of ‘[restoring] the UK tax system’s reputation for predictability, stability and simplicity’ (as set out in the 2010 HMRC/HM Treasury document The new approach to tax policy making). 57% of the surveyed heads of tax and tax directors felt the new approach was successful or very successful, although one observed: ‘Over the lifetime of the coalition, there have been tax “raids” on the oil companies and the banks; and, more recently, the diverted profits tax was pulled from the hat like a bewildered bunny. Some belated relief has been given to the oil sector this year, but these three areas show that “predictability, stability and simplicity” do not always get a proper hearing.’

‘I applaud the consistency that the coalition has shown on building on the previous government’s policies,’ another commenter said. ‘However, a lack of certainty remains – few opportunities for rulings, constantly changing legislation driven by interfering politicians, and unexpected legislation introduced too quickly with minimal consultation, e.g. for the diverted profits tax (DPT). There’s an increased compliance burden with the diverted profits tax and the new BEPS driven transfer pricing. The CFC financing exemption is important for UK competitiveness today, but it is likely to disappear when the EU challenges it, so competitiveness could decline significantly.’ Another added that the plan set out by the roadmap had been ‘largely good except for the bank levy – increases in rate to meet a fixed target make it difficult to price fairly to customers, and the levy is ultimately borne by customers of banks.’

Much was said about the controversial DPT, which came into force on 1 April (see figure 3 below). A significant number of respondents (71%) said the DPT has undermined UK tax competitiveness, with a number expressing concern that the UK’s unilateral action in introducing the tax could lead to double taxation, unpredictability and complexity if others follow suit. The remaining 29% either believed the DPT didn’t undermine the UK’s tax competitiveness significantly (21%), or that it was necessary ‘to ensure companies pay a fair amount’ (8%).

‘The UK seems to lag behind in using tax policy to its full potential, for instance, in encouraging environmentally sustainable investment decisions’, began one comment. ‘The current allowances regime is too narrow. The UK should also resist the urge to act politically, with the DPT being the key case in point. There are already sufficient safeguards in place (arm’s length transfer pricing, CFC, withholding tax); just change the thresholds/rates if they aren’t working (but they are). The DPT introduces uncertainty and signals a worrying shift in policy to a subjective analysis of what is the correct amount of profits to tax (arm’s length, etc) to a new unclear basis.’

‘The coalition government deserves a lot of credit for the approach it took to corporation tax,’ said another. ‘However, I think it has made mistakes in way the DPT was introduced and in playing politics with tax on BEPS. The government seems to want to play the political card at the risk of undermining the UK competitive tax regime.’

Commenting on the survey, Pinsent Masons partner Heather Self added: ‘We said at the time that DPT was poor legislation, introduced in too much of a rush. We hope that the new government will think again on this subject.’

Despite the criticisms of the DPT, a little over half (55%) of respondents were sceptical that the OECD’s BEPS project would meet its objectives (see figure 4 below). The opinions expressed were wide ranging: one responded it would be ‘a marginal “yes” … but there will be uncertainties and mismatches in the final outcome’; while another described it as ‘surprisingly good progress and the process seems to have welcomed engagement with business and been open to suggestions. The UK’s decision to go ahead with DPT is difficult to understand given the recognised need for co-ordinated action and success will only be achieved if all jurisdictions commit to the process.’

Meanwhile, others said it was ‘a sledgehammer to crack a nut’, ‘misguided and misdirected’, while another observed: ‘It’s trying to do the right sort of thing, but like many other EU-led initiatives it will become mired in bureaucracy and a legalistic approach and it will be hard to get a consensus which can be implemented practically within finite time.’ Other views noted the challenges inherent in getting all countries to comply (especially the US) or co-ordinate implementation efforts, and the risk of double taxation on profits.

On enforcement and compliance, 73% of respondents said the process for resolving disputes has neither got better or worse during the coalition’s term in office, with 24% believing it had got worse. Almost two thirds (64%) said HMRC’s litigation and settlement strategy (LSS) works well in practice ‘on the whole’; and there were mixed views on whether accelerated payment notices are a good idea – with 55% saying they are.

James Bullock, head of litigation and compliance at Pinsent Masons, noted: ‘At first blush HMRC might take heart from the fact that 64% of respondents expressed the view that the LSS “worked well, on the whole”. However, we note that a very significant minority – some 32% of respondents – expressed the view that LSS did “not really” work well. That figure is astonishingly high ... The whole question of tax dispute resolution – and the LSS in particular – has to be one of the issues that is looked at very closely by the next government. There are simply too many tax disputes that remain unresolved.’

The top concern for in-house tax directors and heads of tax was for any future government to protect the current tax treatment of interest deductibility (see figure 5 below). Pinsent Masons partner Eloise Walker said any restrictions on interest deductibility could have a ‘particularly detrimental effect’ for infrastructure projects which tend to be very highly geared, and many of which already suffer tax at much higher rates than the standard 20% ‘thanks to the current lack of any proper infrastructure allowances for such capital assets in the UK’.

Other priorities which respondents felt were important were a commitment to maintaining the corporation tax main rate at 20%, and cutting employment taxes. ‘Focus on simplification of the code, rather than anti-avoidance – and be bold,’ urged one respondent.

Many other suggestions for future tax policy were made, including: the continuation of publishing draft legislation for consultation; retaining and expanding the OTS; properly resourcing HMRC, training its staff and restoring public confidence in the organisation; allowing the OECD to complete its work on BEPS without taking any further unilateral action; the reform of business rates; focusing on reducing tax complexity, rather than anti-avoidance; and reissuing a further five-year corporation tax roadmap.

‘Take the politics out of it,’ suggested one. ‘Aim for simplicity. Send Margaret Hodge on a course entitled: “If you don’t agree with the current legislation, change it – this is your job and stop throwing stones at corporates for political ends.”’

Several respondents commented on HMRC’s role. ‘Do not forget that HMRC has to operate the policies and needs support. Business has high regard for HMRC and it is a critical part of a competitive UK, it would be very damaging to lose this’, said one respondent.

‘HMRC needs to be properly resourced, trained and motivated, and needs to be supported at all times by senior management and politicians,’ said another. ‘The work of the Board’s Solicitor needs to be reviewed, as the present impression is that those people are useless.’

However, ‘HMRC now has too much power,’ observed a third. ‘Only those persons with deep pockets and access to good advice have any hope of getting justice if HMRC turns against you. The law is too complex and in too many places it is dependent on the right “intention” to get the right result. This makes effects very subjective and very difficult to plan around. Uncertainty is the greatest hindrance to investment.’

75 in-house tax directors and heads of tax took part in a recent Tax Journal/Pinsent Masons survey to give their views on the coalition government’s tax policies and identify priorities for the new government. Key findings are:

What is the view from business on the coalition government’s tax policies, and what should be the tax priorities for the new government? We report views from 75 in-house tax directors and heads of tax, in response to a recent Tax Journal / Pinsent Masons survey

Last week, Tax Journal featured the end of term reports on the coalition government’s performance, as well as the suggested tax manifestos from several leading advisers; now it’s the turn of industry to give its view. Seventy five in-house tax directors and heads of tax from large companies, including those in the FTSE 100, took part in a survey by Tax Journal and Pinsent Masons to give their view on the coalition’s tax policies and identify priorities for the next government.

When the coalition government took office in May 2010, it said in its agreement that: ‘Our aim is to create the most competitive corporate tax regime in the G20, while protecting manufacturing industries.’ Around 92% of those polled (69 out of 75) rated the coalition government as having been ‘successful’ (80%) or ‘very successful’ (12%) overall (see figure 1 below). One commented that ‘policy has become more unpredictable and, in recent years, more political’. Another added that: ‘They have been trying to do the right big-picture things, in the main. But they still haven’t got to grips with the need for simplicity and certainty, and have given in to the media-led demand for “something to be done” about perceived tax avoidance.’

About 63% said that the lower headline rate of corporation tax, as set out in the Corporation Tax Roadmap 2010, boosted investment or growth in their own company in the UK; however, the vast majority of those respondents admitted this was to a marginal degree rather than a greater one. Also 59% rated the patent box as having been successful or very successful. More significantly, 96% of those surveyed said they felt the current treatment of interest deduction was either very important or somewhat important to UK tax competitiveness (see figure 2 below). ‘Putting the five-year roadmap in place which confirmed interest deductibility would be protected, as well as the direction of travel on corporate tax rates, etc was an excellent idea, as it gave a high level of certainty on the UK corporate tax regime for this parliament,’ one respondent wrote.

‘The Corporation Tax Roadmap was a good idea and it has generally been adhered to,’ another said. ‘A consistent approach has avoided nasty surprises and encouraged investment. The consultation on proposed budget changes in 2010 and the rethink on slashing capital allowances was particularly welcome and demonstrated that the coalition was prepared to listen. I think the presence of David Gauke at HM Treasury throughout the term of the government has been an important factor in ensuring consistency of approach.’

However, 61% of participants said the tax system does not adequately support infrastructure investment, with a number of respondents commenting about complexity, uncertainty and the lack of the long-term vision which is so crucial for projects which typically have a long lifespan.

There were mixed views on whether the coalition’s new approach to tax policy making met its stated aims of ‘[restoring] the UK tax system’s reputation for predictability, stability and simplicity’ (as set out in the 2010 HMRC/HM Treasury document The new approach to tax policy making). 57% of the surveyed heads of tax and tax directors felt the new approach was successful or very successful, although one observed: ‘Over the lifetime of the coalition, there have been tax “raids” on the oil companies and the banks; and, more recently, the diverted profits tax was pulled from the hat like a bewildered bunny. Some belated relief has been given to the oil sector this year, but these three areas show that “predictability, stability and simplicity” do not always get a proper hearing.’

‘I applaud the consistency that the coalition has shown on building on the previous government’s policies,’ another commenter said. ‘However, a lack of certainty remains – few opportunities for rulings, constantly changing legislation driven by interfering politicians, and unexpected legislation introduced too quickly with minimal consultation, e.g. for the diverted profits tax (DPT). There’s an increased compliance burden with the diverted profits tax and the new BEPS driven transfer pricing. The CFC financing exemption is important for UK competitiveness today, but it is likely to disappear when the EU challenges it, so competitiveness could decline significantly.’ Another added that the plan set out by the roadmap had been ‘largely good except for the bank levy – increases in rate to meet a fixed target make it difficult to price fairly to customers, and the levy is ultimately borne by customers of banks.’

Much was said about the controversial DPT, which came into force on 1 April (see figure 3 below). A significant number of respondents (71%) said the DPT has undermined UK tax competitiveness, with a number expressing concern that the UK’s unilateral action in introducing the tax could lead to double taxation, unpredictability and complexity if others follow suit. The remaining 29% either believed the DPT didn’t undermine the UK’s tax competitiveness significantly (21%), or that it was necessary ‘to ensure companies pay a fair amount’ (8%).

‘The UK seems to lag behind in using tax policy to its full potential, for instance, in encouraging environmentally sustainable investment decisions’, began one comment. ‘The current allowances regime is too narrow. The UK should also resist the urge to act politically, with the DPT being the key case in point. There are already sufficient safeguards in place (arm’s length transfer pricing, CFC, withholding tax); just change the thresholds/rates if they aren’t working (but they are). The DPT introduces uncertainty and signals a worrying shift in policy to a subjective analysis of what is the correct amount of profits to tax (arm’s length, etc) to a new unclear basis.’

‘The coalition government deserves a lot of credit for the approach it took to corporation tax,’ said another. ‘However, I think it has made mistakes in way the DPT was introduced and in playing politics with tax on BEPS. The government seems to want to play the political card at the risk of undermining the UK competitive tax regime.’

Commenting on the survey, Pinsent Masons partner Heather Self added: ‘We said at the time that DPT was poor legislation, introduced in too much of a rush. We hope that the new government will think again on this subject.’

Despite the criticisms of the DPT, a little over half (55%) of respondents were sceptical that the OECD’s BEPS project would meet its objectives (see figure 4 below). The opinions expressed were wide ranging: one responded it would be ‘a marginal “yes” … but there will be uncertainties and mismatches in the final outcome’; while another described it as ‘surprisingly good progress and the process seems to have welcomed engagement with business and been open to suggestions. The UK’s decision to go ahead with DPT is difficult to understand given the recognised need for co-ordinated action and success will only be achieved if all jurisdictions commit to the process.’

Meanwhile, others said it was ‘a sledgehammer to crack a nut’, ‘misguided and misdirected’, while another observed: ‘It’s trying to do the right sort of thing, but like many other EU-led initiatives it will become mired in bureaucracy and a legalistic approach and it will be hard to get a consensus which can be implemented practically within finite time.’ Other views noted the challenges inherent in getting all countries to comply (especially the US) or co-ordinate implementation efforts, and the risk of double taxation on profits.

On enforcement and compliance, 73% of respondents said the process for resolving disputes has neither got better or worse during the coalition’s term in office, with 24% believing it had got worse. Almost two thirds (64%) said HMRC’s litigation and settlement strategy (LSS) works well in practice ‘on the whole’; and there were mixed views on whether accelerated payment notices are a good idea – with 55% saying they are.

James Bullock, head of litigation and compliance at Pinsent Masons, noted: ‘At first blush HMRC might take heart from the fact that 64% of respondents expressed the view that the LSS “worked well, on the whole”. However, we note that a very significant minority – some 32% of respondents – expressed the view that LSS did “not really” work well. That figure is astonishingly high ... The whole question of tax dispute resolution – and the LSS in particular – has to be one of the issues that is looked at very closely by the next government. There are simply too many tax disputes that remain unresolved.’

The top concern for in-house tax directors and heads of tax was for any future government to protect the current tax treatment of interest deductibility (see figure 5 below). Pinsent Masons partner Eloise Walker said any restrictions on interest deductibility could have a ‘particularly detrimental effect’ for infrastructure projects which tend to be very highly geared, and many of which already suffer tax at much higher rates than the standard 20% ‘thanks to the current lack of any proper infrastructure allowances for such capital assets in the UK’.

Other priorities which respondents felt were important were a commitment to maintaining the corporation tax main rate at 20%, and cutting employment taxes. ‘Focus on simplification of the code, rather than anti-avoidance – and be bold,’ urged one respondent.

Many other suggestions for future tax policy were made, including: the continuation of publishing draft legislation for consultation; retaining and expanding the OTS; properly resourcing HMRC, training its staff and restoring public confidence in the organisation; allowing the OECD to complete its work on BEPS without taking any further unilateral action; the reform of business rates; focusing on reducing tax complexity, rather than anti-avoidance; and reissuing a further five-year corporation tax roadmap.

‘Take the politics out of it,’ suggested one. ‘Aim for simplicity. Send Margaret Hodge on a course entitled: “If you don’t agree with the current legislation, change it – this is your job and stop throwing stones at corporates for political ends.”’

Several respondents commented on HMRC’s role. ‘Do not forget that HMRC has to operate the policies and needs support. Business has high regard for HMRC and it is a critical part of a competitive UK, it would be very damaging to lose this’, said one respondent.

‘HMRC needs to be properly resourced, trained and motivated, and needs to be supported at all times by senior management and politicians,’ said another. ‘The work of the Board’s Solicitor needs to be reviewed, as the present impression is that those people are useless.’

However, ‘HMRC now has too much power,’ observed a third. ‘Only those persons with deep pockets and access to good advice have any hope of getting justice if HMRC turns against you. The law is too complex and in too many places it is dependent on the right “intention” to get the right result. This makes effects very subjective and very difficult to plan around. Uncertainty is the greatest hindrance to investment.’