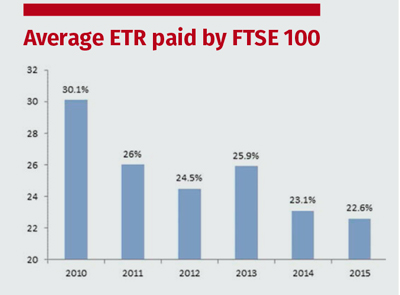

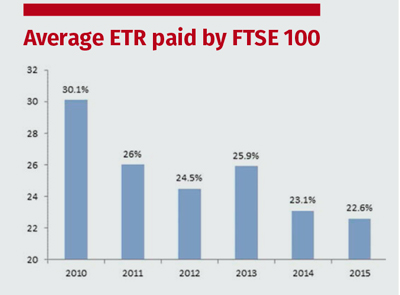

According to research by UHY Hacker Young, the average effective tax rate paid by FTSE 100 companies fell to 22.6% last year – down from 30.1% five years ago.

According to research by UHY Hacker Young, the average effective tax rate paid by FTSE 100 companies fell to 22.6% last year – down from 30.1% five years ago. Key factors behind this decline are falling corporation tax rates and maximum use of tax allowances, combined with pressures on profitability. After property and real estate companies, the pharmaceutical sector had the lowest average effective tax rate of 13.1%.

Clive Gawthorpe, partner at UHY Hacker Young, commented ‘this is less the result of rampant aggressive tax avoidance and more to do with changes to tax rates and reliefs, as well as profitability coming under pressure in some sectors such as pharmaceuticals’.

Oil & gas and resources sectors have the highest effective tax rates in the FTSE 100, at 37.4% and 37.1% respectively, followed by banks at 33.7%.

[include following table underneath, with heading:

Average ETR paid by FTSE 100

According to research by UHY Hacker Young, the average effective tax rate paid by FTSE 100 companies fell to 22.6% last year – down from 30.1% five years ago.

According to research by UHY Hacker Young, the average effective tax rate paid by FTSE 100 companies fell to 22.6% last year – down from 30.1% five years ago. Key factors behind this decline are falling corporation tax rates and maximum use of tax allowances, combined with pressures on profitability. After property and real estate companies, the pharmaceutical sector had the lowest average effective tax rate of 13.1%.

Clive Gawthorpe, partner at UHY Hacker Young, commented ‘this is less the result of rampant aggressive tax avoidance and more to do with changes to tax rates and reliefs, as well as profitability coming under pressure in some sectors such as pharmaceuticals’.

Oil & gas and resources sectors have the highest effective tax rates in the FTSE 100, at 37.4% and 37.1% respectively, followed by banks at 33.7%.

[include following table underneath, with heading:

Average ETR paid by FTSE 100