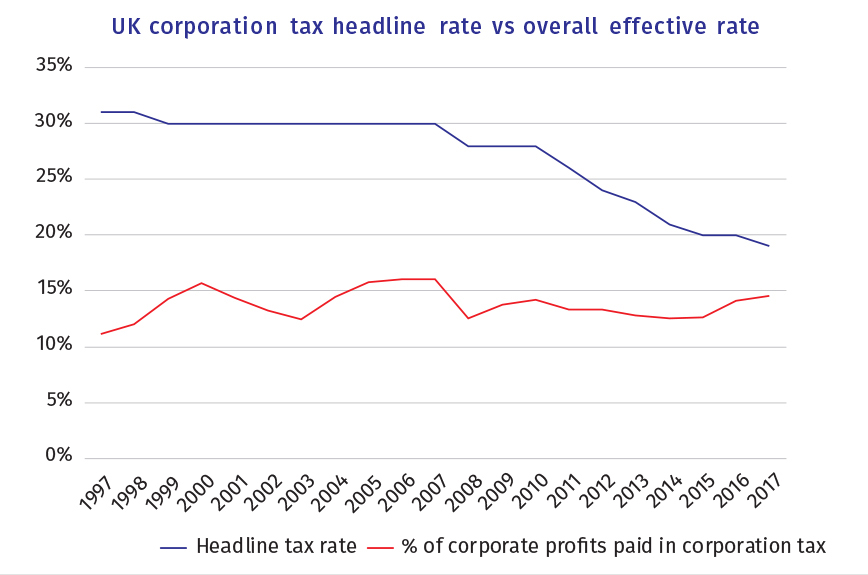

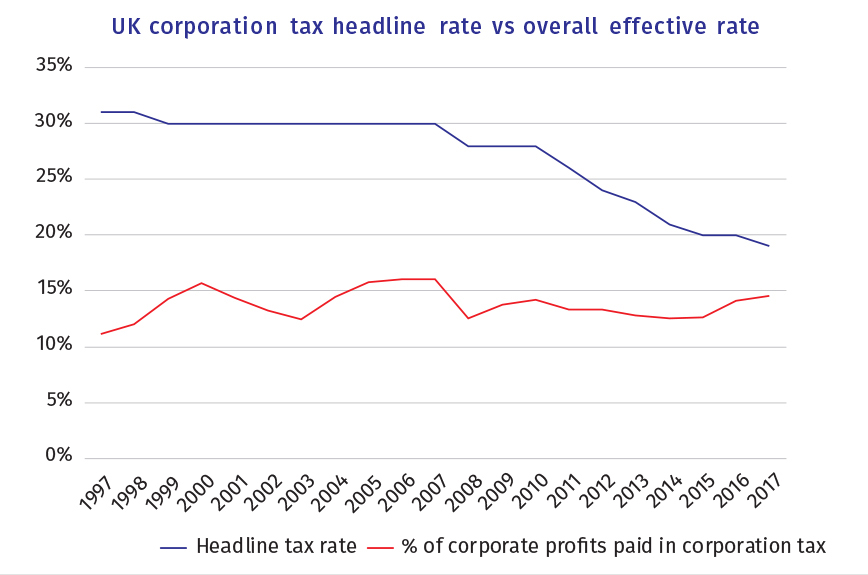

1. 'UK corporation tax has been cut over the last 20 years.’

Nope. The headline rate has been cut, but the base has expanded. The proportion of corporate profits paid in tax has slightly increased.

Source: ONS (bit.ly/2NbbI9o)

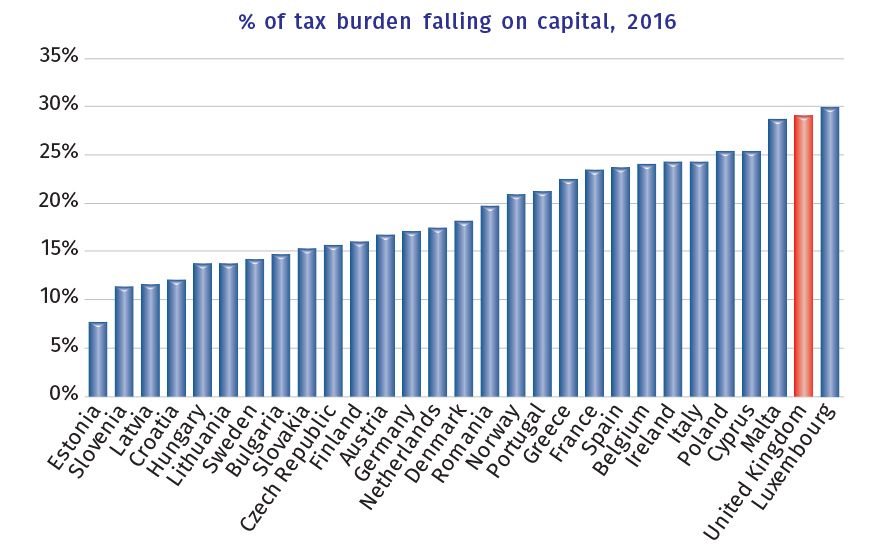

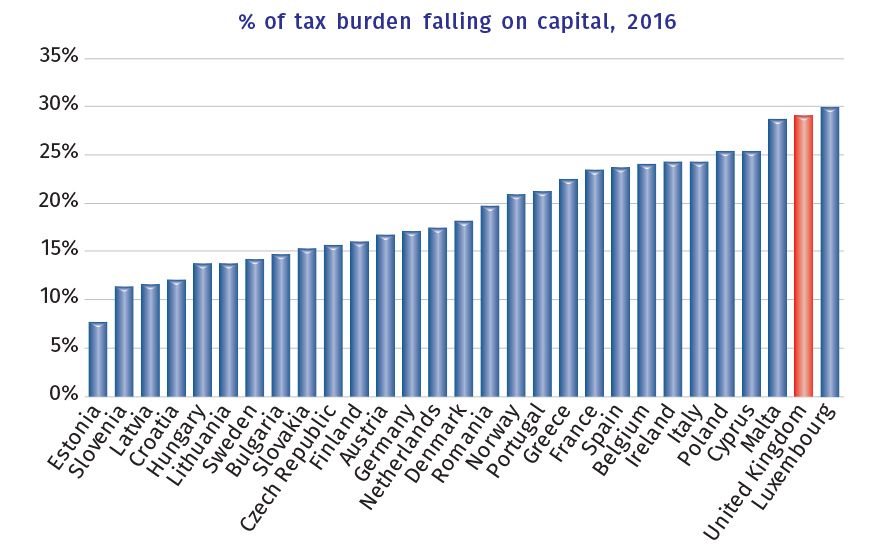

2. 'Compared to the rest of Europe, the UK under-taxes wealth and capital.’

Nope. The UK is unusual for how high a percentage of the tax burden falls on capital rather than labour.

Source: European Commission’s ‘Taxation trends in the European Union’ (bit.ly/2N7ZnTn)

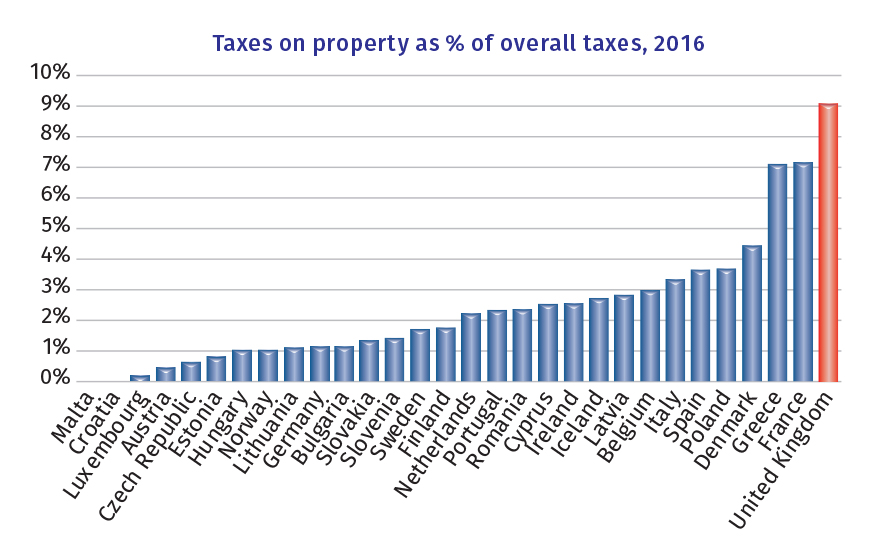

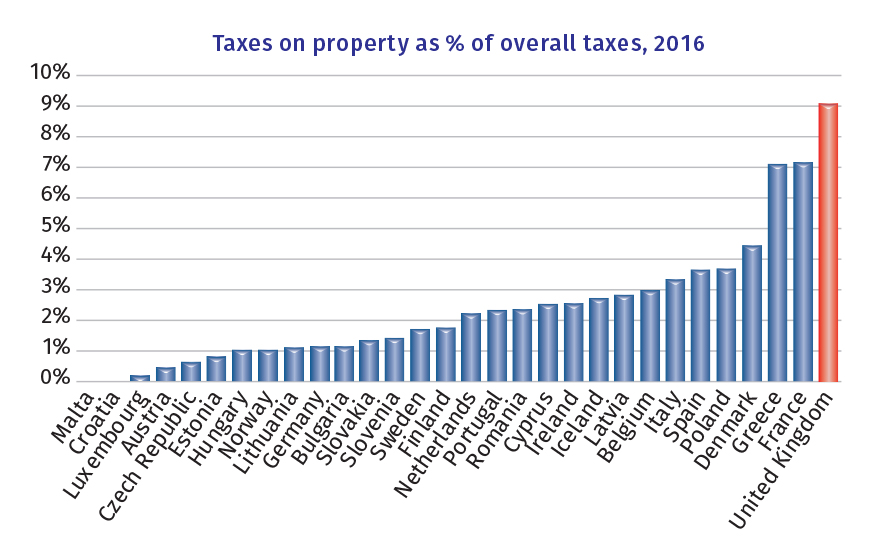

3. 'The UK under-taxes property.’

Again, nope. Inheritance tax, CGT, stamp duty and business rates are all very flawed taxes. But, together, they raise more from property than comparable taxes elsewhere in the EU.

Source: European Commission’s ‘Taxation trends in the European Union’ (bit.ly/2N7ZnTn)

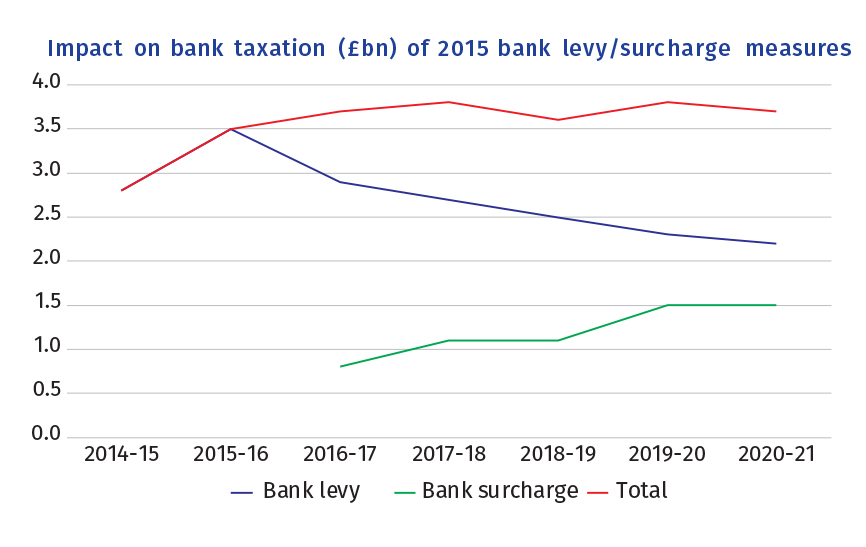

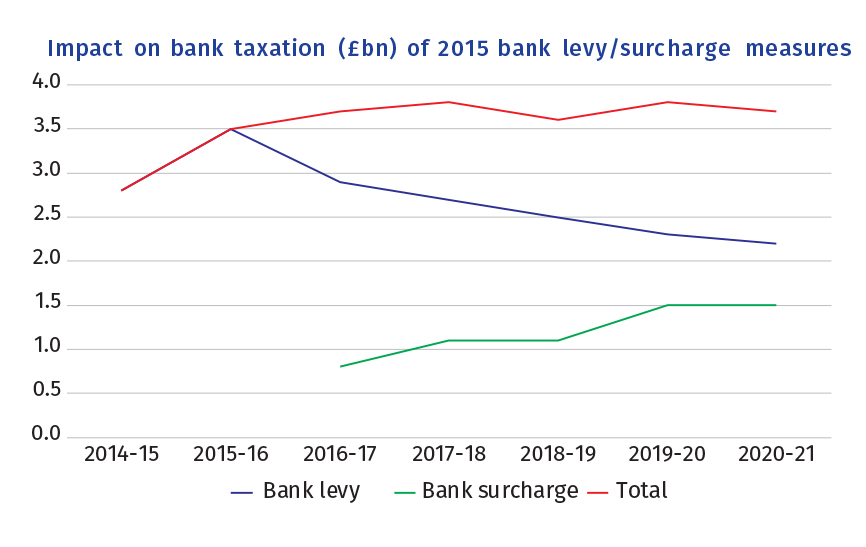

4. ‘Banks got a handout when the bank levy was cut.’

Nope. The bank levy was reduced in 2015 and, to compensate, a new tax – the bank surcharge – was created. The projected overall effect was a slight increase in bank taxation.

Source: HM Treasury’s Red Book for Budget 2016 (bit.ly/2Gu5LDV)

There is plenty of scope for argument on the right level of tax, and huge amount of scope for argument on how existing taxes should be designed. But it would be lovely if people would stop making claims about the UK tax system that just ain’t true.

1. 'UK corporation tax has been cut over the last 20 years.’

Nope. The headline rate has been cut, but the base has expanded. The proportion of corporate profits paid in tax has slightly increased.

Source: ONS (bit.ly/2NbbI9o)

2. 'Compared to the rest of Europe, the UK under-taxes wealth and capital.’

Nope. The UK is unusual for how high a percentage of the tax burden falls on capital rather than labour.

Source: European Commission’s ‘Taxation trends in the European Union’ (bit.ly/2N7ZnTn)

3. 'The UK under-taxes property.’

Again, nope. Inheritance tax, CGT, stamp duty and business rates are all very flawed taxes. But, together, they raise more from property than comparable taxes elsewhere in the EU.

Source: European Commission’s ‘Taxation trends in the European Union’ (bit.ly/2N7ZnTn)

4. ‘Banks got a handout when the bank levy was cut.’

Nope. The bank levy was reduced in 2015 and, to compensate, a new tax – the bank surcharge – was created. The projected overall effect was a slight increase in bank taxation.

Source: HM Treasury’s Red Book for Budget 2016 (bit.ly/2Gu5LDV)

There is plenty of scope for argument on the right level of tax, and huge amount of scope for argument on how existing taxes should be designed. But it would be lovely if people would stop making claims about the UK tax system that just ain’t true.