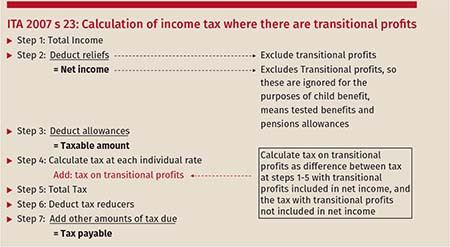

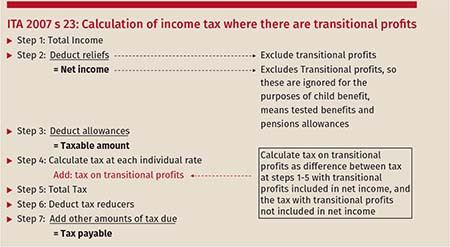

In our previous commentary (‘Basis period reform: updates since the Finance Bill’, Tax Journal, 24 November 2021), we described how business profits arising in the transitional period on the change in 2023/24 from the current year basis to the new tax year basis would be separated out in the income tax calculation so as not to affect the level of a taxpayer’s ‘net income’ used to calculate their entitlement to certain benefits and allowances. This is particularly helpful to individuals in receipt of means-tested benefits, and it also prevents the transitional profits being taken into account when determining an individual’s pension annual allowance, which is good for those saving for retirement.

The mechanics of separating transitional profits from ‘normal’ profits is complex, and relies on various adjustments to the usual rules for calculating an individual’s tax liability (following steps 1 to 7 at ITA 2007 s 23). Although generally beneficial to taxpayers, the proposal to include the tax due on the transitional profits as a stand-alone tax amount at the end of the tax calculation (at step 7) would have meant that this amount could not be offset by certain tax-reducing reliefs which can be deducted at step 6.

With credit to HMRC for listening to and acting upon representations made, the government has published proposed amendments to Finance Bill 2021/22 (27 January 2022) to remove this unintended outcome and allow individuals with transitional profits to claim these reliefs to the same extent as would otherwise have been the case.

(See the diagram below.)

The adjustment to the ordering of steps in the taxation of transitional profits is of most significant benefit to members of international partnerships (including LLPs). Prior to these amendments, there was a significant concern that the transitional provisions could result in double taxation of an individual’s share of overseas partnership profits arising in the transitional period. Although it would have been arguable that relief properly due under a double taxation agreement mandatorily had to be allowed, the position would have been uncertain and, additionally, the mechanism for claiming relief in the tax calculation would have been unclear. Furthermore, it appeared that claims for unilateral relief for tax suffered on transitional profits in non-treaty countries would likely have been blocked.

Therefore, the ability to deduct double taxation relief at step 6 of the tax calculation is a particularly helpful change for partnerships that operate internationally. Nevertheless, difficulties in determining the foreign tax credits that can be claimed in practice will remain, which will be particularly complex where the transition period profits are spread over up to five years. Partnerships with significant foreign profits may need to weigh up the benefits to cash flow of being able to spread the transitional profits with the additional complication that this will create for claiming double taxation relief.

Another benefit of the change arises due to the fact that income tax relief for EIS, SEIS and VCT investments is also given at step 6 of the tax calculation. This means that if individuals make such investments in 2023/24, or in a subsequent year when part of the stand-alone tax amount is charged to tax under the spreading provisions, the relevant income tax relief can be claimed against the stand-alone tax amount as well as their other income in that year.

With little or no further change expected to be made before the Finance Bill receives royal assent, the focus will now switch to HMRC’s promise to consider other legislative and administrative easements that may be made to alleviate the additional burden that the new rules will create for businesses that do not align their accounting date with the tax year. It is hoped that HMRC will continue to engage constructively with tax professionals and businesses in this regard.

In our previous commentary (‘Basis period reform: updates since the Finance Bill’, Tax Journal, 24 November 2021), we described how business profits arising in the transitional period on the change in 2023/24 from the current year basis to the new tax year basis would be separated out in the income tax calculation so as not to affect the level of a taxpayer’s ‘net income’ used to calculate their entitlement to certain benefits and allowances. This is particularly helpful to individuals in receipt of means-tested benefits, and it also prevents the transitional profits being taken into account when determining an individual’s pension annual allowance, which is good for those saving for retirement.

The mechanics of separating transitional profits from ‘normal’ profits is complex, and relies on various adjustments to the usual rules for calculating an individual’s tax liability (following steps 1 to 7 at ITA 2007 s 23). Although generally beneficial to taxpayers, the proposal to include the tax due on the transitional profits as a stand-alone tax amount at the end of the tax calculation (at step 7) would have meant that this amount could not be offset by certain tax-reducing reliefs which can be deducted at step 6.

With credit to HMRC for listening to and acting upon representations made, the government has published proposed amendments to Finance Bill 2021/22 (27 January 2022) to remove this unintended outcome and allow individuals with transitional profits to claim these reliefs to the same extent as would otherwise have been the case.

(See the diagram below.)

The adjustment to the ordering of steps in the taxation of transitional profits is of most significant benefit to members of international partnerships (including LLPs). Prior to these amendments, there was a significant concern that the transitional provisions could result in double taxation of an individual’s share of overseas partnership profits arising in the transitional period. Although it would have been arguable that relief properly due under a double taxation agreement mandatorily had to be allowed, the position would have been uncertain and, additionally, the mechanism for claiming relief in the tax calculation would have been unclear. Furthermore, it appeared that claims for unilateral relief for tax suffered on transitional profits in non-treaty countries would likely have been blocked.

Therefore, the ability to deduct double taxation relief at step 6 of the tax calculation is a particularly helpful change for partnerships that operate internationally. Nevertheless, difficulties in determining the foreign tax credits that can be claimed in practice will remain, which will be particularly complex where the transition period profits are spread over up to five years. Partnerships with significant foreign profits may need to weigh up the benefits to cash flow of being able to spread the transitional profits with the additional complication that this will create for claiming double taxation relief.

Another benefit of the change arises due to the fact that income tax relief for EIS, SEIS and VCT investments is also given at step 6 of the tax calculation. This means that if individuals make such investments in 2023/24, or in a subsequent year when part of the stand-alone tax amount is charged to tax under the spreading provisions, the relevant income tax relief can be claimed against the stand-alone tax amount as well as their other income in that year.

With little or no further change expected to be made before the Finance Bill receives royal assent, the focus will now switch to HMRC’s promise to consider other legislative and administrative easements that may be made to alleviate the additional burden that the new rules will create for businesses that do not align their accounting date with the tax year. It is hoped that HMRC will continue to engage constructively with tax professionals and businesses in this regard.