Business and corporate

Business rates

A number of temporary measures to support businesses impacted by Covid-19, effective from 1 April 2020 to 31 March 2021, were announced in Spring Budget 2020. Further announcements followed on 17 March 2020, extending the scope of the measures to reflect the developing Covid-19 situation. At the time of writing, the following had been announced by government:

At the timing of writing, the applicability of EU state aid rules to the measures had not yet been confirmed, although it is understood that the government has applied for clearance from the European Commission.

Capital allowances

Under the enhanced capital allowances scheme, 100% first-year allowances are available for certain energy-saving or environmentally beneficial plant and machinery, and loss-making companies can claim a payable first-year tax credit in respect of such plant and machinery.

Enhanced capital allowances and payable first-year tax credits will cease to be available in relation to expenditure on such plant and machinery incurred on or after 1 April 2020 (for corporation tax purposes) and 6 April 2020 (for income tax purposes).

100% first-year allowances for qualifying expenditure incurred by certain companies on plant and machinery – for use within designated areas of enterprise zones – were due to end on 31 March 2020. However, this measure has since been extended to 31 March 2021.

Corporation tax: capital loss restriction

From 1 April 2020, companies which have carried forward capital losses will be subject to a restriction on the amount of those losses that can be offset against chargeable gains. Similar restrictions applicable to other types of company tax losses have applied since 1 April 2017.

Subject to a £5m deduction allowance (shared between group companies and between capital losses and other types of tax losses), companies will only be able to offset carried forward capital losses against up to 50% of chargeable gains arising in each period. Transitional arrangements will apply where an accounting period straddles 1 April 2020.

Corporation tax: main rate

Finance Bill 2019/20 repeals the previously enacted reduction of the main rate of corporation tax to 17%. The main rate applicable from 1 April 2020 will continue to be 19%. A resolution under the Provisional Collection of Taxes Act 1968 will give effect to the continuing 19% rate until the Bill receives royal assent later in 2020.

Digital services tax

A new digital services tax (DST) will apply to in-scope revenue earned from 1 April 2020. The DST will be charged at a rate of 2% on gross revenues from in-scope activities of large businesses that provide social media services, a search engine or online marketplace to UK users. There is an allowance of £25m, which means a group’s first £25m of revenues derived from UK users will not be subject to DST.

DST will apply if more than £500m of global revenues arise to the group in connection with any in-scope digital services and more than £25m of those revenues are linked to the participation of UK users. Payment will be due nine months and a day after the end of the accounting period.

The government has reiterated its commitment to developing an internationally agreed solution, via the OECD Inclusive Framework and G20, to the tax challenges presented by the digitalised economy, and has reconfirmed that it will repeal DST once an appropriate global solution is in place.

Entrepreneurs’ relief

Entrepreneurs’ relief (ER) provides for a lower rate of CGT (10%) to be paid when disposing of all or part of a business where certain criteria are met, subject to a lifetime limit of £10m of qualifying gains. The lifetime limit reduced from £10m to £1m on 11 March 2020.

There are special provisions for disposals entered into, but not completed before, 11 March 2020, and in relation to certain transactions that occurred between 6 April 2019 and 10 March 2020 (inclusive) where an election is made to opt out of automatic paper for paper treatment, with the effect that a capital gain is realised on which ER can be claimed. Where the relevant conditions are met, the effect of the provisions is that the reduced £1m lifetime limit applies to the chargeable gain.

ER is also renamed business assets disposal relief.

Non-resident corporate landlords: transition to corporation tax

From 6 April 2020, all non-resident companies with a UK property business will be brought within the scope of corporation tax, with profits taxed at the 19% corporation tax main rate. Prior to this date, non-resident corporate landlords were typically within the scope of the UK income tax regime only, with profits taxed at the basic rate of income tax (20%).

As a result, from 6 April, general rules contained within the corporation tax regime – including restrictions on the deductibility of interest expense, hybrid mismatch rules, and restrictions on the use of tax losses – will apply to non-resident corporate landlords.

Transitional rules will apply to transfer carried forward income tax losses and capital allowance pools from the income tax regime to the corporation tax regime.

R&D expenditure credit: 13% rate

For qualifying R&D expenditure incurred on or after 1 April 2020, the rate of the research and development expenditure credit (RDEC) will increase from 12% to 13%.

Structures and buildings allowances: 3% rate

Effective from 1 April 2020 (for corporation tax purposes) and 6 April 2020 (for income tax purposes), the rate at which structures and buildings allowances (SBAs) are calculated on qualifying expenditure increases from 2% to 3%.

Businesses that were entitled to claim the SBA for structures or buildings that were brought into use between 29 October 2018 and April 2020 can claim the new rate from the operative date above.

Employment

Apprenticeship levy

The government has said it will look at how to improve the working of the apprenticeship levy, but no details have yet been announced. However, the rate of the levy will remain at 0.5% and the levy allowance will remain at £15,000 for 2020/21.

IR35

The planned extension of the off-payroll working rules (IR35) to the private sector is not being introduced as planned on 6 April 2020, but has been delayed for 12 months to help businesses and individuals who are facing difficulties because of Covid-19.

Contractors and their engagers will have to adjust to the delay quickly, as there will be many steps that need to be taken to unwind or defer positions already taken. Engagers will need to revisit whether to continue with or defer previous decisions, for example:

This will also require an extensive communications programme with all contractors, suppliers and clients.

For any particular contractor/role that engagers have already determined is deemed ‘employed’ and are now re-engaged through a PSC for a further year on the same terms, contractors are likely to have to operate PAYE under the existing IR35 rules. Engagers may need to consider whether they require assurances relating to the PSC’s compliance with the existing IR35.

Company cars, vans and fuel

For cars first registered from 6 April 2020, CO2 emissions will be subject to a more stringent test regime which is expected to lead to higher CO2 emissions figures for most cars. To adjust for this, company car tax rates for these cars will be reduced by two percentage points in 2020/21, compared to cars registered before 6 April 2020.There will then be a return to planned rates over the following two years – increasing by one percentage point in 2021/22 and a further one percentage point in 2022/23.

In respect of vehicles registered from 6 April 2020, the cleanest electric cars will be taxed at 0% of list price (reduced from 16% in 2019/20), rising to 37% for cars emitting 160g/km or more. Diesel supplement will be an additional 4% of list price. (Except for cars certified to the RDE2 standard.)

The rate for ultra-low emission vehicles (CO2 emissions of up to 50g/km) will depend on the electric range of the vehicle.

The benefit in kind for private fuel provided in company cars or vans will be calculated at the relevant percentage x £24,500. The van benefit charge will increase to £3,490 and the fuel benefit charge for vans will increase to £666.

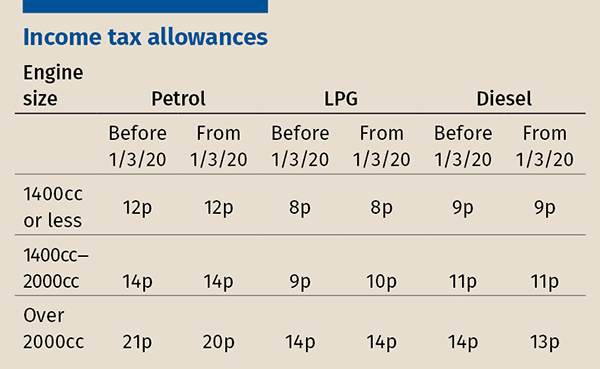

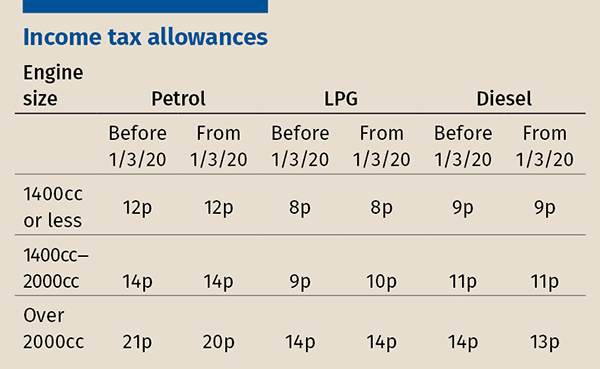

The advisory fuel rates for company car mileage were updated from 1 March 2020

The advisory fuel rate for fully electric cars remains at 4p per mile.

Employment allowance

The employment allowance will increase from £3,000 to £4,000 for 2020/21. From 6 April 2020, you will only be able to claim if your employer’s class 1 NI bill was below £100,000 in the previous tax year.

Holiday pay

From 6 April 2020, for workers with variable pay or hours, holiday pay should be calculated by reference to the average pay from the previous 52 weeks (prior to 6 April 2020 the reference period was 12 weeks).

Termination payments (class 1A NICs)

From 6 April 2020, termination payments in excess of £30,000 will become subject to employer-only class 1A NICs. Class 1A NICs will be subject to in-year PAYE collection for termination payments in cash and class 1A on any termination benefits in kind will be payable along with the class 1A NIC payment on benefits in kind for ongoing employees.

Recovery of statutory sick pay for COVID-19

Businesses employing fewer than 250 employees will be eligible for a refund of two weeks’ statutory sick pay per affected employee, for claims resulting from Covid-19. The new rules will come into effect once emergency legislation is passed (expected later in March – date not confirmed at time of writing).

Personal

Tax rates and allowances from 6 April 2020

For taxpayers resident across the whole of the UK:

For taxpayers resident in England, Wales and Northern Ireland:

Wales has a devolved power to set income tax rates applying to non-savings and non-dividend income for Welsh resident taxpayers. However, for 2020/21 the rates for Welsh resident taxpayers will be the same as those applying to England and Northern Ireland residents, as set out above.

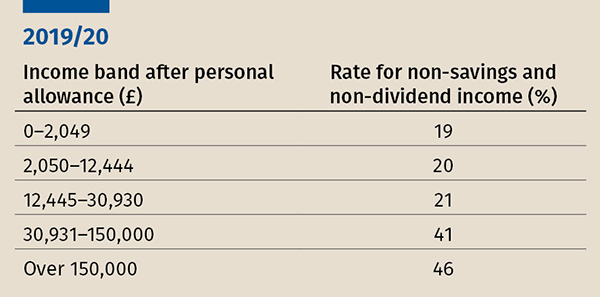

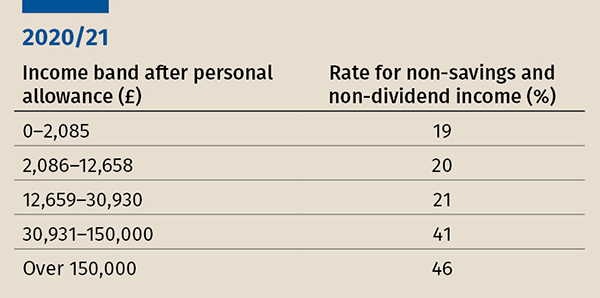

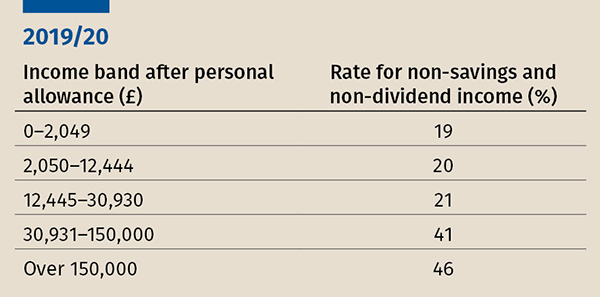

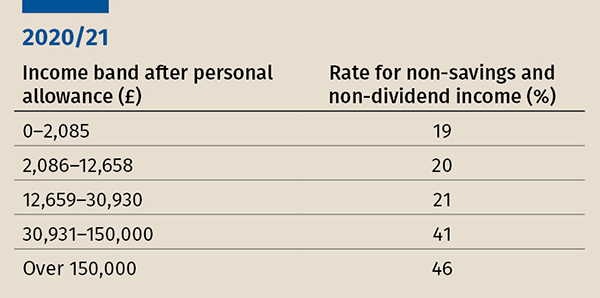

Different rates and thresholds apply to non-savings, non-dividend income for Scottish taxpayers. The Scottish rates and bands for 2020/21 in comparison to 2019/20 are:

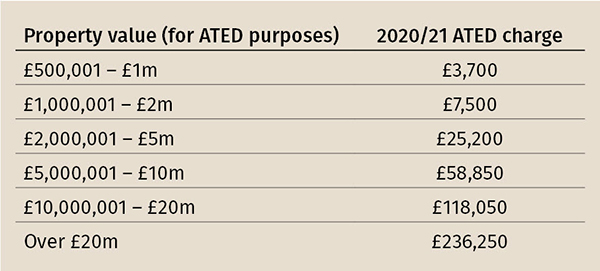

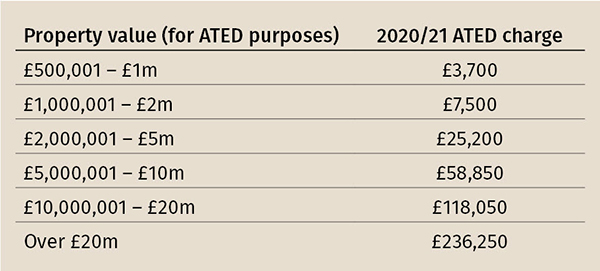

ATED

The ATED annual rates will rise by CPI (1.7%) from 1 April (with the ATED increase rounded down to the nearest £50).

The 2020/21 ATED charges are as follows:

Relief from ATED is available for certain businesses and investors. Reliefs are available to, amongst others, property rental businesses, property developers and property traders. Relief must be claimed annually. A new relief from ATED for housing co-operatives was announced in Spring Budget 2020, expected to take effect from 1 April 2021 with a refund available for 2020/21.

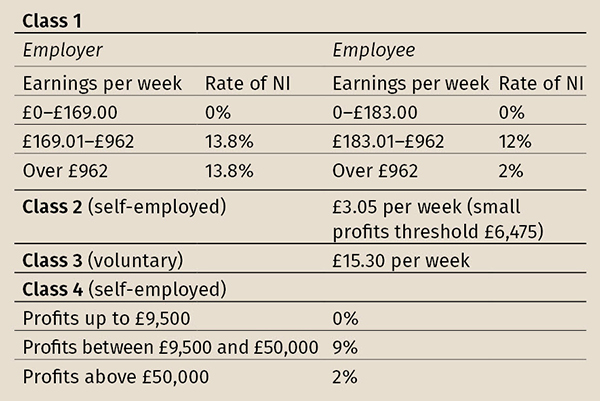

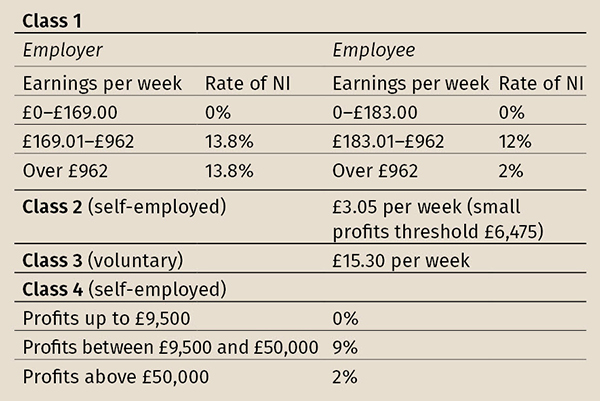

NIC rates

In 2020/21, the NIC rates will be as follows:

Inheritance tax

The inheritance nil rate band remains at £325,000 for 2020/21. The residence nil rate band will increase to £175,000 for deaths on or after 6 April 2020. It is tapered at £1 for £2 for estates over £2m.

ISAs

The ISA annual subscription limit remains at £20,000. For junior ISAs and child trust funds, the limit will more than double to £9,000 on 6 April 2020 (from £4,368 in 2019/20). It will be possible for child trust funds maturing in the year to be transferred to an ISA without the funds counting towards the ISA subscription limit.

Mortgage interest restriction

Since 2017/18, the deduction for mortgage interest in respect of let properties has been increasingly restricted to a basic rate tax reducer. From 6 April 2020, no finance costs on residential properties will be allowable as a deduction against rental profits. Instead, relief will only be available as a basic rate reducer.

Pensions

From 2020/21, the lifetime allowance will increase from £1,055,000 to £1,073,100.

The standard annual allowance will remain at £40,000 and will be subject to tapering to a minimum of £4,000 (£10,000 in 2019/20) for individuals with adjusted income in excess of £240,000 (£150,000 in 2019/20). The annual allowance is not subject to tapering if the individual’s income (before adding back pension contributions) is £200,000 (£110,000 in 2019/20) or less.

Residential property disposals

Private residence relief: Two key changes will take effect from 6 April 2020:

Disposals by UK residents: For disposals of UK residential property on or after 6 April 2020, UK resident individuals and trustees may be required to file standalone CGT returns and make a payment on account of CGT, within 30 days of completion. The filing requirement is waived where there is no payment on account due. Typically, this exception will apply where full private residence relief (see below) applies to the property, or it has been sold at a loss.

Property disposals by non-UK residents: Non-UK resident individuals and trustees are subject to CGT on gains made on disposal of UK property. However, the gain may not be chargeable if the property disposed of is the main home of the individual or a trust beneficiary and certain conditions are met, such that PRR is available.

A standalone CGT return and payment on account of CGT are due within 30 days of completion. In prior years it has been possible for taxpayers who filed self-assessment tax returns to defer payment of CGT until 31 January following the end of the tax year of disposal, although a return was still needed. Deferral is no longer an option from 6 April 2020, so CGT payments on account will be due within 30 days of completion.

Indirect

Air passenger duty (APD)

APD rates for flights over 2,000 miles (‘band B’ destinations) increase on 1 April 2020. The reduced rate of APD for the lowest class of travel (economy) will increase by £2, and the standard rate (for carriage in a higher class of travel) by £4. The rate of APD for the carriage of passengers in private jets will rise by £13.

Climate change levy (CCL)

The main rates of CCL will change from 1 April 2020, as the rates for gas and electricity converge. The CCL rate on gas is being raised and the electricity rate lowered. There are also corresponding adjustments to the level of CCL reduction for intensive energy sectors with climate change agreements (CCA) with the government.

Gaming duty

The gross gaming yield bandings will increase in line with inflation for accounting periods beginning on or after 1 April 2020.

Landfill tax

The landfill tax rates increase from 1 April 2020. The standard rate will increase to £94.15 per tonne and the lower rate to £3.00 per tonne.

Making tax digital (MTD)

VAT-registered businesses with taxable turnover above the VAT threshold (£85,000) were required to respond to the MTD regime by: keeping records digitally (e.g. within relevant software accounting packages, ERP systems or Excel); and using software to submit their VAT returns for VAT periods starting on or after 1 April 2019.

There was an exception for VAT-registered businesses with more complex requirements, for which mandation did not apply until 1 October 2019. From 1 April 2020 (or 1 October 2020 for deferred businesses), businesses must also have in place digital links between all parts of their software programs, products and applications that feed the indirect tax compliance process.

VAT exemption for fund management

From 1 April 2020, the scope of the UK VAT exemption for the management of special investment funds will be extended to include ‘qualifying pension funds’ (principally defined contribution funds) and closed-ended funds which do not invest ‘wholly or mainly in securities’ (e.g. real estate funds).

Vehicle excise duty (VED)

From 1 April 2020, VED rates for cars, vans and motorcycles will increase in line with inflation.

Zero-emission vehicles will be exempted from the VED supplement for vehicles with a list price exceeding £40,000.

Note: Article correct as of date of writing, Friday 20 March.

Business and corporate

Business rates

A number of temporary measures to support businesses impacted by Covid-19, effective from 1 April 2020 to 31 March 2021, were announced in Spring Budget 2020. Further announcements followed on 17 March 2020, extending the scope of the measures to reflect the developing Covid-19 situation. At the time of writing, the following had been announced by government:

At the timing of writing, the applicability of EU state aid rules to the measures had not yet been confirmed, although it is understood that the government has applied for clearance from the European Commission.

Capital allowances

Under the enhanced capital allowances scheme, 100% first-year allowances are available for certain energy-saving or environmentally beneficial plant and machinery, and loss-making companies can claim a payable first-year tax credit in respect of such plant and machinery.

Enhanced capital allowances and payable first-year tax credits will cease to be available in relation to expenditure on such plant and machinery incurred on or after 1 April 2020 (for corporation tax purposes) and 6 April 2020 (for income tax purposes).

100% first-year allowances for qualifying expenditure incurred by certain companies on plant and machinery – for use within designated areas of enterprise zones – were due to end on 31 March 2020. However, this measure has since been extended to 31 March 2021.

Corporation tax: capital loss restriction

From 1 April 2020, companies which have carried forward capital losses will be subject to a restriction on the amount of those losses that can be offset against chargeable gains. Similar restrictions applicable to other types of company tax losses have applied since 1 April 2017.

Subject to a £5m deduction allowance (shared between group companies and between capital losses and other types of tax losses), companies will only be able to offset carried forward capital losses against up to 50% of chargeable gains arising in each period. Transitional arrangements will apply where an accounting period straddles 1 April 2020.

Corporation tax: main rate

Finance Bill 2019/20 repeals the previously enacted reduction of the main rate of corporation tax to 17%. The main rate applicable from 1 April 2020 will continue to be 19%. A resolution under the Provisional Collection of Taxes Act 1968 will give effect to the continuing 19% rate until the Bill receives royal assent later in 2020.

Digital services tax

A new digital services tax (DST) will apply to in-scope revenue earned from 1 April 2020. The DST will be charged at a rate of 2% on gross revenues from in-scope activities of large businesses that provide social media services, a search engine or online marketplace to UK users. There is an allowance of £25m, which means a group’s first £25m of revenues derived from UK users will not be subject to DST.

DST will apply if more than £500m of global revenues arise to the group in connection with any in-scope digital services and more than £25m of those revenues are linked to the participation of UK users. Payment will be due nine months and a day after the end of the accounting period.

The government has reiterated its commitment to developing an internationally agreed solution, via the OECD Inclusive Framework and G20, to the tax challenges presented by the digitalised economy, and has reconfirmed that it will repeal DST once an appropriate global solution is in place.

Entrepreneurs’ relief

Entrepreneurs’ relief (ER) provides for a lower rate of CGT (10%) to be paid when disposing of all or part of a business where certain criteria are met, subject to a lifetime limit of £10m of qualifying gains. The lifetime limit reduced from £10m to £1m on 11 March 2020.

There are special provisions for disposals entered into, but not completed before, 11 March 2020, and in relation to certain transactions that occurred between 6 April 2019 and 10 March 2020 (inclusive) where an election is made to opt out of automatic paper for paper treatment, with the effect that a capital gain is realised on which ER can be claimed. Where the relevant conditions are met, the effect of the provisions is that the reduced £1m lifetime limit applies to the chargeable gain.

ER is also renamed business assets disposal relief.

Non-resident corporate landlords: transition to corporation tax

From 6 April 2020, all non-resident companies with a UK property business will be brought within the scope of corporation tax, with profits taxed at the 19% corporation tax main rate. Prior to this date, non-resident corporate landlords were typically within the scope of the UK income tax regime only, with profits taxed at the basic rate of income tax (20%).

As a result, from 6 April, general rules contained within the corporation tax regime – including restrictions on the deductibility of interest expense, hybrid mismatch rules, and restrictions on the use of tax losses – will apply to non-resident corporate landlords.

Transitional rules will apply to transfer carried forward income tax losses and capital allowance pools from the income tax regime to the corporation tax regime.

R&D expenditure credit: 13% rate

For qualifying R&D expenditure incurred on or after 1 April 2020, the rate of the research and development expenditure credit (RDEC) will increase from 12% to 13%.

Structures and buildings allowances: 3% rate

Effective from 1 April 2020 (for corporation tax purposes) and 6 April 2020 (for income tax purposes), the rate at which structures and buildings allowances (SBAs) are calculated on qualifying expenditure increases from 2% to 3%.

Businesses that were entitled to claim the SBA for structures or buildings that were brought into use between 29 October 2018 and April 2020 can claim the new rate from the operative date above.

Employment

Apprenticeship levy

The government has said it will look at how to improve the working of the apprenticeship levy, but no details have yet been announced. However, the rate of the levy will remain at 0.5% and the levy allowance will remain at £15,000 for 2020/21.

IR35

The planned extension of the off-payroll working rules (IR35) to the private sector is not being introduced as planned on 6 April 2020, but has been delayed for 12 months to help businesses and individuals who are facing difficulties because of Covid-19.

Contractors and their engagers will have to adjust to the delay quickly, as there will be many steps that need to be taken to unwind or defer positions already taken. Engagers will need to revisit whether to continue with or defer previous decisions, for example:

This will also require an extensive communications programme with all contractors, suppliers and clients.

For any particular contractor/role that engagers have already determined is deemed ‘employed’ and are now re-engaged through a PSC for a further year on the same terms, contractors are likely to have to operate PAYE under the existing IR35 rules. Engagers may need to consider whether they require assurances relating to the PSC’s compliance with the existing IR35.

Company cars, vans and fuel

For cars first registered from 6 April 2020, CO2 emissions will be subject to a more stringent test regime which is expected to lead to higher CO2 emissions figures for most cars. To adjust for this, company car tax rates for these cars will be reduced by two percentage points in 2020/21, compared to cars registered before 6 April 2020.There will then be a return to planned rates over the following two years – increasing by one percentage point in 2021/22 and a further one percentage point in 2022/23.

In respect of vehicles registered from 6 April 2020, the cleanest electric cars will be taxed at 0% of list price (reduced from 16% in 2019/20), rising to 37% for cars emitting 160g/km or more. Diesel supplement will be an additional 4% of list price. (Except for cars certified to the RDE2 standard.)

The rate for ultra-low emission vehicles (CO2 emissions of up to 50g/km) will depend on the electric range of the vehicle.

The benefit in kind for private fuel provided in company cars or vans will be calculated at the relevant percentage x £24,500. The van benefit charge will increase to £3,490 and the fuel benefit charge for vans will increase to £666.

The advisory fuel rates for company car mileage were updated from 1 March 2020

The advisory fuel rate for fully electric cars remains at 4p per mile.

Employment allowance

The employment allowance will increase from £3,000 to £4,000 for 2020/21. From 6 April 2020, you will only be able to claim if your employer’s class 1 NI bill was below £100,000 in the previous tax year.

Holiday pay

From 6 April 2020, for workers with variable pay or hours, holiday pay should be calculated by reference to the average pay from the previous 52 weeks (prior to 6 April 2020 the reference period was 12 weeks).

Termination payments (class 1A NICs)

From 6 April 2020, termination payments in excess of £30,000 will become subject to employer-only class 1A NICs. Class 1A NICs will be subject to in-year PAYE collection for termination payments in cash and class 1A on any termination benefits in kind will be payable along with the class 1A NIC payment on benefits in kind for ongoing employees.

Recovery of statutory sick pay for COVID-19

Businesses employing fewer than 250 employees will be eligible for a refund of two weeks’ statutory sick pay per affected employee, for claims resulting from Covid-19. The new rules will come into effect once emergency legislation is passed (expected later in March – date not confirmed at time of writing).

Personal

Tax rates and allowances from 6 April 2020

For taxpayers resident across the whole of the UK:

For taxpayers resident in England, Wales and Northern Ireland:

Wales has a devolved power to set income tax rates applying to non-savings and non-dividend income for Welsh resident taxpayers. However, for 2020/21 the rates for Welsh resident taxpayers will be the same as those applying to England and Northern Ireland residents, as set out above.

Different rates and thresholds apply to non-savings, non-dividend income for Scottish taxpayers. The Scottish rates and bands for 2020/21 in comparison to 2019/20 are:

ATED

The ATED annual rates will rise by CPI (1.7%) from 1 April (with the ATED increase rounded down to the nearest £50).

The 2020/21 ATED charges are as follows:

Relief from ATED is available for certain businesses and investors. Reliefs are available to, amongst others, property rental businesses, property developers and property traders. Relief must be claimed annually. A new relief from ATED for housing co-operatives was announced in Spring Budget 2020, expected to take effect from 1 April 2021 with a refund available for 2020/21.

NIC rates

In 2020/21, the NIC rates will be as follows:

Inheritance tax

The inheritance nil rate band remains at £325,000 for 2020/21. The residence nil rate band will increase to £175,000 for deaths on or after 6 April 2020. It is tapered at £1 for £2 for estates over £2m.

ISAs

The ISA annual subscription limit remains at £20,000. For junior ISAs and child trust funds, the limit will more than double to £9,000 on 6 April 2020 (from £4,368 in 2019/20). It will be possible for child trust funds maturing in the year to be transferred to an ISA without the funds counting towards the ISA subscription limit.

Mortgage interest restriction

Since 2017/18, the deduction for mortgage interest in respect of let properties has been increasingly restricted to a basic rate tax reducer. From 6 April 2020, no finance costs on residential properties will be allowable as a deduction against rental profits. Instead, relief will only be available as a basic rate reducer.

Pensions

From 2020/21, the lifetime allowance will increase from £1,055,000 to £1,073,100.

The standard annual allowance will remain at £40,000 and will be subject to tapering to a minimum of £4,000 (£10,000 in 2019/20) for individuals with adjusted income in excess of £240,000 (£150,000 in 2019/20). The annual allowance is not subject to tapering if the individual’s income (before adding back pension contributions) is £200,000 (£110,000 in 2019/20) or less.

Residential property disposals

Private residence relief: Two key changes will take effect from 6 April 2020:

Disposals by UK residents: For disposals of UK residential property on or after 6 April 2020, UK resident individuals and trustees may be required to file standalone CGT returns and make a payment on account of CGT, within 30 days of completion. The filing requirement is waived where there is no payment on account due. Typically, this exception will apply where full private residence relief (see below) applies to the property, or it has been sold at a loss.

Property disposals by non-UK residents: Non-UK resident individuals and trustees are subject to CGT on gains made on disposal of UK property. However, the gain may not be chargeable if the property disposed of is the main home of the individual or a trust beneficiary and certain conditions are met, such that PRR is available.

A standalone CGT return and payment on account of CGT are due within 30 days of completion. In prior years it has been possible for taxpayers who filed self-assessment tax returns to defer payment of CGT until 31 January following the end of the tax year of disposal, although a return was still needed. Deferral is no longer an option from 6 April 2020, so CGT payments on account will be due within 30 days of completion.

Indirect

Air passenger duty (APD)

APD rates for flights over 2,000 miles (‘band B’ destinations) increase on 1 April 2020. The reduced rate of APD for the lowest class of travel (economy) will increase by £2, and the standard rate (for carriage in a higher class of travel) by £4. The rate of APD for the carriage of passengers in private jets will rise by £13.

Climate change levy (CCL)

The main rates of CCL will change from 1 April 2020, as the rates for gas and electricity converge. The CCL rate on gas is being raised and the electricity rate lowered. There are also corresponding adjustments to the level of CCL reduction for intensive energy sectors with climate change agreements (CCA) with the government.

Gaming duty

The gross gaming yield bandings will increase in line with inflation for accounting periods beginning on or after 1 April 2020.

Landfill tax

The landfill tax rates increase from 1 April 2020. The standard rate will increase to £94.15 per tonne and the lower rate to £3.00 per tonne.

Making tax digital (MTD)

VAT-registered businesses with taxable turnover above the VAT threshold (£85,000) were required to respond to the MTD regime by: keeping records digitally (e.g. within relevant software accounting packages, ERP systems or Excel); and using software to submit their VAT returns for VAT periods starting on or after 1 April 2019.

There was an exception for VAT-registered businesses with more complex requirements, for which mandation did not apply until 1 October 2019. From 1 April 2020 (or 1 October 2020 for deferred businesses), businesses must also have in place digital links between all parts of their software programs, products and applications that feed the indirect tax compliance process.

VAT exemption for fund management

From 1 April 2020, the scope of the UK VAT exemption for the management of special investment funds will be extended to include ‘qualifying pension funds’ (principally defined contribution funds) and closed-ended funds which do not invest ‘wholly or mainly in securities’ (e.g. real estate funds).

Vehicle excise duty (VED)

From 1 April 2020, VED rates for cars, vans and motorcycles will increase in line with inflation.

Zero-emission vehicles will be exempted from the VED supplement for vehicles with a list price exceeding £40,000.

Note: Article correct as of date of writing, Friday 20 March.