Reforms to the taxation of UK domiciliaries are contained in the Finance (No. 2) Bill 2017. These provisions fall into three categories: they restrict the availability of non-dom status for income tax, capital gains tax and inheritance tax purposes; they amend the tax provisions applicable to non-resident trusts; and they extend UK inheritance tax to apply to all UK residential property, however held. These provisions were originally included in the Finance Bill introduced in March 2017, but were withdrawn and excluded from FA 2017 following the announcement of the snap general election, and then reintroduced in this year’s second Finance Bill. The reforms are to take effect from 6 April 2017, as originally proposed. Further draft provisions are to be included in Finance Bill 2018. These measures will reform the taxation of income arising and gains accruing to offshore trusts, and they are to take effect from 6 April 2018.

1. What is domicile?

Domicile is important for determining the liability of an individual to UK income tax, capital gains tax and inheritance tax. The common law concept of domicile requires that every individual has a domicile in a specific legal jurisdiction, for example in England and Wales. It is only possible to have one domicile at a time, and under English law an individual must always be domiciled somewhere. Common law domicile does not, however, have the same meaning as habitual residence and the place where a person is domiciled is not automatically the same place as his habitual residence or his citizenship.

There are three types of domicile at common law:

Although common law domicile would be e.g. England and Wales, for UK tax purposes, we refer to ‘UK domicile’.

2. What are the income tax and capital gains tax implications of being non-UK domiciled?

An individual who is non-UK domiciled (a ‘non-dom’) can elect to be taxed on the ‘remittance basis’ of taxation such that he is liable to UK tax on UK source income and gains in the normal way, but is only liable to UK tax on foreign income and gains that are ‘remitted’ to the UK. For certain limited categories of non-doms, the remittance basis applies automatically.

Introduced by William Pitt the Younger in 1799, the remittance basis was intended to assist those who left their country of origin to live and work in another part of the British Empire. Times have changed, but the rules have continuing relevance to those individuals who choose to reside in more than one country during their lives.

For the first seven years, there is no charge for this treatment, but thereafter, the remittance basis charge (RBC) is payable as follows:

Before 6 April 2017, a non-dom could elect to be taxed on the remittance basis for as long as he remained non-UK domiciled under the common law.

The same regime also applied to those with a UK domicile of origin who emigrated and settled permanently in another country, thereby acquiring a foreign domicile, but later returned to the UK for a limited period.

(ITA 2007 Part 14 Chapter A1.)

3. What are the inheritance tax implications of being non-UK domiciled?

A non-dom is taxable on UK situs assets, but non-UK situs assets are outside the scope of UK inheritance tax (as ‘excluded property’).

For inheritance tax purposes only, before 6 April 2017, an individual became ‘deemed domiciled’ in the UK once he had been resident in the UK in not less than 17 of the 20 tax years ending with the relevant year of assessment (the ‘17 year rule’). The start date of the acquisition of deemed domicile under the 17 year rule was therefore 6 April in the 17th year of tax residence. In practice, deemed domicile could have started in as little as 15 years and a few months of actual residence.

The operation of this rule further meant that deemed domicile status was retained until an individual had been non-UK tax resident for three complete tax years (and assuming they remained non-UK tax resident in the fourth year after departure).

A UK domiciliary who emigrated and acquired a foreign domicile of choice would also remain deemed domiciled for three calendar years.

Non-UK assets held in a trust set up by an individual who is not domiciled or deemed domiciled in the UK at the time of settlement will remain excluded property, even if the individual subsequently becomes UK deemed domiciled or acquires a UK domicile as a matter of common law.

(IHTA 1984 ss 6, 48 and 267.)

Note: this article does not address the position of non-dom spouses who elect to be treated as UK domiciled for inheritance tax purposes (IHTA 1984 s 267ZA).

4. What is the background to the reforms?

The run-up to the 2015 general election involved a great deal of uncertainty in relation to the future taxation of non-doms, with the Labour Party promising to abolish the concept of non-dom tax status to create a ‘fairer’ tax system. After the Conservative Party’s election victory, George Osborne used the first all-Conservative Budget in almost 20 years (delivered on 8 July 2015) to announce significant reforms to the current tax regime, declaring that ‘British people should pay British taxes in Britain – and now they will’.

The reforms were included in the Finance Bill introduced in March 2017, with an effective date of 6 April 2017. In an unexpected twist, the relevant provisions were withdrawn after the general election was called by Theresa May and therefore excluded from FA 2017. The measures have now been reintroduced in the Finance (No. 2) Bill 2017 (also referred to as Finance Bill 2017–2019) (‘FB2 2017’), which was published on 8 September 2017. Despite the delay, FB2 2017 confirms that the effective date of the reforms remains 6 April 2017.

The reforms fall into three main categories:

Finance Bill 2017 to 2018 (‘FB 2018’), published on 13 September 2017, contains further reforms to the taxation of income arising and gains accruing to offshore trusts. The effective date of these measures is stated to be 6 April 2018.

5. What are the new deemed domicile rules for long-term residents?

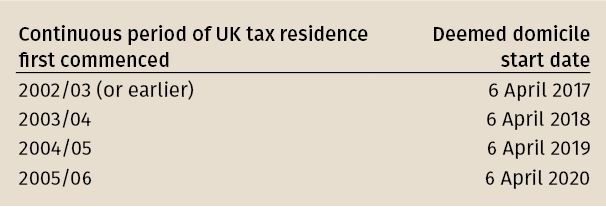

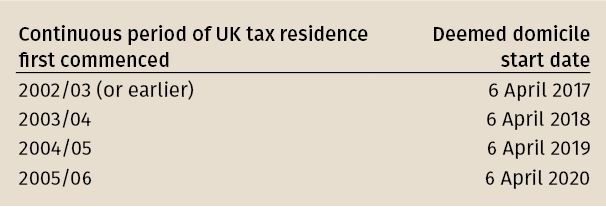

From 6 April 2017, an individual who has been UK resident for at least 15 of the 20 tax years immediately preceding the tax year will be deemed UK domiciled for income tax, capital gains tax and inheritance tax purposes (the ‘15 year rule’). The start date for acquisition of deemed domicile under the 15 year rule is therefore 6 April in the tax year after the 15 year rule is satisfied, i.e. the start of the 16th year of tax residence.

However, there is no requirement that the individual is tax resident in year 16. As a result, tax residence in tax year 15 (i.e. as little as 15 days in some cases) will trigger deemed domicile from 6 April in year 16. This means that an individual who wishes to avoid acquiring deemed domicile status must cease UK tax residence in year 14. This is important for inheritance tax purposes, as discussed below.

For inheritance tax purposes only, there is a further requirement that the individual was resident in the UK for at least one of the four preceding tax years. This is intended as a relieving provision so that an individual who ceases UK tax residence will be outside the scope of IHT in the fifth year of non-residence (which is still one year more than under the old rules). However, as discussed below, he must not return to the UK in the fifth year or the sixth year otherwise his deemed domicile revives immediately.

There is a limited transitional rule: an individual who ceases UK tax residence before 6 April 2017 and remains non-UK tax resident will not be deemed domiciled even if they technically satisfy the 15 year rule due to time spent in the UK in the 20 years before 6 April 2017.

In all cases, it goes without saying that an individual must remain non-UK domiciled as a matter of common law.

Tax residence is assessed both under the statutory residence test and the old common law rules (for tax years before 2013/2014). A tax year for which an individual is UK resident will count in full for the 15-year rules even if the year is a ‘split year’ under the statutory residence test and even if the individual is treated as non-UK resident under the terms of a double tax treaty.

The £90,000 remittance basis charge that previously applied from year 17 of UK tax residence is now obsolete.

(FB2 2017 clauses 29 and 30 and Sch 8 Part 1.)

Example: Maurice, who was born in France with a French domicile of origin, became UK tax resident in 2003/04 but remained non-UK domiciled. If he was continuously resident for the entire period, he will be deemed domiciled under the 15 year rule from 6 April 2018.

If Maurice had instead been non-UK resident for an intervening period of three tax years spent studying in the US, he would only be deemed domiciled under the 15 year rule only from 6 April 2021. This will be the case even if any year of arrival or departure was a ‘split year’.

6. Are individuals with a UK domicile of origin subject to different rules?

A different rule applies to individuals who were born in the UK with a UK domicile of origin, but who subsequently left the UK and acquired a domicile of choice (or dependency) outside the UK, before returning to the UK when still foreign domiciled. From 6 April 2017, such an individual (defined as a ‘formerly domiciled resident’ or ‘FDR’) will be deemed domiciled in the UK for all UK tax purposes during any period when they are UK tax resident.

For inheritance tax purposes only there is a grace period if the individual was not UK resident in either of the preceding two tax years. This means that the deemed domicile start date for a FDR is 6 April in the second year of residence.

As a result, an individual who is born in the UK with a UK domicile of origin will always be deemed UK domiciled (subject to the inheritance tax grace period), no matter how many years he might have spent outside the UK or how tenuous his connection to the UK before his return. An individual with a UK domicile of origin, but who was born outside the UK, will not be a FDR.

Example: Turnor was born in the UK to UK domiciled parents. While still a young child, he emigrated with his parents to Australia. Turnor is now a successful businessman and moves to the UK in 2017/2018 to head up his company’s London office for 4-5 years. Turnor will be a FDR and immediately deemed domiciled for income tax and capital gains tax purposes; he will be deemed domiciled for inheritance tax purposes from the start of his second year of tax residence.

By contrast, Turnor’s sister was born in Australia. If she moved to the UK, she would not be a FDR and would be treated as a non-dom for the first 15 years of residence.

(FB2 2017 clauses 29 and 30 and Sch 8 Part 1.)

7. What happens if a deemed domiciliary leaves the UK?

For income tax and capital gains tax purposes, domicile is irrelevant for non-residents (unless they wish to return to the UK, as discussed below). For inheritance tax purposes, domicile continues to be important:

For income tax, capital gains tax and inheritance tax purposes, an individual who leaves the UK having become deemed domiciled under the 15 year rule would need to remain non-UK resident for six complete tax years in order to ‘reset the domicile clock’ and avoid being deemed domiciled immediately on his return to the UK. He would then have a further 15 years in which he could take advantage of non-dom status (assuming he retains a non-UK domicile for common law purposes and is not a FDR) before again becoming deemed domiciled.

8. Are there any transitional reliefs?

(a) Capital gains tax rebasing (FB2 2017 Sch 8 Part 3):

Individuals who became deemed domiciled in the UK under the 15 year rule on 6 April 2017 are able to ‘rebase’ assets to the value as at 5 April 2017. This is a surprisingly generous relief and as such is limited in scope: this is a one-off relief opportunity for individuals who become deemed domiciled in 2017/2018 and will not be available to individuals who become deemed domiciled in later years.

The effect of this relief is that if there is a disposal of an asset after 6 April 2017, the non-dom will only be subject to a capital gains tax charge on any growth in the value of the asset from that date.

The key requirements for ‘rebasing’ are:

Rebasing will only apply to directly held assets and not to assets held within a trust. Following a late amendment to the draft rules, rebasing will apply to personal holdings in offshore non-reporting funds.

An individual can elect for rebasing not to apply if the asset decreased in value between the date of acquisition and 6 April 2017.

(b) Cleansing of mixed funds (FB2 2017 Sch 8 Part 3): For a period of two years from 6 April 2017, non-doms will have the opportunity to rearrange their overseas bank accounts containing mixed funds and to separate out the different parts into clean capital, foreign income and foreign gains. This opportunity is available to all non-doms, not just those becoming deemed domiciled on 6 April 2017, but excluding FDRs.

This is a significant relief because the general rules do not provide a mechanism to segregate the components of a mixed fund abroad. Under the transitional rules, an individual who is able to identify the make-up of their mixed fund may transfer money from one offshore account to another to cleanse it.

The key requirements for ‘cleansing’ are:

HMRC’s draft guidance suggests that such a nomination can only be made once with respect to any one mixed fund account. If this is correct, all nominated amounts from the mixed fund account would need to be transferred to the receiving account(s) at the same time.

Cleansing is only available for amounts held in bank and similar accounts and will not extend to other assets which might themselves be a mixed fund, such as shares or other property. However, such assets could be sold in the transitional window and the non-dom could then separate the sale proceeds in the same way as other money.

The draft legislation has been amended to make clear that cleansing is available for funds that arose before 6 April 2008.

Neither rebasing nor cleansing is available to assets held in trust.

Example: Gardner, who was born in Russia with a Russian domicile of origin, became UK tax resident in 2002/03. Following the sale of some shares in a Russian company in 2005, he invested the sale proceeds (comprising clean capital of £1m and capital gain of £500,000) in a piece of artwork. The artwork was worth £4m on 5 April 2017 and did not increase in value before its sale in July 2017. Gardner is entitled to take advantage of both rebasing and cleansing so that the element of the sale proceeds comprising the original clean capital of £1m and the £2m gain realised on sale (now effectively clean capital) could be remitted to the UK free of capital gains tax.

By contrast, if Gardner had become UK tax resident only in 2003/04, such that he will be deemed domiciled from 6 April 2018, he would not be eligible for ‘rebasing’. The £1m gain realised on sale in July 2017 would be taxable on the remittance basis meaning that only the original clean capital of £1m could be remitted free of capital gains tax.

(c) Temporary non-residence (FB2 2017 Sch 8 Part 1): There are two limited transitional reliefs for capital gains tax purposes for those who are temporarily non-resident and left the UK before either (a) 6 April 2013; or (b) 8 July 2015.

9. What is the IHT position of trusts settled by a non-dom before the acquisition of deemed domicile?

Non-UK situs assets held by trustees of a trust settled by a non-dom settlor will remain ‘excluded property’ (IHTA 1984 s 48).

This rule is, however, disapplied for a trust settled by a FDR for any period during which the FDR is UK resident (subject to the one year grace period). (FB2 2017 cl 30.)

10. Have there been amendments to the income tax and capital gains tax treatment of overseas trusts?

There are three main income tax and capital gains tax codes that apply to non-resident trusts:

Whilst a detailed explanation of these rules is outside the scope of this article, it is important to understand that income and gains generated within a trust (and its underlying companies) can be attributed to the settlor/transferor. Where the settlor is UK domiciled, the income and gains are taxable on him on the arising basis. Where the settlor is non-UK domiciled, income is taxable on him on the remittance basis, but gains roll-up free of tax.

TOAB and s 87 can also give rise to tax liabilities for UK tax resident beneficiaries (including settlors in the case of s 87) who receive a ‘benefit’ or ‘capital payment’ from the trust. UK domiciled beneficiaries are taxed on the arising basis, but non-doms can take advantage of the remittance basis.

In the absence of further reforms, settlors who have become deemed domiciled in the UK (under the 15 year rule or by virtue of being a FDR) would be subject to tax on trust income and gains in the same way as UK domiciliaries. The government has addressed the position for settlors who are deemed domiciled under the 15 year rule, but not FDRs (see question 11 below). As a result, so-called ‘protected settlements’ will be subject to a tax regime that is considerably more favourable than the regime that applies to non-resident trusts created by UK resident and domiciled individuals or FDRs.

At the same time, the government has introduced further anti-avoidance provisions, some of which are included in FB2 2017, with an effective date of 6 April 2017. The remainder are included in FB 2018, with an effective date of 6 April 2018 – see question 12 below.

11. What are the income tax and capital gains tax protections for overseas trusts?

The government’s intention is to allow foreign income and gains realised in non-UK resident trusts settled by a non-dom before becoming deemed domiciled under the 15 year rule to roll-up tax free.

Where relevant, the amendments described below apply to all trusts with a non-dom settlor, even if the settlor is not yet deemed domiciled. However, the protections will not apply to FDRs, so that FDRs will be taxed in the same way as a UK domiciliary on any trust income or gains. The protections will also cease to apply if an individual acquires a UK domicile as a matter of common law.

Protected settlements (FB2 2017 Sch 8 Part 2): For income tax, UK source income of a settlor interested trust (or a trust subject to the transferor provisions of TOAB) will be attributed to the settlor and taxed on the arising basis. However, these provisions are disapplied for ‘protected foreign source income’. Settlors will instead be taxed on benefits received from the trust (in the same way as other beneficiaries), with deemed domiciliaries taxed on worldwide benefits (rather than the remittance basis). All undistributed pre-6 April 2017 income will now be available for matching to benefits received by beneficiaries.

For capital gains tax, TCGA 1992 s 86 is disapplied so trust and corporate gains are not attributed to a deemed domiciled settlor. Settlors (and beneficiaries) will continue to be taxed on capital payments received in accordance with s 87, with deemed domiciliaries taxed on worldwide benefits (rather than the remittance basis).

There is no 2017 rebasing of trust assets.

Tainting (FB2 2017 Sch 8 Part 2): The above protections will be lost, and the settlor will be taxed in the same way as a UK domiciled settlor, if the trust is ‘tainted’. This will be the case if property or income is provided directly or indirectly for the purposes of the settlement by the settlor, or by the trustees of any other settlement of which the settlor is a beneficiary or settlor, at a time when the settlor is domiciled or deemed domiciled in the UK.

The provisions on tainting are complex and merit careful consideration in each case. The rules applicable to loans are particularly complex and give rise to a number of uncertainties (for example, it is unclear whether loans made by and to underlying companies are caught). Trusts with existing loans have a one year grace period to change the terms of any loans to comply with the new rules.

12. What are the new anti-avoidance rules for trusts?

(a) Valuations (FB2 2017 cl 31 and Sch 9): Fixed valuation rules have been introduced for the purposes of valuing benefits to UK resident beneficiaries that are taxable under TOAB and TCGA 1992 s 87. These provisions legislate what was common practice for many accountants. The effective date for these changes is 6 April 2018.

(b) Settlors and close family members: FB2 2017 amends TOAB to transfer the s 731 benefits charge to the settlor where the beneficiary is (a) a close family member of the settlor and (b) not liable to tax on the benefit (either because the beneficiary is a remittance basis taxpayer or is non-resident). This applies to UK resident settlors who are either non-domiciled or deemed domiciled under the 15 year rule. The effective date for this change is 6 April 2017.

FB 2018 (see ‘Offshore trusts: anti-avoidance’) introduces similar rules for TCGA 1992 s 87 purposes, but with an effective date of 6 April 2018.

Turning to the settlements code, FB 2018 also includes new provisions that are intended to apply to trusts that qualify for the ‘motive defence’ for TOAB purposes and where distributions to settlors and close family members would otherwise be non-taxable. Any ‘untaxed benefits’ paid to settlors and their close family members will be taxed to the extent that they are matched with ‘protected foreign source income’. In the case of a close family member, the tax is payable by the settlor in the event that the close family member is either a remittance basis taxpayer or is non-resident.

Close family members for these purposes are the settlor’s spouse, civil partner (extended to include people living together as though they were spouses or civil partners) and minor children and step-children.

(c) Onward gifts to UK residents/recycling rule (FB 2018, see ‘Offshore trusts: anti-avoidance’): TOAB, the settlements code and TCGA 1992 s 87 are amended so that capital payments or benefits received by individuals who do not pay tax on the distribution (either because the beneficiary is a remittance basis taxpayer or is non-resident) are attributed to a UK resident who subsequently receives a gift from the original recipient. The draft legislation published in December 2016 (for capital gains tax purposes) restricted the application of this rule to gifts made within three years of the capital payment, unless there was a scheme or arrangement. The draft legislation published on 13 September does not contain such a time limit, but does require an arrangement or intention to pass on the payment (directly or indirectly).

The effective date for these changes is 6 April 2018. The new rules will only apply to onwards gifts made from this date, but will affect gifts even where the distribution or capital payment was received by the original beneficiary before this date.

(d) Capital payments to non-residents (FB 2018, see ‘Offshore trusts: anti-avoidance’): Capital payments to non-UK resident individuals are to be disregarded for s 87 purposes. As a result, such payments will not be matched to gains in the s 87 pool and it will no longer be possible to ‘wash-out’ gains by distributions to non-residents.

The effective date for this change is 6 April 2018 and the disregard will apply to distributions made from 6 April 2018 and also unmatched capital payments made before this date.

13. Are there any changes to the rules for offshore companies?

There are no protective measures for individuals subject to the income tax and capital gains tax anti-avoidance provisions relating to non-UK companies in which they are shareholders (TOAB and TCGA 1992 s 13).

14. What was the position pre-April 2017?

It has been common practice for non-doms to own UK real estate through a non-UK company, whether the property was for family occupation or for investment purposes. In this way, the shares in the non-UK company would ‘shield’ the property from the scope of inheritance tax. The shares could be kept outside the scope of inheritance tax long-term, by transferring the shares to a trust before the shareholder became deemed domiciled.

The government has taken a series of steps over the last few years to discourage the use of non-UK companies to hold residential property and encourage ‘de-enveloping’ of existing interests. These steps include the introduction of the annual tax on enveloped dwellings (ATED) at rates up to £218,200 a year and ATED related capital gains tax.

Following these reforms, many individuals and trustees concluded that the value of inheritance tax protection outweighed the ATED cost.

15. What are the new rules?

With effect from 6 April 2017, three categories of property will no longer be ‘excluded property’ for the purposes of the inheritance tax rules (whether owned personally or through a trust):

For personally owned UK residential property, an inheritance tax charge could therefore arise on death or chargeable lifetime gifts. For settled property, ten year charges and exit charges will apply under the relevant property regime and a gift with reservation of benefit charge may arise on the death of the settlor.

Where property that would otherwise be within the scope of the rules is disposed of or a relevant debt is repaid, the proceeds of sale/repayment remain within the scope of inheritance tax for a further two years.

The rules will not apply to the extent that value is derived from commercial property.

(FB2 2017 cl 33 and Sch 10.)

16. How will debts be treated under the new rules?

The government’s original proposals included further restrictions on the deductibility of debts where the borrowing was from a connected party. This proposal was later abandoned in favour of a new rule that treats any debt that is used to finance (directly or indirectly) the acquisition, maintenance or enhancement of value of UK residential property as an asset subject to inheritance tax in the hands of the creditor (defined as ‘relevant loans’).

The inheritance tax charge is further extended to any ‘money or money’s worth held or otherwise made available as security, collateral or guarantee’ for a relevant loan. The value of any security, collateral or guarantee caught by the new rules cannot exceed the amount of the loan. However, there are no provisions preventing duplication of charges, which means assets worth much more than the value of the property may end up within the scope of inheritance tax.

Example: Maurice purchased 4 Turnor Gardens in 2015 for £10m. He financed the purchase using a bank loan of £5m (secured on the property and also on a share portfolio valued at £10m) and a further loan of £5m from a settlor-interested trust that he settled in the same year. On Maurice’s death in 2018 the property remains valued at £10m. The inheritance tax position is as follows:

The value subject to inheritance tax on Maurice’s death is therefore between £10m and £15m, depending on the deductibility of the trust loan.

17. Are there any ‘de-enveloping’ reliefs?

Despite suggestions that there would be a de-enveloping relief (to mitigate or defer taxes payable when unwinding structures), the government announced on 18 August 2016 that there would be no such relief. As a result, companies may incur transactional taxes (such as non-resident capital gains tax, ATED capital gains tax and SDLT) when de-enveloping.

18. What is the effective date for the new rules?

The new rules will be effective from 6 April 2017 (FB2 2017), with the exception of the additional anti-avoidance provisions for trusts which will be effective from 6 April 2018 (FB 2018).

19. What is the relevance of Brexit?

The new reforms were first announced on 8 July 2015, at a time when few would have predicted that less than a year later, the UK electorate would vote to leave the EU.

As a result of the unprecedented political upheaval created by Brexit, it was widely speculated that the reforms would be postponed until 2018 or even shelved in their entirety. The publication of a further consultation document on 19 August 2016 suggested that this was wishful thinking, although some fresh hope was provided as a result of the snap general election and resultant removal of the relevant legislation from the Finance Bill. The publication of FB2 2017 on 8 September 2017 put paid to such hopes, and the publication of FB 2018 less than a week later further dashed any expectation that the wider trust reforms would be abandoned.

It is therefore clear that the government remains committed to this radical overhaul of the taxation of non-doms. Whilst the political motives are clear, many commentators would agree that discouraging foreign investment in the UK is unlikely to be good for the economy in these testing times.

It also remains to be seen whether the EU driven ‘motive defences’ for TOAB and s 13 purposes could be eroded.

20. What should we be doing now?

The list is endless, but the following headlines may be of interest.

These recommendations are subject to the usual caveat that the legislation has not yet been enacted. Whilst changes to the legislation contained in FB2 2017 (effective date 6 April 2017) may be considered unlikely, the provisions of FB 2018 are now subject to a period of consultation.

Reforms to the taxation of UK domiciliaries are contained in the Finance (No. 2) Bill 2017. These provisions fall into three categories: they restrict the availability of non-dom status for income tax, capital gains tax and inheritance tax purposes; they amend the tax provisions applicable to non-resident trusts; and they extend UK inheritance tax to apply to all UK residential property, however held. These provisions were originally included in the Finance Bill introduced in March 2017, but were withdrawn and excluded from FA 2017 following the announcement of the snap general election, and then reintroduced in this year’s second Finance Bill. The reforms are to take effect from 6 April 2017, as originally proposed. Further draft provisions are to be included in Finance Bill 2018. These measures will reform the taxation of income arising and gains accruing to offshore trusts, and they are to take effect from 6 April 2018.

1. What is domicile?

Domicile is important for determining the liability of an individual to UK income tax, capital gains tax and inheritance tax. The common law concept of domicile requires that every individual has a domicile in a specific legal jurisdiction, for example in England and Wales. It is only possible to have one domicile at a time, and under English law an individual must always be domiciled somewhere. Common law domicile does not, however, have the same meaning as habitual residence and the place where a person is domiciled is not automatically the same place as his habitual residence or his citizenship.

There are three types of domicile at common law:

Although common law domicile would be e.g. England and Wales, for UK tax purposes, we refer to ‘UK domicile’.

2. What are the income tax and capital gains tax implications of being non-UK domiciled?

An individual who is non-UK domiciled (a ‘non-dom’) can elect to be taxed on the ‘remittance basis’ of taxation such that he is liable to UK tax on UK source income and gains in the normal way, but is only liable to UK tax on foreign income and gains that are ‘remitted’ to the UK. For certain limited categories of non-doms, the remittance basis applies automatically.

Introduced by William Pitt the Younger in 1799, the remittance basis was intended to assist those who left their country of origin to live and work in another part of the British Empire. Times have changed, but the rules have continuing relevance to those individuals who choose to reside in more than one country during their lives.

For the first seven years, there is no charge for this treatment, but thereafter, the remittance basis charge (RBC) is payable as follows:

Before 6 April 2017, a non-dom could elect to be taxed on the remittance basis for as long as he remained non-UK domiciled under the common law.

The same regime also applied to those with a UK domicile of origin who emigrated and settled permanently in another country, thereby acquiring a foreign domicile, but later returned to the UK for a limited period.

(ITA 2007 Part 14 Chapter A1.)

3. What are the inheritance tax implications of being non-UK domiciled?

A non-dom is taxable on UK situs assets, but non-UK situs assets are outside the scope of UK inheritance tax (as ‘excluded property’).

For inheritance tax purposes only, before 6 April 2017, an individual became ‘deemed domiciled’ in the UK once he had been resident in the UK in not less than 17 of the 20 tax years ending with the relevant year of assessment (the ‘17 year rule’). The start date of the acquisition of deemed domicile under the 17 year rule was therefore 6 April in the 17th year of tax residence. In practice, deemed domicile could have started in as little as 15 years and a few months of actual residence.

The operation of this rule further meant that deemed domicile status was retained until an individual had been non-UK tax resident for three complete tax years (and assuming they remained non-UK tax resident in the fourth year after departure).

A UK domiciliary who emigrated and acquired a foreign domicile of choice would also remain deemed domiciled for three calendar years.

Non-UK assets held in a trust set up by an individual who is not domiciled or deemed domiciled in the UK at the time of settlement will remain excluded property, even if the individual subsequently becomes UK deemed domiciled or acquires a UK domicile as a matter of common law.

(IHTA 1984 ss 6, 48 and 267.)

Note: this article does not address the position of non-dom spouses who elect to be treated as UK domiciled for inheritance tax purposes (IHTA 1984 s 267ZA).

4. What is the background to the reforms?

The run-up to the 2015 general election involved a great deal of uncertainty in relation to the future taxation of non-doms, with the Labour Party promising to abolish the concept of non-dom tax status to create a ‘fairer’ tax system. After the Conservative Party’s election victory, George Osborne used the first all-Conservative Budget in almost 20 years (delivered on 8 July 2015) to announce significant reforms to the current tax regime, declaring that ‘British people should pay British taxes in Britain – and now they will’.

The reforms were included in the Finance Bill introduced in March 2017, with an effective date of 6 April 2017. In an unexpected twist, the relevant provisions were withdrawn after the general election was called by Theresa May and therefore excluded from FA 2017. The measures have now been reintroduced in the Finance (No. 2) Bill 2017 (also referred to as Finance Bill 2017–2019) (‘FB2 2017’), which was published on 8 September 2017. Despite the delay, FB2 2017 confirms that the effective date of the reforms remains 6 April 2017.

The reforms fall into three main categories:

Finance Bill 2017 to 2018 (‘FB 2018’), published on 13 September 2017, contains further reforms to the taxation of income arising and gains accruing to offshore trusts. The effective date of these measures is stated to be 6 April 2018.

5. What are the new deemed domicile rules for long-term residents?

From 6 April 2017, an individual who has been UK resident for at least 15 of the 20 tax years immediately preceding the tax year will be deemed UK domiciled for income tax, capital gains tax and inheritance tax purposes (the ‘15 year rule’). The start date for acquisition of deemed domicile under the 15 year rule is therefore 6 April in the tax year after the 15 year rule is satisfied, i.e. the start of the 16th year of tax residence.

However, there is no requirement that the individual is tax resident in year 16. As a result, tax residence in tax year 15 (i.e. as little as 15 days in some cases) will trigger deemed domicile from 6 April in year 16. This means that an individual who wishes to avoid acquiring deemed domicile status must cease UK tax residence in year 14. This is important for inheritance tax purposes, as discussed below.

For inheritance tax purposes only, there is a further requirement that the individual was resident in the UK for at least one of the four preceding tax years. This is intended as a relieving provision so that an individual who ceases UK tax residence will be outside the scope of IHT in the fifth year of non-residence (which is still one year more than under the old rules). However, as discussed below, he must not return to the UK in the fifth year or the sixth year otherwise his deemed domicile revives immediately.

There is a limited transitional rule: an individual who ceases UK tax residence before 6 April 2017 and remains non-UK tax resident will not be deemed domiciled even if they technically satisfy the 15 year rule due to time spent in the UK in the 20 years before 6 April 2017.

In all cases, it goes without saying that an individual must remain non-UK domiciled as a matter of common law.

Tax residence is assessed both under the statutory residence test and the old common law rules (for tax years before 2013/2014). A tax year for which an individual is UK resident will count in full for the 15-year rules even if the year is a ‘split year’ under the statutory residence test and even if the individual is treated as non-UK resident under the terms of a double tax treaty.

The £90,000 remittance basis charge that previously applied from year 17 of UK tax residence is now obsolete.

(FB2 2017 clauses 29 and 30 and Sch 8 Part 1.)

Example: Maurice, who was born in France with a French domicile of origin, became UK tax resident in 2003/04 but remained non-UK domiciled. If he was continuously resident for the entire period, he will be deemed domiciled under the 15 year rule from 6 April 2018.

If Maurice had instead been non-UK resident for an intervening period of three tax years spent studying in the US, he would only be deemed domiciled under the 15 year rule only from 6 April 2021. This will be the case even if any year of arrival or departure was a ‘split year’.

6. Are individuals with a UK domicile of origin subject to different rules?

A different rule applies to individuals who were born in the UK with a UK domicile of origin, but who subsequently left the UK and acquired a domicile of choice (or dependency) outside the UK, before returning to the UK when still foreign domiciled. From 6 April 2017, such an individual (defined as a ‘formerly domiciled resident’ or ‘FDR’) will be deemed domiciled in the UK for all UK tax purposes during any period when they are UK tax resident.

For inheritance tax purposes only there is a grace period if the individual was not UK resident in either of the preceding two tax years. This means that the deemed domicile start date for a FDR is 6 April in the second year of residence.

As a result, an individual who is born in the UK with a UK domicile of origin will always be deemed UK domiciled (subject to the inheritance tax grace period), no matter how many years he might have spent outside the UK or how tenuous his connection to the UK before his return. An individual with a UK domicile of origin, but who was born outside the UK, will not be a FDR.

Example: Turnor was born in the UK to UK domiciled parents. While still a young child, he emigrated with his parents to Australia. Turnor is now a successful businessman and moves to the UK in 2017/2018 to head up his company’s London office for 4-5 years. Turnor will be a FDR and immediately deemed domiciled for income tax and capital gains tax purposes; he will be deemed domiciled for inheritance tax purposes from the start of his second year of tax residence.

By contrast, Turnor’s sister was born in Australia. If she moved to the UK, she would not be a FDR and would be treated as a non-dom for the first 15 years of residence.

(FB2 2017 clauses 29 and 30 and Sch 8 Part 1.)

7. What happens if a deemed domiciliary leaves the UK?

For income tax and capital gains tax purposes, domicile is irrelevant for non-residents (unless they wish to return to the UK, as discussed below). For inheritance tax purposes, domicile continues to be important:

For income tax, capital gains tax and inheritance tax purposes, an individual who leaves the UK having become deemed domiciled under the 15 year rule would need to remain non-UK resident for six complete tax years in order to ‘reset the domicile clock’ and avoid being deemed domiciled immediately on his return to the UK. He would then have a further 15 years in which he could take advantage of non-dom status (assuming he retains a non-UK domicile for common law purposes and is not a FDR) before again becoming deemed domiciled.

8. Are there any transitional reliefs?

(a) Capital gains tax rebasing (FB2 2017 Sch 8 Part 3):

Individuals who became deemed domiciled in the UK under the 15 year rule on 6 April 2017 are able to ‘rebase’ assets to the value as at 5 April 2017. This is a surprisingly generous relief and as such is limited in scope: this is a one-off relief opportunity for individuals who become deemed domiciled in 2017/2018 and will not be available to individuals who become deemed domiciled in later years.

The effect of this relief is that if there is a disposal of an asset after 6 April 2017, the non-dom will only be subject to a capital gains tax charge on any growth in the value of the asset from that date.

The key requirements for ‘rebasing’ are:

Rebasing will only apply to directly held assets and not to assets held within a trust. Following a late amendment to the draft rules, rebasing will apply to personal holdings in offshore non-reporting funds.

An individual can elect for rebasing not to apply if the asset decreased in value between the date of acquisition and 6 April 2017.

(b) Cleansing of mixed funds (FB2 2017 Sch 8 Part 3): For a period of two years from 6 April 2017, non-doms will have the opportunity to rearrange their overseas bank accounts containing mixed funds and to separate out the different parts into clean capital, foreign income and foreign gains. This opportunity is available to all non-doms, not just those becoming deemed domiciled on 6 April 2017, but excluding FDRs.

This is a significant relief because the general rules do not provide a mechanism to segregate the components of a mixed fund abroad. Under the transitional rules, an individual who is able to identify the make-up of their mixed fund may transfer money from one offshore account to another to cleanse it.

The key requirements for ‘cleansing’ are:

HMRC’s draft guidance suggests that such a nomination can only be made once with respect to any one mixed fund account. If this is correct, all nominated amounts from the mixed fund account would need to be transferred to the receiving account(s) at the same time.

Cleansing is only available for amounts held in bank and similar accounts and will not extend to other assets which might themselves be a mixed fund, such as shares or other property. However, such assets could be sold in the transitional window and the non-dom could then separate the sale proceeds in the same way as other money.

The draft legislation has been amended to make clear that cleansing is available for funds that arose before 6 April 2008.

Neither rebasing nor cleansing is available to assets held in trust.

Example: Gardner, who was born in Russia with a Russian domicile of origin, became UK tax resident in 2002/03. Following the sale of some shares in a Russian company in 2005, he invested the sale proceeds (comprising clean capital of £1m and capital gain of £500,000) in a piece of artwork. The artwork was worth £4m on 5 April 2017 and did not increase in value before its sale in July 2017. Gardner is entitled to take advantage of both rebasing and cleansing so that the element of the sale proceeds comprising the original clean capital of £1m and the £2m gain realised on sale (now effectively clean capital) could be remitted to the UK free of capital gains tax.

By contrast, if Gardner had become UK tax resident only in 2003/04, such that he will be deemed domiciled from 6 April 2018, he would not be eligible for ‘rebasing’. The £1m gain realised on sale in July 2017 would be taxable on the remittance basis meaning that only the original clean capital of £1m could be remitted free of capital gains tax.

(c) Temporary non-residence (FB2 2017 Sch 8 Part 1): There are two limited transitional reliefs for capital gains tax purposes for those who are temporarily non-resident and left the UK before either (a) 6 April 2013; or (b) 8 July 2015.

9. What is the IHT position of trusts settled by a non-dom before the acquisition of deemed domicile?

Non-UK situs assets held by trustees of a trust settled by a non-dom settlor will remain ‘excluded property’ (IHTA 1984 s 48).

This rule is, however, disapplied for a trust settled by a FDR for any period during which the FDR is UK resident (subject to the one year grace period). (FB2 2017 cl 30.)

10. Have there been amendments to the income tax and capital gains tax treatment of overseas trusts?

There are three main income tax and capital gains tax codes that apply to non-resident trusts:

Whilst a detailed explanation of these rules is outside the scope of this article, it is important to understand that income and gains generated within a trust (and its underlying companies) can be attributed to the settlor/transferor. Where the settlor is UK domiciled, the income and gains are taxable on him on the arising basis. Where the settlor is non-UK domiciled, income is taxable on him on the remittance basis, but gains roll-up free of tax.

TOAB and s 87 can also give rise to tax liabilities for UK tax resident beneficiaries (including settlors in the case of s 87) who receive a ‘benefit’ or ‘capital payment’ from the trust. UK domiciled beneficiaries are taxed on the arising basis, but non-doms can take advantage of the remittance basis.

In the absence of further reforms, settlors who have become deemed domiciled in the UK (under the 15 year rule or by virtue of being a FDR) would be subject to tax on trust income and gains in the same way as UK domiciliaries. The government has addressed the position for settlors who are deemed domiciled under the 15 year rule, but not FDRs (see question 11 below). As a result, so-called ‘protected settlements’ will be subject to a tax regime that is considerably more favourable than the regime that applies to non-resident trusts created by UK resident and domiciled individuals or FDRs.

At the same time, the government has introduced further anti-avoidance provisions, some of which are included in FB2 2017, with an effective date of 6 April 2017. The remainder are included in FB 2018, with an effective date of 6 April 2018 – see question 12 below.

11. What are the income tax and capital gains tax protections for overseas trusts?

The government’s intention is to allow foreign income and gains realised in non-UK resident trusts settled by a non-dom before becoming deemed domiciled under the 15 year rule to roll-up tax free.

Where relevant, the amendments described below apply to all trusts with a non-dom settlor, even if the settlor is not yet deemed domiciled. However, the protections will not apply to FDRs, so that FDRs will be taxed in the same way as a UK domiciliary on any trust income or gains. The protections will also cease to apply if an individual acquires a UK domicile as a matter of common law.

Protected settlements (FB2 2017 Sch 8 Part 2): For income tax, UK source income of a settlor interested trust (or a trust subject to the transferor provisions of TOAB) will be attributed to the settlor and taxed on the arising basis. However, these provisions are disapplied for ‘protected foreign source income’. Settlors will instead be taxed on benefits received from the trust (in the same way as other beneficiaries), with deemed domiciliaries taxed on worldwide benefits (rather than the remittance basis). All undistributed pre-6 April 2017 income will now be available for matching to benefits received by beneficiaries.

For capital gains tax, TCGA 1992 s 86 is disapplied so trust and corporate gains are not attributed to a deemed domiciled settlor. Settlors (and beneficiaries) will continue to be taxed on capital payments received in accordance with s 87, with deemed domiciliaries taxed on worldwide benefits (rather than the remittance basis).

There is no 2017 rebasing of trust assets.

Tainting (FB2 2017 Sch 8 Part 2): The above protections will be lost, and the settlor will be taxed in the same way as a UK domiciled settlor, if the trust is ‘tainted’. This will be the case if property or income is provided directly or indirectly for the purposes of the settlement by the settlor, or by the trustees of any other settlement of which the settlor is a beneficiary or settlor, at a time when the settlor is domiciled or deemed domiciled in the UK.

The provisions on tainting are complex and merit careful consideration in each case. The rules applicable to loans are particularly complex and give rise to a number of uncertainties (for example, it is unclear whether loans made by and to underlying companies are caught). Trusts with existing loans have a one year grace period to change the terms of any loans to comply with the new rules.

12. What are the new anti-avoidance rules for trusts?

(a) Valuations (FB2 2017 cl 31 and Sch 9): Fixed valuation rules have been introduced for the purposes of valuing benefits to UK resident beneficiaries that are taxable under TOAB and TCGA 1992 s 87. These provisions legislate what was common practice for many accountants. The effective date for these changes is 6 April 2018.

(b) Settlors and close family members: FB2 2017 amends TOAB to transfer the s 731 benefits charge to the settlor where the beneficiary is (a) a close family member of the settlor and (b) not liable to tax on the benefit (either because the beneficiary is a remittance basis taxpayer or is non-resident). This applies to UK resident settlors who are either non-domiciled or deemed domiciled under the 15 year rule. The effective date for this change is 6 April 2017.

FB 2018 (see ‘Offshore trusts: anti-avoidance’) introduces similar rules for TCGA 1992 s 87 purposes, but with an effective date of 6 April 2018.

Turning to the settlements code, FB 2018 also includes new provisions that are intended to apply to trusts that qualify for the ‘motive defence’ for TOAB purposes and where distributions to settlors and close family members would otherwise be non-taxable. Any ‘untaxed benefits’ paid to settlors and their close family members will be taxed to the extent that they are matched with ‘protected foreign source income’. In the case of a close family member, the tax is payable by the settlor in the event that the close family member is either a remittance basis taxpayer or is non-resident.

Close family members for these purposes are the settlor’s spouse, civil partner (extended to include people living together as though they were spouses or civil partners) and minor children and step-children.

(c) Onward gifts to UK residents/recycling rule (FB 2018, see ‘Offshore trusts: anti-avoidance’): TOAB, the settlements code and TCGA 1992 s 87 are amended so that capital payments or benefits received by individuals who do not pay tax on the distribution (either because the beneficiary is a remittance basis taxpayer or is non-resident) are attributed to a UK resident who subsequently receives a gift from the original recipient. The draft legislation published in December 2016 (for capital gains tax purposes) restricted the application of this rule to gifts made within three years of the capital payment, unless there was a scheme or arrangement. The draft legislation published on 13 September does not contain such a time limit, but does require an arrangement or intention to pass on the payment (directly or indirectly).

The effective date for these changes is 6 April 2018. The new rules will only apply to onwards gifts made from this date, but will affect gifts even where the distribution or capital payment was received by the original beneficiary before this date.

(d) Capital payments to non-residents (FB 2018, see ‘Offshore trusts: anti-avoidance’): Capital payments to non-UK resident individuals are to be disregarded for s 87 purposes. As a result, such payments will not be matched to gains in the s 87 pool and it will no longer be possible to ‘wash-out’ gains by distributions to non-residents.

The effective date for this change is 6 April 2018 and the disregard will apply to distributions made from 6 April 2018 and also unmatched capital payments made before this date.

13. Are there any changes to the rules for offshore companies?

There are no protective measures for individuals subject to the income tax and capital gains tax anti-avoidance provisions relating to non-UK companies in which they are shareholders (TOAB and TCGA 1992 s 13).

14. What was the position pre-April 2017?

It has been common practice for non-doms to own UK real estate through a non-UK company, whether the property was for family occupation or for investment purposes. In this way, the shares in the non-UK company would ‘shield’ the property from the scope of inheritance tax. The shares could be kept outside the scope of inheritance tax long-term, by transferring the shares to a trust before the shareholder became deemed domiciled.

The government has taken a series of steps over the last few years to discourage the use of non-UK companies to hold residential property and encourage ‘de-enveloping’ of existing interests. These steps include the introduction of the annual tax on enveloped dwellings (ATED) at rates up to £218,200 a year and ATED related capital gains tax.

Following these reforms, many individuals and trustees concluded that the value of inheritance tax protection outweighed the ATED cost.

15. What are the new rules?

With effect from 6 April 2017, three categories of property will no longer be ‘excluded property’ for the purposes of the inheritance tax rules (whether owned personally or through a trust):

For personally owned UK residential property, an inheritance tax charge could therefore arise on death or chargeable lifetime gifts. For settled property, ten year charges and exit charges will apply under the relevant property regime and a gift with reservation of benefit charge may arise on the death of the settlor.

Where property that would otherwise be within the scope of the rules is disposed of or a relevant debt is repaid, the proceeds of sale/repayment remain within the scope of inheritance tax for a further two years.

The rules will not apply to the extent that value is derived from commercial property.

(FB2 2017 cl 33 and Sch 10.)

16. How will debts be treated under the new rules?

The government’s original proposals included further restrictions on the deductibility of debts where the borrowing was from a connected party. This proposal was later abandoned in favour of a new rule that treats any debt that is used to finance (directly or indirectly) the acquisition, maintenance or enhancement of value of UK residential property as an asset subject to inheritance tax in the hands of the creditor (defined as ‘relevant loans’).

The inheritance tax charge is further extended to any ‘money or money’s worth held or otherwise made available as security, collateral or guarantee’ for a relevant loan. The value of any security, collateral or guarantee caught by the new rules cannot exceed the amount of the loan. However, there are no provisions preventing duplication of charges, which means assets worth much more than the value of the property may end up within the scope of inheritance tax.

Example: Maurice purchased 4 Turnor Gardens in 2015 for £10m. He financed the purchase using a bank loan of £5m (secured on the property and also on a share portfolio valued at £10m) and a further loan of £5m from a settlor-interested trust that he settled in the same year. On Maurice’s death in 2018 the property remains valued at £10m. The inheritance tax position is as follows:

The value subject to inheritance tax on Maurice’s death is therefore between £10m and £15m, depending on the deductibility of the trust loan.

17. Are there any ‘de-enveloping’ reliefs?

Despite suggestions that there would be a de-enveloping relief (to mitigate or defer taxes payable when unwinding structures), the government announced on 18 August 2016 that there would be no such relief. As a result, companies may incur transactional taxes (such as non-resident capital gains tax, ATED capital gains tax and SDLT) when de-enveloping.

18. What is the effective date for the new rules?

The new rules will be effective from 6 April 2017 (FB2 2017), with the exception of the additional anti-avoidance provisions for trusts which will be effective from 6 April 2018 (FB 2018).

19. What is the relevance of Brexit?

The new reforms were first announced on 8 July 2015, at a time when few would have predicted that less than a year later, the UK electorate would vote to leave the EU.

As a result of the unprecedented political upheaval created by Brexit, it was widely speculated that the reforms would be postponed until 2018 or even shelved in their entirety. The publication of a further consultation document on 19 August 2016 suggested that this was wishful thinking, although some fresh hope was provided as a result of the snap general election and resultant removal of the relevant legislation from the Finance Bill. The publication of FB2 2017 on 8 September 2017 put paid to such hopes, and the publication of FB 2018 less than a week later further dashed any expectation that the wider trust reforms would be abandoned.

It is therefore clear that the government remains committed to this radical overhaul of the taxation of non-doms. Whilst the political motives are clear, many commentators would agree that discouraging foreign investment in the UK is unlikely to be good for the economy in these testing times.

It also remains to be seen whether the EU driven ‘motive defences’ for TOAB and s 13 purposes could be eroded.

20. What should we be doing now?

The list is endless, but the following headlines may be of interest.

These recommendations are subject to the usual caveat that the legislation has not yet been enacted. Whilst changes to the legislation contained in FB2 2017 (effective date 6 April 2017) may be considered unlikely, the provisions of FB 2018 are now subject to a period of consultation.