On 15 June 2021, prime ministers Scott Morrison and Boris Johnson announced the main elements that will be included in the Australia/UK Free Trade Agreement. This is expected to lead to increased cross-border activity between the two countries. One of the greatest difficulties in doing business overseas is understanding another jurisdiction’s tax laws and the implications that could have on the domestic tax position.

For businesses expanding into Australia there are several new tax considerations. Australia is a federation with legislative powers distributed between the Commonwealth and the States and Territories. This means that a business can have different tax liabilities depending on which state or territory it establishes its business. The Commonwealth Government is responsible for income tax (individual and companies), fringe benefits tax (FBT) and goods and services tax (GST) while the States and Territories typically impose stamp duties, land taxes and payroll taxes.

Similar to the UK there are several different business structures in Australia ranging from a simple sole trader status to a public company. The more common entities being companies, trusts and partnerships. Private businesses seeking limited liability would typically use a propriety company (‘Pty’) which is a private company designed to be used by a maximum of 50 non-employee members. Trusts are also used as business vehicles, and many large groups have unit trusts as part of their group structures. Widely held unit trusts are taxed on their own income at corporate income tax rates whereas closely held trusts are not taxed as separate entities; instead the stakeholders are taxed on their share of the income, ‘flow through’ taxation. Discretionary trusts are popular trading vehicles for SMEs; they provide some generous tax benefits, as well as asset protection. Discretionary trusts allow for income splitting which can reduce the overall tax liability, as the income retains its character when distributed to beneficiaries, and the capital gains tax discount that can halve the rate that applies to some chargeable gains also applies to gains derived by a trust.

Much like the UK, an overseas company establishing an Australian presence would do so through a branch or a subsidiary. Whether a branch creates a taxable presence will depend on whether it comprises a permanent establishment (PE). ITAA 1936 s 6(1) defines a PE as ‘a place at or through which the person carries on any business’, and it then goes on to list what that includes which broadly aligns with the UK definition under CTA 2010 s 1141.

If incorporating a subsidiary this can be a public or private company. Private companies must have at least one director residing in Australia, whereas a public company must have at least three directors and one secretary, with two directors and one secretary residing in Australia.

Whether the business is established as a branch or a subsidiary it would need to have an Australian business number (ABN), Australian tax file number (TFN) and be registered with the Australian Securities & Investments Commission (ASIC).

In this article, we focus on the taxation of corporates which encompasses companies, corporate limited partnerships and public trading trusts. Throughout Australian tax legislation references to company includes any body corporate or unincorporated associations or body of persons but does not include a partnership but it does include a corporate limited partnership (ITAA 1997 s 995-1, ITAA 1936 s 94J).

Companies that are resident in Australia are subject to income tax. A company is resident (ITAA 1936 s 6) in Australia if is:

Income tax also applies to any business profits attributed to a permanent establishment.

Corporate residency was considered a settled matter until the recent case of The Bywater Investments Ltd & Ors v Commissioner of Taxation; Hua Wang Bank Berhad v Commissioner of Taxation [2016] HCA 45 (Bywater).

Prior to Bywater, the Australian Tax Office (ATO) set out its view in Taxation Ruling 2004/15 which stated (at para 19): ‘Where a parent company exercises CM&C [central management and control] in Australia over a subsidiary (but does not conduct the day-to-day activities of the business … FCT ..., the subsidiary would need to also be carrying on business in Australia for it to be a resident under the second statutory test.’

Following Bywater, the Commissioner released a decision impact statement which stated: ‘The approach the Commissioner took in TR 2004/15 in relation to the earlier High Court decision in Malayan Shipping can no longer be sustained … If a company carrying on business has its central management and control in Australia it will necessarily carry on business in Australia. That is so even when the only business carried on in Australia consists of that central management and control, and trading operations are conducted outside this country.’

Prior to this a company not incorporated in Australia needed to have central management and control in Australia and carry on a business in Australia to be tax resident. Foreign companies which were previously outside the Australian tax net were suddenly at risk of being Australian tax resident under domestic law and taxed in Australia on worldwide income.

In the 2020/21 Federal Budget, the government announced that it would make legislative amendments to clarify the corporate tax residency test. It is expected that new test will ensure that a foreign company will only trigger residency where it ‘has a significant economic connection’ with Australia. That connection occurring where the company (a) has central management and control in Australia; and (b) its ‘core commercial activities’ are undertaken in Australia. Crucially companies have the option of applying these rules from March 2017.

Companies are subject to income tax on their assessable income. The full tax rate for companies is 30% but for base rate entities this rate is reduced to 25%. A base rate entity is a company that has an aggregated turnover of less than $50m and 80% or less of their assessable income is passive income (such as dividends and interest).

The tax (or financial) year in Australia runs from 1 July to 30 June. There are provisions that allow a company to apply for a substituted accounting period (SAP). Where an overseas holding company has a different year end date the ATO will typically allow the subsidiary to have a SAP to align their financial year with that of the controlling entity and to prepare their income tax returns on that basis.

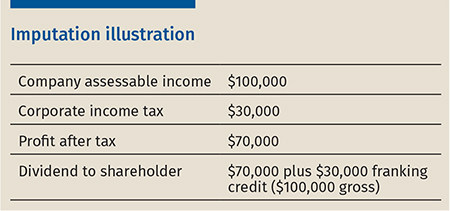

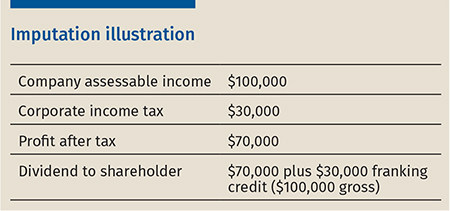

Australia operates an imputation system which enables tax paid on company profits to flow through to members as ‘franking credits’.

This kind of corporate tax system is intended to eliminate the economic double tax on company profits. However, the Australian imputation system is not straightforward. In Australia, when a company declares a distribution it must decide on the amount of the franking credits to attach to that dividend. That could be anywhere between 0% and the company’s income tax rate.

The amount of franking credits to attach to a dividend is an important decision as it establishes the ‘benchmark’ for the period and requires all subsequent dividends paid in the period to be franked to the same percentage. Breaching the benchmarking rule has financial consequences. Under franking results in a debit to the franking account but the shareholders cannot benefit, and over franking results in a penalty tax (ITAA 1997 s 203-50).

Assessable profits are very often less than the distributable profits because of fiscal incentives such as instant asset write offs, research and development etc, so the company may not have enough in its franking account to attach franking credits equivalent to the corporate income tax rate.

When a company makes a frankable distribution, it is required by ITAA 1997 s 202-75 to give shareholders distribution statements showing, inter alia the amount of franking credit. For public companies, this statement must be provided on or before the time the distribution is made. For a private company, this must be provided within four months after the year of income in which the distribution is made. This gives private companies the opportunity to retrospectively determine the amount of franking credits to attach to a dividend and avoid the financial penalties of over or under franking.

Franking credits are a valuable method of passing value to shareholders.

Under domestic law the full rate of withholding tax on dividends to an overseas resident is 30%. Under the UK and Australia DTA this is reduced to 15% subject to the exceptions below:

1. an exemption applies for dividends paid to a listed company that satisfies certain public listing requirements and controls 80% or more of the voting power in the company paying the dividend.

2. a 5% limit applies to dividends paid to other companies with voting power of 10% or greater in the dividend paying company.

3. to the extent that a dividend is franked there is no withholding tax.

The interaction of franking credits and the withholding tax should be considered carefully where dividends are paid to a UK company that is likely to be exempt from corporation tax on the dividend in the UK by virtue of CTA 2009 Part 9A. If the UK company is a holding company then it is within (2) above and the withholding tax rate would be 5%. It would be more economically efficient to frank any dividends up to the 5% rate. That avoids any tax leakage. Where there are multiple shareholders or perhaps individuals, the figures would need to be calculated to ascertain if it is worth franking all the distributions or withholding tax at 30% on the individual payments.

The withholding tax rate for interest payments to the UK is 10% unless the interest payment is directly to a financial institution in which case the withholding rate is reduced to 0%. Whether a payment qualifies as interest is considered later.

The rate of withholding tax on royalties is usually 30% but this is reduced to 5% under the Australia/UK DTA.

Under the Australian/UK DTA, a branch is taxed only on its business profits to the extent that the branch constitutes a PE in Australia in which case the profits attributable to that PE are taxed at corporate income tax rates. There is no tax withholding on profits repatriated to the UK.

The distinction between debt and equity interest is crucial for tax purposes. Payments in relation to debt interest are deductible and are usually not frankable; and payments in relation to equity interest are usually not deductible and are usually frankable. The classification of funding into either debt or equity is dealt with in ITAA 1997 Div 974 which sets out the prescriptive rules.

Where a company receives funds from its shareholder or parent company and there is no documentation or specific terms as regards repayment date these are ‘at-call’ loans so would ordinarily be classified as equity meaning that the interest paid is not deductible. There is a carve out for certain loans made to a connected company where the GST turnover is less than $20m but to ensure that loans are not reclassified as equity for tax purposes it is recommended that loans are documented and the terms and the repayment dates are clearly defined.

The Australian transfer pricing legislation was overhauled in 2013 with the introduction of ITAA 1997 Suddiv 815B to bring it more in line with the OECD model with the rules explicitly focusing on applying arm’s length principles where the cross border condition is satisfied. The cross-border condition ensures that purely domestic arrangements are excluded.

The transfer pricing rules operate by self-assessment. It is the responsibility of the entity to determine if a transfer pricing benefit has arisen and if it has then the entity should make the necessary adjustments by applying the arm’s length substitution rule. Before lodging the income tax return a company must have all its supporting transfer pricing documentation in place. TR 2014/8 Income tax: transfer pricing documentation gives guidance for entities to demonstrate to the ATO that they have complied with the principle and can minimise penalties in the event of an ATO audit adjustment.

Where a company is engaged in international dealings with related parties and has more than $2m of such dealings in a year, the company must complete an international dealings schedule (IDS) and lodge it with the company income tax return.

For companies that are part of an international group with a global revenue of $1bn or more Australia has implemented the OECD’s documentation standards which require:

Transfer pricing is a key focus of the ATO and in recent years the ATO has shared its risk assessment parameters with taxpayers. Through its Practical Compliance Guidelines materials, the ATO has set out its perspective on what are considered safe ‘green zone’ arrangements in relation to transfer pricing issues, as well as detail on what are considered risky ‘red zone’ arrangements. By way of example, for an Australian distributor in the ICT sector where the entity is involved in the sales and marketing, pre and/or post-sales services, and logistics and warehousing functions, a profit margin of 3.6% would be in the ‘red zone’ and considered high risk; a profit margin of 4.1% would be in the ‘green zone’ and considered low risk. Being high risk increases the likelihood of an ATO audit.

Companies can of course apply for an advance pricing arrangement (APA) or agree a settlement with the ATO depending on their circumstances.

The thin capitalisation rules in ITAA 1997 Div 820 apply to inbound and outbound financing arrangements. Under the safe harbour test, the prescribed debt to equity ratio is 1.5:1. Debt deductions will be denied to the extent that borrowing exceeds the allowed maximum debt. The rules apply to total debt, not just related-party. The existence of the safe harbour debt amount does not prevent the transfer pricing rules from applying so the arm’s length cost of the debt funding would need to be considered.

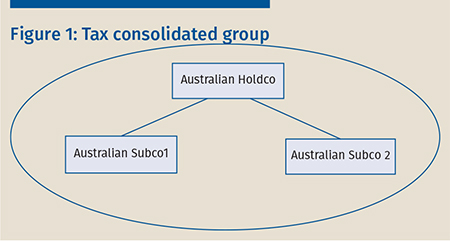

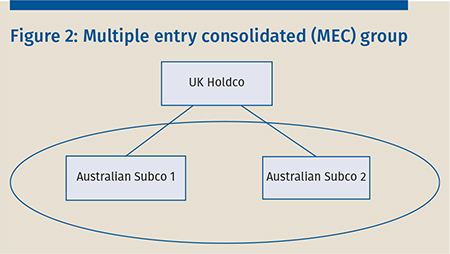

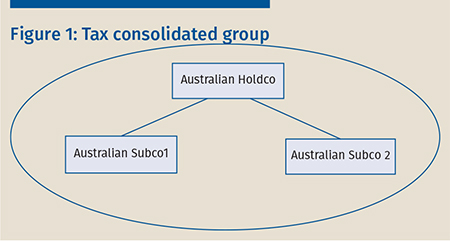

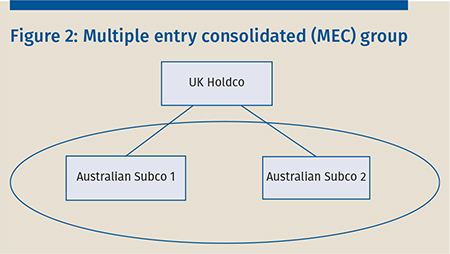

Wholly owned Australian resident entities can elect to form a tax consolidated group. The benefit is that the group is treated as a single consolidated entity for income tax purposes. Australian resident companies that are 100% owned (directly or indirectly) by the same foreign company but have no common Australian head company between them and the non-resident parent can consolidate as a multiple entry consolidated (MEC) group. This consolidation regime makes it easier to restructure groups, it allows for the pooling of losses, intra group transactions are disregarded for tax purposes (avoids the need for management fees), franking credits can be pooled and used across the group, assets can be moved intra group without any formal rollover relief and only one tax return in required. However the election to become a tax consolidated group is irrevocable and there can be adverse tax issues if one of the members leaves the group, so the decision does need to be taken carefully. Furthermore the entities in a consolidated group are jointly and severally liable for the tax liabilities so a formal tax sharing agreement should be entered into.

Employers are required to register for pay as you go withholding (PAYGW) and withhold tax from amounts paid to employees. Employees are required to submit a tax return at the end of the year and report the income and tax withheld. With the availability of generous deductions for employees and tax offsets most employees are in a tax repayment position and this encourages compliance.

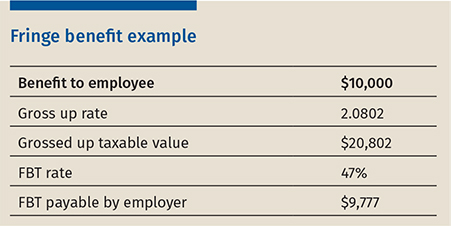

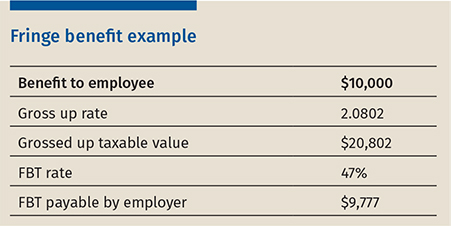

Where non-cash benefits are provided to employees in respect of their employment these are taxable as a fringe benefit. What can take UK companies by surprise is that the fringe benefit tax (FBT) is the employer’s liability. The taxation of fringe benefits is dealt with in the Fringe Benefits Tax Assessment Act 1986 and is payable on benefits such as cars, entertainment, loans, housing and meal entertainment. There is a grossing up mechanism on the value of the benefit with the grossing up percentage dependent on whether the cost of providing the benefit includes GST. For an employer who provides a benefit worth $10,000 to an employee this could result in an FBT charge of $9,777. This puts the cost of providing the benefit at almost twice the expected cost.

The superannuation guarantee (SG) mandates that employers pay 10% of an employee’s earnings into their superannuation fund. There are severe penalties if the amounts are not paid to the super fund by the dues date. The employer must pay a superannuation guarantee charge plus an administration fee that is not tax deductible in addition to the payment of the superannuation amount.

The States and Territories impose a payroll tax where the annual Australian wages exceed an exemption amount. The rates and exemption threshold varies between the states. For example, in NSW the threshold for 2021/22 is $1.2m. Companies with Australian wages of more than $1.2m are liable to a payroll tax charge at 4.85%. The tax is paid monthly with a yearly reconciliation determining the final amount. As well as being imposed on wages, payroll tax is imposed on fringe benefits, superannuation contributions and employee shares.

GST, which is governed by the GST 1999 Act and the associated regulations, is levied at a rate of 10% on most goods and services. Food with some exceptions, exports and some other supplies are ‘GST free’ (similar to zero rated in the UK). Financial supplies and some other supplies are ‘input taxed’ (similar to exempt supplies in the UK).

For ease of administration entities can form a GST group. Companies, trusts and partnerships with common ownership or membership can operate as a GST group. Individuals, or family members of individuals, associated with these entities may also be part of the GST group. The representative member of the group (responsible for preparing activity statement and reporting GST) must be an Australian tax resident. There is no requirement for the other members of the group to be Australian tax resident.

One of the envious features of the Australian tax system is the availability of ATO rulings. A ruling explains a taxpayer’s obligations under a particular part of tax law. There are many types of rulings and for the tax adviser private rulings are frequently used. The closest comparison to the UK is obtaining a clearance from HMRC, but a private ruling can cover anything involved in applying the tax law and ultimate conclusions of fact (for example, on residency status). When applying for a private ruling the ATO can also be asked to consider whether the general anti-avoidance rules, (ITAA 1936 Part IVA) would apply. A private ruling binds the ATO provided all material facts are included. The ATO publish edited versions of all private rulings which are publicly available.

By signing an Agreement in Principle, the UK and Australia have demonstrated their intent to increase trade between the two countries. The next few years will see an increase in UK companies establishing businesses in Australia and vice versa. Understanding the potential tax issues and opportunities facing these businesses will enable advisers to plan and assist clients as they expand into these new markets.

On 15 June 2021, prime ministers Scott Morrison and Boris Johnson announced the main elements that will be included in the Australia/UK Free Trade Agreement. This is expected to lead to increased cross-border activity between the two countries. One of the greatest difficulties in doing business overseas is understanding another jurisdiction’s tax laws and the implications that could have on the domestic tax position.

For businesses expanding into Australia there are several new tax considerations. Australia is a federation with legislative powers distributed between the Commonwealth and the States and Territories. This means that a business can have different tax liabilities depending on which state or territory it establishes its business. The Commonwealth Government is responsible for income tax (individual and companies), fringe benefits tax (FBT) and goods and services tax (GST) while the States and Territories typically impose stamp duties, land taxes and payroll taxes.

Similar to the UK there are several different business structures in Australia ranging from a simple sole trader status to a public company. The more common entities being companies, trusts and partnerships. Private businesses seeking limited liability would typically use a propriety company (‘Pty’) which is a private company designed to be used by a maximum of 50 non-employee members. Trusts are also used as business vehicles, and many large groups have unit trusts as part of their group structures. Widely held unit trusts are taxed on their own income at corporate income tax rates whereas closely held trusts are not taxed as separate entities; instead the stakeholders are taxed on their share of the income, ‘flow through’ taxation. Discretionary trusts are popular trading vehicles for SMEs; they provide some generous tax benefits, as well as asset protection. Discretionary trusts allow for income splitting which can reduce the overall tax liability, as the income retains its character when distributed to beneficiaries, and the capital gains tax discount that can halve the rate that applies to some chargeable gains also applies to gains derived by a trust.

Much like the UK, an overseas company establishing an Australian presence would do so through a branch or a subsidiary. Whether a branch creates a taxable presence will depend on whether it comprises a permanent establishment (PE). ITAA 1936 s 6(1) defines a PE as ‘a place at or through which the person carries on any business’, and it then goes on to list what that includes which broadly aligns with the UK definition under CTA 2010 s 1141.

If incorporating a subsidiary this can be a public or private company. Private companies must have at least one director residing in Australia, whereas a public company must have at least three directors and one secretary, with two directors and one secretary residing in Australia.

Whether the business is established as a branch or a subsidiary it would need to have an Australian business number (ABN), Australian tax file number (TFN) and be registered with the Australian Securities & Investments Commission (ASIC).

In this article, we focus on the taxation of corporates which encompasses companies, corporate limited partnerships and public trading trusts. Throughout Australian tax legislation references to company includes any body corporate or unincorporated associations or body of persons but does not include a partnership but it does include a corporate limited partnership (ITAA 1997 s 995-1, ITAA 1936 s 94J).

Companies that are resident in Australia are subject to income tax. A company is resident (ITAA 1936 s 6) in Australia if is:

Income tax also applies to any business profits attributed to a permanent establishment.

Corporate residency was considered a settled matter until the recent case of The Bywater Investments Ltd & Ors v Commissioner of Taxation; Hua Wang Bank Berhad v Commissioner of Taxation [2016] HCA 45 (Bywater).

Prior to Bywater, the Australian Tax Office (ATO) set out its view in Taxation Ruling 2004/15 which stated (at para 19): ‘Where a parent company exercises CM&C [central management and control] in Australia over a subsidiary (but does not conduct the day-to-day activities of the business … FCT ..., the subsidiary would need to also be carrying on business in Australia for it to be a resident under the second statutory test.’

Following Bywater, the Commissioner released a decision impact statement which stated: ‘The approach the Commissioner took in TR 2004/15 in relation to the earlier High Court decision in Malayan Shipping can no longer be sustained … If a company carrying on business has its central management and control in Australia it will necessarily carry on business in Australia. That is so even when the only business carried on in Australia consists of that central management and control, and trading operations are conducted outside this country.’

Prior to this a company not incorporated in Australia needed to have central management and control in Australia and carry on a business in Australia to be tax resident. Foreign companies which were previously outside the Australian tax net were suddenly at risk of being Australian tax resident under domestic law and taxed in Australia on worldwide income.

In the 2020/21 Federal Budget, the government announced that it would make legislative amendments to clarify the corporate tax residency test. It is expected that new test will ensure that a foreign company will only trigger residency where it ‘has a significant economic connection’ with Australia. That connection occurring where the company (a) has central management and control in Australia; and (b) its ‘core commercial activities’ are undertaken in Australia. Crucially companies have the option of applying these rules from March 2017.

Companies are subject to income tax on their assessable income. The full tax rate for companies is 30% but for base rate entities this rate is reduced to 25%. A base rate entity is a company that has an aggregated turnover of less than $50m and 80% or less of their assessable income is passive income (such as dividends and interest).

The tax (or financial) year in Australia runs from 1 July to 30 June. There are provisions that allow a company to apply for a substituted accounting period (SAP). Where an overseas holding company has a different year end date the ATO will typically allow the subsidiary to have a SAP to align their financial year with that of the controlling entity and to prepare their income tax returns on that basis.

Australia operates an imputation system which enables tax paid on company profits to flow through to members as ‘franking credits’.

This kind of corporate tax system is intended to eliminate the economic double tax on company profits. However, the Australian imputation system is not straightforward. In Australia, when a company declares a distribution it must decide on the amount of the franking credits to attach to that dividend. That could be anywhere between 0% and the company’s income tax rate.

The amount of franking credits to attach to a dividend is an important decision as it establishes the ‘benchmark’ for the period and requires all subsequent dividends paid in the period to be franked to the same percentage. Breaching the benchmarking rule has financial consequences. Under franking results in a debit to the franking account but the shareholders cannot benefit, and over franking results in a penalty tax (ITAA 1997 s 203-50).

Assessable profits are very often less than the distributable profits because of fiscal incentives such as instant asset write offs, research and development etc, so the company may not have enough in its franking account to attach franking credits equivalent to the corporate income tax rate.

When a company makes a frankable distribution, it is required by ITAA 1997 s 202-75 to give shareholders distribution statements showing, inter alia the amount of franking credit. For public companies, this statement must be provided on or before the time the distribution is made. For a private company, this must be provided within four months after the year of income in which the distribution is made. This gives private companies the opportunity to retrospectively determine the amount of franking credits to attach to a dividend and avoid the financial penalties of over or under franking.

Franking credits are a valuable method of passing value to shareholders.

Under domestic law the full rate of withholding tax on dividends to an overseas resident is 30%. Under the UK and Australia DTA this is reduced to 15% subject to the exceptions below:

1. an exemption applies for dividends paid to a listed company that satisfies certain public listing requirements and controls 80% or more of the voting power in the company paying the dividend.

2. a 5% limit applies to dividends paid to other companies with voting power of 10% or greater in the dividend paying company.

3. to the extent that a dividend is franked there is no withholding tax.

The interaction of franking credits and the withholding tax should be considered carefully where dividends are paid to a UK company that is likely to be exempt from corporation tax on the dividend in the UK by virtue of CTA 2009 Part 9A. If the UK company is a holding company then it is within (2) above and the withholding tax rate would be 5%. It would be more economically efficient to frank any dividends up to the 5% rate. That avoids any tax leakage. Where there are multiple shareholders or perhaps individuals, the figures would need to be calculated to ascertain if it is worth franking all the distributions or withholding tax at 30% on the individual payments.

The withholding tax rate for interest payments to the UK is 10% unless the interest payment is directly to a financial institution in which case the withholding rate is reduced to 0%. Whether a payment qualifies as interest is considered later.

The rate of withholding tax on royalties is usually 30% but this is reduced to 5% under the Australia/UK DTA.

Under the Australian/UK DTA, a branch is taxed only on its business profits to the extent that the branch constitutes a PE in Australia in which case the profits attributable to that PE are taxed at corporate income tax rates. There is no tax withholding on profits repatriated to the UK.

The distinction between debt and equity interest is crucial for tax purposes. Payments in relation to debt interest are deductible and are usually not frankable; and payments in relation to equity interest are usually not deductible and are usually frankable. The classification of funding into either debt or equity is dealt with in ITAA 1997 Div 974 which sets out the prescriptive rules.

Where a company receives funds from its shareholder or parent company and there is no documentation or specific terms as regards repayment date these are ‘at-call’ loans so would ordinarily be classified as equity meaning that the interest paid is not deductible. There is a carve out for certain loans made to a connected company where the GST turnover is less than $20m but to ensure that loans are not reclassified as equity for tax purposes it is recommended that loans are documented and the terms and the repayment dates are clearly defined.

The Australian transfer pricing legislation was overhauled in 2013 with the introduction of ITAA 1997 Suddiv 815B to bring it more in line with the OECD model with the rules explicitly focusing on applying arm’s length principles where the cross border condition is satisfied. The cross-border condition ensures that purely domestic arrangements are excluded.

The transfer pricing rules operate by self-assessment. It is the responsibility of the entity to determine if a transfer pricing benefit has arisen and if it has then the entity should make the necessary adjustments by applying the arm’s length substitution rule. Before lodging the income tax return a company must have all its supporting transfer pricing documentation in place. TR 2014/8 Income tax: transfer pricing documentation gives guidance for entities to demonstrate to the ATO that they have complied with the principle and can minimise penalties in the event of an ATO audit adjustment.

Where a company is engaged in international dealings with related parties and has more than $2m of such dealings in a year, the company must complete an international dealings schedule (IDS) and lodge it with the company income tax return.

For companies that are part of an international group with a global revenue of $1bn or more Australia has implemented the OECD’s documentation standards which require:

Transfer pricing is a key focus of the ATO and in recent years the ATO has shared its risk assessment parameters with taxpayers. Through its Practical Compliance Guidelines materials, the ATO has set out its perspective on what are considered safe ‘green zone’ arrangements in relation to transfer pricing issues, as well as detail on what are considered risky ‘red zone’ arrangements. By way of example, for an Australian distributor in the ICT sector where the entity is involved in the sales and marketing, pre and/or post-sales services, and logistics and warehousing functions, a profit margin of 3.6% would be in the ‘red zone’ and considered high risk; a profit margin of 4.1% would be in the ‘green zone’ and considered low risk. Being high risk increases the likelihood of an ATO audit.

Companies can of course apply for an advance pricing arrangement (APA) or agree a settlement with the ATO depending on their circumstances.

The thin capitalisation rules in ITAA 1997 Div 820 apply to inbound and outbound financing arrangements. Under the safe harbour test, the prescribed debt to equity ratio is 1.5:1. Debt deductions will be denied to the extent that borrowing exceeds the allowed maximum debt. The rules apply to total debt, not just related-party. The existence of the safe harbour debt amount does not prevent the transfer pricing rules from applying so the arm’s length cost of the debt funding would need to be considered.

Wholly owned Australian resident entities can elect to form a tax consolidated group. The benefit is that the group is treated as a single consolidated entity for income tax purposes. Australian resident companies that are 100% owned (directly or indirectly) by the same foreign company but have no common Australian head company between them and the non-resident parent can consolidate as a multiple entry consolidated (MEC) group. This consolidation regime makes it easier to restructure groups, it allows for the pooling of losses, intra group transactions are disregarded for tax purposes (avoids the need for management fees), franking credits can be pooled and used across the group, assets can be moved intra group without any formal rollover relief and only one tax return in required. However the election to become a tax consolidated group is irrevocable and there can be adverse tax issues if one of the members leaves the group, so the decision does need to be taken carefully. Furthermore the entities in a consolidated group are jointly and severally liable for the tax liabilities so a formal tax sharing agreement should be entered into.

Employers are required to register for pay as you go withholding (PAYGW) and withhold tax from amounts paid to employees. Employees are required to submit a tax return at the end of the year and report the income and tax withheld. With the availability of generous deductions for employees and tax offsets most employees are in a tax repayment position and this encourages compliance.

Where non-cash benefits are provided to employees in respect of their employment these are taxable as a fringe benefit. What can take UK companies by surprise is that the fringe benefit tax (FBT) is the employer’s liability. The taxation of fringe benefits is dealt with in the Fringe Benefits Tax Assessment Act 1986 and is payable on benefits such as cars, entertainment, loans, housing and meal entertainment. There is a grossing up mechanism on the value of the benefit with the grossing up percentage dependent on whether the cost of providing the benefit includes GST. For an employer who provides a benefit worth $10,000 to an employee this could result in an FBT charge of $9,777. This puts the cost of providing the benefit at almost twice the expected cost.

The superannuation guarantee (SG) mandates that employers pay 10% of an employee’s earnings into their superannuation fund. There are severe penalties if the amounts are not paid to the super fund by the dues date. The employer must pay a superannuation guarantee charge plus an administration fee that is not tax deductible in addition to the payment of the superannuation amount.

The States and Territories impose a payroll tax where the annual Australian wages exceed an exemption amount. The rates and exemption threshold varies between the states. For example, in NSW the threshold for 2021/22 is $1.2m. Companies with Australian wages of more than $1.2m are liable to a payroll tax charge at 4.85%. The tax is paid monthly with a yearly reconciliation determining the final amount. As well as being imposed on wages, payroll tax is imposed on fringe benefits, superannuation contributions and employee shares.

GST, which is governed by the GST 1999 Act and the associated regulations, is levied at a rate of 10% on most goods and services. Food with some exceptions, exports and some other supplies are ‘GST free’ (similar to zero rated in the UK). Financial supplies and some other supplies are ‘input taxed’ (similar to exempt supplies in the UK).

For ease of administration entities can form a GST group. Companies, trusts and partnerships with common ownership or membership can operate as a GST group. Individuals, or family members of individuals, associated with these entities may also be part of the GST group. The representative member of the group (responsible for preparing activity statement and reporting GST) must be an Australian tax resident. There is no requirement for the other members of the group to be Australian tax resident.

One of the envious features of the Australian tax system is the availability of ATO rulings. A ruling explains a taxpayer’s obligations under a particular part of tax law. There are many types of rulings and for the tax adviser private rulings are frequently used. The closest comparison to the UK is obtaining a clearance from HMRC, but a private ruling can cover anything involved in applying the tax law and ultimate conclusions of fact (for example, on residency status). When applying for a private ruling the ATO can also be asked to consider whether the general anti-avoidance rules, (ITAA 1936 Part IVA) would apply. A private ruling binds the ATO provided all material facts are included. The ATO publish edited versions of all private rulings which are publicly available.

By signing an Agreement in Principle, the UK and Australia have demonstrated their intent to increase trade between the two countries. The next few years will see an increase in UK companies establishing businesses in Australia and vice versa. Understanding the potential tax issues and opportunities facing these businesses will enable advisers to plan and assist clients as they expand into these new markets.