At the time of writing, the following had been announced in England, with further guidance expected to be published by the Ministry of Housing, Communities and Local Government in due course:

Different rates relief schemes and grant schemes have been announced in Scotland and Wales, including extensions of certain existing 2020/21 business rate holiday measures for a further 12 months. At the time of writing, Northern Ireland is yet to announce its plans.

Two new temporary capital allowances reliefs were announced in Budget 2021 for companies investing in qualifying new plant and machinery:

These reliefs will apply to qualifying expenditure incurred by companies between 1 April 2021 until 31 March 2023, in respect of contracts entered into on or after 3 March 2021.

Certain types of assets will be excluded, and anti-avoidance provisions will be introduced to counteract contrived arrangements.

CO2 emission thresholds for certain capital allowance purposes change from April 2021:

The relevant emissions thresholds for the 15% restriction on corporation tax and income tax deductions by businesses for the costs of car hire are linked to capital allowance emissions thresholds and therefore reduce to 50 g/km from April 2021, subject to grandfathering rules for existing leases.

Certain enhanced capital allowances provisions will cease to apply in relation to expenditure incurred on or after 1 April 2021. Specifically, these relate to the 100% first-year allowances for qualifying expenditure incurred by certain companies on plant and machinery for use within designated assisted areas of enterprise zones.

There will be a temporarily increase in the period over which companies can carry back trading losses from one year to three years.

Technical changes are also to be made to the corporation tax loss relief rules to ensure that the legislation works as intended and to reduce administrative burdens for businesses. Whilst some of the proposed changes will be given retrospective effect, others will apply only to accounting periods beginning on or after 1 April 2021, and a change to the definition of ‘change of ownership’ will apply to acquisitions made on or after 1 April 2021.

Digital services tax (DST) is charged at a rate of 2% on gross revenues from in-scope activities of large businesses that provide social media services, a search engine or online marketplace to UK users.

The responsible member of a group within the scope of DST is required to notify HMRC if the group exceeds the worldwide and UK revenue threshold conditions. These conditions are broadly:

A notification must be made within 90 days of the end of the first DST accounting period in which the threshold conditions are met. DST was introduced with effect from 1 April 2020, and therefore, for groups with a 31 December accounting period end date, and which meet the threshold conditions, the first notification deadline is 31 March 2021.

Companies that are small and medium enterprises (SMEs) for R&D purposes are entitled to an additional deduction of 130% of qualifying R&D expenditure that is not subsidised. For non-taxpaying SMEs, a cash alternative of up to 33.35 pence for every pound of qualifying expenditure may be available depending on their current year tax losses.

For accounting periods beginning on or after 1 April 2021, there will be a cap on the cash credit available to SMEs. Amounts will be capped at £20,000 plus three times the amount paid in respect of PAYE and class 1 NIC liabilities. A company will be exempt from the cap if its employees are creating, preparing to create, or actively managing intellectual property, and its qualifying R&D expenditure does not include more than 15% of spend relating to connected party subcontractors or connected party externally provided workers.

For cars first registered since 6 April 2020, CO2 emissions are measured under a more stringent test regime which has led to higher CO2 emissions figures for most cars. To adjust for this, company car tax rates for these cars will be discounted by one percentage point of the car’s list price in 2021/22, compared to cars registered before 6 April 2020. By 2022/23, the percentages in the regimes for cars registered before and after 6 April 2020 will be aligned once again.

In respect of vehicles registered up to 5 April 2020, the tax charge percentages for all cars other than zero emission vehicles will be frozen at 2020/21 rates. The diesel supplement will continue to be an additional 4% of list price, up to the 37% maximum, except for cars certified to the RDE2 emission standard.

Once the rates for the two CO2 test regimes are aligned again, the rates will be frozen at 2022/23 levels for two years until 2024/25.

In both regimes, fully electric cars will be taxed at 1% of list price (up from 0% in 2020/21) and the rate for ultra-low emission vehicles (CO22emissions of up to 50g/km) continues to depend on the electric range of the vehicle. Zero emission vans will benefit from a new 0% tax charge from 2021/22.

From 6 April 2021, the benefit in kind for private fuel provided in company cars or vans will be calculated at the relevant percentage x £24,600. The van benefit charge will increase to £3,500 and the fuel benefit charge for vans will increase to £669.

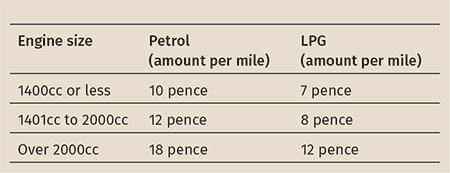

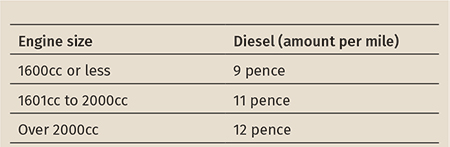

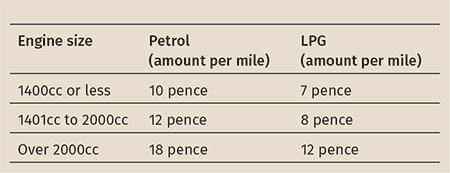

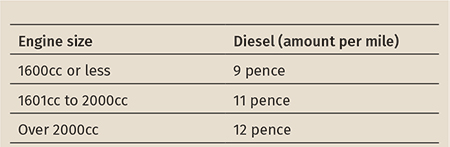

The advisory fuel rates for company car mileage were updated from 1 March 2021:

The advisory fuel rate for fully electric cars remains at 4p per mile.

The government has extended the tax and NICs exemption for employer-provided or reimbursed COVID-19 tests until 5 April 2022. The exemption had been due to come to an end on 5 April 2021 but was extended at the Budget on 3 March 2021. It covers employer-provided and employer-reimbursed PCR and lateral flow antigen and RNA tests. Antibody tests are not covered by the exemption.

The exemption for employer-reimbursed home office expenses was also due to come to an end on 5 April 2021 and has been extended until 5 April 2022.

Under an enterprise management incentive (EMI) scheme, small and medium sized companies can grant tax efficient share options to employees. One condition which must be satisfied for the tax favourable treatment, relates to the minimum amount of time an employee works for the company. A temporary easement of this condition has allowed employees who are furloughed or who have their working hours reduced below the minimum as a result of covid-19 to retain access to the scheme’s tax advantages. This easement was also extended to 6 April 2022 at the Budget and will apply both to existing participants of EMI schemes and in circumstances where new EMI share options are being granted.

One of the conditions for the tax favoured treatment of ‘cycle to work’ schemes is that the cycling equipment provided should be used mainly for ‘qualifying journeys’ (i.e. work journeys or commuting). The government introduced a time-limited easement to disapply that condition, available to employees who have joined a scheme and have been provided with cycle equipment on or before 20 December 2020. For these arrangements, it will be in place until 5 April 2022, after which the normal rules of the exemption will apply. Any bikes provided after 20 December 2020 will need to meet the condition to benefit from the tax advantages.

From 6 April 2021, medium and large companies will be responsible for determining the employment status of contractors working through an intermediary such as a personal service company (PSC). The rules have applied in the public sector since 2017. End clients will need to determine whether the worker would be employed or self-employed if they were engaged directly by the end client. End clients will have to issue a status determination statement (SDS) to the worker and any agency they directly contract with to communicate their conclusion, with reasons. In general, the entity paying the worker’s PSC will need to operate PAYE/NIC on payments made for the worker’s services. This will normally be the end client or an agency.

Arrangements where the end client is small (under Companies Act definitions) will be excluded from the new rules. Similarly, if the end client is neither UK resident nor has a permanent establishment in the UK, the new regime will not apply. Instead, the previous IR35 rules will continue to apply in these cases, under which the PSC itself needs to assess the hypothetical employment status and apply PAYE/NIC where appropriate.

The new rules will apply to payments made on or after 6 April 2021, but only in so far as they are in respect of work performed on or after 6 April 2021.

There will be a slight change in the way the taxable post-employment notice pay (PENP) element of a termination payment is calculated if an employee’s pay period is defined in months, but their contractual notice period or post-employment notice period is not a whole number of months. In such a case, the monthly pay will have to be divided by 30.42 to arrive at a daily equivalent and not by the actual number of days in the month. The new calculation method has been optional since October 2019 but will become mandatory from 6 April 2021.

The tax treatment of a PENP for employees who are non-resident in the year of termination will also be aligned with the treatment which applies to UK residents. The amounts will be taxable to the extent the employee would have worked in the UK during their notice period.

APD rates for flights over 2,000 miles (‘band B’ destinations) increase on 1 April 2021. The reduced rate of APD for the lowest class of travel (economy) will increase by £2, and the standard rate (for carriage in a higher class of travel) by £4. The rate of APD for the carriage of passengers in private jets will rise by £13.

The main rates of CCL will change from 1 April 2021. The CCL rate for electricity is being lowered and the rate on gas is being raised, to reach 60% of the main electricity rate. There are also adjustments to the level of CCL reduction for intensive energy sectors with Climate Change Agreements (CCA) with the government.

The gross gaming yield bandings will increase in line with inflation for accounting periods beginning on or after 1 April 2021.

The rates of landfill tax for England and Northern Ireland will increase from 1 April 2021. The standard rate will increase to £96.70 per tonne, from £94.15 and the lower rate to £3.10 per tonne, from £3.00.

From 1 April 2019, or 1 October 2019 for VAT-registered businesses with more complex requirements, VAT-registered businesses with taxable turnover above the VAT threshold (£85,000) have been required to keep records digitally and use software to submit their VAT returns. For VAT periods starting on or after 1 April 2021, businesses must also have in place digital links between all parts of their software programs, products and applications that feed the indirect tax compliance process.

The temporary reduced VAT rate of 5% for goods and services supplied by the tourism and hospitality sector was scheduled to come to an end on 31 March 2021. This has now been extended until 30 September 2021, at which point the rate will increase to 12.5% for a further six months until 31 March 2022, before returning to 20%.

From 1 April 2021, VED rates for cars, vans and motorcycles will increase in line with inflation.

VED rates for heavy goods vehicles (HGVs) will be frozen and the HGV levy will be suspended for another 12 months from August 2021.

One of the biggest pieces of news in the Budget was the freezing of many rates and allowances for five years. In 2021/22, most rates and allowances will increase based on the consumer prices index (0.5%), before some of those rates and allowances are frozen for five years until April 2026.

For individual taxpayers across the whole of the UK, the personal allowance will increase by £70 from £12,500 to £12,570. The personal allowance will be frozen until April 2026. The below zero rate bands will remain at their 2020/21 level in 2021/22:

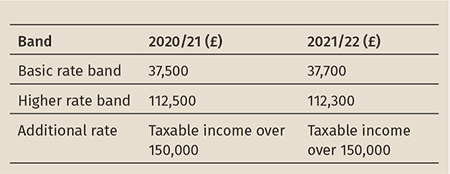

For taxpayers resident in England, Northern Ireland and Wales:

Taxable non-savings income and savings income in excess of the zero rate bands will remain subject to 20% basic rate tax, 40% higher rate tax and 45% additional rate tax. Dividend income in excess of the nil rate band will remain subject to 7.5% basic rate, 32.5% higher rate and 38.1% additional rate taxation.

The higher rate threshold is frozen at £50,270 until April 2026 (£12,570 + £37,700).

Wales has a devolved power to set income tax rates applying to non-savings, non-dividend income for Welsh tax residents. However, in 2021/22 the income tax rates will remain the same as for taxpayers in England and Northern Ireland.

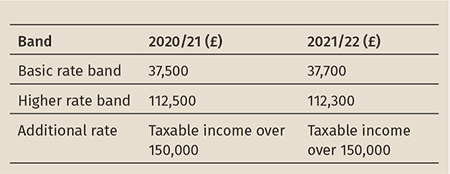

The table below summarises income tax bands in 2021/22 compared to 2020/21. The table summarises the personal allowance and the basic rate, higher rate and additional rate tax bands that apply to income received by UK resident taxpayers, with the exception of non-savings, non-dividend income received by Scottish resident taxpayers, to which different income tax bands apply (see below).

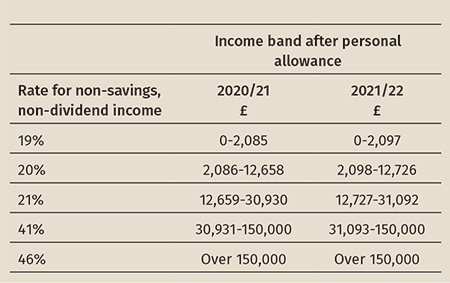

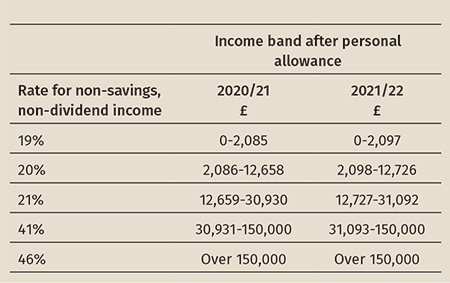

Different rates and thresholds apply to non-savings, non-dividend income for Scottish resident taxpayers. The 2021/22 tax rates remain unchanged compared to 2020/21.

The 2021/22 bands in comparison to 2020/21 and applicable tax rates are:

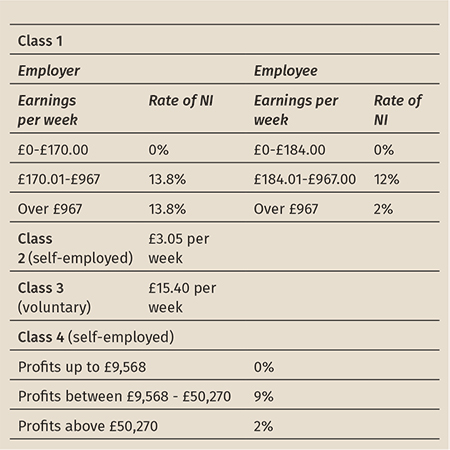

NICs limits will also rise with the CPI with effect from 6 April 2021.

The primary threshold for employees (above which NICs are payable at 12%) increases from £9,500 per annum to £9,568 and the upper earnings limit (above which the NIC rate is 2%) rises from £50,000 to £50,270 in line with the higher rate threshold.

As the upper limits for NICs are linked to the income tax higher rate threshold, these are frozen at £50,270 until April 2026. The amount of all other NIC thresholds will be considered in future fiscal events.

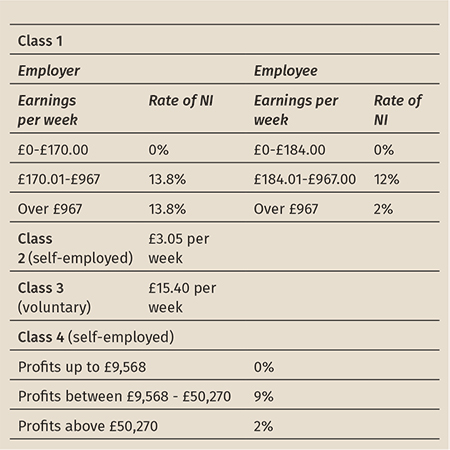

The table below summarises NIC rates for 2021/22.

The HICBC is an income tax charge that applies where the higher earner of a couple has income exceeding £50,000 and one or both of them has received child benefit payments. The charge is 1% of the child benefit payments for every £100 of additional income, resulting in full clawback where income is £60,000 or more. These thresholds have been fixed since the charge was introduced in 2012/13. To date the charge has only affected higher rate taxpayers.

As the higher rate threshold has increased to £50,270 for 2021/22, but the HICBC threshold remains £50,000, this means that some basic rate taxpayers will become subject to the HICBC.

The annual exempt amount will not increase in 2021/22. It will remain at £12,300 for individuals and £6,150 for trustees. The annual exempt amount is now frozen at 2020/21 levels until April 2026.

No changes were made to CGT rates for 2021/22: CGT rates remain unchanged from 2020/21.

The inheritance tax nil rate band remains frozen at £325,000. The nil rate band has been £325,000 since 6 April 2009.

The residence nil rate band in 2021/22 will be frozen at its 2020/21 level of £175,000. The residence nil rate band is tapered by £1 for every £2 the estate is worth in excess of £2m.

Both the inheritance tax nil rate band and residence nil rate band are frozen until April 2026.

No changes were announced to the annual allowance which will remain at its 2020/21 level in 2021/22. The standard lifetime allowance will remain at £40,000 and will be subject to tapering down to a minimum £4,000 annual allowance for individuals with adjusted income in excess of £240,000. The annual allowance is not subject to tapering if the individual’s income (before adding back pension contributions) is £200,000 or less.

The lifetime allowance is frozen at its 2020/21 level of £1,073,100 until April 2026.

The ISA limits for 2021/22 remain unchanged from 2020/21. These are:

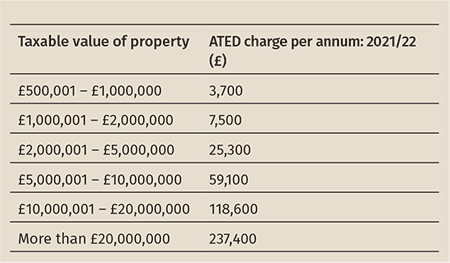

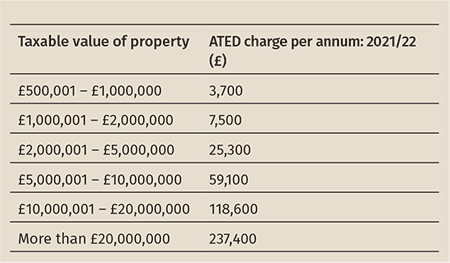

The ATED rates for 2021/22 will increase with CPI from 1 April (0.5% – rounded down to the nearest £50).

Relief from ATED is available for certain businesses and investors. Reliefs are available to, amongst others, property rental businesses, property developers and property traders. Relief must be claimed annually. In the March 2021 Budget, the government confirmed that a new relief from ATED for qualifying housing co-operatives in relation to chargeable periods from 1 April 2020 onwards will be enacted. Where applicable it will be possible to claim a refund for ATED already paid where the new relief is retrospectively available.

Nil rate band: In the Scottish Budget 2021/22, the Scottish government confirmed the increased nil rate band will not be extended for LBTT purposes. From 1 April 2021, the nil rate band will revert to its usual £145,000 level, following the temporary increase to £250,000.

Nil rate band: The Welsh Revenue Authority have announced that the temporary increase in the LTT nil rate band to £250,000 will be extended and will continue to apply to purchases made up to 30 June 2021. From 1 July 2021 the nil rate band will revert to its usual level of £180,000.

Nil rate band: It was announced in the Budget that the temporary increase in the SDLT nil rate band that applies on the purchase of residential property in England or Northern Ireland will be extended. The nil rate band will therefore remain at £500,000 until 30 June 2021.

The nil rate band will then halve, and it will be £250,000 for purchases made between 1 July 2021 and 30 September 2021. It will then revert to its usual level of £125,000.

Surcharge applicable to non-UK residents: The government have confirmed that a 2% surcharge will apply to non-UK residents purchasing residential property in England or Northern Ireland on or after 1 April 2021. A specific residence test will be introduced for SDLT purposes, and so residence for SDLT purposes may differ from that which applies for other tax purposes.

The surcharge will apply to non-UK residents who are either natural persons (i.e. individuals) or non-natural persons (e.g. trusts, companies and partnerships).

The surcharge will also apply to UK resident close companies that are controlled by non-UK resident shareholders.

Relief from 15% SDLT rate for co-operatives: A new relief from the 15% SDLT rate will be introduced to apply to housing cooperatives, to align with the relief being introduced for ATED purposes. The SDLT relief will apply to transactions with an effective date of 3 March 2021 or later.

Freeports (England only): Full relief from SDLT will be introduced on the purchase of land within one of eight designated ‘freeports’ within England. Relief will be available for purchases made between the date of designation of a site as a freeport and 30 September 2026. The relief will be legislated for in Finance Bill 2021.

At the time of writing, the following had been announced in England, with further guidance expected to be published by the Ministry of Housing, Communities and Local Government in due course:

Different rates relief schemes and grant schemes have been announced in Scotland and Wales, including extensions of certain existing 2020/21 business rate holiday measures for a further 12 months. At the time of writing, Northern Ireland is yet to announce its plans.

Two new temporary capital allowances reliefs were announced in Budget 2021 for companies investing in qualifying new plant and machinery:

These reliefs will apply to qualifying expenditure incurred by companies between 1 April 2021 until 31 March 2023, in respect of contracts entered into on or after 3 March 2021.

Certain types of assets will be excluded, and anti-avoidance provisions will be introduced to counteract contrived arrangements.

CO2 emission thresholds for certain capital allowance purposes change from April 2021:

The relevant emissions thresholds for the 15% restriction on corporation tax and income tax deductions by businesses for the costs of car hire are linked to capital allowance emissions thresholds and therefore reduce to 50 g/km from April 2021, subject to grandfathering rules for existing leases.

Certain enhanced capital allowances provisions will cease to apply in relation to expenditure incurred on or after 1 April 2021. Specifically, these relate to the 100% first-year allowances for qualifying expenditure incurred by certain companies on plant and machinery for use within designated assisted areas of enterprise zones.

There will be a temporarily increase in the period over which companies can carry back trading losses from one year to three years.

Technical changes are also to be made to the corporation tax loss relief rules to ensure that the legislation works as intended and to reduce administrative burdens for businesses. Whilst some of the proposed changes will be given retrospective effect, others will apply only to accounting periods beginning on or after 1 April 2021, and a change to the definition of ‘change of ownership’ will apply to acquisitions made on or after 1 April 2021.

Digital services tax (DST) is charged at a rate of 2% on gross revenues from in-scope activities of large businesses that provide social media services, a search engine or online marketplace to UK users.

The responsible member of a group within the scope of DST is required to notify HMRC if the group exceeds the worldwide and UK revenue threshold conditions. These conditions are broadly:

A notification must be made within 90 days of the end of the first DST accounting period in which the threshold conditions are met. DST was introduced with effect from 1 April 2020, and therefore, for groups with a 31 December accounting period end date, and which meet the threshold conditions, the first notification deadline is 31 March 2021.

Companies that are small and medium enterprises (SMEs) for R&D purposes are entitled to an additional deduction of 130% of qualifying R&D expenditure that is not subsidised. For non-taxpaying SMEs, a cash alternative of up to 33.35 pence for every pound of qualifying expenditure may be available depending on their current year tax losses.

For accounting periods beginning on or after 1 April 2021, there will be a cap on the cash credit available to SMEs. Amounts will be capped at £20,000 plus three times the amount paid in respect of PAYE and class 1 NIC liabilities. A company will be exempt from the cap if its employees are creating, preparing to create, or actively managing intellectual property, and its qualifying R&D expenditure does not include more than 15% of spend relating to connected party subcontractors or connected party externally provided workers.

For cars first registered since 6 April 2020, CO2 emissions are measured under a more stringent test regime which has led to higher CO2 emissions figures for most cars. To adjust for this, company car tax rates for these cars will be discounted by one percentage point of the car’s list price in 2021/22, compared to cars registered before 6 April 2020. By 2022/23, the percentages in the regimes for cars registered before and after 6 April 2020 will be aligned once again.

In respect of vehicles registered up to 5 April 2020, the tax charge percentages for all cars other than zero emission vehicles will be frozen at 2020/21 rates. The diesel supplement will continue to be an additional 4% of list price, up to the 37% maximum, except for cars certified to the RDE2 emission standard.

Once the rates for the two CO2 test regimes are aligned again, the rates will be frozen at 2022/23 levels for two years until 2024/25.

In both regimes, fully electric cars will be taxed at 1% of list price (up from 0% in 2020/21) and the rate for ultra-low emission vehicles (CO22emissions of up to 50g/km) continues to depend on the electric range of the vehicle. Zero emission vans will benefit from a new 0% tax charge from 2021/22.

From 6 April 2021, the benefit in kind for private fuel provided in company cars or vans will be calculated at the relevant percentage x £24,600. The van benefit charge will increase to £3,500 and the fuel benefit charge for vans will increase to £669.

The advisory fuel rates for company car mileage were updated from 1 March 2021:

The advisory fuel rate for fully electric cars remains at 4p per mile.

The government has extended the tax and NICs exemption for employer-provided or reimbursed COVID-19 tests until 5 April 2022. The exemption had been due to come to an end on 5 April 2021 but was extended at the Budget on 3 March 2021. It covers employer-provided and employer-reimbursed PCR and lateral flow antigen and RNA tests. Antibody tests are not covered by the exemption.

The exemption for employer-reimbursed home office expenses was also due to come to an end on 5 April 2021 and has been extended until 5 April 2022.

Under an enterprise management incentive (EMI) scheme, small and medium sized companies can grant tax efficient share options to employees. One condition which must be satisfied for the tax favourable treatment, relates to the minimum amount of time an employee works for the company. A temporary easement of this condition has allowed employees who are furloughed or who have their working hours reduced below the minimum as a result of covid-19 to retain access to the scheme’s tax advantages. This easement was also extended to 6 April 2022 at the Budget and will apply both to existing participants of EMI schemes and in circumstances where new EMI share options are being granted.

One of the conditions for the tax favoured treatment of ‘cycle to work’ schemes is that the cycling equipment provided should be used mainly for ‘qualifying journeys’ (i.e. work journeys or commuting). The government introduced a time-limited easement to disapply that condition, available to employees who have joined a scheme and have been provided with cycle equipment on or before 20 December 2020. For these arrangements, it will be in place until 5 April 2022, after which the normal rules of the exemption will apply. Any bikes provided after 20 December 2020 will need to meet the condition to benefit from the tax advantages.

From 6 April 2021, medium and large companies will be responsible for determining the employment status of contractors working through an intermediary such as a personal service company (PSC). The rules have applied in the public sector since 2017. End clients will need to determine whether the worker would be employed or self-employed if they were engaged directly by the end client. End clients will have to issue a status determination statement (SDS) to the worker and any agency they directly contract with to communicate their conclusion, with reasons. In general, the entity paying the worker’s PSC will need to operate PAYE/NIC on payments made for the worker’s services. This will normally be the end client or an agency.

Arrangements where the end client is small (under Companies Act definitions) will be excluded from the new rules. Similarly, if the end client is neither UK resident nor has a permanent establishment in the UK, the new regime will not apply. Instead, the previous IR35 rules will continue to apply in these cases, under which the PSC itself needs to assess the hypothetical employment status and apply PAYE/NIC where appropriate.

The new rules will apply to payments made on or after 6 April 2021, but only in so far as they are in respect of work performed on or after 6 April 2021.

There will be a slight change in the way the taxable post-employment notice pay (PENP) element of a termination payment is calculated if an employee’s pay period is defined in months, but their contractual notice period or post-employment notice period is not a whole number of months. In such a case, the monthly pay will have to be divided by 30.42 to arrive at a daily equivalent and not by the actual number of days in the month. The new calculation method has been optional since October 2019 but will become mandatory from 6 April 2021.

The tax treatment of a PENP for employees who are non-resident in the year of termination will also be aligned with the treatment which applies to UK residents. The amounts will be taxable to the extent the employee would have worked in the UK during their notice period.

APD rates for flights over 2,000 miles (‘band B’ destinations) increase on 1 April 2021. The reduced rate of APD for the lowest class of travel (economy) will increase by £2, and the standard rate (for carriage in a higher class of travel) by £4. The rate of APD for the carriage of passengers in private jets will rise by £13.

The main rates of CCL will change from 1 April 2021. The CCL rate for electricity is being lowered and the rate on gas is being raised, to reach 60% of the main electricity rate. There are also adjustments to the level of CCL reduction for intensive energy sectors with Climate Change Agreements (CCA) with the government.

The gross gaming yield bandings will increase in line with inflation for accounting periods beginning on or after 1 April 2021.

The rates of landfill tax for England and Northern Ireland will increase from 1 April 2021. The standard rate will increase to £96.70 per tonne, from £94.15 and the lower rate to £3.10 per tonne, from £3.00.

From 1 April 2019, or 1 October 2019 for VAT-registered businesses with more complex requirements, VAT-registered businesses with taxable turnover above the VAT threshold (£85,000) have been required to keep records digitally and use software to submit their VAT returns. For VAT periods starting on or after 1 April 2021, businesses must also have in place digital links between all parts of their software programs, products and applications that feed the indirect tax compliance process.

The temporary reduced VAT rate of 5% for goods and services supplied by the tourism and hospitality sector was scheduled to come to an end on 31 March 2021. This has now been extended until 30 September 2021, at which point the rate will increase to 12.5% for a further six months until 31 March 2022, before returning to 20%.

From 1 April 2021, VED rates for cars, vans and motorcycles will increase in line with inflation.

VED rates for heavy goods vehicles (HGVs) will be frozen and the HGV levy will be suspended for another 12 months from August 2021.

One of the biggest pieces of news in the Budget was the freezing of many rates and allowances for five years. In 2021/22, most rates and allowances will increase based on the consumer prices index (0.5%), before some of those rates and allowances are frozen for five years until April 2026.

For individual taxpayers across the whole of the UK, the personal allowance will increase by £70 from £12,500 to £12,570. The personal allowance will be frozen until April 2026. The below zero rate bands will remain at their 2020/21 level in 2021/22:

For taxpayers resident in England, Northern Ireland and Wales:

Taxable non-savings income and savings income in excess of the zero rate bands will remain subject to 20% basic rate tax, 40% higher rate tax and 45% additional rate tax. Dividend income in excess of the nil rate band will remain subject to 7.5% basic rate, 32.5% higher rate and 38.1% additional rate taxation.

The higher rate threshold is frozen at £50,270 until April 2026 (£12,570 + £37,700).

Wales has a devolved power to set income tax rates applying to non-savings, non-dividend income for Welsh tax residents. However, in 2021/22 the income tax rates will remain the same as for taxpayers in England and Northern Ireland.

The table below summarises income tax bands in 2021/22 compared to 2020/21. The table summarises the personal allowance and the basic rate, higher rate and additional rate tax bands that apply to income received by UK resident taxpayers, with the exception of non-savings, non-dividend income received by Scottish resident taxpayers, to which different income tax bands apply (see below).

Different rates and thresholds apply to non-savings, non-dividend income for Scottish resident taxpayers. The 2021/22 tax rates remain unchanged compared to 2020/21.

The 2021/22 bands in comparison to 2020/21 and applicable tax rates are:

NICs limits will also rise with the CPI with effect from 6 April 2021.

The primary threshold for employees (above which NICs are payable at 12%) increases from £9,500 per annum to £9,568 and the upper earnings limit (above which the NIC rate is 2%) rises from £50,000 to £50,270 in line with the higher rate threshold.

As the upper limits for NICs are linked to the income tax higher rate threshold, these are frozen at £50,270 until April 2026. The amount of all other NIC thresholds will be considered in future fiscal events.

The table below summarises NIC rates for 2021/22.

The HICBC is an income tax charge that applies where the higher earner of a couple has income exceeding £50,000 and one or both of them has received child benefit payments. The charge is 1% of the child benefit payments for every £100 of additional income, resulting in full clawback where income is £60,000 or more. These thresholds have been fixed since the charge was introduced in 2012/13. To date the charge has only affected higher rate taxpayers.

As the higher rate threshold has increased to £50,270 for 2021/22, but the HICBC threshold remains £50,000, this means that some basic rate taxpayers will become subject to the HICBC.

The annual exempt amount will not increase in 2021/22. It will remain at £12,300 for individuals and £6,150 for trustees. The annual exempt amount is now frozen at 2020/21 levels until April 2026.

No changes were made to CGT rates for 2021/22: CGT rates remain unchanged from 2020/21.

The inheritance tax nil rate band remains frozen at £325,000. The nil rate band has been £325,000 since 6 April 2009.

The residence nil rate band in 2021/22 will be frozen at its 2020/21 level of £175,000. The residence nil rate band is tapered by £1 for every £2 the estate is worth in excess of £2m.

Both the inheritance tax nil rate band and residence nil rate band are frozen until April 2026.

No changes were announced to the annual allowance which will remain at its 2020/21 level in 2021/22. The standard lifetime allowance will remain at £40,000 and will be subject to tapering down to a minimum £4,000 annual allowance for individuals with adjusted income in excess of £240,000. The annual allowance is not subject to tapering if the individual’s income (before adding back pension contributions) is £200,000 or less.

The lifetime allowance is frozen at its 2020/21 level of £1,073,100 until April 2026.

The ISA limits for 2021/22 remain unchanged from 2020/21. These are:

The ATED rates for 2021/22 will increase with CPI from 1 April (0.5% – rounded down to the nearest £50).

Relief from ATED is available for certain businesses and investors. Reliefs are available to, amongst others, property rental businesses, property developers and property traders. Relief must be claimed annually. In the March 2021 Budget, the government confirmed that a new relief from ATED for qualifying housing co-operatives in relation to chargeable periods from 1 April 2020 onwards will be enacted. Where applicable it will be possible to claim a refund for ATED already paid where the new relief is retrospectively available.

Nil rate band: In the Scottish Budget 2021/22, the Scottish government confirmed the increased nil rate band will not be extended for LBTT purposes. From 1 April 2021, the nil rate band will revert to its usual £145,000 level, following the temporary increase to £250,000.

Nil rate band: The Welsh Revenue Authority have announced that the temporary increase in the LTT nil rate band to £250,000 will be extended and will continue to apply to purchases made up to 30 June 2021. From 1 July 2021 the nil rate band will revert to its usual level of £180,000.

Nil rate band: It was announced in the Budget that the temporary increase in the SDLT nil rate band that applies on the purchase of residential property in England or Northern Ireland will be extended. The nil rate band will therefore remain at £500,000 until 30 June 2021.

The nil rate band will then halve, and it will be £250,000 for purchases made between 1 July 2021 and 30 September 2021. It will then revert to its usual level of £125,000.

Surcharge applicable to non-UK residents: The government have confirmed that a 2% surcharge will apply to non-UK residents purchasing residential property in England or Northern Ireland on or after 1 April 2021. A specific residence test will be introduced for SDLT purposes, and so residence for SDLT purposes may differ from that which applies for other tax purposes.

The surcharge will apply to non-UK residents who are either natural persons (i.e. individuals) or non-natural persons (e.g. trusts, companies and partnerships).

The surcharge will also apply to UK resident close companies that are controlled by non-UK resident shareholders.

Relief from 15% SDLT rate for co-operatives: A new relief from the 15% SDLT rate will be introduced to apply to housing cooperatives, to align with the relief being introduced for ATED purposes. The SDLT relief will apply to transactions with an effective date of 3 March 2021 or later.

Freeports (England only): Full relief from SDLT will be introduced on the purchase of land within one of eight designated ‘freeports’ within England. Relief will be available for purchases made between the date of designation of a site as a freeport and 30 September 2026. The relief will be legislated for in Finance Bill 2021.