Rishi Sunak set himself three objectives in this Budget. First and foremost, he wanted to support the economy through the rest of this pandemic. Second, he wanted to chart a path back to fiscal sustainability in the medium term. Third, he wanted to support longer term growth.

He did so against an economic backdrop that remains difficult and uncertain, but should soon start to improve, according to the latest Office for Budget Responsibility (OBR) forecasts. This is primarily because, while the OBR had not anticipated the third national lockdown when it prepared its previous forecasts last November, it had also not expected vaccines to roll out so fast.

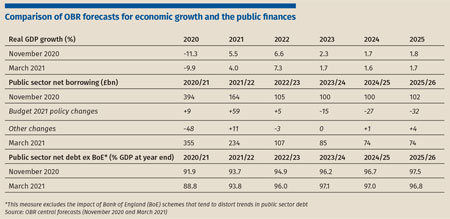

The net effect of these offsetting factors is, as the table below shows, a somewhat lower average GDP growth rate in 2021 due to the slow start to this year because of the lockdown, but a somewhat quicker recovery after that and into 2022. The OBR’s central estimate of the longer term ‘scarring’ to the UK economy from the pandemic has remained at 3% of GDP, however – the same as in November. Without policy changes, a smaller economy implies a significant potential hole in the public finances from lower tax receipts.

In the event, there were significant policy changes in the Budget, the net impact of which on public borrowing is shown in the table. In the short term, these measures push up the deficit in 2021/22 by an estimated £59bn, with around £43bn of this being due to extension of the furlough scheme and other virus-related support measures for both individuals and businesses. The other £16bn is due to net tax cuts, primarily the capital allowances ‘super deduction’, which represents an estimated giveaway of around £12bn–13bn in both 2021/22 and 2022/23.

In addition to some other changes to economic and fiscal assumptions, this leads the OBR to project the budget deficit in 2021/22 to be £234bn, just over 10% of GDP and around £70bn higher than its estimate of £164bn in November.

From 2022/23 onwards, however, almost all the virus-related support measures are assumed to come to an end and tax rises start to come into effect. These start small with the freezing of income tax allowances and thresholds from April 2022 but become significant from 2023/24 onwards when the main corporation tax rate rises sharply to 25% and the capital allowance super deduction comes to an end. By 2025/26, the implied net tax rise is estimated by the OBR to be around £28bn.

Departmental spending plans in 2022/23 and subsequent years have also been cut back by around £4bn per annum, on top of the £10bn–12bn of cuts to previous plans announced in November. However, the detail of where these cuts will fall will have to wait for the spending review in the autumn. As the OBR points out, it will be challenging to keep to these spending plans at a time of rising public demands to spend more in areas like the NHS, social care and education in the wake of the pandemic.

The chancellor’s Budget measures did enable him to reduce projected borrowing in 2025/26 from around £102bn to an estimated £74bn, which is just low enough to meet the ‘golden rule’ of borrowing only to invest. It would also just about be enough to stabilise underlying public debt (excluding Bank of England schemes that distort debt trends) at just under 100% of GDP.

But by pre-announcing large tax rises from 2023, as well as tighter public spending plans from next year, Sunak might also dampen the economic recovery on which his fiscal calculations depend.

Rishi Sunak set himself three objectives in this Budget. First and foremost, he wanted to support the economy through the rest of this pandemic. Second, he wanted to chart a path back to fiscal sustainability in the medium term. Third, he wanted to support longer term growth.

He did so against an economic backdrop that remains difficult and uncertain, but should soon start to improve, according to the latest Office for Budget Responsibility (OBR) forecasts. This is primarily because, while the OBR had not anticipated the third national lockdown when it prepared its previous forecasts last November, it had also not expected vaccines to roll out so fast.

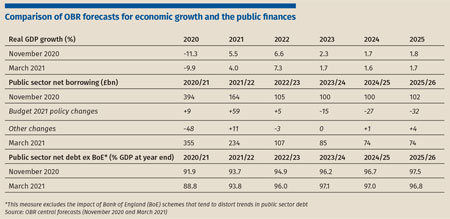

The net effect of these offsetting factors is, as the table below shows, a somewhat lower average GDP growth rate in 2021 due to the slow start to this year because of the lockdown, but a somewhat quicker recovery after that and into 2022. The OBR’s central estimate of the longer term ‘scarring’ to the UK economy from the pandemic has remained at 3% of GDP, however – the same as in November. Without policy changes, a smaller economy implies a significant potential hole in the public finances from lower tax receipts.

In the event, there were significant policy changes in the Budget, the net impact of which on public borrowing is shown in the table. In the short term, these measures push up the deficit in 2021/22 by an estimated £59bn, with around £43bn of this being due to extension of the furlough scheme and other virus-related support measures for both individuals and businesses. The other £16bn is due to net tax cuts, primarily the capital allowances ‘super deduction’, which represents an estimated giveaway of around £12bn–13bn in both 2021/22 and 2022/23.

In addition to some other changes to economic and fiscal assumptions, this leads the OBR to project the budget deficit in 2021/22 to be £234bn, just over 10% of GDP and around £70bn higher than its estimate of £164bn in November.

From 2022/23 onwards, however, almost all the virus-related support measures are assumed to come to an end and tax rises start to come into effect. These start small with the freezing of income tax allowances and thresholds from April 2022 but become significant from 2023/24 onwards when the main corporation tax rate rises sharply to 25% and the capital allowance super deduction comes to an end. By 2025/26, the implied net tax rise is estimated by the OBR to be around £28bn.

Departmental spending plans in 2022/23 and subsequent years have also been cut back by around £4bn per annum, on top of the £10bn–12bn of cuts to previous plans announced in November. However, the detail of where these cuts will fall will have to wait for the spending review in the autumn. As the OBR points out, it will be challenging to keep to these spending plans at a time of rising public demands to spend more in areas like the NHS, social care and education in the wake of the pandemic.

The chancellor’s Budget measures did enable him to reduce projected borrowing in 2025/26 from around £102bn to an estimated £74bn, which is just low enough to meet the ‘golden rule’ of borrowing only to invest. It would also just about be enough to stabilise underlying public debt (excluding Bank of England schemes that distort debt trends) at just under 100% of GDP.

But by pre-announcing large tax rises from 2023, as well as tighter public spending plans from next year, Sunak might also dampen the economic recovery on which his fiscal calculations depend.