Tackling BEPS: Andrew Goodall on current priorities and concerns

Download our special report, Tackling BEPS: one year on, in its entirety as a PDF

The G20/OECD project on measures to tackle base erosion and profit shifting (BEPS) appears to be on track despite a very ambitious timetable. But the project is still in its early stages, and there are signs that expectations may be running a little too high.

New Zealand revenue minister Todd McClay declared on 3 July that the OECD Committee on Fiscal Affairs (CFA) had ‘approved the final recommendations for the first set of actions’. G20 finance ministers are to consider a report of the CFA, following its meeting last month to vote on a series of ‘deliverables’ representing the outputs of several discussion drafts, public consultations and working groups. But the OECD is not expected to release any details before finance ministers meet in the Australian city of Cairns in September 2014.

McClay said the BEPS project is ‘on track’ to meet targets on seven ‘2014 deliverables’ relating

EU tax commissioner Algirdas Šemeta noted earlier this month that the BEPS project represents a ‘fundamental overhaul of the global tax environment’. But Peter Cussons, international corporate tax partner at PwC, has pointed out that EU and EEA countries – comprising more than half of the countries participating in the BEPS project – may need to modify any BEPS action that is not compliant with EU law. In that event, there would be at least two possible outcomes for the same BEPS action, he wrote in Tax Journal (20 June 2014, page 16).

On digital business, for example, Cussons said there may be state aid issues if Action 1 results in tax on a digitised sale where there would be no tax on a comparable physical sale. The proposed adoption of the US limitation of benefits article on treaty abuse (Action 6) arguably gives rise to ‘major EU concerns’, he suggested.

Cussons said that the constraints imposed by the Treaty on the Functioning of the European Union should be acknowledged, and any anti-treaty shopping rule or GAAR must incorporate a commercial purpose justification test.

An OECD economic survey of the US published in June noted that tax reform has been on the agenda for some time. The statutory corporate income tax rate of 39.1% (when combined with the average of state taxes) is the highest in the OECD. But the tax base is ‘narrow’ and effective rates vary widely across sectors, the OECD said. ‘Continued US leadership on the BEPS project is crucial for ensuring that [reforms to combat BEPS] are consistent and coordinated across countries.’

But the US appears less than enthusiastic. ‘No good can come of this’ would be a fair summary of the view of many US businesses on the BEPS project, according to Paul Oosterhuis, senior international tax partner at Skadden Arps in Washington DC. He told delegates at a conference hosted by the Oxford University Centre for Business Taxation last month that the US Treasury believes the right way to combat BEPS is to widen the US rules on controlled foreign companies. But US tax reform is ‘not likely any time soon’.

Wolfgang Schön, managing director at the Max Planck Institute for Tax Law and Public Finance in Munich, told the Oxford conference that the German government’s specific aims are to protect German SMEs against foreign multinationals that benefit from international tax planning, and to protect German multinationals against double taxation, increased compliance costs and ‘undue constraints’.

He noted that the BEPS project is ‘largely driven by tax strategies implemented by large US corporates’, and suggested that Germany was not particularly keen to sacrifice the German taxes currently paid by Daimler, a major exporter of cars to China, in order to ‘solve the Apple/Google problem’.

Pascal Saint-Amans, director of the OECD’s Centre for Tax Policy and Administration, has insisted that developing countries are being consulted on the G20/OECD BEPS

Joseph Stead,

‘Sadly, both continue to be lacking,’ Stead said. ‘The result is that while BEPS was never going to address all the problems that poor countries face with tax, the project is missing an opportunity to at least make a start.’

But Saint-Amans told Tax Journal: ‘The engagement with developing countries is a key feature of the BEPS project. Developing countries have been and are regularly consulted. They have identified their priorities and these are being taken into account. We plan to strengthen and foster this engagement going forward, in particular regarding the implementation of the different measures developed in the course of the project.’

Generally, the OECD has made ‘herculean efforts’ to consult, according to Paul Morton, head of group tax at Reed Elsevier. Morton was speaking at a recent Tax Journal debate on BEPS, where the OECD’s special adviser on BEPS, Kate Ramm said 1,400 pages of comments have been received on

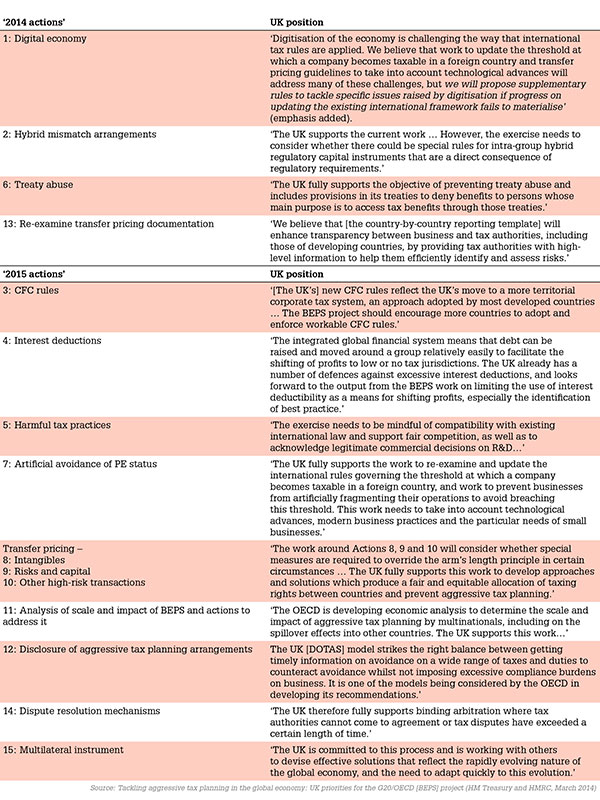

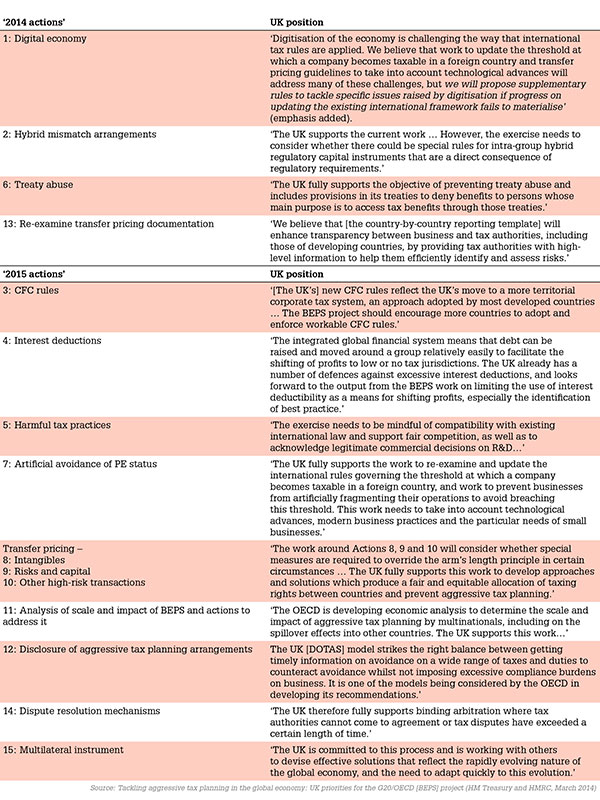

The UK government is widely regarded as one of the more enthusiastic proponents of reform. Its priorities for the BEPS project are set out in a position paper, published at Budget 2014. Chancellor George Osborne said in the foreword that the government has set out ‘to aggressively tackle tax evasion and avoidance’, alongside moves to create for the UK the most competitive tax environment in the G20. A successful BEPS project would change the international tax landscape fundamentally, he said, and would ‘shift the balance of the rules in favour of tax authorities, enabling us to clamp down on those who refuse to play by the rules’.

Osborne added that unilateral action would be ineffective and counterproductive. But the paper indicated that the UK government would ‘propose supplementary rules’ to tackle issues raised by digital business if progress on updating the existing international framework ‘fails to materialise’ (see the table at the foot of this report). There is no indication yet that the UK government might launch a formal consultation on domestic tax policy. Ireland is consulting on how its domestic tax system might best respond to the changing international tax environment.

Responding to a debate at the OECD forum on tax and development in May, Alan McLean, tax vice-president at Royal Dutch Shell in the Netherlands and vice chair of the taxation and fiscal policy committee at BIAC, the business and industry advisory committee to the OECD, said there have been ‘lots of suggestions’ that multinationals are ‘part of the problem’.

He added: ‘If that is the case, and I’m

But some tax professionals are beginning to voice concerns. EY said a recent survey has identified as a ‘new risk’ the BEPS agenda’s ‘galvanizing effect on tax administration’. Many companies have reported that the approach of tax administrations seems to be changing, ‘ahead of any law changes that may be made as a result of BEPS recommendations’. These early actions ‘may actually threaten the coherence of the overall BEPS project’, the firm said.

Tackling BEPS: Andrew Goodall on current priorities and concerns

Download our special report, Tackling BEPS: one year on, in its entirety as a PDF

The G20/OECD project on measures to tackle base erosion and profit shifting (BEPS) appears to be on track despite a very ambitious timetable. But the project is still in its early stages, and there are signs that expectations may be running a little too high.

New Zealand revenue minister Todd McClay declared on 3 July that the OECD Committee on Fiscal Affairs (CFA) had ‘approved the final recommendations for the first set of actions’. G20 finance ministers are to consider a report of the CFA, following its meeting last month to vote on a series of ‘deliverables’ representing the outputs of several discussion drafts, public consultations and working groups. But the OECD is not expected to release any details before finance ministers meet in the Australian city of Cairns in September 2014.

McClay said the BEPS project is ‘on track’ to meet targets on seven ‘2014 deliverables’ relating

EU tax commissioner Algirdas Šemeta noted earlier this month that the BEPS project represents a ‘fundamental overhaul of the global tax environment’. But Peter Cussons, international corporate tax partner at PwC, has pointed out that EU and EEA countries – comprising more than half of the countries participating in the BEPS project – may need to modify any BEPS action that is not compliant with EU law. In that event, there would be at least two possible outcomes for the same BEPS action, he wrote in Tax Journal (20 June 2014, page 16).

On digital business, for example, Cussons said there may be state aid issues if Action 1 results in tax on a digitised sale where there would be no tax on a comparable physical sale. The proposed adoption of the US limitation of benefits article on treaty abuse (Action 6) arguably gives rise to ‘major EU concerns’, he suggested.

Cussons said that the constraints imposed by the Treaty on the Functioning of the European Union should be acknowledged, and any anti-treaty shopping rule or GAAR must incorporate a commercial purpose justification test.

An OECD economic survey of the US published in June noted that tax reform has been on the agenda for some time. The statutory corporate income tax rate of 39.1% (when combined with the average of state taxes) is the highest in the OECD. But the tax base is ‘narrow’ and effective rates vary widely across sectors, the OECD said. ‘Continued US leadership on the BEPS project is crucial for ensuring that [reforms to combat BEPS] are consistent and coordinated across countries.’

But the US appears less than enthusiastic. ‘No good can come of this’ would be a fair summary of the view of many US businesses on the BEPS project, according to Paul Oosterhuis, senior international tax partner at Skadden Arps in Washington DC. He told delegates at a conference hosted by the Oxford University Centre for Business Taxation last month that the US Treasury believes the right way to combat BEPS is to widen the US rules on controlled foreign companies. But US tax reform is ‘not likely any time soon’.

Wolfgang Schön, managing director at the Max Planck Institute for Tax Law and Public Finance in Munich, told the Oxford conference that the German government’s specific aims are to protect German SMEs against foreign multinationals that benefit from international tax planning, and to protect German multinationals against double taxation, increased compliance costs and ‘undue constraints’.

He noted that the BEPS project is ‘largely driven by tax strategies implemented by large US corporates’, and suggested that Germany was not particularly keen to sacrifice the German taxes currently paid by Daimler, a major exporter of cars to China, in order to ‘solve the Apple/Google problem’.

Pascal Saint-Amans, director of the OECD’s Centre for Tax Policy and Administration, has insisted that developing countries are being consulted on the G20/OECD BEPS

Joseph Stead,

‘Sadly, both continue to be lacking,’ Stead said. ‘The result is that while BEPS was never going to address all the problems that poor countries face with tax, the project is missing an opportunity to at least make a start.’

But Saint-Amans told Tax Journal: ‘The engagement with developing countries is a key feature of the BEPS project. Developing countries have been and are regularly consulted. They have identified their priorities and these are being taken into account. We plan to strengthen and foster this engagement going forward, in particular regarding the implementation of the different measures developed in the course of the project.’

Generally, the OECD has made ‘herculean efforts’ to consult, according to Paul Morton, head of group tax at Reed Elsevier. Morton was speaking at a recent Tax Journal debate on BEPS, where the OECD’s special adviser on BEPS, Kate Ramm said 1,400 pages of comments have been received on

The UK government is widely regarded as one of the more enthusiastic proponents of reform. Its priorities for the BEPS project are set out in a position paper, published at Budget 2014. Chancellor George Osborne said in the foreword that the government has set out ‘to aggressively tackle tax evasion and avoidance’, alongside moves to create for the UK the most competitive tax environment in the G20. A successful BEPS project would change the international tax landscape fundamentally, he said, and would ‘shift the balance of the rules in favour of tax authorities, enabling us to clamp down on those who refuse to play by the rules’.

Osborne added that unilateral action would be ineffective and counterproductive. But the paper indicated that the UK government would ‘propose supplementary rules’ to tackle issues raised by digital business if progress on updating the existing international framework ‘fails to materialise’ (see the table at the foot of this report). There is no indication yet that the UK government might launch a formal consultation on domestic tax policy. Ireland is consulting on how its domestic tax system might best respond to the changing international tax environment.

Responding to a debate at the OECD forum on tax and development in May, Alan McLean, tax vice-president at Royal Dutch Shell in the Netherlands and vice chair of the taxation and fiscal policy committee at BIAC, the business and industry advisory committee to the OECD, said there have been ‘lots of suggestions’ that multinationals are ‘part of the problem’.

He added: ‘If that is the case, and I’m

But some tax professionals are beginning to voice concerns. EY said a recent survey has identified as a ‘new risk’ the BEPS agenda’s ‘galvanizing effect on tax administration’. Many companies have reported that the approach of tax administrations seems to be changing, ‘ahead of any law changes that may be made as a result of BEPS recommendations’. These early actions ‘may actually threaten the coherence of the overall BEPS project’, the firm said.